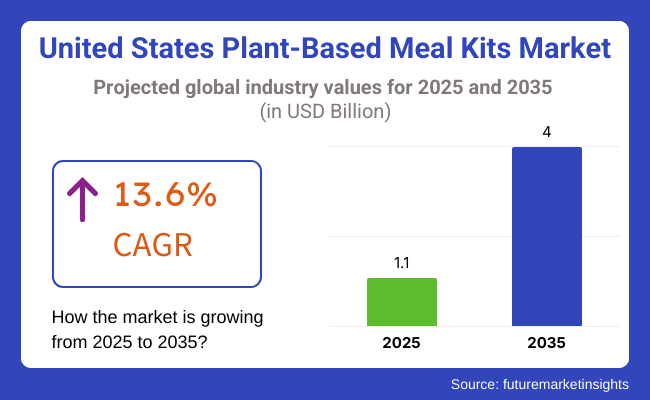

The demand for plant-based meal kits in the United States is likely to be USD 1.1 billion in 2025. The industry will have a CAGR of 13.6% during the forecast period between 2025 and 2035. The overall market's net valuation will be USD 4 billion in the year 2035.

In the USA plant-based meal kits market, the key driving factor is the noticeable consumer shift to plant-based diets caused by concerns about health, the environment, and ethics. Given that more people have a craving for easy and healthy meal choices, the meal kit is a good option since it has well-balanced recipes designed by the chef, and the ingredients are sustainably sourced. The rising request for vegan, vegetarian, and flexitarian diets is also a factor that speeds up the growth.

Increasing awareness about the health advantages of plant-based diets, like better digestion, heart health, and the lower risk of chronic diseases, mainly governs sales growth. Customers are also prioritizing plant-based meal kits as a solution to conventional meal options, which are a sustainable alternative to their commitment to carbon footprints and animal rights. The rapid transition of the internet and the direct-to-consumer delivery model also contributed to making these meal kits accessible and straightforward.

The change in food packaging technology usage and conservation techniques, which means less spoilage and less wastage of plant-based meal kits, is another reason that companies can increase their reach all over different countries. Besides, the cooperation of grocery retailers and meal kit providers is boosting product availability in supermarkets and specialty stores, which further increases customer engagement.

There are some challenges, such as high subscription fees and competition with traditional meal kits and home-cooked meals. Another problem is retaining customers, such as some of the subscribers who may not continue their services due to cost issues or lack of variety in meals. Meal kit providers are also facing logistics issues in the provisioning of fresh, high-quality, and plant-based ingredients.

Even with these challenges, there are several hidden opportunities. It is expected that the rise in customized nutrition and diet-specific meal plans, including high-protein, gluten-free, and organic plant-based meals, will lead to more growth.

Further, innovations in plant-based protein alternatives and gourmet dishes are sustaining the attractiveness of plant-based meal kits. Even when the tastes of customers continue to shift, the USA plant-based meal kits market will keep flourishing in the upcoming years.

The USA plant-based meal kits market grew strongly between 2020 and 2024, driven by increasing consumer interest in health, sustainability, and ethical food consumption. The increasing trend of plant-based diets, driven by health-conscious consumers and the new flexitarian lifestyle, fueled demand for meal kits with organic vegetables, plant-based proteins, and dairy alternatives.

Businesses emphasized offering differentiated and ethnically influenced meal solutions to meet changing consumer preferences. Meal kit subscription services became trendy because of the convenience of portioned ingredients and simple recipes.

Big players incorporated sustainable packaging and carbon-neutral delivery practices to align with increasing environmental awareness. Technology incorporation, including mobile apps and AI-powered suggestions, improved customer interaction, and customized meal planning.

Between 2025 and 2035, the USA plant-based meal kits market will progress with food technology innovations and supply chain optimization. Meal customization through AI will enable providers to customize meal kits according to individual nutritional requirements and tastes. Lab-cultured meat and plant-based proteins with more texture and improved flavor will be everywhere, enhancing the dining experience.

