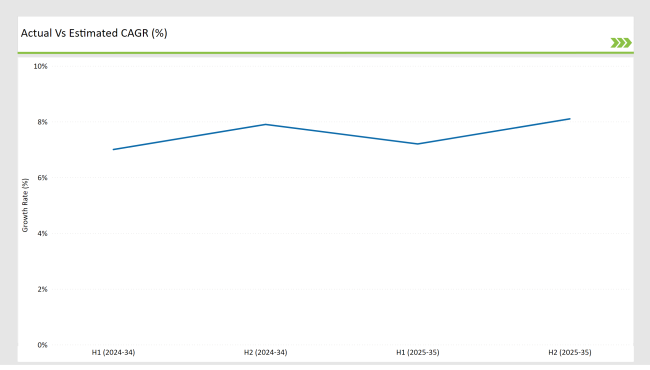

The USA plant-based pet food market is projected to reach a value of USD 8,345.0 Million in 2025, growing at a CAGR of 7.8% over the next decade to an estimated value of USD 17,719.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 8,345.0 Million |

| Projected USA Industry Value (2035) | USD 17,719.8 Million |

| Value-based CAGR (2025 to 2035) | 7.8% |

This is an important expansion fueled by the rising preference for sustainable and ethical pet food solutions, increased awareness of pet health, and changing consumer attitudes toward plant-based nutrition. Pet owners are turning to alternative options from traditional meat-based pet food because of allergies, sustainability, and ethical reasons.

A plant-based pet food is a perfect alternative to traditional protein sources of high quality like fast lentils, chickpeas, and quinoa. The organic, non-GMO, and grain-free niches are additionally promoting the growth of this particular market. The USA-based plant-based pet food formulations are now going through a significant technological renovation.

Companies invest in research and development to increase the palatability and nutrition profile of the products. Co-branding pet food brands with veterinary nutritionists also help enhance product credibility among consumers. More online sales channels and greater access to premium plant-based pet food in specialty stores are also stimulating market growth.

The natural increase in green consumption among pet owners is due to increased awareness about sustainable consumption and eco-friendly lifestyle choices. It will also encourage the development of more plant-based pet food, establishing the industry as a mainstream segment in the broader market for pet food. Fortified and functional products targeting specific health conditions will further drive demand over the forecast period.

Explore FMI!

Book a free demo

Consumers, particularly those interested in the environmental impact of pet food and the use of food products as potential allergens in pet diets, continue to opt for plant-based diets for pets. New launches of alternative sources of protein include pea protein and algae-based nutrition.

H1 signifies period from January to June, H2 Signifies period from July to December

In recent years, grain-free and high-protein plant-based pet foods have been experiencing growing demand. One of the popular trends that could increase shortly involves sustainability, ingredient transparency, and ethical sourcing among their particular brand choices.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Abbott Laboratories: Launched a new line of oral nutritional supplements specifically designed for patients with swallowing difficulties. |

| March 2024 | Nestlé Health Science: Acquired a startup focused on developing plant-based oral nutritional supplements to expand its product portfolio. |

| April 2024 | Danone Nutricia: Introduced a new flavor range for its oral nutritional supplements to enhance patient compliance and satisfaction. |

| July 2024 | Fresenius Kabi: Announced a partnership with healthcare providers to improve access to oral nutritional supplements for patients in home care settings. |

| September 2024 | Kate Farms: Expanded its distribution network to include more healthcare facilities, focusing on its plant-based oral nutritional products. |

Increasing Demand for Sustainable and Ethical Pet Food

Consumers today actively promote environmentally friendly products as the plant-based pet food market changes. Throughout their product alignment search pet owners now prioritize purchasing environmentally safe products that protect animals and minimize ecological impact. The plant-based pet food industry now employs sustainable farming techniques alongside biodegradable containers and ethics-directed manufacturing practices.

The preference for plant-based diets extends from the younger population who select plant-based diets for themselves and apply these choices to their pet food consumption. The pet food market continues to develop because increasing numbers of companies implement sustainable practices while environmental-conscious consumers search for sustainably produced food options for their animals.

Advances in Alternative Protein Sources for Pet Nutrition

Alternative proteins revolutionize the space of plant-based pet food innovations. What were once traditional sources of plant-based proteins like soy and peas can now be added to newer inputs such as insect protein, algae, and cultured plant-based proteins. The innovative sources provide additional nutritional advantages over traditional plant proteins, have greater digestibility levels, and yield higher amino acid profiles.

