The USA Plant based Preservatives market is anticipated to reach USD 936.5 million by 2025, with projections indicating further expansion to USD 2,191.4 million by 2035, representing a CAGR of 8.9% during the forecast period, primarily fueled by rising consumer demand for clean-label and natural products, advancements in preservation technologies, and increased focus on sustainability.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 936.5 million |

| Industry Value (2035F) | USD 2,191.4 million |

| CAGR (2025 to 2035) | 8.9% |

In the USA, this market is growing dynamically owing to a consumer preference for natural, sustainable, and health-conscious products. As consumers continue their shift towards clean-label offerings, manufacturers capitalize on plant-based preservatives to enhance shelf life without losing anything in product safety or quality.

Some of the notable trends include increased popularity of essential oils as antimicrobial agents, growing application of plant extracts in high-end food products, and use of liquid preservative formulations to improve efficiency in industrial food processing.

The market concentration is medium, and the market is consolidated with major players Kerry Group, IFF, and Kemin Industries acquiring massive shares mainly because of their product portfolio length and robust supply networks. These players invest in R&D, targeting differentiated solutions unique to varied applications including bakery, dairy, and meat processing.

Bell Flavors & Fragrances is just one of the emerging players looking to make niches, especially organic and non-GMO preservatives, stand out in an increasingly competitive marketplace. Innovation, sustainability, and compliance have interplayed and positioned the USA market at the forefront of global plant-based preservatives.

Explore FMI!

Book a free demo

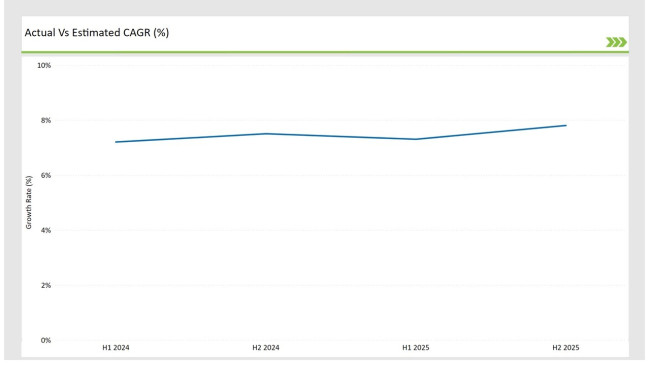

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Plant-Based Preservatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 7.2% |

| H2 Growth Rate (%) | 7.5% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 7.3% |

| H2 Growth Rate (%) | 7.8% |

For the USA market, the Plant-Based Preservatives sector is predicted to grow at a CAGR of 7.2% during the first half of 2024, with an increase to 7.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.3% in H1 and rise further to 7.8% in H2.

These figures underscore the growing adoption of natural preservation methods, particularly in high-growth categories like bakery and meat products. The rising integration of antimicrobial essential oils and antioxidant-rich plant extracts in food manufacturing reflects the evolving demands of health-conscious consumers.

This semi-annual analysis provides a comprehensive view of the market’s trajectory and offers valuable insights for stakeholders aiming to capitalize on emerging trends.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Kerry Group introduced a new preservative blend featuring rosemary and thyme extracts for meat applications. |

| Sep-2024 | IFF launched liquid plant-based preservatives targeting the beverage and dairy sectors for enhanced shelf stability. |

| Jun-2024 | Kalsec Inc. expanded its portfolio with turmeric-based preservatives for bakery and confectionery items. |

| Apr-2024 | Naturex partnered with a major snack manufacturer to develop preservative systems for clean-label chips. |

| Jan-2024 | Archer Daniels Midland Company invested in advanced extraction technologies to improve essential oil purity. |

Essential Oils as Antimicrobial Powerhouses

Foremost among them are essential oils from rosemary, thyme, and oregano, which are rising in popularity in the USA Plant-Based Preservatives market. Its strong antimicrobial effect makes it increasingly popular for addition to meat, dairy, and snack products with little impact on flavor profiles.

Because of the demand for increased quality in the final product, Kemin Industries and ADM are already ahead in this process, utilizing modern extraction methods to ensure greater purity of oil and effectiveness. With demand for clean-label and natural preservation solutions on the rise, essential oils are poised to take the lead in reforming the preservative landscape.

Growth of Liquid Formulations for Industrial Efficiency

Liquid plant-based preservatives are widely accepted in the industrial food processing industry due to ease of application and easy incorporation into an automated production line.

The formula provides a homogenous distribution as well as an even efficacy which is perfect for beverages, dairy products, or sauces. Recent examples of the release of liquid preservatives by IFF for beverages indicate that there is a priority given to the efficiency and scale at which products meet consumer needs for natural safety.