Vertical farming and regenerative farming will render sourcing more local and sustainable. Blockchain will enable higher transparency of the supply chain to enable customers to trace the origin and quality of ingredients.

Sustainability will be trending upwards, and biodegradable packaging and zero-waste production will be the new standards. Future food preservation technology will progressively allow for more extended shelf life for meal kits, minimize wastage of food, and provide greater convenience for customers.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for plant-based meal kits due to health and environment-awareness. | Personalized nutrition with an AI-created flavor profile and recipe. |

| Continued interest in meal diversification with increased flexitarian and plant-based lifestyles. | Value-added and cell-grown plant protein expanded. |

| Subscription-based business models became popular due to convenience. | Blockchain-based ingredient traceability and supply chain transparency. |

| Sustainable packaging and carbon-neutral shipping emerged as major differentiators. | Biodegradable packaging and zero-waste production became industry trends. |

| AI-powered suggestions improved meal planning and customer interaction. | Food preservation technology to prolong shelf life and minimize waste. |

Plant-based meal kit sales are growing at a fast pace due to factors such as increasing consumers opting for health-focused, sustainable, and convenient meal solutions. The growing interest in veganism, flexitarians, and plant-forward diets is fueling demand for easy-to-prepare, chef-created, and portioned meal kits.

Home shoppers value convenience and variety and seek fast meals with little prep time. Health-conscious consumers favor high-protein, nutrient-rich plant-based foods that aid muscle recovery and well-being. Plant-based and vegan consumers require new, flavorful, and varied meal solutions, and flexitarians seek meat alternatives that enable them to transition slowly away from animal products.

Value shoppers are more price-sensitive, but premium meal kits are performing well against heightened awareness regarding organic, non-GMO, and sustainably sourced foods. While online and subscription are expanding, companies are focusing on personalization, clean labels, and green packaging to win over health-aware shoppers.

The increase in demand for USA plant-based meal kits is due to the surge in consumer demand for food options that are convenient, healthy, and sustainable. However, the problem is the strict food safety regulations and labeling requirements that how companies should have compliance processes.

Companies are supposed to do ingredient sourcing properly, allergen transparency, and follow new FDA guidelines to keep consumers' trust.Among the various operational inefficiencies, supply chain disruptions are the foremost, consisting of plant-based ingredient shortages, transport delays, and unavailability of packaging material.

Price fluctuations and seasonal supply instability are the reasons that the sector should be careful about the over-reliance on certain special ingredients and fresh parcels. Companies have to focus on supplier diversification and a sustainable approach to improve supply chain resilience.

Consumers' preferences for clean labels and organic and minimally processed meal kits rise, but their skepticism toward processed plants and worry about ingredient quality affect their purchasing decisions. Firms must make transparency, science-backed nutritional claims, and consumer education their top priorities to achieve industry penetration and growth.

Economic downturns, inflation, and shifts in discretionary spending influence consumer purchasing behavior. In this regard, companies need to re-evaluate their pricing strategies, expand retail and e-commerce channels, and bring innovation by adding a variety of meal options that fit the consumer and the environment.

The industry is experiencing rapid growth fueled by consumer trends toward convenience, healthy eating, and sustainable food. During the year 2025, two well-defined sub-segments will help in the development of the plant-based meal kit industry - meal kits and prepared meal kits.

One of the best-known options is meal kits, and for good reason: their pre-measured ingredients paired with easy-to-follow recipes make them the ultimate snack selection. These kits attract consumers who enjoy cooking but don't want to spend time planning meals or shopping for ingredients.

Innovators in the segment, including Purple Carrot and Green Chef, have long been providing plant-based meal options. By 2025, meal kits are estimated to comprise ~60% of the USA plant-based meal kit market. The growth of plant-based diets fuels this, as consumers need nutritious meals to fit their way of life.

