The USA Pectin Market is projected to reach a value of USD 317.60 million in 2025, growing at a CAGR of 4.6% over the next decade to an estimated value of USD 497.96 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 317.6 Million |

| Projected USA Value in 2035 | USD 497.96 Billion |

| Value-based CAGR from 2025 to 2035 | 4.6 % |

The market, dominated by moderate to high concentration, is witnessing key companies battling with various tactics to gain more share. The production capacities of manufacturers have witnessed an upward shift to meet the demands of rising production, especially from the food and beverage industry which widely adopts pectin as a gelling and stabilizing agent.

Firms are also channeling their resources toward technological improvements in extraction procedures, thus boosting the quality and yield of the product. The industry is experiencing a notable transition to the use of natural and clean-label ingredients spurred by consumer preference for organic and plant-based products. The trend has brought about a positive impact on innovation leading to pectin formulations that include low sugar and functional variants appropriate for dietary concerned consumers.

Also, strategic alliances, mergers, and acquisitions are the main forces transforming the competitive environment, enabling producers to both increase product lines and expand into new regions. The USA pectin market is set for a stable growth path with the ongoing demand for natural ingredients in processed foods, beverages, and pharmaceutical products.

Explore FMI!

Book a free demo

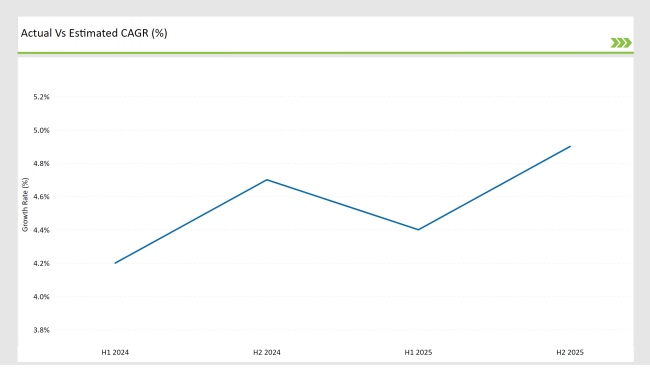

The USA Pectin Market is anticipated to have a growth rate of 4.2% CAGR in the first half of 2024, which would then increase to a 4.7% CAGR in the latter half. The CAGR for the year 2025 is projected at 4.4% for H1 and 4.9% for H2.

H1 signifies period from January to June, H2 Signifies period from July to December

These trends depict the growing need for natural ingredients, the amendments in regulations, and the upsurge in innovation, which renders this breakdown necessary for the strategic planning of the USA Pectin Market.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | DuPont: Launched citrus-based pectin for plant-based foods, emphasizing sustainability in dairy alternatives. |

| March 2024 | J.M. Huber: Acquired pectin innovator Naturex to strengthen natural ingredient portfolio for pharmaceuticals. |

| May 2024 | CP Kelco: Introduced low-methoxyl pectin for sugar-reduced beverages, enhancing texture in low-calorie drinks. |

| July 2024 | Ingredion: Expanded pectin production in Iowa, increasing capacity by 25% to meet clean-label demand. |

| August 2024 | Tate & Lyle: Partnered with Algaia for algae-pectin blends targeting vegan gummies and confectionery. |

Surge in Clean-Label and Plant-Based Demand

Driven by the increasing consumer preference for clean-label and plant-based ingredients, the USA pectin market is experiencing a healthy upturn. The pectin from citrus peels and apple pomace is the one chosen increasingly by food and beverage manufacturers over synthetic additives.

The trend for organic and minimally processed foods has resulted in the production of theurity non-GMO pectin variants. Moreover, the growing interest in dairy and confectionery plant-based products has led to some breakthroughs in texturizing and stabilizing solutions. Consequently, the re-engineering of product formulations, investment in sustainable sourcing, and encouraging regulatory compliance have become the dominant characteristics of this trend.

Expansion of Domestic Production and Processing Capabilities

Faced with the growing demand for pectin by food, beverage, and pharmaceutical industries, USA manufacturers have decided to expand to domestic production to lessen the reliance on imports. Several companies have taken steps to achieve this by making investments in state-of-the-art extraction technologies aimed at improving yield and efficiency without compromising quality.

