The USA Mezcal market is projected to reach a value of USD 8,345.0 Million in 2025, growing at a CAGR of 7.8% over the next decade to an estimated value of USD 17,719.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 8,345.0 Million |

| Projected USA Industry Value in 2035 | USD 17,719.8 Million |

| Value-based CAGR from 2025 to 2035 | 7.8% |

The USA mezcal market is set for a big jump from 2025 to 2035, with the main driving forces being the increasing people & acute attention to artistic and premium drinks. The more consumers look for initial and natural beverage drinks, the more mezcal becomes popular among the millennials and young people who prefer it for its original taste.

The market will also take advantage of the better distribution channels: the addition of brick-and-mortar outlets and e-commerce platforms will ensure that the retailing, as well as the direct sales to the consumer, are quite easily done. What is more, the switching trend to manufacturing under sustainable and organic conditions corresponds with the booming health-conscious narrative of the people.

The marketing will be partly done through a cultural focus on the uniqueness of the product (i.e. mezcal) and spreading the idea of mixing it into cocktails in an innovative manner which would further grow it. To summarize, the airy USA mezcal market which is expected to be more buoyant is also a result of strong demand that logically brings in the process of changing consumer preferences in the alcoholic beverages sector.

Explore FMI!

Book a free demo

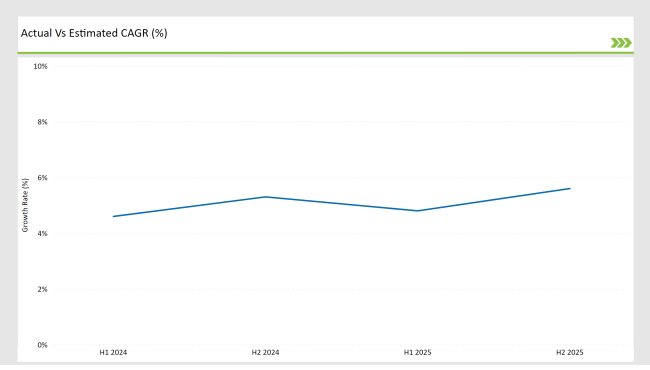

The semi-annual market update highlights the rising preference for small-batch and premium mezcal offerings, particularly among millennial and high-income consumers.

H1 signifies period from January to June, H2 Signifies period from July to December

The expansion of mezcal-based cocktail programs, sustainable production practices, and premiumization of spirits is driving industry growth.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Del Maguey: Launched a limited-edition artisanal mezcal, promoting sustainable agave harvesting. |

| March 2024 | Ilegal Mezcal: Partnered with high-end bars and restaurants to introduce mezcal-based cocktail experiences. |

| May 2024 | Montelobos: Expanded distribution in premium liquor stores and online retailers, increasing accessibility. |

| July 2024 | Sombra Mezcal: Announced a zero-waste distillation initiative, aligning with eco-conscious consumer trends. |

| September 2024 | Mezcal Vago: Developed a new barrel-aged mezcal to cater to the rising demand for aged spirits. |

Artisanal Mezcals and Handcrafted According to the Consumers' Requirements

Small batch and traditional production methods of high-grade mezcals are the alcoholic drinks which consumers are more likely to buy now. In this case, in particular, they prefer that the a distillery disrespect the harvest-age corn sustainability. Organic and fair trade brands have been rebranded especially by the artistic brands mentioning their traditions, hints of different materials, and traceability. Usually, it is devised to attract palmists and bourbon lovers.

In addition to that, agave tourism and the rise of mezcal tastings make people very engaging to them while premium brands are setting up distillery tours, holding guided tastings, and conducting educational workshops to accrue the loyalty and naming of their brand.

More Aged Mezcals and More Crafts

The market is posed by a bigger wave of mezcal interest aged types, including mezcal Reposado and Mezcal Añejo that are designed quite appealingly to consumers of whiskey and tequila. Casks and barrels which have oak wood and are left for a longer-time maturing are the primary tools of brand innovation that mezcal, the new smoking gun of spirits, uses in building its corporate image as a luxury sipping alternative.

Furthermore, alongside that, premium mescal brands are partnering with Michelin-starred establishments and are issuing limited releases in order to strengthen brand identity and market competitiveness.

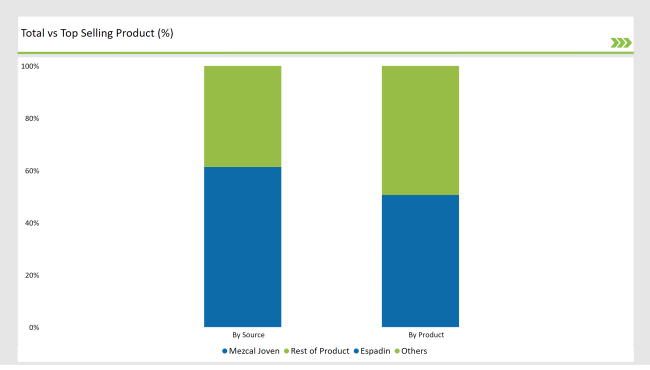

% share of Individual categories by Product and Source in 2025

Mezcal Joven is the dominant player in the mezcal market.