Alternatively, with Prepared Meal Kits, the meal is delivered fully cooked and just needs to be warmed up before eating. This segment is growing faster, in some instances, than the consumer goods market can keep up, as consumers want speed without compromising on quality or taste. Territory Foods and Snap Kitchen, for example, both specialize in health-focused, plant-based, ready-to-eat meals. The percentage of prepared meal kits is expected to be about 40% of the share in 2025.

Chilled meal kits are generally refrigerated and offer a fresh taste and texture, attracting both quality-minded consumers and more fresh components. Chilled kits must be eaten sooner than frozen kits, which some will see as a win for frozen people worried about preservatives in their meals.

Companies like Purple Carrot and Green Chef have been profiting from this line of thinking with meal kits that emphasize fresh, seasonal ingredients. Non-alcoholic beverages: Ready-to-drink segments, particularly enjoyed for convenience, portable, and health benefits (through chilled versions), will account for an estimated 55-60% by 2025

Frozen meal kits have a longer shelf life and greater convenience, as consumers do not have to utilize the meal kit immediately. These kits have long shelf lives, making them easy to keep on hand for busy families.

Companies like Territory Foods and Snap Kitchen are responding to that demand and providing plant-based meals that can be frozen so busy consumers can eat nutritious food without sacrificing convenience. Much of that will come from frozen meal kits, with projected shares of 40-45% by 2025.

Both types of meal kits are gaining steam, with the chilled segment growing fastest on the back of the increasing need for fresh meal solutions in the home and frozen meal kits making headway as consumers search for longer-lived, convenient meal solutions.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The industry is expected to exhibit a CAGR of 7.1% during the forecast period. Increased demand for plant-based diets, driven by enhanced consumer awareness of health benefits and sustainability, is a key driver of growth. Consumers are becoming more inclined toward plant-based consumption due to concerns over chronic diseases, animal well-being, and the environment.

Meal kit companies are taking advantage of the trend by delivering nutritionally comparable, chef-created, and ready-to-cook plant-based meals appealing to both flexitarians and vegans. Purple Carrot, Splendid Spoon, and Daily Harvest are leading the way by introducing convenient and diverse plant-based meal options, from high-protein bowls to smoothie-based meal replacements.

The American industry is expanding as well, with more direct-to-consumer subscription services and more e-commerce adoption. Customers adore the convenience of pre-portioned, ready-to-cook ingredients sent directly to their doorsteps, reducing food waste and meal prep time.

Companies are also using sustainable methods such as compostable packaging and organic ingredients to entice eco-friendly shoppers. Grocery retailers like Whole Foods and Walmart are partnering with meal kit companies to expand distribution.

In addition, advances in technology, such as AI-driven personalized meal planning and mobile app integration, are enhancing the shopping experience. The industry's future is secure as plant-based eating shifts from a niche trend to a mainstream diet in the United States.

The industry is on a fast growth trajectory propelled by consumer demand for convenient, healthy, and sustainable food options. Increased adoption of flexitarian, vegetarian, and vegan diets fosters competition between the established meal kit players as well as niche plant-based brands.

Leading players like Purple Carrot, Green Chef (HelloFresh), Daily Harvest, Splendid Spoon, and Sunbasket provide chef-curated, organic, customizable plant-based meals. Startups and niche operatives are concentrating on gluten-free, high-protein, and allergen-friendly meals, responding to changing consumer preferences.

Several innovations are happening in ready-to-eat and pre-prepped ingredients, coupled with AI-based personalizations for dietary needs. The companies are enhancing flavor diversity, plant-based protein integration, and international cuisines as product differentiators.

