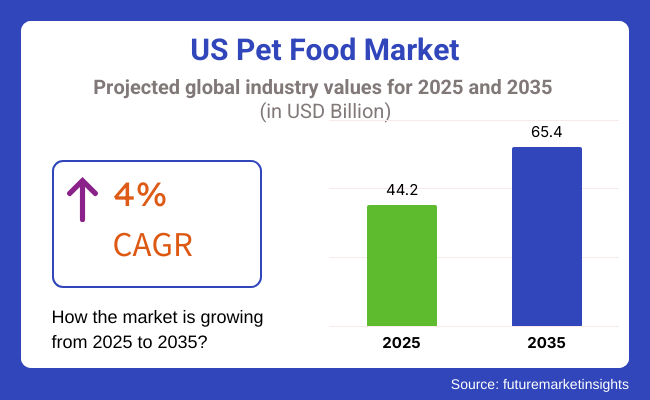

The demand for pet food in the United States has a strong potential growth, with a forecast of USD 44.2 billion in 2025. The growth of the overall sector is expected to achieve a CAGR of 4.0% during the estimated period, which is between the years 2025 and 2035. The estimated value of the industry is predicted to be USD 65.4 billion in the long run by 2035.

The USA pet food market is mainly influenced by factors such as the pet ownership rate and the quest for dog and cat humanization. Recently, pet owners have been more on the side of buying food that is of superior nutritional quality for their animals. With consumers shifting their focus to wellness and health, the pet industry is witnessing a rise in organic, grain-free, and high-protein products. One type of functional pet foods that contain added vitamins, probiotics, and omega-3 fatty acids is also becoming!

The incremental market growth rate is due to an increase in the demand for customized and specialty pet diets, such as breed-specific, age-specific, and condition-based formulations. Another reason for the growth is the rise of direct-to-consumer brands, subscription-based food delivery services, and e-commerce platforms, which are making pet food more accessible and convenient for pet owners across the United States.

Pet care products are securely regulated by the FDA and the Association of American Feed Control Officials (AAFC), which continuously work to ensure that the products are safe and nutritious. The sourcing and labeling of the ingredients, which are much more transparent, also contribute greatly to consumers trusting premium and high-quality food brands more. The trend toward the use of sustainable and eco-friendly packaging is also a factor affecting the purchasing decision.

Nevertheless, the market also faces some setbacks, like escalating raw materials prices, supply chain issues, and growing rivalry both from established companies and newcomers. Also, some issues about food recalls and contamination incidents require manufacturers to follow strict quality control procedures in order to keep the trust of consumers intact.

In spite of all the challenges, the market growth prospects are good. The increase in the demand for human-grade, raw, and freeze-dried food is anticipated to be one of the main factors driving the industry forward. Moreover, the improvement in pet nutrition science and the personalization of meal plans are projected to bring further growth to the market. With pet owners who constantly care about their animals' well-being and health, the USA will witness a continuous rise in the years to come.

Explore FMI!

Book a free demo

The United States industry grew significantly between 2020 and 2024, fueled by rising pet ownership and pet humanization. Pet owners became increasingly aware of the nutritional requirements of their pets, resulting in greater demand for premium, organic, and functional food products. Raw and grain-free animal foods picked up speed, and customers asked for natural and least-processed animal foods for pets.

Leading contenders launched products containing added probiotics, omega-3 fatty acids, and other functional nutrients that could target the health of the gut, joints, and immunity. Internet platforms and subscription-based delivery programs became central channels of distribution, further boosting convenience to the customers.

Regulatory control on labeling and safety of ingredients also grew, compelling manufacturers to concentrate on product quality and transparency. From 2025 to 2035, the United States industry for pet meals will experience revolutionary changes.

Accuracy nutrition, achieved through biotech and AI, will allow makers to create tailored pet meals that are specific to individual health profiles and genetic makeup. Insect protein and cell-based meat will go mainstream as the world remains on the trajectory of increased environmental awareness.

