The USA Omega-3 Concentrates Market is projected to reach USD 1,522.6 million in 2025, with substantial growth expected to drive its valuation to USD 3,464.2 million by 2035. This reflects a forecasted CAGR of 8.6% over the period from 2025 to 2035, fueled by increasing consumer awareness about heart health, cognitive benefits, and anti-inflammatory properties of omega-3 fatty acids.

The market is further driven by advancements in purification technologies, the shift toward high-concentration omega-3 formulations, and the growing popularity of plant-based omega-3 alternatives.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,522.6 million |

| Industry Value (2035F) | USD 3,464.2 million |

| CAGR (2025 to 2035) | 8.6% |

The USA Omega-3 Concentrates Market is experiencing strong growth because consumers are increasingly adopting concentrates of omega-3 as supplements for cardiovascular, cognitive, and joint health. Consumers are rapidly moving toward high-purity formulations that have higher levels of EPA and DHA to enhance better absorption and effectiveness in inflammation management, brain functioning, and lipid profiles.

Companies like DSM Nutritional Products, BASF SE, and Nordic Naturals have been in the forefront of delivering innovative omega-3 delivery formats, purity improvements, and scaling up sustainability of sourcing marine-based omega-3s.

Algal oil-based omega-3 concentrates appeal to vegan and vegetarian consumers for whom the surge in demand from plant-based alternative sources is witnessing a trend increase. The growth of the market is also partly due to pharma, mainly through prescription products for hypertriglyceridemia and the treatment of other inflammatory conditions, while omega-3 concentrates enter functional foods and infant formulas with pet nutrition still diversifying them across various kinds of consumer categories.

Explore FMI!

Book a free demo

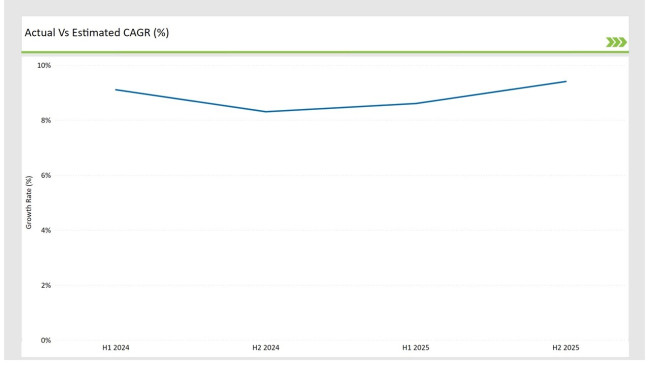

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Omega-3 Concentrates market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 9.1% |

| H2 Growth Rate (%) | 8.3% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 8.6% |

| H2 Growth Rate (%) | 9.4% |

For the USA market, the Omega-3 Concentrates sector is projected to grow at a CAGR of 9.1% during the first half of 2024, with an increase to 8.3% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 8.6% in H1 and reach 9.4% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Golden Omega unveiled an ultra-concentrated omega-3 powder using novel spray-drying technology. The innovative process achieves 75% EPA/DHA content with superior oxidative stability and eliminates fishy taste. |

| Oct-2024 | BASF and Cargill launched a joint algal omega-3 production facility in Brazil with USD 200 million investment. The sustainable facility produces high-purity DHA concentrates from microalgae cultivation. |

| Aug-2024 | Norwegian firm Epax introduced pharmaceutical-grade omega-3 concentrates with 98% purity. The product uses advanced molecular distillation and chromatography techniques to achieve unprecedented purity levels. |

| Jun-2024 | DSM developed a new omega-3 concentrate specifically for prenatal nutrition. The product features an optimized EPA:DHA ratio (1:4) supported by clinical studies showing enhanced fetal brain development. |

| Apr-2024 | Croda acquired AlgaeOmega Technologies for USD 150 million, expanding their sustainable omega-3 portfolio. The acquisition includes proprietary fermentation technology for producing high-concentration EPA from marine microalgae. |

High-Concentration Omega-3 Formulations Gain Popularity in Premium Supplement Segments

The demand for concentrates of omega-3 with a purity level of 50-70% is increasing at 38.3% market share, and over 70% concentration is rising at 36.9%. Consumers and health professionals are keen on the use of highly potent formulations that give better health benefits with less dose requirement.

The high concentration of omega-3 products offers greater bioavailability, enhanced anti-inflammatory effects, and higher absorption rates, which is why it's preferred for therapeutic use, high-performance nutrition, and pharmaceutical-grade omega-3 formulations.

