The USA Marine Excipient Market is projected to reach a value of USD 236.09 million in 2025, growing at a CAGR of 6.4% over the next decade to an estimated value of USD 440.49 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 236.09 million |

| Projected USA Value in 2035 | USD 440.49 million |

| Value-based CAGR from 2025 to 2035 | 6.4 % |

Manufacturers are striving to enhance both their production capabilities and consolidated market share, making the market more consolidated. To gain an edge over the competition, companies are employing innovative extraction and purification protocols as a means of better characterizing and enhancing the functional properties of excipients obtained from marine sources.

Corporations have turned to acquisition and strategic collaboration to increase product portfolios and gain distribution more broadly. Manufacturers, as well, are expanding research and development (R&D) to develop new marine-derived excipients to follow the clean-label trend.

Increasing consumer demand for organic and environmentally friendly components is leading market growth. Due to their biocompatibility and lower environmental impact, consumers prefer marine-origin excipients (algae and fish-based by-products). Also stimulating the market adoption of marine-based solutions is government support in the marine-based solution sector. Along with a growing production capacity, the industry trend toward sustainability will further lead to market consolidation and growth.

Explore FMI!

Book a free demo

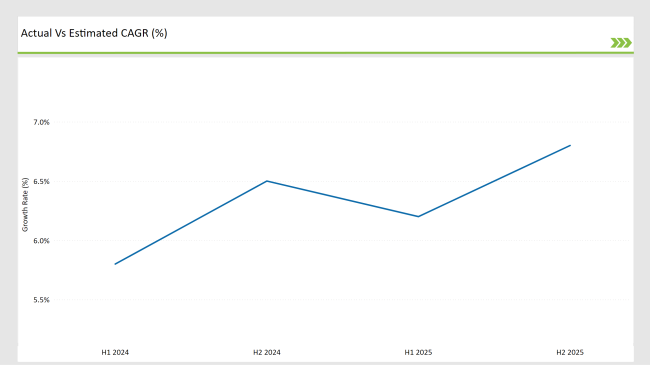

For the USA Marine Excipient Market, the sector is expected to grow at a compound annual rate CAGR of 5. 8% in the first half of 2024 with a target of growth of 6. 5% in the second half of the same year. In the financial year 2025, it is expected that the growth rate of the marine excipient market will slightly reduce to 6. 2% in H1 but is expected to slightly increase in H2 to 6. 8%.

H1 signifies period from January to June, H2 Signifies period from July to December

These recent developments are providing an excellent window into the ever-changing marine excipient market of the USA where demand for natural ingredients is increasing along with regulatory changes and the advancement in formulations of marine-based products. This semi-annual survey is a critical part of the process for businesses that are looking to see how the likes of consumer products are changing and adjust their strategies and plans accordingly.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Ashland: Unveiled marine-sourced polymer for controlled drug delivery, FDA-approved for injectables. |

| February 2024 | Kerry Group : Partnered with AlgaeTech to commercialize algae-based stabilizers for plant-based pharmaceuticals. |

| March 2024 | IFF : Launched seaweed-derived excipient for nutraceuticals, enhancing bioavailability in supplements. |

| April 2024 | Ingredion : Expanded carrageenan production in Maine, targeting 15% output increase for clean-label formulations. |

| May 2024 | FMC Corporation: Secured patent for novel algae-derived binder in tablet coatings, scaling production by Q4. |

Expansion of Marine-Based Functional Excipients

The American market for marine excipients is being driven by rising demand for functionally active marine-based excipients, including algal and fish by-product-based excipients. These excipients, applied to pharmaceuticals as well as to nutraceuticals, promote bioavailability as well as stability, thus providing a clean-label solution of preference.

R&D investment is ongoing to enhance marine derived polysaccharides such as carrageenan and alginate for use in extended-release preparations. This change is being driven by the increased demand for natural solutions versus synthetic excipients. Regulators are also simplifying approvals, fostering innovation, and propelling market growth through sustainable marine ingredient use.

Sustainability Initiatives Driving Market Growth

The primary point of worry in the United States is sustainability. Thanks to companies using eco-friendly extraction and processing techniques, the marine excipient sector ranks Using marine byproducts such as fish scales and seaweed to make excipients reduces waste and meets the requirements for biodegradable and sustainable substances.

