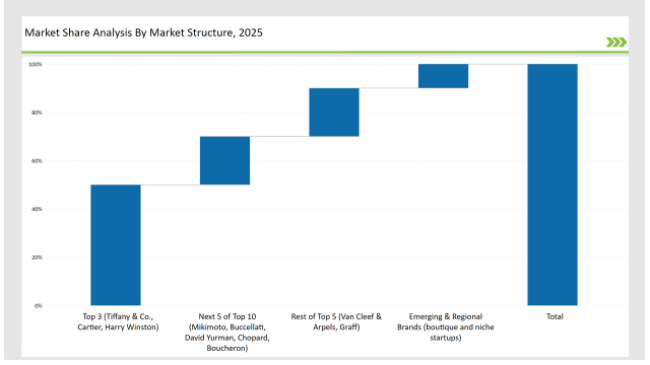

USA Luxury fine jewelry has largely been influenced by famous global brands, boutique designers, and recent newcomers who focus much on the environment. Such world-famous names like Tiffany & Co., Cartier, and Harry Winston constitute the majority 60% share in the marketplace. Their classical design and high familiarity with international buyers have provided continuous strength within the luxury lines of business. Regional and boutique jewelers account for 30% of the market share. These companies are specialized in bespoke services and localized designs to cater to individual tastes of customers. They concentrate on producing unique, high-quality pieces, while the startups and niche brands, which account for the remaining 10% of the market, are changing the game with lab-grown diamonds and sustainable practices. These new entrants will attract these green-conscious consumers who want luxury without compromising on the environment. Sustainability will then be at the heart of the industry as it has been for these brands in being responsible luxury brands.

Explore FMI!

Book a free demo

| Global Market Share, 2025 | Industry Share (%) |

|---|---|

| Top 3 (Tiffany & Co., Cartier, Harry Winston) | 50% |

| Rest of Top 5 (Van Cleef & Arpels, Graff) | 20% |

| Next 5 of Top 10 (Mikimoto, Buccellati, David Yurman, Chopard, Boucheron) | 20% |

| Emerging & Regional Brands (boutique and niche startups) | 10% |

The USA luxury fine jewelry market in 2025 is highly concentrated, with brands such as Tiffany & Co., Cartier, and Harry Winston dominating. While independent jewelers and boutique designers cater to niche audiences, heritage brands retain strong market control through prestige, branding, and exclusivity.

Brick-and-mortar stores represent 65% of sales in the luxury fine jewelry market, as they offer an individualized shopping experience. E-commerce platforms and brand-owned websites account for 25%, driven by convenience and virtual try-on technologies. Private showrooms and exclusive auctions account for 10%, catering to affluent customers seeking one-of-a-kind pieces.

High-jewelry stands at 55 percent, which points to high craftsmanship and exclusive use of precious stones. The bridal line takes 30 percent, which sells steadily to brides. Made-to-order bespoke pieces take 10 percent market share as it caters to the diversified consumer preferences. Lab-grown and sustainable diamond jewelry growing at a 15% CAGR take up 5% share.

Transformative Year for USA Luxury Fine Jewelry Market, 2024: Sustainability, Innovation, Timelessness The main players involved in this trend are:

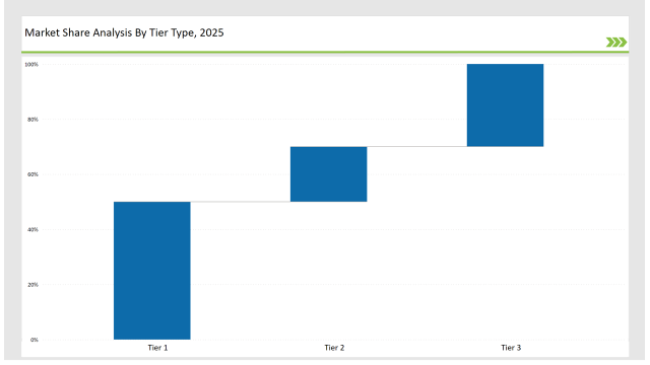

Tier-Wise Brand Classification, 2025

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Tiffany & Co., Cartier, Harry Winston |

| Market share% | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Van Cleef & Arpels, Graff |

| Market share% | 20% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, boutique jewelers |

| Market share% | 30% |

| Brand | Key Focus Areas |

|---|---|

| Tiffany & Co. | Sustainability and modern bridal designs |

| Cartier | Bold, contemporary collections |

| Harry Winston | Exceptional diamonds and engagement rings |

| Van Cleef | Heritage designs with modern relevance |

| Graff | Ultra-luxury high jewelry |

| Emerging Brands | Eco-conscious and affordable innovations |

The USA luxury fine jewelry market will grow as it is empowered by digital innovation, sustainability, and growing bridal demand. Brands have focused on direct-to-consumer strategies, which have prioritized virtual consultations and exclusive online collections to reach a wider audience. This approach makes shopping more personal and convenient for customers. Therewith, brick-and-mortar stores will be experiential centers, that can introduce immersive experiences through displaying the product while applying the services specific for each client's profile. The in-store experience reaches its peak through even closer communication with the brand. Sustainability will be given high importance, and it will become one of the most important factors for luxury jewelry brands due to ethical sourcing and environmentally friendly practices. Today, the consumers have been increasingly sensitized toward the repercussions their purchases generate in the world. The luxury brands are catching this wave, talking about initiatives which are greener. Digital innovation and personal services, besides sustainability, would thus form the USPs in defining the future course of the USA luxury fine jewelry market.

Tiffany & Co., Cartier, and Harry Winston collectively control around 50% of the market.

Regional luxury jewelers such as David Yurman and Mikimoto hold approximately 25% of the market.

Boutique designers and high-end independent jewelers hold around 10% of the market.

Private labels from department stores and luxury houses contribute roughly 5% of the market.

High for brands controlling 60%+, medium for 40-60%, and low for those holding under 30%.

Automatic Dishwashing Products Market Insights – Growth & Forecast 2025 to 2035

Aquarium & Fish Bowls Market Growth - Trends & Forecast to 2035

Aquarium Water Treatment Market Growth - Trends & Forecast 2025 to 2035

Aquarium Heaters and Chillers Market - Growth & Forecast 2025 to 2035

Anti-Fog Lens Market Insights - Size, Trends & Forecast 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.