The United States pharmaceutical intermediate market is expected to reach USD 6,591.4 million in 2025 and is projected to reach a total value of USD 9,052.8 million by 2035. This represents a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 6,591.4 million |

| Projected USA Value (2035) | USD 9,052.8 million |

| Value-based CAGR (2025 to 2035) | 3.2% |

The United States pharmaceutical intermediates market is likely to increase because of the trend for generic drugs, advanced biotechnology, and the significance given to cheaper drug manufacturing.

Specialty drugs with intricate chemical compounds frequently require treatments of deadly conditions, such as cancer. Therefore, chemical synthesis continues to advance, considering the prospect of technological innovation and appreciation for green chemistry. This therefore brings about a highly efficient, productive, and clean route for attaining the intermediates.

Consolidations in terms of agreements from pharmaceutical companies to CMOs further look to the growth that is going to be anticipated. Such strategic position is going to bring in capacity addition with an advantage of being cost-effective that is also coming to be quite accessible and low-cost.

Explore FMI!

Book a free demo

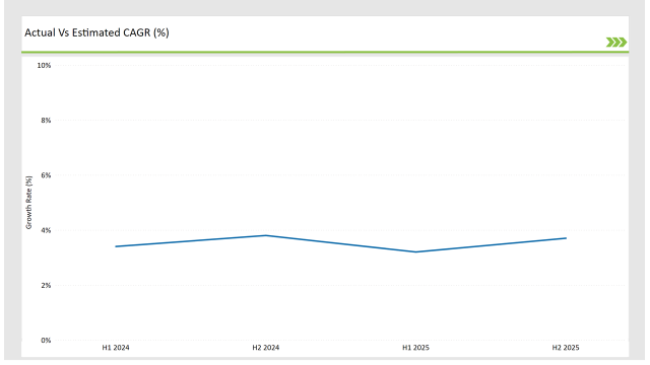

The table below provides a comprehensive comparative analysis of the six-month change in CAGR for the base year, 2024, and the current year, 2025, specifically for the United States pharmaceutical intermediate market.

Such semiannual analysis captures critical shifts in the dynamics of a market and how revenues are being realized, in order for one to have a proper view about the growth pattern within the calendar year. A year is simply divided into two broad parts-H1, covering January to June, and the other half called H2, between July to December.

H1 is considered as between January and June; and H2 is considered as between July and December.

The pharmaceutical intermediate industry is now expected to expand at about 3.4% CAGR in H1 2024 and then fall to 3.8% CAGR for H2 of the same year. It is now forecasted to shave off 3.2% of the 2024 CAGR in H1, before rebounding to expand 3.7% in H2.

This would reduce the same from 20 basis points from the first half of 2024 to the first half of 2025 and later lower by 16 basis points in the second half of 2025 relative to the corresponding period of 2024. 5 and will be 16 basis points lower in the second half of 2025 relative to the corresponding period in 2024.

Such semi-annual distribution is quite fundamental for companies and their strategic considerations for exploitation in the envisioned boom and through complexities in the marketplace.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | 2025 Rising Production of Pharmaceutical Intermediate: Indoco Remedies, a subsidiary of Warren Remedies Pvt Ltd, declared that it would commercially produce pharmaceutical intermediates and APIs in India. |

| 2024 | Agreements made in the year 2024 Development and Supply of Advanced Pharmaceutical Intermediate Ami Organics agreed for supplying advanced pharmaceutical intermediate to Finland-based Orion Corp. |

| 2024 | Active Participation in International Exhibition: Yutian Pharmaceutical participated in CPHI China Exhibition for expansion of their customer based in the country. |

Growing Investment in R&D of New Drug Products Contributes to the Growing Demand of Pharmaceutical Intermediates

The continued drive for innovation suggests ongoing demand for an increasing number of intermediates within drug manufacturing processes. This demand is further mired in the need for complex intermediates to meet the requirements of both traditional and biologic drug formulations.

Outsourcing and Contract Manufacturing Propels Pharmaceutical Intermediates in USA

Strategic collaborations helps pharmaceutical companies reduce their cost of production, increase their efficiency, and expand their capacity without investing massively in infrastructure. Many CMOs specialize in the production of intermediates, supplying continuously at low costs.

This model enables pharmaceutical companies to focus on R&D and marketing while outsourcing complex intermediate production to experts. As the demand for new drugs grows, CMOs also become essential in meeting the rising need for specialized intermediates in drug manufacturing.

