The USA Probiotic Ingredients market is projected to reach USD 1,677.2 million by 2025, with a CAGR of 6.3% through 2035. Analysts estimate the market will expand to USD 3,100.1 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,677.2 million |

| Projected USA Value in 2035 | USD 3,100.1 million |

| Value-based CAGR from 2025 to 2035 | 6.3% |

The main scalable points are the rise in the consumers` consciousness of gut health, the opportunistic demand for functional foods, and the second trend in the field of dietary supplements and animal feed.

Probiotics are an essential part of the overall body health, they do not just facilitate digestion but improve immunity and also sustain normal metabolic processes. The application of these products in the food industries, like fermented yogurt drinks and dietary supplements, and the animal feed sector has been a key driver for the expansion of several market types. The prevalence of bacterial probiotics on the market, which has a 76% share, is linked to their common use in the preparation of food and medicines.

Plant-based, natural, and probiotics with no genetically modified organisms (GMO) are products that the consumers are influencing the developments in fermentation technologies and strain development. Probiotic supplements have gained a particular following mainly among those who care about their health and their stomach-brain connection, who are interested in weight loss, and who want to support their immunity.

The probiotic industry focuses on developing better encapsulation methods together with stable formulations as its main improvement initiative. The improved probiotic functional beverages along with enhanced dietary supplements and personal care products will lead to better effectiveness.

The USA Probiotic Ingredients market should have steady growth among different consumer groups because manufacturers are supporting advanced pro-bacterial strains and postbiotic formulations.

Explore FMI!

Book a free demo

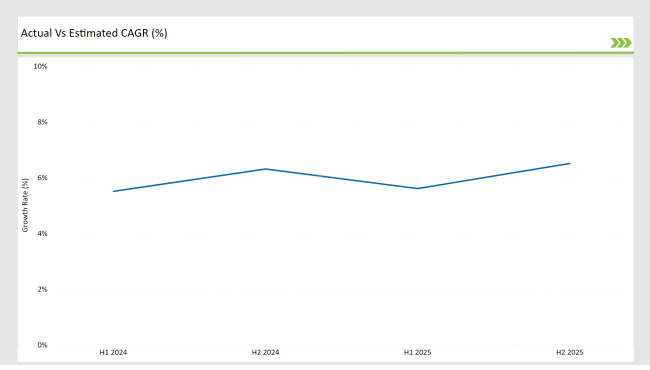

The table shown here clarifies the half-year growth paths regarding the USA Probiotic Ingredients market which has a constant increase in the CAGR during the subsequent years. The convenience of the above-mentioned is the remarkable adaptability of the probiotic market to the changes in consumer preferences, and the highlighting of the fact that consumers are aware of gut health and its impact on general well-being.

H1 signifies period from January to June, H2 Signifies period from July to December

Creative compositions and an intentionally directed distribution system have been the alternative means to fulfill different customer requirements in dietary supplements and functional foods. Plus, the breakthroughs in encapsulation technology and the new model of product delivery have contributed to the expansion of the probiotic ingredients market, by developing the stability and efficacy of the, thus ensuring the transfer of probiotic ingredients to broader segments of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | DuPont Nutrition & Biosciences: Launched a spore-forming probiotic strain designed for high-temperature food processing applications. |

| March 2024 | Novonesis Group: Expanded its fermentation-based probiotic production to enhance strain diversity in functional foods. |

| May 2024 | Lallemand Inc.: Developed a next-generation dairy probiotic blend optimized for enhanced digestive support. |

| July 2024 | Probi AB: Partnered with beverage brands to introduce probiotic-infused plant-based drinks. |

| September 2024 | Ganeden Biotech (Danone): Announced an extended shelf-life probiotic technology for ready-to-drink nutritional products. |

Increasing Focus on Probiotic Stability and Shelf Life

The market demand for reliable probiotics triggered manufacturers to develop microencapsulation with freeze-drying and bio-shield coating techniques. The developed technologies protect probiotics from degradation in high-temperature and acidic environments therefore allowing them to function effectively in functional beverages and powders as well as capsules.

Manufacturers focus on developing survival-ready probiotic strains for ready-to-drink formulas that need extended shelf life without cold storage requirements. Spore-forming probiotics along with synbiotics which combine probiotics and prebiotics now strengthen and increase the bioavailability of probiotic benefits.

Expanding Applications in Animal Feed and Personal Care

The use of probiotics in animal feed demonstrates steady growth because of mounting limitations on the utilization of antibiotic growth promoters (AGPs). Probiotic ingredients help improve gut health as well as nutrient absorption and boost immunity in poultry animals alongside cattle and swine.

