The USA Lactase market is anticipated to reach USD 527.7 million by 2025, with projections indicating further expansion to USD 893.5 million by 2035, representing a CAGR of 5.4% during the forecast period, primarily driven by rising demand in the dairy processing, infant formula, and beverage industries. Lactase enzymes are increasingly utilized to produce lactose-free and reduced-lactose products, catering to the significant percentage of lactose-intolerant consumers in the USA

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 527.7 million |

| Projected USA Industry Value (2035) | USD 893.5 million |

| Value-based CAGR (2025 to 2035) | 5.4% |

Continuous growth for the USA Lactase market is observed, where the prime momentum generally relates to an increasing number of individuals being lactose intolerant and an increased appetite for non-lactose dairy and beverage products in the B2B sector. Approximately 36% of Americans fall into the lactose intolerance category; hence, manufacturers of food and beverages are introducing lactase enzymes to fill this growing demand.

The requirement for highly efficient lactase enzymes is considered to be highest in large-scale dairy manufacturers that produce lactose-free milk, cheese, and yogurts. Lactase enzymes are also gaining significance in the infant formula sector, where the demand for lactose-free and hypoallergenic formulas is rising sharply.

The key market trends include advancements in fungal-derived lactase enzymes toward higher stability and efficiency, rising liquid lactase application in the beverage industry, and growing attention toward clean label and non-GMO certifications.

Players like Novozymes, DuPont/IFF, and DSM-Firmenich heavily invest in research and development on the improvement of yields and the performance of enzymes with the specific requirement of their B2B customers. Amano Enzyme and Antozyme Biotech, for example, are targeting niche application areas like vegan and plant-based dairy alternatives as a niche area to stand out in the competitive landscape.

Explore FMI!

Book a free demo

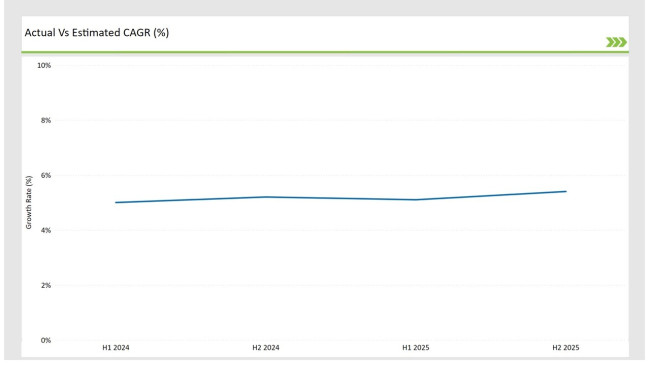

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the USA Lactase market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2023 |

|---|---|

| H1 Growth Rate (%) | 5.0% |

| H2 Growth Rate (%) | 5.2% |

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 5.1% |

| H2 Growth Rate (%) | 5.4% |

For the USA market, the Lactase sector is predicted to grow at a CAGR of 5.0% during the first half of 2023, with an increase to 5.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly increase to 5.1% in H1 and rise further to 5.4% in H2.

This growth trajectory is closely tied to the expansion of the lactose-free segment in dairy and beverage industries, with B2B clients investing in high-performance lactase enzymes to improve production efficiency and product consistency. The semi-annual analysis also underscores the rising adoption of lactase enzymes in infant formula and niche applications like plant-based alternatives, which are driving innovation in the market.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Novozymes launched a new high-efficiency liquid lactase tailored for large-scale dairy beverage production. |

| Sep-2024 | DuPont/IFF partnered with a leading infant formula brand to co-develop lactose-free nutritional solutions. |

| Jun-2024 | DSM-Firmenich introduced fungal-based lactase optimized for high-yield cheese production in industrial settings. |

| Apr-2024 | Chr. Hansen expanded its enzyme portfolio to include specialized lactase for vegan and plant-based dairy alternatives. |

| Jan-2024 | Advanced Enzymes announced the acquisition of a niche enzyme manufacturer to strengthen its position in the B2B market. |

Growth of Fungal-Derived Lactase in B2B Applications

The latest use of lactase enzymes that come from fungi is preferred in applications since it surpasses the stability characteristics exhibited at different pH levels and temperatures. This gives it an advantage in larger-scale industrial dairy and beverage processing.

DSM-Firmenich and Chr. Hansen are introducing advanced formulations of fungal lactase, which ensure smoother production with consistent hydrolysis of lactose. This reflects the trend to sustainable and high-performance enzyme solutions, as these enzymes are increasingly being adopted by large dairy processors.

Expansion of Liquid Lactase Solutions for Beverage Manufacturing

Driven primarily by the beverage industries' increasing trends towards lactose-free products, the demand in liquid lactase enzymes has substantially increased as their application is fairly straightforward and is taken into production processes. Liquid lactase reduces process times, minimizes waste, and breaks down lactose uniformly in any given dairy-based drink such as a milkshake or flavored milk-protein drink.