Algal Oil-Based Omega-3 Concentrates See Strong Growth as Vegan and Sustainable Alternatives Expand

The rapid growth of algal oil omega-3 products, which comprise 21.4% market share, results from the replacement of traditional fish and krill oil with eco-friendly and plant-based alternatives. Sources of algae-derived omega-3 are a rich source of DHA. Such sources make it a well-received nutraceutical supplement for vegan populations, infant nutrition products, and functional food applications. Companies such as Corbion NV and Epax Norway AS are leading sustainable microalgae cultivation and extraction processes to enable environmentally friendly high-quality omega-3 production.

| By Source Type | Market Share |

|---|---|

| Fish Oil | 43.2% |

| Remaining Segments | 56.8% |

While the majority of the omega-3 concentrates still derive from fish oil (43.2%), with its well-developed supply chain, high DHA/EPA ratios, and extensive clinical background, krill oil (28.7%) and algal oil (21.4%) are growing much faster as a result of a shift in public concerns toward sustainable sources and personal preferences for a more varied diet. The higher regulatory scrutiny towards the sourcing of marine fish oils is also increasing the pressure to invest in more alternative sources with better purity and eco-friendly methods of production.

| By Application | Market Share |

|---|---|

| Dietary Supplements | 52.4% |

| Remaining Segments | 47.6% |

Dietary supplements account for the largest share, at 52.4%, since consumers are looking for high-quality formulations of omega-3 for purposes such as heart health, cognitive support, and alleviation of joint inflammation. The supplement industry has made a major shift toward higher purity and sustainability for sources of omega-3, while brands have focused on delivering bioavailability through soft gels, emulsions, and liposomal formulations.

Concurrently, pharmaceutical applications (25.1%) have also been growing and certainly highly represented by the prescribing of prescription-strength omega-3 drugs such as Vascepa and Lovaza for lipid management and reduction of cardiovascular risk.

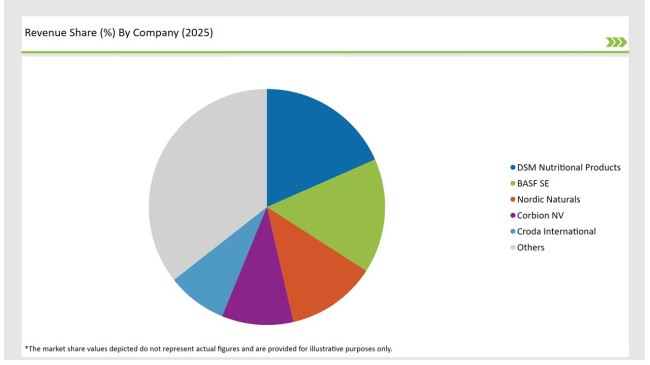

There have been multinational suppliers of ingredients with marine oil refining companies competing and vying in the USA. DSM Nutritional Products, along with BASF SE and Nordic Naturals are the leaders on account of advancement in purification processes, diversified varieties of omega 3 products range, and greater supply chain power.

Companies in the likes of Corbion NV and Croda International emphasize sustainable microalgal production in contrast to focus on pharmaceutical quality innovations by the KD Pharma Group and Omega Protein Corporation.

| Company | Market Share |

|---|---|

| DSM Nutritional Products | 18.4% |

| BASF SE | 15.7% |

| Nordic Naturals | 12.3% |

| Corbion NV | 9.8% |

| Croda International | 8.2% |

| Other Players | 35.6% |

To lead in competition, top companies for omega-3 production rely on high purity through extraction technology, plant-based sources, and pharmaceutical-grade product forms. Leading molecular distillation technology providers to which DSM and BASF SE invested significantly improves omega-3 concentration while getting rid of unwanted substances.

However, Nordic Naturals and Corbion NV produce algal-based omega-3 products focusing on vegan consumers as well as environmentally friendly people. KD Pharma Group and Omega Protein Corporation are strengthening their pharmaceutical-grade omega-3 offerings to meet clinical and medical demands while expanding the supply chain networks.

By 2025, the USA Omega-3 Concentrates Market is expected to grow at a CAGR of 8.6%, driven by rising demand for high-purity omega-3 supplements, pharmaceutical applications, and plant-based alternatives.

By 2035, the USA Omega-3 Concentrates Market is projected to reach USD 3,464.2 million, fueled by expanding functional food applications and increasing adoption in heart and brain health formulations.

The market is driven by growing consumer awareness of omega-3 health benefits, increasing demand for sustainable marine and plant-based sources, and the rise of prescription omega-3 drugs for cardiovascular care.

The West Coast and Northeast USA lead in omega-3 consumption due to their health-conscious populations and strong retail presence for dietary supplements and functional foods.

Prominent manufacturers in the USA Omega-3 Concentrates Market include DSM Nutritional Products, BASF SE, Nordic Naturals, Corbion NV, and Croda International, along with specialized marine oil refiners and plant-based omega-3 producers.

Fish Oil, Krill Oil, Algal Oil, Others

30-50% Concentration, 50-70% Concentration, Above 70% Concentration

Dietary Supplements, Pharmaceuticals, Functional Foods, Infant Formula, Pet Food

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Non-Alcoholic Malt Beverages Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.