The leading mezcal market player is Mezcal Joven, with 50.6% of the market share, because it is relatively affordable and as widely used as mezcal in cocktails, premium spirit collections, and mixology programs.

By the way, Mezcal Joven is completely unaged, and its rawness is the most major agave discreetly trailing the perception of the independent distillation methods. Even though various types of agave can be used to make mezcal, the classic Espadin stands out from others because of its unique profile, mildness, and easy-to-drink characteristics, thus, it is the first choice for drinkers who undertake the first time and also for drinkers who like to discover new.

The flexibility of Mezcal Joven for both drinking straight and mixing with other liquors registered its increasing popularity in on-trade places such as bars, upscale restaurants, and lounges.

Also, the expansion of small-batch Mezcal Joven brands that are added to the popularity of craft premium spirits has helped to further consolidate its position in the market. The entry of consumers, who have started the journey to discover agave spirits beyond the tequila mark, with Mezcal Joven as the initial product, leads to the further expansion of the category.

Espadin is the major variety of agave for the mezcal production process.

Espadin contributes 61.3% to the mezcal market, and this is because it is widely grown, sustainable, and versatile in flavor. The wide variety of Espadin agave means there is a continuous supply and easy access to it for mass production and artisanal distillation. This particular agave matures quicker than other wild types, which is roughly 6 to 8 years, thus, a more efficient farming and production cycle is possible.

Besides, the smooth and palatable taste of Espadin makes it a good basic syrup for a huge number of variations in mezcal, from light and fresh to strong and smoky. With the increase in the demand for genuine, quality mezcal, Espadin is still the symbol of the sector providing a raw ingredient that is sustainable and of high quality for traditional and innovative distillers.

Note: above chart is indicative in nature

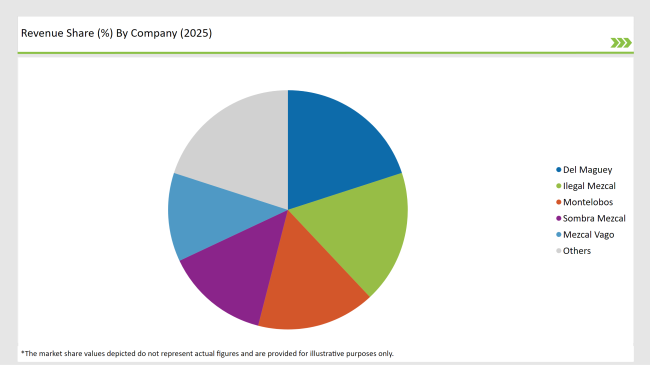

The USA mezcal market is very prominent, with some brands getting a higher focus on sustainability, traditional techniques of production, and only some editions that are out in the market. The top five distributors namely Del Maguey, Ilegal Mezcal, Montelobos, Sombra Mezcal, and Mezcal Vago are increasing their sales by the distribution of their products through collaborations with mixologists, and using new media to tell their stories to the consumers.

The increasing inclination towards originality and terroir-oriented drinks has led companies to discuss the agave source, the process of making a product in a small batch, and the ways of farming that meet the criteria for sustainability. Prospective buyers are finding interest in variants of premium mezcal such as Mezcal Reposado and Mezcal Añejo which are highly aged and therefore similar to whiskey and other spirits.

Besides the broader market that now has more companies selling mezcal in hotels restaurants and shops that specialize in alcohol, the enterprises are taking advantage of their digital marketing, educational events, and direct-to-consumer strategies to achieve a stronger market penetration.

The market is expected to grow at a CAGR of 7.8% from 2025 to 2035.

The USA mezcal market is projected to reach USD 17,719.8 Million by 2035.

Key drivers include rising consumer interest in craft spirits, premiumization trends, and increasing mezcal-based cocktail adoption.

Mezcal Joven leads by product type, while Espadin is the most widely used agave source in 2025.

Top manufacturers include Del Maguey, Ilegal Mezcal, Montelobos, Sombra Mezcal, and Mezcal Vago.

By product, the market includes Mezcal Joven, Mezcal Reposado, Mezcal Añejo, Mezcal Vidrio, and others.

By source, the industry is segmented into Espadin, Tobala, Tobaziche, Tepeztate, Arroqueño, and others.

By concentration, the market is divided into 100% Agave Mezcal and Blends.

By distribution channel, the market consists of on-trade and off-trade channels.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

USA Lactase Industry Analysis from 2025 to 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.