The USA oral clinical nutrition supplement market is projected to reach a value of USD 4,090.3 Million in 2025, growing at a CAGR of 4.9% over the next decade to an estimated value of USD 6,568.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 4,090.3 Million |

| Projected Global Value in 2035 | USD 6,568.8 Million |

| Value-based CAGR from 2025 to 2035 | 4.9% |

Growing awareness among people about clinical nutrition, the increasing number of elderly people, and the existence of chronic diseases that need specific nutritional assistance are the main drivers of the market growth. The essential nutrients obtained like vitamins and minerals are of great importance for recovering patients and oral clinical nutrition supplements are the custom-made solutions for that.

These supplements have been fabricated to satiate the particular dietary requirements of the patients suffering from different health reasons, like, malnutrition from diseases, eating needs of the cancer patients, kidney problems, and diabetes. The fact that these come in the form of powder, liquid, and semi-solid makes it easy for medical professionals and patients to decide on a suitable product.

The innovative drive in the market is due to the higher frequency of chronic illnesses, as well as the emerging demand for more tailored and focused nutrition. Production companies have excessive investments in innovations and development to enhance taste and texture together with nutrient absorption of the clinical products.

Likewise, the advent of OTC (over-the-counter) sales will add to the factor of improved convenience which will, in turn, empower customers to easily adopt clinical nutrition in their daily lives. Marking its emphasis on both creativity and customer-oriented plans the market for oral clinical nutrition in the USA stands to boisterous progression during the predicted time.

Explore FMI!

Book a free demo

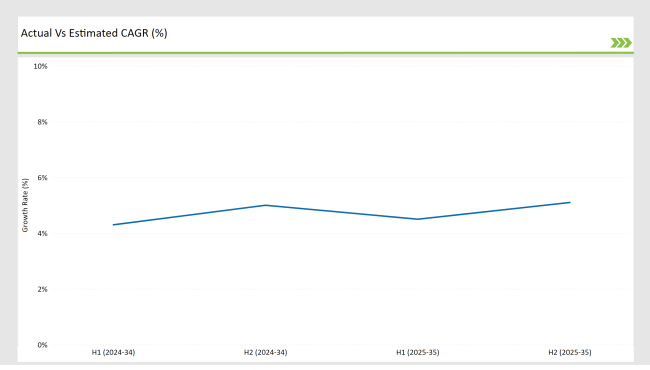

The semi-annual market update shows steady growth in oral clinical nutrition supplements adoption, as more healthcare professionals recommend it and as people become increasingly aware of targeted nutrition.

H1 signifies period from January to June, H2 Signifies period from July to December

Improvements in formulation technologies and the launching of condition-specific supplements have increased the pace of the market's growth. The expansion of the OTC channel also played a key role in expanding the distribution network for clinical nutrition products.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Abbott Laboratories: Launched a new line of oral nutritional supplements specifically designed for patients with swallowing difficulties. |

| March 2024 | Nestlé Health Science: Acquired a startup focused on developing plant-based oral nutritional supplements to expand its product portfolio. |

| April 2024 | Danone Nutricia: Introduced a new flavor range for its oral nutritional supplements to enhance patient compliance and satisfaction. |

| July 2024 | Fresenius Kabi: Announced a partnership with healthcare providers to improve access to oral nutritional supplements for patients in home care settings. |

| September 2024 | Kate Farms: Expanded its distribution network to include more healthcare facilities, focusing on its plant-based oral nutritional products. |

Growing Demand for Personalized Nutrition Solutions

Personalized nutrition is changing the oral clinical nutrition supplement market with the ongoing shift by healthcare providers and consumers towards customized solutions. Improvements in genomics, biomarkers, and AI-driven diagnostics are allowing formulators to produce precision nutrition formulas tailored to each patient's metabolic need and health condition. Customized supplements designed for oncology patients focus on boosting immunity and combating treatment-induced side effects.

These customized solutions optimize patient compliance as well as improve therapeutic outcomes for patients suffering from specific nutrient deficiencies. Moreover, these companies are implementing wearable health technologies and mobile application-based real-time feedback and guidance to increase the take of personalized clinical nutrition.

Innovation in Nutrient Delivery Systems

Bioavailability and absorption of nutrients is another prime focus of manufacturers of clinical nutrition supplements. Recently, technological breakthroughs in microencapsulation and nano-emulsion technologies have provided an opportunity for creating nutritional supplements with greater stability, solubility, and palatability. The inventions will efficiently ensure that these critical nutrients are delivered to the patient with absorptive difficulties - either from postoperative or chronic conditions.

Integration of lipid-based delivery systems with slow-release formulations has further optimized nutrient retention and therapeutic efficacy. Therefore, these technological advancements are promoting the uptake of advanced oral clinical nutrition supplements among various patient populations.

