The USA Meal Replacement Products market is expected to reach USD 7,300.8 million in 2025 and is projected to experience steady year-over-year growth to reach a total value of USD 14,830.2 million by 2035. This represents a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7,300.8 million |

| Industry Value (2035F) | USD 14,830.2 million |

| CAGR (2025 to 2035) | 7.3% |

The USA Meal Replacement Products market is expanding heavily. The increased interest in easy-to-consume, healthy, and protein-based food products for the diet has encouraged the usage of meal replacement products among health-conscious consumers, athletes, and individuals who maintain weight. It also results from a growing concern regarding macronutrient consumption, personalized nutrition, and fast lifestyles of people living in urban cities.

Market Key players are gravitating towards the plant-based form of formulations based on sustainable raw materials, targeted at the surging vegan and flexitarian demography. Apart from this, ready-to-drink (RTD) forms are driving this market because these are easy, taste better, and contain nutrient profiles.

The USA market consists of top multinational corporations competing with emerging brands for market share. Major brands such as Abbott Laboratories, Herbalife, and Premier Protein by PepsiCo retain a strong foothold in brand loyalty and product innovation. E-commerce and direct-to-consumer models are pushing the industry ahead by offering more convenience and access to subscription orders.

Explore FMI!

Book a free demo

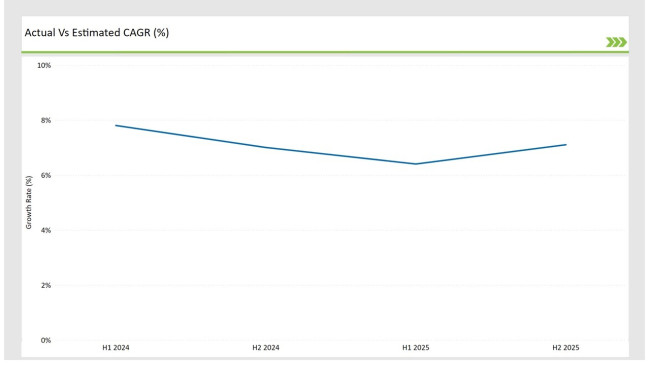

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Meal Replacement Products market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 7.8% |

| H2 Growth Rate (%) | 7.0% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 6.4% |

| H2 Growth Rate (%) | 7.1% |

For the USA market, the Meal Replacement Products sector is projected to grow at a CAGR of 7.8% during the first half of 2024, with an increase to 7.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 6.4% in H1 and reach 7.1% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Abbott launches new plant-based Ensure range to cater to vegan and lactose-intolerant consumers. |

| Aug-2024 | PepsiCo’s Premier Protein expands into RTD functional beverages , adding nootropic and collagen-infused variants. |

| May-2024 | SlimFast introduces a meal replacement subscription service , tapping into the direct-to-consumer trend. |

| Mar-2024 | Herbalife acquires a niche protein bar manufacturer , enhancing its meal replacement portfolio. |

| Jan-2024 | Orgain announces its largest distribution expansion into mainstream supermarkets , growing market reach. |

Rising Popularity of High-Protein, Low-Sugar RTD Meal Replacements

The demand for ready-to-drink meal replacement is the greatest witness for the upswing in consumer preference for convenient and nutritious dietary solutions. Leaders Premier Protein and Ensure respond by refashioning their RTD offerings to reduce sugar levels, increase levels of protein and vitamins, and minerals to satisfy fitness-conscious and diabetic consumers.

Beverages are growing smarter, using the addition of probiotics, adaptogens, and fiber toward healthier gut life. Direct-to-consumer, and subscription models continue to see exponential growth through their RTD platforms. Most companies are able to leverage strong marketing through various online strategies combined with social influencers that can assist to heighten recognition and subsequently enhance sales volumes.

Growing Demand for Plant-Based and Dairy-Free Meal Replacements

The vegan movement is changing the meal replacement industry significantly, with one-third of all its products, or 33%, now being plant-based. Leading companies such as Orgain and Garden of Life (Nestlé) are pushing the envelope by providing dairy-free, soy-free, and allergen-friendly formulas in place of milk-based formulas that cater to flexitarian and lactose-intolerant consumers.

Besides just dietary preferences, the growing demand for plant-based products is driven more by increasing sustainability concerns. Many brands are now moving to pea protein, almond, oat, and hemp-based meal replacement for environmental impacts and catering to the eco-friendly buyers.