The cosmetic and personal care market integrates probiotics for maintaining skin bacterial equilibrium as well as treating acne and aging skin problems. Beauty products now contain fermented extracts and live cultures because these ingredients strengthen skin biomass and minimize inflammatory responses..

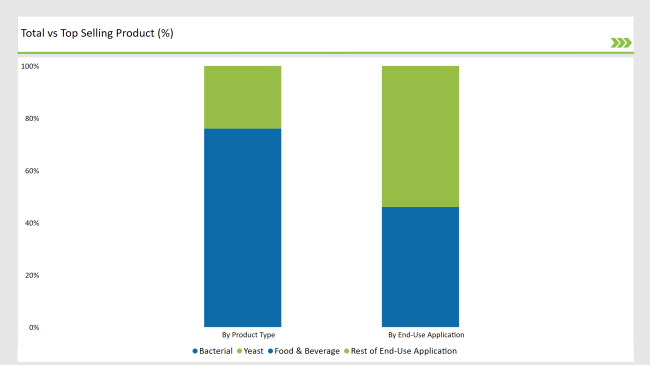

% share of Individual categories by Product Type and End Use in 2025

Bacterial probiotics comprise 76% of the market and are widely applied in dairy products, supplements, and functional beverages. The power of the company is known health aid and the support it gives to gut microbiome health and immune modulation together continue to be the root of the increase in demand.

Industry standards are transcended by Lactobacillus and Bifidobacterium strains, which are being used in the experimental process and development focusing on health advantages specific to the strains.

This adaptability in use is the main reason for the position of bacterial probiotics in modern nutrition; they not only adapt to the consumer's needs and preferences but also concur with general health and wellness.

Food and beverage applications are the major part of the probiotic market, with the highest use in fermented dairy products, kombucha, and functional snacks. The realization of the importance of gut health has been the main driving force behind the popularity of probiotic-enriched juices, plant-based yogurts, and protein bars.

Moreover, the need for fortified non-dairy probiotic foods is a major driver of innovation and product development across various categories. While consumers have been searching for healthier choices, the food and beverage industry kept on including probiotics which improved flavor and nutritional value in their products.

Note: above chart is indicative in nature

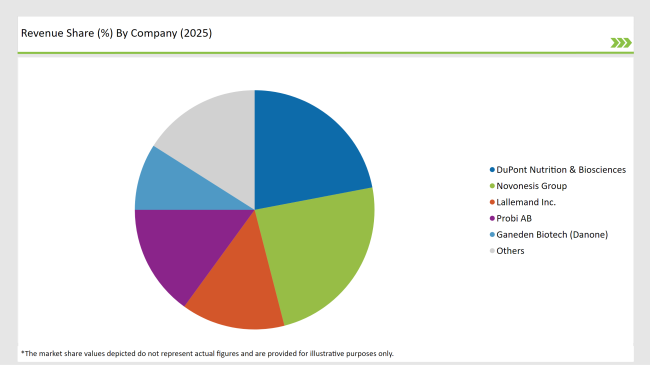

The USA Probiotic Ingredients market experiences intense competition because DuPont Nutrition & Biosciences and Novonesis Group, Lallemand Inc., Probi AB, and Ganeden Biotech (Danone) control the segment through their strain innovations and proprietary formulations and research collaborations.

Increasing popularity among customers for immune-boosting gut-friendly probiotics drives companies to develop clinically tested bacterial strains through precision fermentation processes alongside next-generation postbiotic solutions. The changes in digital commerce and direct-to-consumer supplement distribution create a new competitive field where smaller firms with distinctive formulations can successfully enter the market.

The regulatory landscape demands key focus because manufacturers emphasize GRAS certification and allergen labeling while establishing health claims linked to specific strains. Probiotic research validation at various health stages will fuel both sector consolidation and wider product selection in the market.

The market is expected to grow at a CAGR of 6.3% from 2025 to 2035.

The USA probiotic ingredients market is projected to reach USD 3,100.1 Million by 2035.

Key drivers include rising consumer interest in gut health, expanding applications in functional foods, and advancements in probiotic formulation technologies.

Bacterial probiotics lead by product type, while food & beverage remains the largest application segment in 2025.

Top manufacturers include DuPont Nutrition & Biosciences, Novonesis Group, Lallemand Inc., Probi AB, and Ganeden Biotech (Danone).

By product type, the market includes bacterial and yeast-based probiotics.

By product form, the industry is segmented into powder, granules, capsules, gel, and others

By end use, the market is divided into food & beverage, dietary supplements, animal feed, and cosmetics & personal care.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.