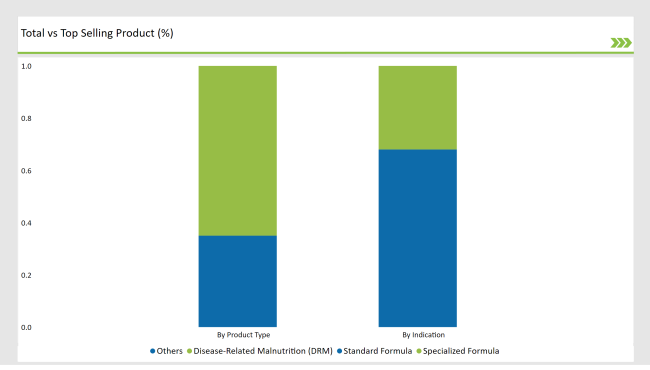

% share of Individual categories by Species and Forms in 2025

Specialized Formulas Lead the Market

The market will be led by the 65% share of the specialized formulas while the standard formulas will be relegated to a mere 35%. These specialized formulas are for specific nutritional solutions for patients with chronic diseases like renal diseases, diabetes, and oncology-related malnutrition. They are bioengineered to deliver nutrients directly to the body, which leads to best health and rapid recovery.

The increasing emphasis on the use of personalized healthcare plans in turn drives the cycle of innovation, product evolution, and adoption in this product category which consequently, underlines the importance of such goods in treating patients.

Disease-Related Malnutrition Drives Market Demand

Disease-related malnutrition (DRM) is anticipated to hold the largest share of the market at 32% in 2025, indicating the growing requirement for clinical nutrition in the treatment of chronic diseases and recovery after surgery. Attention has been increasingly given by healthcare workers to the targeted supplementation of nutrients prescribed to patients with nutrient deficiencies to better the results of their diseases. Consequently, the strong demand in this sector is guaranteed.

Note: above chart is indicative in nature

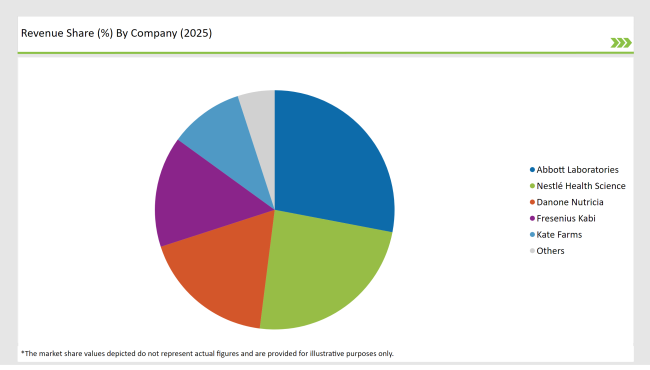

The USA oral clinical nutrition supplement sector consists of both globally centralized brands and recently founded ones. The market is primarily ruled by Abbott Laboratories, Nestlé Health Science, and Danone Nutricia. Such enterprises are actively engaged in the creation of particular nutritional products that target the exacting needs of patients dealing with chronic diseases and recovery processes.

For instance, Kate Farms is one such brand, even gaining the leeward of other startup companies by its admittance of the untapped potential of organic and plant-based clinical nutrition solutions.

Throughout the years, leading organic and sustainable medical food companies entered the segment of clinical nutrition. Such brands create niche differences by giving healthy consumers products free from allergens and having clean labels.

In-house collaboration between the manufacturer and health providers adds more to the competition dynamics in the market. Direct relations with hospitals and clinics would guarantee wide acceptance of clinical nutrition supplements, while digital marketing and e-commerce channels would ensure end consumers can easily reach out to them.

Prescription-based products amount to 70% of sales, while 30% go through over-the-counter channels have marked increased penetration of consumer-driven health solutions.

The market is expected to grow at a CAGR of 4.9% from 2025 to 2035.

The USA Oral Clinical Nutrition Supplement market is projected to reach USD 6,568.8 Million by 2035.

The market is growing due to increasing awareness of clinical nutrition, rising geriatric populations, and higher prevalence of chronic diseases requiring targeted dietary support.

Top players include Abbott Laboratories, Nestlé Health Science, Danone Nutricia, Fresenius Kabi, and Kate Farms.

By product type, the market includes standard and specialized formulas

By indication, the market is segmented into disease-related malnutrition (DRM), renal disorders, hepatic disorders, oncology nutrition, diabetes, and others.

By form, the industry is categorized into liquid, semi-solid, and powdered formulations.

By sales channel, the market covers prescription-based and over-the-counter (OTC) sales.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.