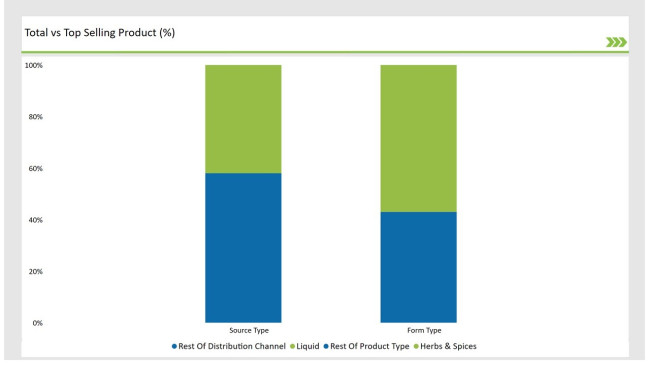

| Source Type | Market Share (2025) |

|---|---|

| Herbs & Spices | 42% |

| Remaining segments | 58% |

Herbs and spices lead the market with their twin action of adding flavor and being natural preservatives. Most widely used ones include rosemary, thyme, and clove.

These herb extracts have antioxidant and antimicrobial properties. Green tea and grapeseed plant extracts are increasingly finding premium food applications for their potential in increasing shelf life while maintaining the quality of products. Though small in market share, essential oils are growing at a rapid pace due to their strength and versatility in diverse applications.

| Form Type | Market Share (2025) |

|---|---|

| Liquid | 57% |

| Remaining segments | 43% |

Liquid formulations is the most diverse in form type, which is a reflection of their widespread usage in beverages and sauces. In such products, there is a greater importance of accurate dosing and uniformity. The powdered preservatives are significant and continue to dominate, especially in bakery and confectionery products, where they provide stability and ease of incorporation. The diverse forms ensure applicability through several food and beverage categories.

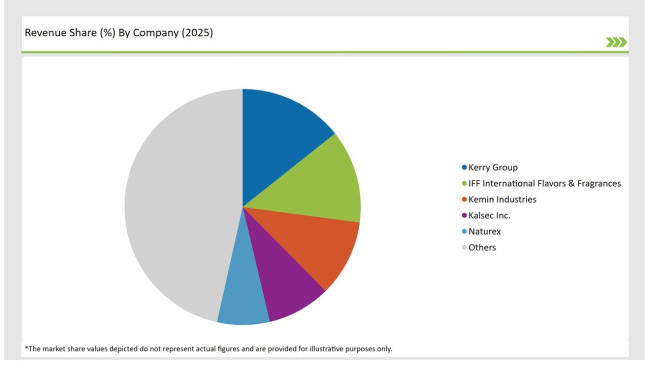

The USA Plant-Based Preservatives market is moderately concentrated. Tier-1 players, including Kerry Group, IFF, and Kemin Industries, dominate the market share, owing to their comprehensive product offerings and strong R&D capabilities. Altogether, they command about 45% of the market and focus on new formulations and strategic partnerships to sustain their lead in the market.

| Company Name | Market Share (%) |

|---|---|

| Kerry Group | 14.3% |

| IFF International Flavors & Fragrances | 12.8% |

| Kemin Industries | 10.5% |

| Kalsec Inc. | 8.7% |

| Naturex | 7.2% |

| Others | 46.5% |

Tier-2 companies, such as Kalsec Inc. and Naturex, expand their market position in niche preservatives, organic, and non-GMO, to stand out. Tier-3 emerging companies, including Bell Flavors & Fragrances and Blue Pacific Flavors, target regional markets with niche solutions. The competition is dynamic with innovation and cooperation, thus a constant stream of advanced preservative solutions to the market.

By 2025, the USA Plant Based Preservatives market is expected to grow at a CAGR of 8.9%.

By 2035, the sales value of the USA Plant Based Preservatives industry is expected to reach USD 2,191.4 million.

Key factors include rising demand for clean-label products, advancements in extraction technologies, and growing consumer awareness of natural preservative benefits.

Regions such as the West Coast and Northeast, known for their health-conscious populations, lead consumption in the USA.

Prominent players include Kerry Group, IFF, Kemin Industries, Kalsec Inc., and Naturex, noted for their innovation and strong market presence.

Herbs & Spices, Plant Extracts, Fruits & Vegetables, Essential Oils.

Liquid, Powder, Others.

Bakery & Confectionery, Dairy & Frozen Products, Snacks & Beverages, Meat & Poultry, Sauces & Dressings.

Antimicrobial, Antioxidant, Anti-enzymatic, Others.

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Comprehensive Probiotic Ingredients market analysis and forecast by from, ingredient type, animal type and region

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.