The key strategic factors surrounding their procurement will be subscription-based models, retail partnerships, and eco-packaging initiatives. Brands will leverage e-commerce, direct-to-consumer channels, and social media influencers to mark their presence and lure health-conscious consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Purple Carrot | 25-30% |

| Green Chef (HelloFresh) | 20-25% |

| Daily Harvest | 15-20% |

| Splendid Spoon | 10-15% |

| Sunbasket | 5-10% |

| Other Players (Combined) | 5-15% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Purple Carrot | Industry leader in 100% plant-based meal kits, delivering chef-created, high-protein, and internationally inspired recipes. |

| Green Chef | Provides organic, plant-based meal kits as part of a broader meal platform, utilizing HelloFresh's large logistics and reach. |

| Daily Harvest | Concentrates on frozen, pre-prepared plant-based meals, smoothies, and bowls for busy professionals and health-focused consumers. |

| Splendid Spoon | Operates in ready-to-eat vegan soups, bowls, and wellness shots, focusing on functional nutrition and clean ingredients. |

| Sunbasket | Offers organic, chef-created plant-based meal kits, combining sustainable sourcing and high-protein vegan meals. |

Key Company Insights

Purple Carrot (25-30%)

Pioneers is the only vegan meal kit that has expanded into retail partnerships and innovative high-protein plant-based meal options.

Green Chef (20-25%)

It strengthens its position with organic and diet-specific meal plans and has the logistic and supply chain benefits from being part of HelloFresh.

Daily Harvest (15-20%)

Its frozen and easy-to-eat offers are turning into investments in newer plant-based ice cream and grain bowl product lines.

Splendid Spoon (10-15%)

A very strong presence in functional well-being-focused plans for plant-based meals with openings for subscription weight-management programs.

Sunbasket (5-10%)

Provides hybrid options such as meal kits and pre-prepped plant-based meals. The ingredients used are, however, organic and sustainably sourced.

It's classified as Meal Kit and Prepared Meal Kit.

It's classified as Chilled, Frozen, and Shelf Stable.

It's divided into Store-based Retailing (including Convenience Stores, Discounters, Forecourt Retailers, Hypermarkets/Supermarkets, Food Specialists, Independent Small Grocers, and Other Grocery Retailers) and Online Retail.

It's divided into California, Texas, Florida, New York, Illinois, Ohio, North Carolina, Michigan, Colorado, Wisconsin, and Washington.

The industry is expected to generate USD 1.1 billion in 2025, driven by growing consumer interest in plant-based diets, convenience-driven lifestyles, and demand for sustainable meal solutions.

The market is projected to grow to USD 4 billion by 2035, fueled by innovations in plant-based ingredients, expansion of delivery services, and heightened focus on health and environmental sustainability. The market is expected to expand at a CAGR of 13.6%.

Key players include Purple Carrot, Green Chef (HelloFresh), Daily Harvest, Splendid Spoon, Sunbasket, Fresh N Lean, Veestro, Thistle, Territory Foods, and Greenfork.

States such as California, New York, Texas, and Florida offer strong growth potential due to the high adoption of plant-based diets, urban consumer bases, and access to robust delivery infrastructure.

Prepared meal kits are gaining traction alongside traditional meal kits. Chilled and frozen formats dominate, offering convenience and freshness. Online retail leads sales, though store-based retailing continues to grow through supermarkets and specialty food retailers.

Table 1: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 9: California Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: California Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: California Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: California Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 13: California Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 14: California Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 15: California Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: California Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 17: Florida Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Florida Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 19: Florida Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Florida Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: Florida Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 22: Florida Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 23: Florida Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Florida Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 25: Texas Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Texas Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: Texas Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Texas Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 29: Texas Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 30: Texas Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 31: Texas Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Texas Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 33: New York Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: New York Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 35: New York Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: New York Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 37: New York Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 38: New York Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 39: New York Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: New York Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 41: Illinois Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Illinois Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 43: Illinois Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Illinois Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 45: Illinois Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 46: Illinois Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 47: Illinois Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Illinois Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 49: Ohio Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Ohio Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Ohio Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Ohio Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 53: Ohio Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 54: Ohio Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 55: Ohio Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: Ohio Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 57: North Carolina Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: North Carolina Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 59: North Carolina Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: North Carolina Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 61: North Carolina Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 62: North Carolina Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 63: North Carolina Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: North Carolina Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 65: Michigan Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 66: Michigan Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 67: Michigan Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: Michigan Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 69: Michigan Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 70: Michigan Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 71: Michigan Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: Michigan Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 73: Colorado Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: Colorado Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 75: Colorado Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Colorado Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 77: Colorado Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 78: Colorado Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 79: Colorado Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Colorado Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 81: Wisconsin Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 82: Wisconsin Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 83: Wisconsin Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 84: Wisconsin Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 85: Wisconsin Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 86: Wisconsin Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 87: Wisconsin Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 88: Wisconsin Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 89: Washington Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 90: Washington Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 91: Washington Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 92: Washington Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 93: Washington Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 94: Washington Market Value (US$ Million) Forecast by Format, 2018 to 2033