Supply chain traceability, enabled through blockchain, will enable customers to track ingredient provenance and quality. Smart food dispensers driven by AI will track pet health and adjust feeding patterns as needed. Therapeutic and functional foods for geriatric and chronic disease will be better available. Plant-based and alternative protein form development will satisfy health and sustainability motivations.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing premium, organic, and functional pet food consumption. | Utilization of AI and genetic data for precision nutrition and tailored pet foods. |

| Expansion of grain-free and raw diets. | Growth of insect-based and lab-grown protein sources. |

| Growing application of probiotics and functional ingredients for pet well-being. | AI drives food dispensers to monitor health and feeding. |

| Subscription-based delivery and e-commerce gained momentum. | Blockchain technology is used for supply chain transparency and product traceability. |

| Regulatory emphasis on product labeling and ingredient safety. | Therapeutic and plant-based food products expanded. |

The USA Pet Food Industry is witnessing consistent growth, spurred by premiumization, growing humanization of pets, and high interest in pet health and nutrition. There's a move towards organic, grain-free, and high-protein formulas with more awareness regarding pet dietary needs and pet allergies.

One of the fastest-expanding segments is organic and natural pet meal, with pet owners now choosing clean-label, preservative-free, high-protein ingredients. Wet meals are seeing increased popularity thanks to greater water content, greater digestibility, and improved palatability, particularly for seniors.

Prescription diets are growing, spurred mainly by the increasing incidence of pet obesity, diabetes, and digestive disease, prompting demand for vet-formulated products. Snacks and treats also remain strong, spurred by the pet training craze and fear of owner concerns about functional treats with supplementary vitamins and minerals.

With the development of the market, personalization, transparency of ingredients, and sustainability are becoming major drivers of purchase, determining the future of pet food consumption in the USA.

The pet food market in the USA is really flourishing as the increase in pet ownership and demand for premium pet dietary specialties support it. Nevertheless, the hard-hitting FDA and AAFCO regulations on food safety, ingredient sourcing, and labeling create compliance issues. Companies must, first of all, comply with the changing standards and then be open to their customer to build their trust.

Market stabilization is facing supply chain troubles, which include shortages of raw materials, transportation disruptions, and the high costs of raw materials. The industry's dependence on a few selected protein sources and unique ingredients is the reason it is subject to volatility in the cost of raw materials. It is recommended that the firms diversify the number of suppliers, take part in environmentally friendly sourcing, and enhance logistic operations to counter the possible threats.

The trend of customers choosing organic, grain-free, and functional foods with additional health perks is getting stronger. Yet, disbelief regarding marketing claims and worries about the presence of artificial additives in the products are two of the factors that affect their buying behavior. To maintain brand credibility, enterprises have to emphasize straightforward labeling, the use of only clinically tested formulas, and informative campaigns aimed at consumers.

The tremendous pressure of pricing and innovation, which is caused by the rivalry from well-known brands, private labels, and direct-to-consumer startups, becomes a challenge to enterprises. To stand firm against the competition, firms must engage their clients through a combination of unique formulations, environmentally friendly packaging, and nutrient-dense products while keeping prices low enough for a wide range of customers.

Economic downturn, inflation, and the way people spend their income on things that they do not have to, as well as the leaking purchasing power of consumers, are causing changes in the way consumers purchase goods. As for the companies, they need the same long-term growth due to which they are supposed to take a step into digital marketing, join their e-commerce one-fold, and produce value-for-money product lines that will cope with changing owners of the pets` tastes and budget considerations.

There is a rising demand for organic and monoprotein pet food in the USA market, as owners care more about health-conscious and specialized diets for their pets. As consumers continue to recognize the need to provide their pets with cleaner, sustainable options, demand for organic meals has also increased.

This segment is still performing well, accounting for an expected 29.7% share in 2025. At its core, organic meal is food made from ingredients that are grown without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), and it mirrors the broader trend toward natural and environmentally friendly products.

Many pet owners are choosing organic food for their dogs and cats, convinced it is both healthier for them and with fewer chemicals, just as they prefer organic products for their diets. Brands like The Honest Kitchen and Orijen and Castor & Pollux (all of which have an organic offering) have jumped on this demand, with free-range meats, organic vegetables, and whole grains packed into their products for a healthy, balanced diet.

Alternatively, monoprotein food is designed for the needs of pets with food sensitivities or allergies by providing a single animal protein source, like chicken, lamb, or fish. This segment has a predicted share of 16.8% by 2025. These diets minimize the risk of allergic reactions resulting from multiple protein sources and enhance digestibility by using a single protein.

Monoprotein foods can be gentler on pets' digestive systems than food with various protein sources, making them a great option for pets with sensitive stomachs. This category has been expanding as pet parents look for products that meet specific dietary requirements.

