The USA Monoprotein Market is expected to reach USD 1409.8 million in 2025 and is projected to experience a steady year-over-year growth of 3.3%, reaching a total value of USD 1786.1 million by 2035. This represents a compound annual growth rate (CAGR) of 2.4% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 1409.8 million |

| Projected USA Value (2035) | USD 1786.1 million |

| Value-based CAGR (2025 to 2035) | 2.4% |

The mono protein market in the USA is going through a consistent growth trajectory, as people prefer clean-label, allergen-free, and highly digestible protein sources. The manufacturers are now putting in more seriousness to grab extra market shares through product differentiation, capacity expansion, and strategic partnerships.

To meet the demand, the companies are taking the route of increasing production facilities through investment in the latest processing technologies and effective supply chain management. A fair number of manufacturers are also moving to automatic production lines as a way to enhance efficiency while ensuring the consistency of their products.

Furthermore, a shift to sustainable ingredient sourcing has also been noted, where the producers are looking at ethically raised, traceable protein sources thus meeting the consumer concern for more transparency.

The demand for natural ingredients is profoundly affecting the changes in the sector. Consumers are actively after monoprotein sources like beef, chicken, fish, or plant-based alternatives because of the high digestibility and low food intolerance risks. In reply, some manufacturers have brought clean-label formulations into the market that stress the use of the least possible processing, organic certification, and the absence of artificial additives.

The pet food market sector is the biggest starter fire in market growth, the pet owners are the ones who are more and more choosing mono protein-based diets for their pets to combat allergies and intestinal discomfort. This is giving rise to the trend of developing mono-protein products made freeze-dried, raw, and without grain.

Explore FMI!

Book a free demo

The USA monoprotein market is transforming, led by the single source of proteins and clean-label products. Key growth influencers include regulatory updates, consumer preference changes, and production improvements. This semiannual report helps businesses stay informed and make improved strategic adjustments to achieve growth in a competitive environment.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Theet Food Uniform Regulatory Reform Act (PURR Act) was introduced to modernize pet food |

| January 2024 | The Associatioof American Feed Control Officials (AAFCO) implemented new pet food labeling guidelines to enhance transparency. |

| April 2024 | Nestlé Purina invested €472 milliono open a new pet foofactory in Mantua, Ita, expanding their production capacity. |

| May 2024 | Nestlé Purina invested USD 220 million to boost production in Mexico, aiming to meet increasing demand in the region. |

| October 2024 | Nestlé Purina expanded its factory in Hungary by adding two new production units, increasing its manufacturing capabilities. |

Rising Demand for Hypoallergenic Nutrition

The increase in demand for hypoallergenic food, especially in pet food and specialized human diets, is the most noticeable trend in the USA mono protein segment. Genetic hypersensitivity, problems with the digestive system, and food allergies are the most important reasons for customers to utilize single-source protein to reduce adverse reactions. Thus, the industry is offering one of the new products- mostly available only with one or two ingredients, soy inks, new peas, etc.

This development has been made possible in part by the increasing knowledge of the gut, intestine health, and wellness that propels the demand for monoprotein formulations that are easy to digest. Such a turn of events is the basis for the manufacturers to be more and more committed to transparency, traceability, and sustainable sourcing to deliver consumer expectations regarding the increase of cleaner and more functional proteins or ingredients.

Expansion of Freeze-Dried and Raw Monoprotein Formats

The USA mono protein market brings the significant introduction of freeze-dried and raw mono protein product variants that are powered by the emerging trend for minimally processed foods.

The freeze-dried monoprotein meals and treats allowed for nutrient retention in the pet food sector and are now trending as the most practical solution of aliment for their increased use. Furthermore, raw protein powders and freeze-dried mono protein chips are being recognized in the human nutrition industry as premium quality light weight, fast-food nutrients that can be taken anywhere.

Besides, the producers are pouring funds into modern dryers to ensure the integrity of infinite protein and raise the expiration date. At the same time, it corresponds to everything the buyers admire when it concerns naturally-made, high-protein, and fast-to-digest nutrients. Through all that lasting time, monoprotein maintains stable participation in the forefront of product innovations with clean labels.