Table 95: Washington Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Washington Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Figure 1: Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Format, 2023 to 2033

Figure 3: Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 14: Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 15: Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 17: Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Market Attractiveness by Format, 2023 to 2033

Figure 23: Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Market Attractiveness by Region, 2023 to 2033

Figure 25: California Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: California Market Value (US$ Million) by Format, 2023 to 2033

Figure 27: California Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: California Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: California Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: California Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 31: California Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: California Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: California Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: California Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 35: California Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: California Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: California Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 38: California Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 39: California Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 40: California Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 41: California Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: California Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 43: California Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: California Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: California Market Attractiveness by Product Type, 2023 to 2033

Figure 46: California Market Attractiveness by Format, 2023 to 2033

Figure 47: California Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: California Market Attractiveness by Country, 2023 to 2033

Figure 49: Florida Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Florida Market Value (US$ Million) by Format, 2023 to 2033

Figure 51: Florida Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Florida Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Florida Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Florida Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 55: Florida Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Florida Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Florida Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Florida Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 59: Florida Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Florida Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Florida Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 62: Florida Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 63: Florida Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 64: Florida Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 65: Florida Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Florida Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 67: Florida Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Florida Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Florida Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Florida Market Attractiveness by Format, 2023 to 2033

Figure 71: Florida Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Florida Market Attractiveness by Country, 2023 to 2033

Figure 73: Texas Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Texas Market Value (US$ Million) by Format, 2023 to 2033

Figure 75: Texas Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Texas Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Texas Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Texas Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Texas Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Texas Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Texas Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Texas Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: Texas Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Texas Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Texas Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 86: Texas Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 87: Texas Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 88: Texas Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 89: Texas Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Texas Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 91: Texas Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Texas Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Texas Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Texas Market Attractiveness by Format, 2023 to 2033

Figure 95: Texas Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Texas Market Attractiveness by Country, 2023 to 2033

Figure 97: New York Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: New York Market Value (US$ Million) by Format, 2023 to 2033

Figure 99: New York Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: New York Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: New York Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: New York Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 103: New York Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: New York Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: New York Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: New York Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 107: New York Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: New York Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: New York Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 110: New York Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 111: New York Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 112: New York Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 113: New York Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: New York Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 115: New York Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: New York Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: New York Market Attractiveness by Product Type, 2023 to 2033

Figure 118: New York Market Attractiveness by Format, 2023 to 2033

Figure 119: New York Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: New York Market Attractiveness by Country, 2023 to 2033

Figure 121: Illinois Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Illinois Market Value (US$ Million) by Format, 2023 to 2033

Figure 123: Illinois Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Illinois Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Illinois Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Illinois Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Illinois Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Illinois Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Illinois Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: Illinois Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Illinois Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: Illinois Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: Illinois Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 134: Illinois Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 135: Illinois Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 136: Illinois Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 137: Illinois Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: Illinois Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Illinois Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: Illinois Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: Illinois Market Attractiveness by Product Type, 2023 to 2033

Figure 142: Illinois Market Attractiveness by Format, 2023 to 2033

Figure 143: Illinois Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Illinois Market Attractiveness by Country, 2023 to 2033

Figure 145: Ohio Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Ohio Market Value (US$ Million) by Format, 2023 to 2033

Figure 147: Ohio Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: Ohio Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Ohio Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Ohio Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 151: Ohio Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Ohio Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Ohio Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Ohio Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 155: Ohio Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Ohio Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Ohio Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 158: Ohio Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 159: Ohio Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 160: Ohio Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 161: Ohio Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: Ohio Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 163: Ohio Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: Ohio Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: Ohio Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Ohio Market Attractiveness by Format, 2023 to 2033

Figure 167: Ohio Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Ohio Market Attractiveness by Country, 2023 to 2033

Figure 169: North Carolina Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: North Carolina Market Value (US$ Million) by Format, 2023 to 2033