Moprotein pet food Hybrid Mix Shift Brands like Canidae, Natural Balance, and Merrick present a range of monoprotein food offerings and entail consumers interested in highly focused, readily absorbed nutrition for their pets.

Pet meals in the USA are expected to be segmented based on product type, including but not limited to dry food, wet/canned food, and others. Predicted to make up 34.5% share by 2025, dry food includes kibble, extruded, baked, and coated products. And for a good reason: it is quick and inexpensive and has a long shelf life.

For pet owners, dry food is the best option, providing balanced proteins, carbohydrates, fats, vitamins, and minerals. Purina Pro Plan, Hill's Science Diet, and Royal Canin are the big names in this category, which covers formulas for specific health problems, from weight management to sensitive stomachs. Dry food's compactness also plays a role in dental health, as pets are able to crunch up the food and clean their teeth.

By 2025, wet/canned food will account for 25.0% of the total share; moist products like stews, pâté, and gravies are included in this category. These foods are tastier and offer greater water levels that are important for hydration, especially for those pets who are not as willing to drink water.

Pouring your pet's meal into a single bowl of wet food is also helpful for certain pets that have dietary restrictions or are having issues with hydration if they have kidney problems or urinary issues. High-end brands such as Royal Canin and Wellness provide several formulations, including those catered to a specific breed or age.

| CAGR | (2025 to 2035) |

|---|---|

| USA | 8.2% |

The USA is likely to grow at a CAGR of 8.2% during the period from 2025 to 2035, higher than the world average of 6.2%. Growth is fueled by increasing pet ownership, with nearly 70% of American households owning at least one pet. Pet humanization is driving demand for high-end and specialty items as pet owners are increasingly adopting a family approach toward pets.

Pet owners are moving towards organic, grain-free, and high-protein foods, mirroring what humans consume. Additionally, functional foods, addressing digestive health, skin allergies, and joint health, are increasing. Pet nutrition and health concerns have also driven demand for natural ingredients away from dependence on synthetic additives and preservatives.

Leading companies have played a crucial role in defining the market tone. Nestlé Purina PetCare, headquartered in St. Louis, Missouri, is at the forefront of the market with Purina Pro Plan, Purina ONE, and Friskies brands.

Mars Petcare, another leading company, boasts Pedigree, IAMS, and Royal Canin, catering to various pet nutritional needs. The emergence of direct-to-consumer (DTC) brands like The Farmer's Dog and Ollie has further revolutionized the market, offering fresh, human-grade food tailored to individual pets.

Online stores like Chewy and Amazon have fueled market expansion by shipping premium pet food nationwide. In addition, sustainability concerns are compelling manufacturers to source responsibly and use green packaging solutions in accordance with consumers' aspirations for transparency and environmental-friendliness.

The pet food industry in the United States is extremely competitive and driven by the humanization of pets, an inclination toward premium nutrition, and an increase in expenditure on pet health. Consumers are looking for high-end, natural, and functional pet foods, pushing companies to innovate their offerings in terms of ingredients, formulation, and sustainability.

Major players like Mars Petcare (Pedigree, Royal Canin), Nestlé Purina, J.M. Smucker Co. (Meow Mix, Milk-Bone), Hill's Pet Nutrition, and Diamond Blue Buffalo (General Mills) form a highly consolidated space with a wide portfolio of dry, wet, raw, and prescription-based foods. Startups and niche brands deal in fresh, freeze-dried, and plant-based diets for those pet owners prioritizing digestive health, allergies, and grain-free options.

This is how the industry is currently evolving: premiumization, growth of DTC sales, and, lastly, trends in sustainability. Companies would incorporate human-grade ingredients, functional additives such as probiotics and omega fatty acids, and alternative proteins, such as insect-based and lab-grown meats.