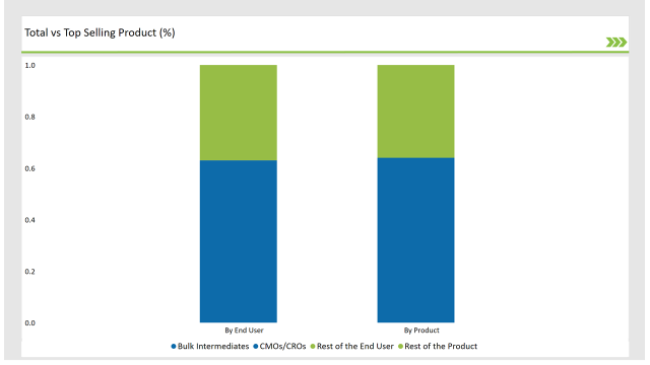

% share of Individual categories by Product Type and End User in 2025

Bulk drug intermediates records significant surge in the market owing to its growing adoption in manufacturing of dietary supplements

The bulk drug intermediates have dominated the USA pharmaceutical intermediate market, mainly because, in essence, bulk drug intermediates are basically crucial in large-scale API production.

Both branded and generic drugs rely on these pharmaceutical intermediates, especially for therapeutic areas with the highest demand: oncology, cardiology, and diabetes management. This dominance is also encouraged by the surging demand for generic drugs since bulk intermediates are important for the cost-effective manufacturing of generic drugs.

Besides that, advances in the manufacturing process and movement towards contract manufacturing have developed their production efficiency. Increasing demand for bulk drug intermediates is also contributed to the rise in the aging population and management of chronic diseases.

Emphasis on outsourcing their production facilities has aided CMOs to hold dominant position

In terms of end user, CMOs hold dominant position by holding 64.8% of the USA pharmaceutical intermediate market. Various reasons make CMOs dominant in the USA pharmaceutical intermediate market.

Firstly, they are cost-effective as companies just need to outsource their production instead of investing in an expensive facility to manufacture the medicine themselves. This also enables pharmaceutical firms to focus on research and development. CMOs also offer scalability, flexibility, and specialized expertise in complex manufacturing processes.

The number of CMOs addressing large volumes of production accordingly increases with the increasing demand for generic drugs and biologics. In addition, regulatory compliance and quality control make them alluring to pharmaceutical companies in ensuring the safe and efficient production of intermediates while minimizing risk and time to market.

Note: above chart is indicative in nature

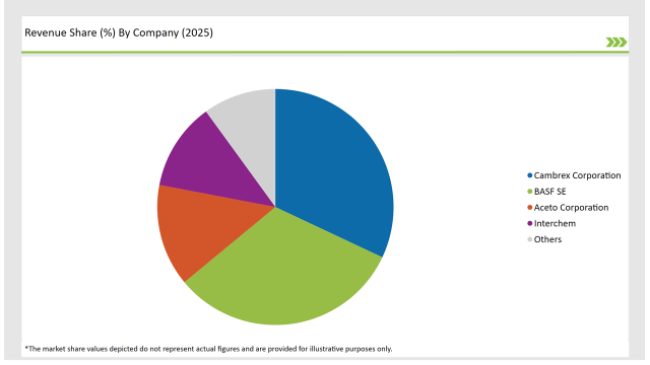

The United States pharmaceutical intermediate market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies like Cambrex Corporation, BASF SE, Aceto Corporation, Interchem, Cambrex Corporation, Arkema Inc. dominate the market by leveraging advanced technologies for streamlining their production process.

By 2035, the United States pharmaceutical intermediate market is expected to grow at a CAGR of 3.2%.

By 2035, the sales value of the United States pharmaceutical intermediate industry is expected to reach USD 9,052.8 million.

Key factors propelling the United States pharmaceutical intermediate market include the growing strategic collaboration of market players to meet growing demand of key players, and increase in investment towards development of new therapeutic drug products.

Prominent players in the United States pharmaceutical intermediate manufacturing include BASF SE, Cambrex Corporation, Interchem, Arkema Inc, Pfizer, BMSetc, Midas Pharma GmbH, Chiracon GmbH, Codexis, Inc, A.R. Life Sciences Private Limited, Dishman Group and Dextra Laboratories Limited.

The industry includes chemical intermediates, bulk drug intermediates and custom intermediates.

Available in forms branded drug intermediates, and generic drug intermediates.

The industry is divided into analgesics, anti-inflammatory drugs, Cardiovascular Drugs, Anti-diabetic Drugs, Antimicrobial Drugs, Anti-cancer Drugs and others.

The industry is classified by end user as biotech and pharma companies, research laboratory and CMOs/CROs

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.