Moreover, more citrus byproducts will be used as a way to ensure a sustainable supply chain. Also, cooperation between the food manufacturers and the pectin suppliers are the other reasons why the market stability will be reached and the demand will be ensured for the end-users. Hence, the USA pectin market is recovering its supply chain, and cost efficiency increased, thus, the long-term growth of the industry is secured.

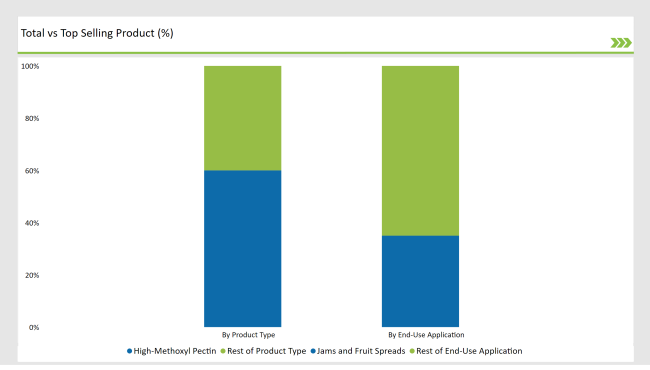

High-methoxyl (HM) pectin accounts for the largest share of the USA pectin market, holding nearly 60% of total consumption. The fact that so many producers use it in jams, jellies, and fruit spreads as a gelling agent under high-sugar conditions accounts for its dominance.

The increase in the sale of premium fruit preserves and the reduction of sugar in formulations has led to a higher usage of it. Furthermore, HM pectin widely appears in confectionery products and dairy desserts, being the one that gives the best texture and stability to the final product. As the clean-label trend increases awareness, manufacturers are developing new HM pectin extraction methods to maintain the quality of the product and the sustainability aspect of the production process.

The largest end-use application in the USA pectin market is Jams and fruit spreads, accounting for about 35% of the total market share. This growth has been spurred by the change in consumer preferences towards natural, fruit-based spreads compared to synthetic alternatives.

The very first ingredient that spans the majority of these goods, pectin, has played a crucial role in improving the organoleptic properties associated with taste, stability, and shelf life. The quest for lower sugar and organic formulations in the jam sector has been responsible for the development of a modified pectin that is low-methoxyl or amidated. As people are looking for clean-label products and minimally processed foods, this segment is expected to keep rising in the future.

The pectin market in the USA is a bit middle-of-the-road and not completely fragmented, as few key players focus on the industry. Big manufacturers like DuPont, CP Kelco, J.M. Huber Corporation, and Ingredion Incorporated are the ones who own considerable market shares due to their effective overhead and high-class production technologies.

These companies are at the forefront in terms of resources dedicated to research and development so that they meet the burgeoning demand for health and nutrition-oriented natural and clean addition formulation elements, which are the core of food brands' quest for plant-based, organic, and sugar-reduced formulations.

To increase their sales, major manufacturers are prioritizing the expansion of production capacity which is particularly productive in the sectors such as fruit spreads, jams, and reduced-sugar beverages. Strategic partnerships, acquisitions, and the opening of new sites are the primary methods to extend their outreach in the crowded industry.

The manufacturers are also driven by the requirement of environmentally sustainable sourcing and manufacturing processes that have them to go green again as well as innovate new solutions, these being the factors of competition and market dynamics to the USA pectin market.

2025 Market share of USA Pectin Market suppliers

.png)

The USA pectin market is expected to grow at a CAGR of 4.6% from 2025 to 2035.

The USA pectin market is projected to reach a value of USD 497.96 million by 2035.

The high-methoxyl pectin segment is expected to grow the fastest, driven by its use in jams and fruit spreads.

Factors driving growth include increasing demand for clean-label products, plant-based ingredients, and health-conscious formulations like reduced-sugar alternatives.

Key players in the market include DuPont, CP Kelco, Ingredion, J.M. Huber Corporation, and Tate & Lyle.

The market is segmented into High-methoxyl Pectin, Low-methoxyl Pectin, Amidated (LMA), and Non-Amidated (LMC) types, each catering to specific applications.

Pectin is used in various applications, including Fermented Plant-based Products, Jams, Jellies, Fruit Spreads, Sauces, Glazes, Bakery Fillings, Fruit Roll Ups, and more.

The market is segmented by source into Citrus Fruits such as Oranges, Grapefruit, Lemons, Limes, and Apples, along with other fruits like Pears, Plums, and Berries.

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.