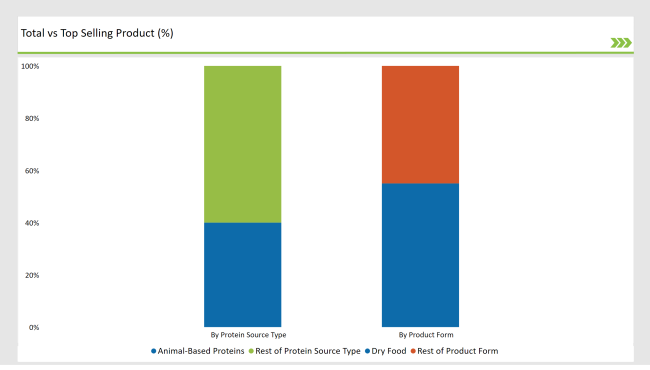

% share of Individual categories by Source Type and Form in 2025

Protein Source Type: Animal-Based Proteins

Due to their ability to closely mimic the taste and texture of traditional dairy products, animal-based proteins explain about 67% of the USA cheese alternatives market. Many consumers opt for these products because they are familiar with them and consider them to be more nutritious, for example, higher protein and essential amino acids.

Among the products that are made from whey or casein are the particularly popular ones, they are good for health-conscious people as well as for people interested in different flavors. Meanwhile, some cheese manufacturers are improving the sensory experience of this kind of cheese by the innovation of various techniques thus the cheese fans are being assured of their normal expectations while being trained on different ethical preferences.

Product Form: Dry Food

By a wide margin, dry cheese alternatives represent 55% of the cheese alternatives market in the United States. This subcategory includes several products that are shredded, sliced, and block forms of cheese alternatives. They have been in high demand because of their ease of use, flexibility, and long shelf life. The use of dry cheese alternatives has been on the rise in numerous applications in cooking and snacking, thus forming a necessity in several homes.

The meal-prepping and on-the-go eating trends have surged, driving the demand for these products even more. Aside from that, producers are committed to improvement in flavor profiles and melting ability, thus really enhancing the whole customer experience, be it for plant-based or traditional cheese fans.

Note: above chart is indicative in nature

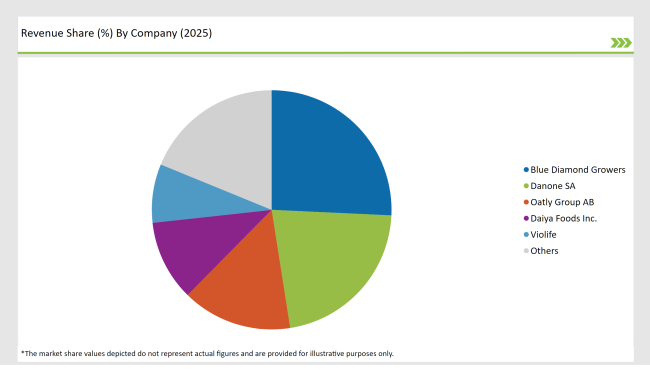

The USA monoprotein market portrays a highly competitive atmosphere along with the presence of different levels of market concentration among key players.

Tier 1 companies are powerful industry forces that include the likes of Nestlé and Mars, Inc., which take control of the market with a wide range of products and firm brand recognition. These companies exploit their innovative and distributive capabilities to reach numerous consumer groups widely.

Tier 2 companies are the original physical brands such as Blue Buffalo and Wellness Pet Food, which are focused on premium monoprotein and attract health-conscious consumers. The brands advertise with high-quality ingredients and one-of-a-kind recipes to match pet owners' requirements for a solution to dietary problems.

Companies mostly composed of small, specialized market players like The Honest Kitchen and PetPlate, are mostly Level 3 companies. These companies continue to promote their product lines as unique and distinctly separate from other market sectors. The companies, although usually stressed on natural, organic, and sustainable practices, created their loyal customer base.

The market is expected to grow at a CAGR of 2.4% from 2025 to 2035.

The USA Monoprotein market is projected to reach USD 1786.1 Million by 2035.

The plant-based protein segment is expected to grow the fastest, driven by increasing consumer demand for healthier and sustainable options.

Key growth factors include rising health consciousness, the prevalence of food allergies, and the increasing popularity of clean-label and sustainable products.

Key players include Blue Diamond Growers, Danone SA, Oatly Group AB, Daiya Foods Inc., and Violife, known for their innovative product offerings.

The market is segmented into animal-based proteins and plant-based proteins, catering to diverse consumer preferences and dietary needs.

The market is segmented into dry food, wet food, and treats and snacks, offering various options for pet owners.

The market is segmented into products for dogs, cats, and other pets, addressing the specific nutritional requirements of different animals.

The market is segmented into online retail and offline channels, providing consumers with multiple purchasing options for convenience and accessibility.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.