The USA potato flakes market is projected to reach a value of USD 721.5 Million in 2025, growing at a CAGR of 5.2% over the next decade to an estimated value of USD 1,197.9 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 721.5 Million |

| Projected USA Industry Value in 2035 | USD 1,197.9 Million |

| Value-based CAGR from 2025 to 2035 | 5.2% |

This remarkable progress is primarily a consequence of the increased need for readily available and durable foodstuffs, more and more potato forms of flaking in light meals and quick snacks, and also the enhancement of manufacturing machinery.

Potato flakes are the most common ingredient in food manufacture, mainly as a result of their flexible use, easy work, and long duration of consumption. They are indispensable items in the assortment of snacks, a distinguishing feature in the recipes of soups and sauces, as well as in some bakery products that satisfy growing consumer needs for convenience and ready meals.

The consumption of other potato flake types, like organic or gluten-free ones, also increases due to the rising number of people who use chemical-free products.

Explore FMI!

Book a free demo

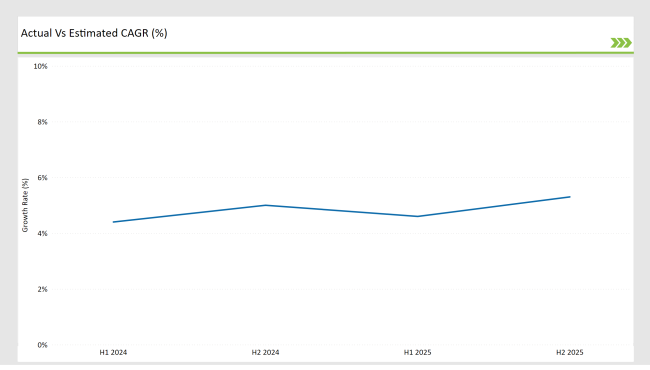

An analysis using the following table reveals that the USA potato flakes market has experienced steady growth with increasing CAGR values during each successive half-year period. The market analysis demonstrates its capability to accommodate changing consumer taste and technology development patterns.

H1 signifies period from January to June, H2 Signifies period from July to December

The market continues to expand steadily because entrepreneurs begin using potato flakes in new retail and industrial projects. Market performance will experience additional growth as potato-based snacks and ready meals gain increasing consumer interest.

| Date | Development/M&A Activity & Details |

|---|---|

| January 25 | Idahoan Foods LLC launched a new line of organic potato flakes, responding to the growing consumer demand for healthier, natural food options. |

| December 24 | Lamb Weston Holdings, Inc. expanded its processing capabilities by investing in advanced technology to enhance the quality and efficiency of potato flake production. |

| November 24 | McCain Foods Limited introduced a new range of flavored potato flakes aimed at the food service industry, enhancing menu options for restaurants. |

| October 24 | Bob’s Red Mill Natural Foods launched gluten-free potato flakes, targeting the increasing number of consumers seeking gluten-free and plant-based alternatives |

| September 24 | Basic American Foods announced plans to increase production capacity at its facilities to meet rising demand for dehydrated potato products across the USA. |

Standard Flakes Dominate the Market by Form

The leading market form is standard flakes, which are those that dominate the market by form. Standard flakes are the market leaders with The reason for this is their multifunctionality and the use in the snack food, soup, and sauce industries. They are the main choice of the manufacturers. Mashed potato pellets, on the other hand, are the second most popular ones, thanks to their imposition in ready meals and foodservice applications.

The market is also witnessing a boom in the demand for specialty flakes, such as gluten-free and organic variants. These products not only differ from the mainstream but also correspond to the preferences of consumers for environmentally friendly choices.

Snack Foods Lead End-Use Applications

Snack Foods Lead End-Use Applications The largest end-use application is the snack food segment. Potato flakes are the key ingredient in the production of chips, crisps, and extruded snacks, thus aligning perfectly with the increasing consumer preference for the most convenient and pre-cooked meals.

As the industry evolves Ready meals stand as the secondary option. People choose pre-packaged and frozen meal options more frequently which drives this market shift. Beyond their beverage usage potato flakes find applications in bakery products and contribute to soups and sauces throughout the food industry.

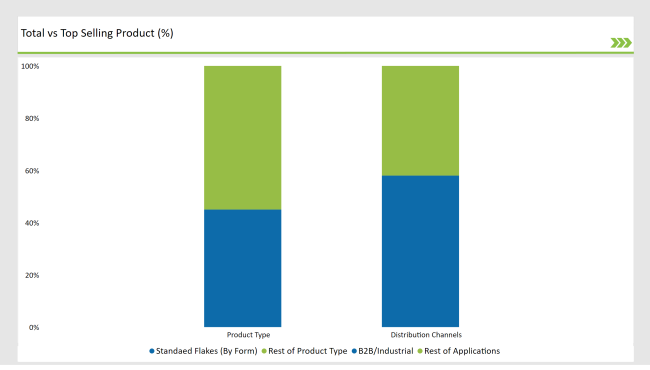

% share of Individual categories by Form and Distribution Channel in 2025

Extracts and Roots Lead the Market by Product Form

Standard Flakes and Mashed Potato Pellets Dominate by Form According to the study conducted, standard flakes and mashed potato pellets, as the top representatives in the form type segment, will prevail. The largest share goes to the standard flake, which will account for 45% of the market share in 2025.

The broad use of mashed potato pellets in snack foods and soups and bakery products makes them dominant players. The 28% market share position for mashed potato pellets represents a strong sector performance that is supported by foodservice and ready meal applications.

Food products other than those mentioned above are also very popular among consumers. Specialty flakes that include organic and gluten-free options are slowly but surely being added to the line of products since manufacturers search for those who deal with health-related issues and those who are more likely to buy niche food products.

B2B/Industrial Leads Distribution Channels

The Special Flakes, Additional and Direct Channels The B2B/industrial channel is the most significant form of distribution, holding 58% of the market in 2025. As widely as potato flakes are used in the making of snacks, ready meals, and other processed foods, their importance in industrial applications is highlighted.

Apart from these channels, wholesale and retail also play a key role where potato flakes are made available for both commercial and consumer use. Online channels that have just a fraction of the share right now are registering very fast growth due to the booming of the e-commerce sector and the trend of direct sales.

Note: above chart is indicative in nature

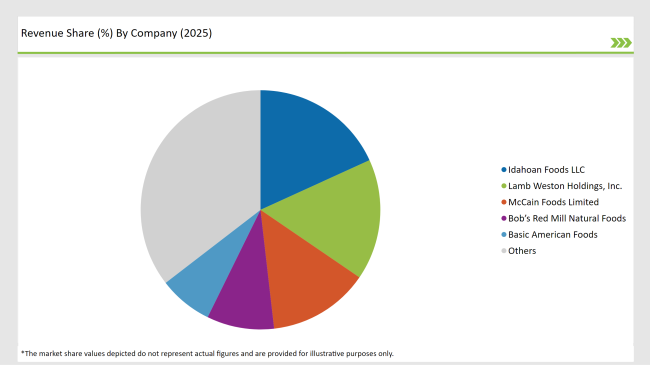

The culture of the USA potato flakes market is multinational and includes both global leaders and regional players. They are both the contributors and the drivers of the industry. The leading producers are committed to the delivery of high-quality, standardized products through the use of a significant amount of their R&D budget as well as a well-established distribution network.

While regional teams are focused on cost savings through high productivity and local production, niche companies are dedicated to providing potato flakes targeted to health-conscious consumers. The very same actions are the forces of competition and innovation in the market.

Another trend is strategic collaboration between potato flake manufacturers and food processors, which, while better custom design and performance optimization, are the enablement. These associations are snippets of meeting consumer requirements for high-value and functional foods.

The market is expected to grow at a CAGR of 5.2% from 2025 to 2035.

The USA potato flakes market is projected to reach USD 1,197.9 Million by 2035.

Key drivers include rising demand for convenient and shelf-stable food products, advancements in processing technologies, and the growing popularity of potato-based snacks and ready meals.

Standard flakes dominate by form/type, while snack foods lead the end-use applications in 2025.

Top manufacturers include Idahoan Foods LLC, Lamb Weston Holdings, McCain Foods Limited, and Bob’s Red Mill Natural Foods.

By form, the industry has been categorized into standard flakes, mashed potato pellets, powder/granules, and specialty flakes.

The industry has been categorized into snack foods, ready meals, foodservice, bakery, soups and sauces, and others.

By distribution channel, the industry has been categorized into B2B/industrial, wholesale, retail, and online

By nature, the industry has been categorized into conventional and organic

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.