The USA Nucleotide Premixes Market is projected to achieve a market value of USD 951.7 million by 2025, with forecasts indicating significant expansion to USD 2,105.1 million by 2035. Over the forecast period (2025 to 2035), the industry is expected to grow at a CAGR of 8.3%, fueled by technological advancements in genetic research, rising adoption of nucleotides in personalized medicine, and innovations in cell culture techniques for biopharmaceutical applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 951.7 million |

| Industry Value (2035F) | USD 2,105.1 million |

| CAGR (2025 to 2035) | 8.3% |

The USA Nucleotide Premixes Market is growing rapidly, driven by increasing applications in PCR & amplification, molecular diagnostics, and DNA/RNA synthesis. Ultra-pure nucleotide premixes are now in higher demand due to biotechnology, genomics, and advanced biopharmaceutical research findings in personalized medicine and cell culture advancements.

Among the trends of this industry are high-purity nucleotides that improve the efficiency of PCR and the accuracy of next-generation sequencing. Also, lyophilized nucleotide formulations are trending nowadays because these offer longer shelf life and better stability for various applications in molecular biology.

Thermo Fisher Scientific, Merck KGaA, and Bio-Rad Laboratories are driving their growth with R&D spending, new product development, and strategic collaborations with genomic research centers. The market is moderately concentrated, and key players continue to expand their supply chains and deliver customized nucleotide solutions for newly emerging genetic research applications.

Explore FMI!

Book a free demo

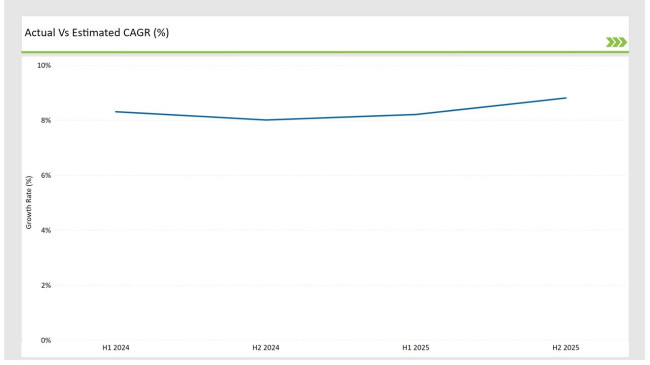

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Nucleotide Premixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 8.3% |

| H2 Growth Rate (%) | 8.0% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 8.2% |

| H2 Growth Rate (%) | 8.8% |

For the USA market, the Nucleotide Premixes sector is projected to grow at a CAGR of 8.3% during the first half of 2024, with an increase to 8.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 8.2% in H1 and reach 8.8% in H2.

| Date | Details |

|---|---|

| Nov-2024 | DSM unveiled a new nucleotide complex for aquaculture feed. The premix improves growth rates and disease resistance in farmed fish species. |

| Sep-2024 | Ajinomoto launched a clean-label nucleotide premix for pet food applications. The product enhances palatability while supporting immune system development. |

| Jul-2024 | CJ CheilJedang acquired nucleotide specialist BioNutra Solutions. The acquisition strengthens their position in premium infant nutrition ingredients. |

| May-2024 | Lallemand Bio-Ingredients introduced a sports nutrition nucleotide blend. The product is clinically proven to enhance post-exercise recovery and immune function. |

| Mar-2024 | Star Lake Bioscience developed a new fermentation process for nucleotide production. Their technology increases yield by 40% while reducing production costs. |

Rising Demand for Ultra-Pure Nucleotides in High-Precision Genetic Applications

The demand is on the surge for ultra-pure nucleotides (>99% purity), given their application in high precision PCR, DNA/RNA sequencing, and in molecular diagnostics applications. Researching institutes and firms dealing with pharmaceutical biotechnology largely rely on using premix nucleotide solutions as they improve on PCR efficiency to yield better sequencings by the accuracy delivered.

Thermo Fisher Scientific and Merck KGaA, among other companies, are extending their ultra-pure nucleotide portfolios to enable next-generation sequencing and synthetic biology innovations. Such innovations help to ensure the reliability and reproducibility of genetic research.

Lyophilized Nucleotide Formulations Gaining Traction for Enhanced Stability and Storage

The use of lyophilized nucleotide premixes is becoming increasingly popular since researchers want higher shelf life and better stability besides ease of transporting in molecular biology applications. Being freeze-dried (lyophilized) unlike liquid nucleotide solutions, freeze-dried ones do not have to be kept in the refrigerator and can find extensive applications for point-of-care diagnostics and even remote genetic testing.

The major applications include cell culture and fermentation, where maintaining consistent concentrations without losing efficiency, lyophilized nucleotides play a good role.