Firms are partnering with fisheries and marine farms to get a steady supply of natural resources. Moreover, government departments are encouraging sustainable marine sourcing, so businesses are obtaining green practice certifications. All of these are positioning marine excipients as a core component of the push toward more natural medicines and foodstuffs.

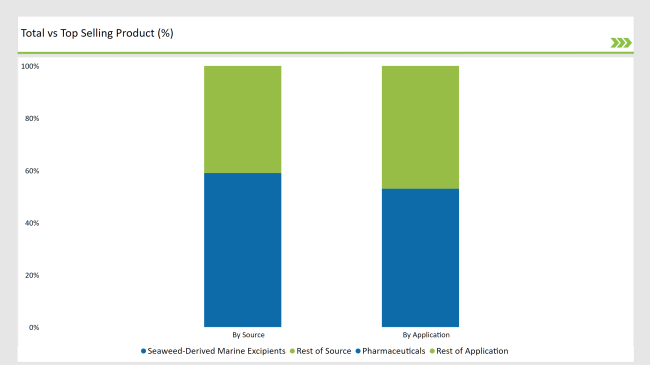

Their popularity in medical, nutraceutical, and cosmetic products accounts for their maximum market share of 59% thanks to the variety of uses they see. Among gelling agents, biocompatible and stable seaweed polysaccharides include alginate and carrageenan. The rise in need fueled by consumer choice for ingredients derived from nature and sustainability has further benefited.

Developments made have also improved extractive technology's purity levels, therefore underlining seaweed-derived excipient attractiveness for clean label formulations. Encouragement for biodegradable and natural additives from the legislature has driven producers to enlarge the procurement of seaweed, therefore confirming its grip in the United States. marine excipient industry.

The pharmaceuticals are the largest application category at 53%, taking advantage of the functional benefits of marine-excipient-derived materials in drug formulation and delivery. Polysaccharides from marine sources such as alginate and carrageenan are commonly applied as stabilizers, binders, and controlled-release agents.

Growing demand for excipients from a bio-based platform in tableting and injectable drug delivery platforms is fueling growth. Second, growing pressure on the pharma industry due to concerns about sustainability has influenced greater acceptance of marine-based vs. synthetic alternative excipients. With increased studies on the utility of marine excipients for controlled drug release as well as their biocompatibility, this product segment will retain a leadership position concerning share.

The USA marine excipient market is also identified as being moderately concentrated, which is characterized by several major producers who considerably contribute to the specific branch of the industry. The most important among them are International Flavors & Fragrances Inc. (IFF), Kerry Group plc, and Ingredion Incorporated, which have achieved remarkable results and secured market shares through vast product portfolios and strategic programs.

These top companies have been actively funding research and development to create new attractive marine excipients and at the same time, they are trying to meet the growing demand for eco-friendly and sustainable elements in pharmaceuticals and nutraceuticals.

In addition to that, mergers and acquisitions are strategic moves that are regularly applied to increase their market share and broaden their distribution networks. Besides, the competitive landscape is changed as well by new players, who enter the market through niche segments, thus making the market environment more dynamic and evolving.

2025 Market share of USA Marine Excipient Market suppliers

.png)

The market is expected to grow at a CAGR of 6.4% from 2025 to 2035, indicating steady industry expansion.

The market is projected to reach approximately USD 440.49 million by 2035, driven by rising demand for natural excipients.

The seaweed-derived excipient segment is expected to grow the fastest due to increasing preference for sustainable and plant-based ingredients.

Rising demand for natural excipients, regulatory support, sustainability trends, and innovations in pharmaceutical and nutraceutical formulations are key drivers.

Key players include International Flavors & Fragrances (IFF), Kerry Group, Ingredion, Ashland Global, and FMC Corporation.

The USA marine excipient market is segmented into seaweed-derived, fish-derived, and shellfish-derived excipients, each offering unique functional properties for diverse applications.

The market is categorized into polysaccharides (e.g., alginate, carrageenan), proteins & peptides, lipids & omega-based excipients, and others, catering to pharmaceutical and nutraceutical needs.

The market is divided into direct supply & B2B, specialty ingredient distributors, and online bulk suppliers, ensuring efficient product availability across industries.

The market is segmented into pharmaceuticals, nutraceuticals & dietary supplements, and cosmetics & personal care, driven by the increasing demand for natural and sustainable ingredients.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.