The USA Lactic Acid Market is forecasted to achieve a market size of USD 735.1 million by 2025, with projections indicating a significant rise to USD 1,610.8 million by 2035. Over the forecast period (2025 to 2035), the industry is expected to expand at a CAGR of 8.2%, propelled by the shift toward bio-based lactic acid production, rising consumer preference for natural ingredients, and the increasing adoption of lactic acid-based biodegradable plastics in sustainable packaging solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 735.1 million |

| Industry Value (2035F) | USD 1,610.8 million |

| CAGR (2025 to 2035) | 8.2% |

USA Lactic Acid Market The market is also growing quite strongly due to widespread applications of the product in food preservation, personal care formulations, biodegradable polymers, and pharmaceutical industries. It finds application as a natural acidulant and pH regulator in food & beverages. Apart from being used as an essential ingredient in cosmetics, pharmaceuticals, and industrial processes.

The most significant trends in the market are the higher demand for bio-based lactic acid, in light of increasing sustainability initiatives that promote biodegradable plastics. Encouraged by the rising trend toward more plant-based sources and fermented types of lactic acid, it is driving further investments in the area of green chemistry and new biotechnologies.

Innovation and innovation in terms of lactic acid-based biopolymers are also happening, especially at the packaging segment, where businesses are developing their PLA (Polylactic Acid) solutions towards sustainable applications.

Explore FMI!

Book a free demo

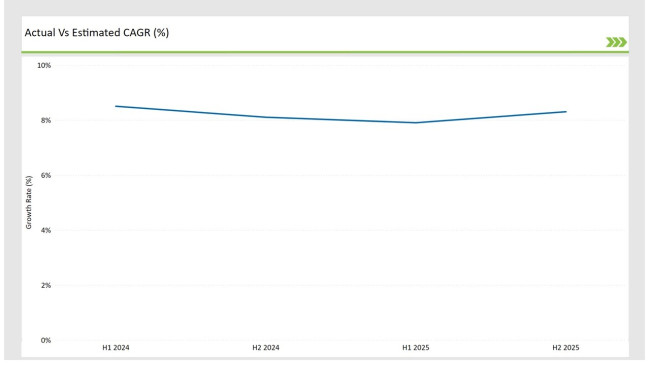

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Lactic Acid market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 8.5% |

| H2 Growth Rate (%) | 8.1% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 7.9% |

| H2 Growth Rate (%) | 8.3% |

For the USA market, the Lactic Acid sector is projected to grow at a CAGR of 8.5% during the first half of 2024, with an increase to 8.1 in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 7.9% in H1 and reach 8.3% in H2.

| Date | Details |

| Dec-2024 | BASF introduced a new grade of lactic acid for natural preservation in cosmetics. The product offers extended antimicrobial efficacy while meeting clean label requirements. |

| Oct-2024 | ADM partnered with Qingdao Biotech for lactic acid production from corn processing byproducts. The collaboration aims to establish circular economy principles in lactic acid production. |

| Aug-2024 | NatureWorks announced a new polymerization facility for lactic acid-based bioplastics. The Thailand-based facility will produce 75,000 tons annually of PLA polymers. |

| Jun-2024 | Chinese producer Henan Jindan launched bio-based lactic acid from agricultural waste. Their innovative process reduces production costs by 30% while maintaining quality. |

| Apr-2024 | Galactic SA expanded their Spanish facility for specialty lactic acid derivatives. The expansion doubles their capacity for heat-stable lactic acid esters. |

Bio-Based Lactic Acid is Gaining Prominence Due to Sustainability Trends

Bio-based lactic acid production is fast becoming the direction of the times as industries begin to focus more on sustainability and carbon footprint reduction. Companies like Corbion and Cargill are focusing on fermentation-based lactic acid production, substituting traditional petroleum-derived synthetic lactic acid with renewable feedstocks such as corn and sugarcane.

It is particularly significant in food, pharmaceuticals, and biodegradable plastics where companies are now looking for a natural alternative for chemical-based ingredients. Growth is driven further by rising demand for PLA-based bioplastics as 'green' variants, particularly for packaging and disposable product applications.

Polylactic Acid (PLA) Bioplastics Are Expanding in Sustainable Packaging

Lactic acid-based PLA bioplastics are getting increasingly popular in the USA packaging industry, including biodegradable food containers, cutlery, and flexible films. NatureWorks LLC and other companies continue to expand the production capacity for PLA due to increasing demand in biodegradable and compostable alternatives with stringent global regulations toward single-use plastics.

With increased consumer awareness and corporate sustainability goals, the demand for PLA-based packaging is expected to continue outpacing traditional lactic acid applications, thereby emerging as a high-growth segment for years to come.