Novozymes recently launched a high-performance liquid lactase in 2024, which has been designed for beverage manufacturers who are looking at tailored enzyme solutions to cater to the growing consumption of lactose-free beverages by health-conscious consumers.

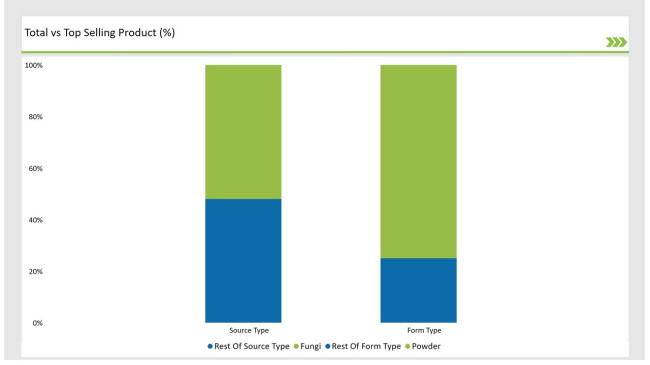

| Form Type | Market Share (2025) |

|---|---|

| Powder | 75% |

| Remaining segments | 25% |

Powdered lactase is leading the form segment since it has a longer shelf life and is cost-effective. Liquid lactase, though not leading in terms of popularity for large-scale production of dairy products, is rapidly emerging as the superior choice in beverage processing, streamlining the production process for industrial-scale beverage manufacturers. Hence, it will lead to significant growth for the liquid lactase segment over the next few years.

| Source Type | Market Share (2025) |

|---|---|

| Fungi | 52% |

| Remaining segments | 48% |

Lactase from fungal origin dominates the source segment because of its versatility and efficacy in various applications of dairy products. Yeast-derived lactase is also very important and is mainly used in classical dairy fermentation processes. The share of bacterial-derived lactase is lesser, but it is increasingly being used in specialized applications such as infant formula and low-pH dairy products where specific enzymatic performance is required.

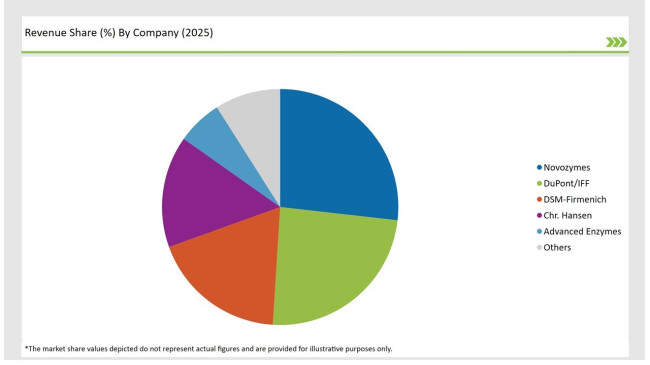

The USA Lactase market has a fair concentration level; it is dominated by Tier-1 companies like Novozymes, DuPont/IFF, and DSM-Firmenich, with a total market share of over 69%. Major B2B players tend to lead through their strong advanced production technologies for enzymes and relationships with leading dairy and beverage manufacturers.

For example, Novozymes focused on liquid lactase solutions dedicated to large-scale beverage processing, while DuPont/IFF highlights its ability to partner with infant formula manufacturers for the development of custom enzyme solutions.

| Company Name | Market Share (%) |

|---|---|

| Novozymes | 26.8% |

| DuPont/IFF | 24.2% |

| DSM-Firmenich | 18.5% |

| Chr. Hansen | 15.3% |

| Advanced Enzymes | 6.2% |

| Others | 9.0% |

The need for expansion of enzyme portfolios by Tier 2 companies like Chr. Hansen in niche markets like plant-based and vegan applications brings opportunities for Tier 3 players such as Antozyme Biotech and Creative Enzymes, to further invest in region-specific demands and innovative formulations that target smaller-scale B2B clients. Therefore, this competitive landscape enhances innovation and furnishes new sources of advanced enzyme solutions that are tailored to diverse industrial needs.

By 2025, the USA Lactase market is expected to grow at a CAGR of 5.4%.

By 2035, the sales value of the USA Lactase industry is expected to reach USD 893.5 million.

Key factors include rising lactose intolerance rates, growing demand for lactose-free products, and advancements in enzyme technologies.

Regions with significant dairy production and health-conscious populations, such as the Midwest and Northeast, lead consumption.

Prominent players include Novozymes, DuPont/IFF, DSM-Firmenich, Chr. Hansen, and Advanced Enzymes.

Powder, Liquid.

Fungi, Yeast, Bacteria.

Dairy Products Manufacturing, Infant Formula Production, Beverage Processing.

Food-grade, Feed-grade.

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Non-Alcoholic Malt Beverages Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.