Companies are also developing fortified plant-based pet food formulations to overcome specific pet health issues: for example, joint health, digestion, and immune support. The progress witnessed in these areas is improving product acceptance among pet owners and sets the direction for meeting the complete dietary needs of cats, dogs, and other pets.

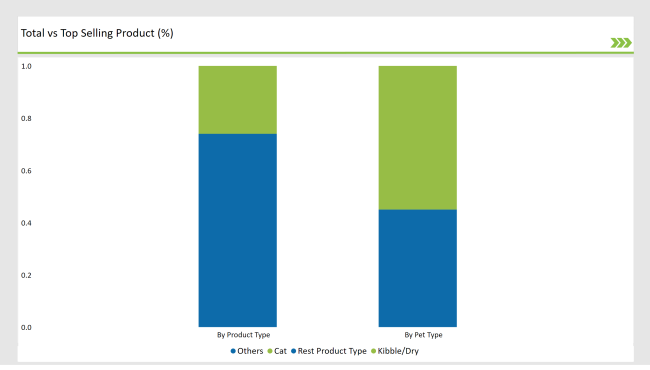

% share of Individual categories by Product Type and Pet Type in 2025

Kibble/Dry Pet Food Leads the Market

Data indicates that dry plant-based pet food from Kibble leads the market with a projected 25.7% share in 2025. Pet owners continue choosing the kibble format because this form provides easy access while being cost-effective with extended durability.

Manufacturers of this food category produce multiple versions including hypoallergenic meals and high-protein offerings for different pet dietary needs. Advanced knowledge about plant-based nutrition at Kibble leads to improved nutritional kibbles through the addition of omega fatty acids fiber and probiotics.

Cats Dominate the Plant-Based Pet Food Market

Granting to market forecasts cats will claim the biggest segment at 55.3% of the plant-based pet food market in 2025. Most cats choose plant-based diets because modern vegan cat foods provide complete nutritional balance.

Modern brands create specialized diets for cats using plant-based ingredients certified with essential vitamins taurine and amino acids to meet their food requirements. The market of healthy sustainable pet food products keeps accelerating the substantial market expansion because pet owners actively adopt these options.

Note: above chart is indicative in nature

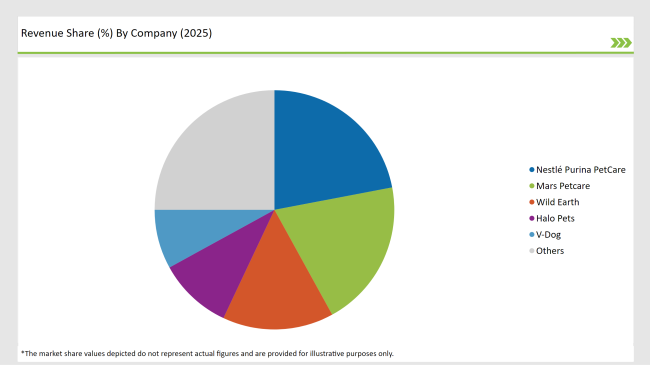

The market for plant-based pet food in the USA is characterized by intense competition, comprising both long-established pet food behemoths and newer, specialized brands. Prominent players, including Nestlé Purina PetCare, Mars Petcare, and Wild Earth, are making substantial investments in research and development (R&D) as well as product innovation to meet the increasing demand for plant-based nutrition. Companies employ their branching distribution systems to boost accessibility for their plant-based products.

Pet brands that maintain smaller sizes focus on selling organic, non-GMO, and specialty diet foods for pets to gain differentiation from bigger manufacturers. Small enterprises are using direct-to-consumer sales with e-commerce platform to building strong customer relationships.

The retail market continues to grow because plant-based pet food products find expanding space across major grocery stores together with pet specialty stores and online outlets. The combination of partnerships between veterinarians and pet nutritionists ensures that valuable information about plant-based dietary benefits reaches pet owners leading to higher market acceptance. While more pet owners acknowledge plant-based benefits various consumers remain reluctant to shift their pets to this dietary pattern.

The market is expected to grow at a CAGR of 7.8% from 2025 to 2035.

The USA plant-based pet food market is projected to reach USD 17,719.8 Million by 2035.

The growth of the USA plant-based pet food market is driven by health consciousness, sustainability awareness, pet humanization, and increasing demand for specialized dietary options.

Top manufacturers include Nestlé Purina PetCare, Mars Petcare, Wild Earth, Halo Pets, and V-Dog.

By product type, the market is categorized into kibble/dry, dehydrated food, treats and chews, freeze-dried raw, wet food, and frozen.

By pet type, the market includes cats, dogs, birds, and others.

By sales channel, the market is segmented into store-based retailing and online retailers.

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.