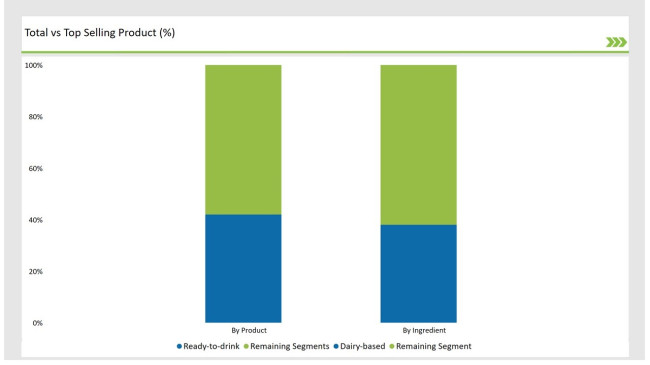

| Market Share | Category |

|---|---|

| 42% | Ready-to-drink (RTD) |

| 58% | Remaining segments |

RTD products are ahead of the curve due to the need for convenient and improved formulations, together with urban professional demand. Personalized nutrition is changing this segment and redefines this category as a choice for purchasers seeking holistic health advantages beyond mere sustenance-from functional ingredients like collagen, adaptogens, and nootropics.

| Market Share | Category |

|---|---|

| 38% | Dairy-based |

| 62% | Remaining segments |

While dairy-based product still retains leadership positions owing to higher-quality proteins, growth for plant-based versions is rocketing with surging adoption rates among vegans. Formulations have also innovated, embracing fermentable plant proteins and nutrient-enhanced blends in creating even palatable and digested textures to increase uptake levels.

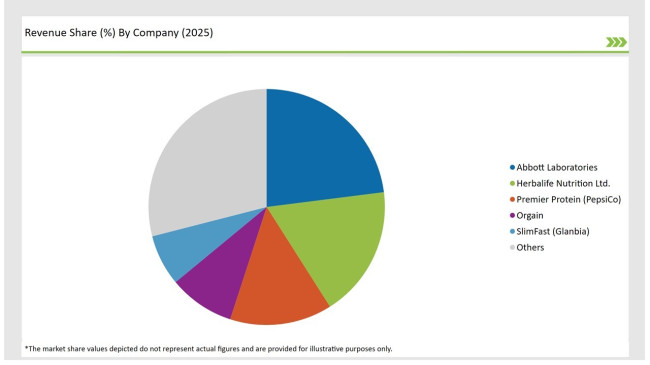

The USA meal replacement products market is moderately concentrated with multinational leaders and niche-based companies emerging now. Tier-1 companies garner over 60% of market share through large-scale distribution capabilities and brand consciousness while the latter small players focused on clean innovations and direct customer connections.

| Company | Market Share |

|---|---|

| Abbott Laboratories | 23% |

| Herbalife Nutrition Ltd. | 18% |

| Premier Protein (PepsiCo) | 14% |

| Orgain | 9% |

| SlimFast (Glanbia) | 7% |

| Other Players | 29% |

The top companies implement multi-channel selling strategies that blend brick-and-mortar retailing, e-commerce, and direct selling. Other trends are found in the emergence of subscription models, influencer marketing, and nutrition-based personalization in their competitive landscapes.

This also includes sustainability initiatives such as the adoption of green packaging and introduction of plant-based product lines to meet the emerging consumer awareness in environmental impact. Companies are investing in R&D for enhanced taste, texture, and nutrient absorption to boost consumer acceptance and repeat purchases.

The market is driven by rising health consciousness, demand for convenience, and growing adoption of plant-based nutrition.

Ready-to-drink (RTD) products hold the highest share at 42%, while dairy-based meal replacements dominate ingredient preference at 38%.

Brands are increasingly investing in eco-friendly packaging, plant-based formulas, and ethical sourcing to cater to environmentally conscious consumers.

E-commerce is playing a crucial role, allowing brands to sell directly to consumers, offer subscription plans, and provide personalized nutrition recommendations.

Yes, brands are incorporating functional ingredients like collagen, probiotics, and nootropics to enhance health benefits and differentiate their products.

Challenges include taste perception, regulatory compliance, and competition from whole food-based dietary alternatives.

The West Coast and Northeast USA lead in meal replacement consumption due to health-conscious demographics and strong retail distribution networks.

Ready-to-drink (RTD), Powder, Bars, Others.

Plant-based, Dairy-based, Mixed Source.

Weight Management, Sports Nutrition, Clinical Nutrition, General Wellness.

Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.