As much as subscription-based models, veterinary partnerships, and omnichannelling will be key competitive strategies, the companies have also begun to invest in eco-friendly packaging and regenerative agriculture, which is a major attraction to those consumers who are ethically aware of the source.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mars Petcare (Pedigree, Royal Canin, Nutro) | 35-40% |

| Nestlé Purina PetCare (Purina, Fancy Feast) | 30-35% |

| J.M. Smucker Co. (Meow Mix, Milk-Bone) | 8-12% |

| Hill’s Pet Nutrition (Colgate-Palmolive) | 5-9% |

| Blue Buffalo (General Mills) | 4-8% |

| Other Players (Combined) | 8-15% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Mars Petcare | Key leader offering mass-market and premium brands, investing in veterinary diets, sustainable ingredients, and fresh food (Cesar, Sheba, Nutro Ultra). |

| Nestlé Purina PetCare | Focuses on high-protein, functional nutrition, and science-backed pet health formulas, expanding in wet, fresh, and grain-free food categories. |

| J.M. Smucker Co. | Strong in value-focused food treats, with a growing presence in premium and natural formulations (Nutrish, Nature’s Recipe). |

| Hill’s Pet Nutrition | Veterinary-recommended, science-driven formulas for specific health conditions, emphasizing digestive health, weight management, and senior pet diets. |

| Blue Buffalo | Fast-growing premium natural brand focusing on grain-free, holistic, and raw-inspired nutrition with high-quality proteins and limited-ingredient diets. |

Key Company Insights

Mars Petcare (35-40%)

Leaders in the international industry are investing in intelligent pet technology (Whistle, Wisdom Panel) and green packaging with recent fresh pet food acquisitions.

Nestlé Purina (30-35%)

Bolster's premium and veterinary pet diets are launching probiotic-enhanced and prescription varieties, growing direct-to-consumer and customized nutrition.

J.M. Smucker Co. (8-12%)

Acquired Rachael Ray's Nutrish, emphasizing human-grade ingredients and appealing to budget-conscious premium shoppers.

Hill's Pet Nutrition (5-9%)

In prescription pet food, the leader has gotten a boost from veterinary endorsements and is extending its therapeutic diet lines.

Blue Buffalo (4-8%)

It perseveres in strong grain-free and raw-inspired diet expansion, with strength from DTC selling and expanding specialty pet retail channels.

The industry is expected to generate USD 44.2 billion in 2025, driven by rising pet ownership, premiumization of pet nutrition, and growing demand for specialized pet food products.

The market is projected to grow to USD 65.4 billion by 2035.

Key players include Mars Petcare (Pedigree, Royal Canin, Nutro), Nestlé Purina PetCare (Purina, Fancy Feast), J.M. Smucker Co. (Meow Mix, Milk-Bone), Hill’s Pet Nutrition (Colgate-Palmolive), Blue Buffalo (General Mills), Diamond Pet Foods, Freshpet, The Honest Kitchen, Wellness Pet Company, and Nature’s Logic.

States like California, Texas, Florida, New York, and Illinois present strong growth potential due to large pet populations and high consumer spending on premium pet food products.

Kibble/dry and wet food remain dominant, with freeze-dried and raw food segments growing rapidly. Animal-derived proteins like chicken and fish are popular, while plant- and insect-based sources are emerging. Store-based retailing leads, but online channels are seeing significant expansion.

It's classified as Organic, Monoprotein, and Conventional.

It's classified as Kibble/Dry, Extruded, Baked, Coated, Dehydrated Food, Freeze-Dried Food, Freeze-Dried Raw, Wet Food, Frozen, Raw Food, Powder, Treats and Chews, Dog-specific products (Pastes, Crèmes, Crunchy Snacks, Chew Sticks, Tablets, Biscuits, Jerky, Rawhide), and Cat-specific products (Pastes, Crèmes, Crunchy Snacks, Chew Sticks, Tablets, Biscuits, Cat Milk/Milk Snacks).

It's classified as Animal-derived (including fish such as Tuna, Salmon, Whitefish, Cod, Herring, Walleye, Flounder, Arctic Char, Whiting Chicken, Duck, Beef Pork, Venison/Game Lamb, and Turkey) and Plant-derived, with Insect-derived sources like Crickets, Mealworms, and Black Soldier Flies.

It's divided into cats (kittens, adults, seniors), dogs (puppies, adults, seniors), birds, and others (Rabbits, hamsters, etc.).

It's classified as pouches, bags, folding cartons, tubs & cups, and cans.

It's divided into Store-based Retailing (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Pet Stores, Discounters, Independent Grocery Retailers, Drugstores, and Other Retail Formats) and Online Retailers.

It's divided into California, Texas, Florida, New York, Illinois, Ohio, North Carolina, Michigan, Colorado, Wisconsin, and Washington.

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Korea Vanilla Bean Market Analysis byDistribution Channel, Form, Nature, Product Variety, and Region Through 2025 to 2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Korea Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.