Figure 171: North Carolina Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: North Carolina Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: North Carolina Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: North Carolina Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 175: North Carolina Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: North Carolina Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: North Carolina Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: North Carolina Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 179: North Carolina Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: North Carolina Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: North Carolina Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 182: North Carolina Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 183: North Carolina Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 184: North Carolina Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 185: North Carolina Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: North Carolina Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 187: North Carolina Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: North Carolina Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: North Carolina Market Attractiveness by Product Type, 2023 to 2033

Figure 190: North Carolina Market Attractiveness by Format, 2023 to 2033

Figure 191: North Carolina Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: North Carolina Market Attractiveness by Country, 2023 to 2033

Figure 193: Michigan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 194: Michigan Market Value (US$ Million) by Format, 2023 to 2033

Figure 195: Michigan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 196: Michigan Market Value (US$ Million) by Country, 2023 to 2033

Figure 197: Michigan Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 198: Michigan Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 199: Michigan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 200: Michigan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 201: Michigan Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 202: Michigan Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 203: Michigan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 204: Michigan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 205: Michigan Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 206: Michigan Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 207: Michigan Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 208: Michigan Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 209: Michigan Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 210: Michigan Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 211: Michigan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 212: Michigan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 213: Michigan Market Attractiveness by Product Type, 2023 to 2033

Figure 214: Michigan Market Attractiveness by Format, 2023 to 2033

Figure 215: Michigan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: Michigan Market Attractiveness by Country, 2023 to 2033

Figure 217: Colorado Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: Colorado Market Value (US$ Million) by Format, 2023 to 2033

Figure 219: Colorado Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 220: Colorado Market Value (US$ Million) by Country, 2023 to 2033

Figure 221: Colorado Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 222: Colorado Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 223: Colorado Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 224: Colorado Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 225: Colorado Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 226: Colorado Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 227: Colorado Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 228: Colorado Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 229: Colorado Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 230: Colorado Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 231: Colorado Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 232: Colorado Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 233: Colorado Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 234: Colorado Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 235: Colorado Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 236: Colorado Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 237: Colorado Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Colorado Market Attractiveness by Format, 2023 to 2033

Figure 239: Colorado Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Colorado Market Attractiveness by Country, 2023 to 2033

Figure 241: Wisconsin Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 242: Wisconsin Market Value (US$ Million) by Format, 2023 to 2033

Figure 243: Wisconsin Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 244: Wisconsin Market Value (US$ Million) by Country, 2023 to 2033

Figure 245: Wisconsin Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 246: Wisconsin Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 247: Wisconsin Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 248: Wisconsin Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 249: Wisconsin Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 250: Wisconsin Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 251: Wisconsin Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 252: Wisconsin Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 253: Wisconsin Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 254: Wisconsin Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 255: Wisconsin Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 256: Wisconsin Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 257: Wisconsin Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 258: Wisconsin Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 259: Wisconsin Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 260: Wisconsin Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 261: Wisconsin Market Attractiveness by Product Type, 2023 to 2033

Figure 262: Wisconsin Market Attractiveness by Format, 2023 to 2033

Figure 263: Wisconsin Market Attractiveness by Sales Channel, 2023 to 2033

Figure 264: Wisconsin Market Attractiveness by Country, 2023 to 2033

Figure 265: Washington Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 266: Washington Market Value (US$ Million) by Format, 2023 to 2033

Figure 267: Washington Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 268: Washington Market Value (US$ Million) by Country, 2023 to 2033

Figure 269: Washington Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 270: Washington Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 271: Washington Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 272: Washington Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 273: Washington Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 274: Washington Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 275: Washington Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 276: Washington Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 277: Washington Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 278: Washington Market Value (US$ Million) Analysis by Format, 2018 to 2033

Figure 279: Washington Market Value Share (%) and BPS Analysis by Format, 2023 to 2033

Figure 280: Washington Market Y-o-Y Growth (%) Projections by Format, 2023 to 2033

Figure 281: Washington Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 282: Washington Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 283: Washington Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 284: Washington Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 285: Washington Market Attractiveness by Product Type, 2023 to 2033

Figure 286: Washington Market Attractiveness by Format, 2023 to 2033

Figure 287: Washington Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Washington Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA