The USA Postbiotic Pet Food market is expected to reach USD 290.0 million in 2025 and is projected to experience steady year-over-year growth to reach a total value of USD 467.7 million by 2035. This represents a compound annual growth rate (CAGR) of 4.9% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 290.0 million |

| Projected USA Value (2035) | USD 467.7 million |

| Value-based CAGR (2025 to 2035) | 4.9% |

The USA Postbiotic Pet Food market is highly expected to grow since the pet care industry is surging with people owning pets, gaining awareness about pets' health and nutritional science improvement.

Postbiotics are considered bioactive products that are yielded during the process of fermentation with probiotics as they help in enriching gut health and strengthening immunity levels in pets as well as to improve their wellness. Increasingly, pet owners seek functional food solutions, which is why postbiotic pet food is emerging as the go-to requirement for maintaining optimal health of pets.

Innovative product offers include postbiotic-enhanced treats and supplements, helping markets grow. Manufacturers are leveraging the research and development process in producing products which have been engineered specifically to alleviate or address problems including digestive distress, joint disorders, and even dermatological conditions.

A premium trend for pet food items is gaining the market where people are looking forward to spending some premium on superior scientifically validated foodstuffs.

More and more strategic partnerships and mergers among industry players are driving innovation and growth in the market. Brands will continue to look for clean-label practices and sustainable sourcing as consumer demand for transparency and sustainability grows in this competitive market.

Explore FMI!

Book a free demo

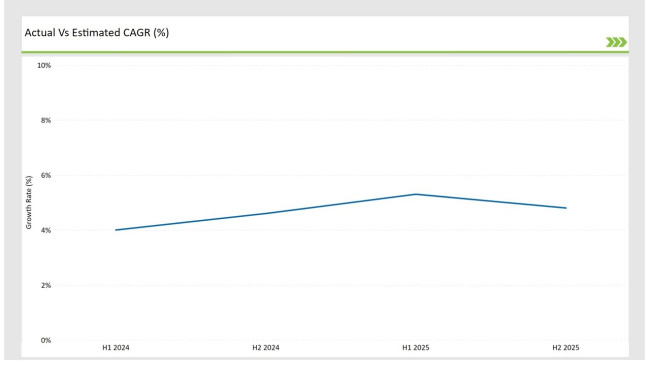

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Postbiotic Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.0% |

| H2 Growth Rate (%) | 4.6% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.3% |

| H2 Growth Rate (%) | 4.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the USA market, the natural food colors sector is predicted to grow at a CAGR of 4.0% during the first half of 2024, with an increase to 4.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.3% in H1 but is expected to rise to 4.8% in H2.

These figures highlight a consistent growth trajectory driven by increased consumer interest in functional pet food and innovations in postbiotic applications. The semi-annual breakdown allows businesses to plan strategically, aligning their product launches and marketing efforts with seasonal consumer behaviors.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Hill’s Pet Nutrition introduced a new postbiotic-enriched formula targeting gut health in dogs, focusing on immune support and digestive balance. |

| 2024 | Purina launched an innovative wet food range with postbiotics designed to address common digestive issues in both cats and dogs. This launch reinforces Purina’s commitment to advanced nutritional science. |

| 2024 | Mars Petcare announced a strategic partnership with a leading biotech company to develop proprietary postbiotic formulations, strengthening its R&D capabilities. |

| 2024 | Blue Buffalo expanded its product line with postbiotic-based treats aimed at improving coat health and reducing inflammation in pets. These treats cater to the growing demand for functional pet snacks. |

| 2024 | Diamond Pet Foods invested in a state-of-the-art production facility to enhance its capacity for producing postbiotic pet food, highlighting its focus on meeting rising consumer demand. |

Rising Demand for Functional Pet Food

Demand in functional pet food solutions containing postbiotics has increased due to the growing awareness of pet health and wellness. Pets can gain additional health benefits from gut microbiome health, enhanced absorption of nutrition, and immunity through postbiotics.

Consequently, manufacturers produce tailor-made formulas for some problems common among pets, including digestive issues, joint health, and skin conditions. Such brands as Hill's Pet Nutrition and Purina have taken the lead in innovative products specifically addressing these issues. This trend reflects the increasing contribution of science-driven nutrition in pet food, reflecting a broader shift toward preventative health care for pets.

Sustainability in Production and Packaging

Sustainability is emerging as a crucial variable in the USA Postbiotic Pet Food market, as more companies embrace ecological practices through each stage of manufacturing and packaging. Biotech firms partner with Mars Petcare to produce the sustainable ingredients to be used for postbiotic-based formulations.

Meanwhile, companies incorporate recyclable or biodegradable packaging for sustainability. This support for the values consumers expect automatically makes a brand reputation stronger while strengthening the relationship between the customer and company in this highly competitive market. A focus on sustainability communicates particularly well to millennial and Gen Z pet owners, who have environmentally conscious purchasing decisions.

Dogs are the prominent animal due to widespread adoption of postbiotics by the pet owners

Dogs are the market leaders, holding 45% of the market share, primarily due to their increased nutritional needs and the fact that postbiotic-enhanced dog food is increasingly adopted. Digestive health and immunity products are also popular among dogs, as they offer preventive care solutions.

Cats are the second market leaders, with 35% of the market share, and postbiotics are gaining popularity in treating specific feline health issues, such as urinary tract infections and skin allergies. Other animals include rabbits, guinea pigs, and birds, with a market share of 20%, while niche products serve these special diets.

Wet food is preferred for its higher moisture content which leads to better palatability

Dry food tops the segment at 55%, due to the longer shelf life, convenience, and cost-effectiveness. Wet food has 30% of the market because it is perceived as palatable and higher in moisture content, making it easier to hydrate pets.

Treats and supplements take up 15% of the market, with the most rapid growth occurring as owners now use them for specific targeted health issues. These formats allow for flexibility in incorporating postbiotics into the diets of pets, hence their increasing popularity.

Pet Stores dominate the distribution channels as they are trusted sources for premium pet products

Specialty stores lead with a 40 percent share of market, considering these stores are widely used sources of the premium and niche pet food brands. Internet sales share 30% of the market, since there is no easier way than through home delivery.

Veterinary clinics contribute to 15%, and here veterinary recommendations become important, as this helps to seek only top-quality, functional pet food. Supermarkets and hypermarkets, at 15%, are also an entry point for the budget-conscious customer looking for postbiotic pet food.

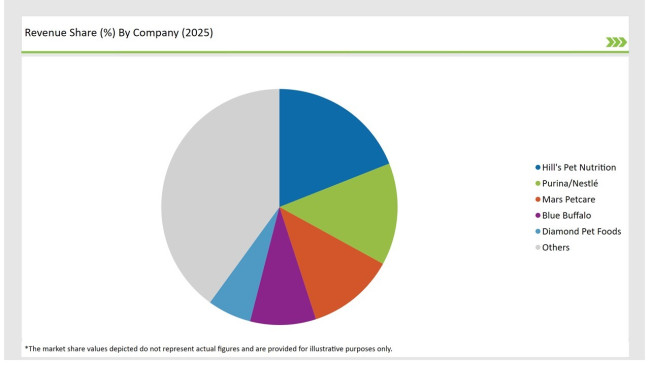

The USA Postbiotic Pet Food market is relatively fragmented. Tier-1 players in the market include Hill's Pet Nutrition, Purina/Nestlé, and Mars Petcare, with an aggregate market share of about 45%. Such companies are leveraging superior research capabilities and broad distribution channels to maintain their competitive advantage.

For example, Hill's Pet Nutrition introduces postbiotic formulations for gut health, while Purina is doing product diversification with wet and dry food types.

Tier-2 players comprise mainly of Blue Buffalo/General Mills and Diamond Pet Foods, accounting for 25 percent of the market. They cater to niche plays, including treatments and supplements full of postbiotics that may target a particular type of health-related concern.

Tier-3 and regional players, such as Merrick Pet Care and Stella & Chewy's, account for the remaining 30% and focus on premium and natural formulations. This competitive structure encourages innovation and ensures a diverse range of products to meet evolving consumer demands.

The USA Postbiotic Pet Food market is expected to grow at a CAGR of 4.9% from 2025 to 2035.

The industry’s value is projected to reach USD 467.7 million by 2035.

Key drivers include rising pet ownership, increasing awareness of pet health benefits, and advancements in nutritional science.

Dogs lead the market by pet type, with a 45% share, followed by cats at 35%.

Prominent players include Hill’s Pet Nutrition, Purina/Nestlé, Mars Petcare, Blue Buffalo/General Mills, and Diamond Pet Foods.

Dogs, Cats, Other Pets.

Dry Food, Wet Food, Treats & Supplements.

Pet Specialty Stores, Online Retail, Veterinary Clinics, Supermarkets/Hypermarkets.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.