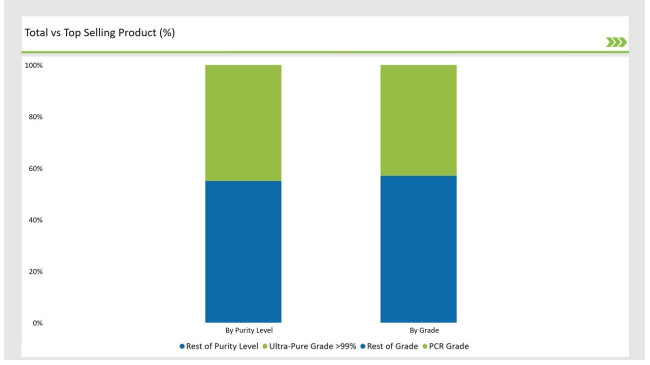

| By Grade | Market Share |

|---|---|

| PCR Grade | 43% |

| Remaining segments | 57% |

The PCR-grade nucleotides segment continues to be the biggest segment due to growing demand for molecular diagnostics, clinical research, and PCR-based testing related to COVID-19. The rising need for genetic point-of-care testing and research on infectious diseases is leading to increased production as manufacturers scale up production of nucleotide premixes.

In terms of nucleotides applied in molecular biology and sequencing applications, the demand is increasing; however, growth is not so strong since applications of PCR in routine diagnostic and research workflows command a larger share of the market.

| By Storage Form | Market Share |

|---|---|

| Solution Form | 58% |

| Remaining segments | 42% |

Solution-form nucleotide premixes are the largest share, with instant usability in automated workflows in labs. These premixes are successfully utilized in applications such as high-throughput PCR and DNA amplification as well as cell culture, all of which require particular consistency and efficiency.

In contrast, lyophilized nucleotides are growing faster in biopharmaceutical and field-based molecular diagnostics applications, where long shelf life and less storage requirement are the distinct advantages. The company is offering more customized lyophilized formulations for the evolving needs of the biotech and healthcare sectors.

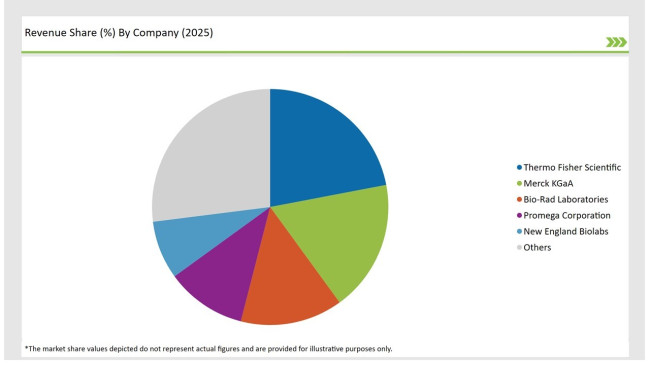

The USA Nucleotide Premixes Market is highly consolidated in nature, because of the leadership of global multinational corporations (MNCs), who have command over the superior technology, scale of production and distribution networks, leading to large-scale market influence.

The dominant players in this market are Thermo Fisher Scientific, Merck KGaA, and Bio-Rad Laboratories, which supplies nucleotide premixes used in PCR and molecular diagnostics application and genetic research. These organizations enjoy robust association with pharmaceuticals, biotechnological, and academic research groups.

Regional players do exist, but they primarily focus on niche and custom nucleotide formulations. Established global leaders offer higher purity grades and advanced storage solutions that challenge regional players.

| Company | Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 22% |

| Merck KGaA | 18% |

| Bio-Rad Laboratories | 14% |

| Promega Corporation | 11% |

| New England Biolabs | 8% |

| Other Players | 27% |

Through expansions in production facilities, research collaborations, and supply chain networks, leading companies in the USA Nucleotide Premixes Market are catering to the growing demand of these products in molecular diagnostics and synthetic biology.

Thermo Fisher Scientific and Merck KGaA have massive nucleotide production facilities based across the USA, which continues the focus on PCR-grade and ultra-pure nucleotides for genomic research. Bio-Rad Laboratories and Promega Corporation are investing in lyophilized nucleotide premixes, which are improving product stability and shelf life.

New England Biolabs is the leading manufacturer for DNA/RNA synthesis and sequencing nucleotides for NGS applications. These firms achieve strong supply chain relationships around the world that ensure availability of high-purity nucleotides on a regular basis.

By 2025, the USA Nucleotide Premixes Market is projected to grow at a CAGR of 8.3%, driven by the rising demand for genetic research and diagnostic applications.

By 2035, the sales value of the USA Nucleotide Premixes Market is expected to reach USD 2,105.1 million, reflecting the growth in molecular biology, gene sequencing, and synthetic biology applications.

The increasing adoption of nucleotides in PCR diagnostics, synthetic biology, and personalized medicine, along with technological advancements in genetic research, is fueling industry growth.

The West Coast and Northeast regions lead in nucleotide premixes consumption, driven by the presence of leading biotech research institutions, genomic companies, and pharmaceutical industries.

Major manufacturers in the USA Nucleotide Premixes Market include Thermo Fisher Scientific, Merck KGaA, Bio-Rad Laboratories, Promega Corporation, and New England Biolabs, along with Agilent Technologies, Takara Bio, Beckman Coulter, Jena Bioscience, and Lonza Group.

Includes PCR Grade, Molecular Biology Grade, Cell Culture Grade, and Sequencing Grade.

Comprises Ultra-Pure Grade (>99%), High-Pure Grade (95-99%), and Standard Grade (90-95%).

Categorized into Solution Form and Lyophilized Form.

Used in PCR & Amplification, DNA/RNA Synthesis, Cell Culture & Fermentation, Molecular Diagnostics, and DNA Sequencing.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.