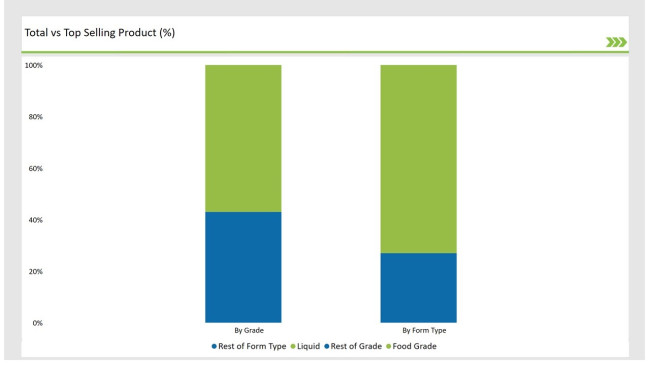

| By Grade | Market Share |

|---|---|

| Food Grade | 56.8% |

| Remaining segments | 43.2% |

Food-grade lactic acid occupies the highest share of the market, mainly driven by its common application as a natural preservative, pH regulator, and flavor enhancer in food & beverages. With clean-label trends catching up, customers are choosing to have more of natural acidulants instead of synthetic additives; hence, producers are turning to fermentation-based solutions for lactic acid.

Industrial and pharmaceutical-grade lactic acid continue to gain, but at a much slower pace, as food applications remain the biggest revenue driver. Biodegradable polymer applications are growing, at least as a minor segment, as there is continued growth in PLA-based plastics demand.

| By Form Type | Market Share |

|---|---|

| Liquid | 73.2% |

| Remaining segments | 26.8% |

Liquid lactic acid is still the most widely used form, which represents more than 70% of market consumption because it has better solubility, easier assimilation into formulations, and best processing efficiency. It leads in food & beverage, pharmaceutical, and personal care applications where the speed of absorption, and uniform distribution of the chemical needs to be fast.

Nevertheless, powder and granule forms are gaining traction in industrial applications and biodegradable polymer production that require longer shelf life and improved handling properties. The growth in natural lactic acid sources also contributes to further expansion of the liquid segment.

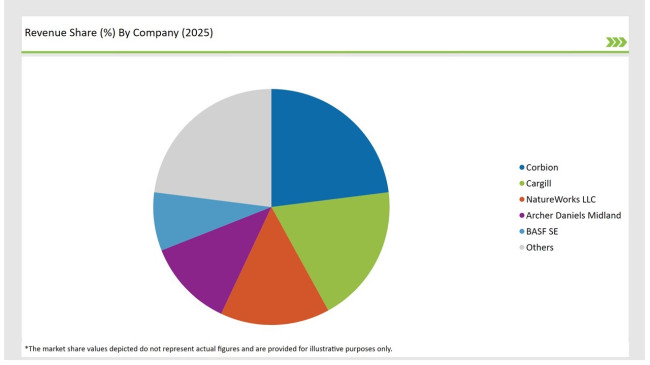

USA Lactic Acid Market has MNC dominance owing to higher strength production capability, an integrated supply chain network, and bio-based lactic acid R&D solutions investments. Top-line control rests in hands of giants Corbion, Cargill, and NatureWorks LLC who boast access to some of the advanced fermentation technology capabilities with healthy international reach capabilities.

While regional and mid-sized players are more focused on niche applications in personal care and biodegradable polymers, the scale-up is challenging, as well as access to raw material supply. Increased sustainability efforts make competition harder for bio-based lactic acid manufacturers, especially in the biodegradable plastics market.

| Company | Market Share (%) |

|---|---|

| Corbion | 23.4% |

| Cargill | 18.7% |

| NatureWorks LLC | 15.2% |

| Archer Daniels Midland | 11.8% |

| BASF SE | 8.3% |

| Other Players | 22.6% |

The largest USA players in the lactic acid market expand their bio-based lactic acid production in response to the rising demand for more sustainable and biodegradable solutions. Large fermentation facilities operated by Corbion and Cargill are found in the Midwest and West Coast, sourcing feedstocks based on corn and sugar for the bio-lactic acid production.

NatureWorks LLC concentrates on PLA as a feedstock for bioplastics and is located in Blair, Nebraska. Companies are investing in R&D for high-purity lactic acid to address the needs of food, pharmaceutical, and personal care industries. They are also expanding their global distribution networks to strengthen their presence in the market.

By 2025, the USA Lactic Acid Market is projected to grow at a CAGR of 8.2%, supported by the rising adoption of bio-based lactic acid in food, personal care, and bioplastics.

By 2035, the sales value of the USA Lactic Acid Market is expected to reach USD 1,610.8 million, driven by demand for sustainable, biodegradable, and high-purity lactic acid formulations.

The increasing use of lactic acid in food preservation, skincare formulations, biodegradable packaging, and pharmaceutical excipients, along with the shift towards bio-based fermentation processes, is fueling industry growth.

The West Coast and Midwest regions lead in lactic acid consumption, with strong demand from food manufacturers, pharmaceutical industries, and biopolymer production facilities.

Leading manufacturers in the USA Lactic Acid Market include Corbion, Cargill, NatureWorks LLC, Archer Daniels Midland, BASF SE, Galactic, Henan Jindan Lactic Acid Technology, Musashino Chemical Laboratory, ThyssenKrupp, and Xiaogan Kaifeng Bioengineering.

Includes Food Grade, Industrial Grade, and Pharmaceutical Grade.

Comprises Liquid, Powder, and Granules.

Covers Synthetic and Natural/Bio-based sources.

Used in Food & Beverages, Personal Care, Pharmaceuticals, Industrial, Animal Feed, and Biodegradable Polymers.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Brain Health Supplement Market Analysis by Ingredient Type, Product Category, Form, and Distribution Channel Through 2035

Freeze Dried Melt Market Analysis by Product Form, Fruit Type, Sales Channel, Packaging, , and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.