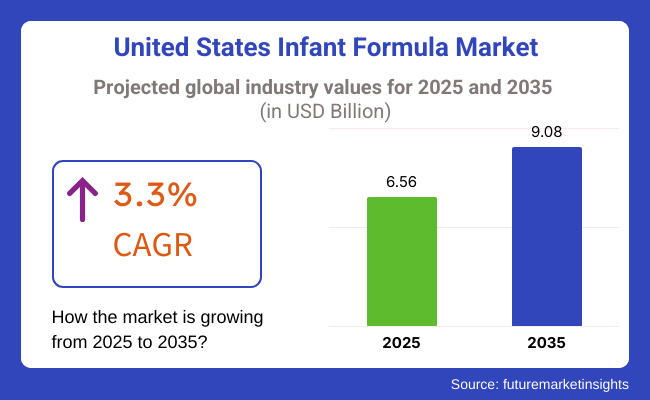

The United States infant formula market is targeted to rise with a steady accelerating rate and is anticipated to be valued at about USD 6.56 billion in 2025. The expected overall industry will be growing at a rate of 3.3% CAGR during the period from 2025 to 2035. The total industry value is likely to go up to USD 9.08 billion by 2035.

The industry is driven by the increasing consciousness of infant nutrition and the need for high-quality, nutritionally enriched formula products. The demand for infant formula has grown as parents look for alternatives to breastfeeding due to lifestyle factors, health issues, or personal choice. Furthermore, the development of formula composition options, which are organic, non-GMO, and probiotic-enriched, are influencing the industry.

The rise in the industry is powered by the increasing demand for special infant formulas addressing various dietary concerns, such as hypoallergenic, lactose-free, and plant-based alternatives. The diversification of formula fortification, including the addition of DHA, ARA, and prebiotics for cognitive and immune system support, has further increased product attractiveness.

The surge in internet sales and the promotion of infant formula products via the DTC (direct-to-consumer) channel have resulted in better accessibility of these products to parents in the USA. The industry is significantly influenced by FDA regulation and high quality standards.

The focus on food safety, product transparency, and traceability guarantees that strict adherence to the regulations is maintained by the manufacturers, which in turn, builds consumer trust. Additionally, government schemes like the WIC (Women, Infants, and Children) program carry on with the formula provision support for many families, thereby enhancing the industry's stability.

Meanwhile, problems such as raw material prices, supply chain disturbances, and growing international brand competition, are present along with industry challenges. Past recalls have raised safety issues about some infant formula brands that pose the manufacturers a difficulty in keeping consumers' trust and loyalty.

Although there are these issues, possibilities for developing the industry still exist. The increasing need for organic and clean-label infant formula along with the exploration of new nutrition science is thought to drive future development.

The healthcare partnership that the infant formula brands have with medical professionals is also significant in terms of the information the parents get and the consequent increase in the marketing share of the companies. With the ensuring progress in infant nutrition, the USA infant formula industry will have along the decade continuous growth rate.

Explore FMI!

Book a free demo

The industry is transforming rapidly because of the major factors such as heightened parental consciousness, surging organic and specialty formula demand, and tight regulatory compliance. Organic and hypoallergenic formulas are being favored more by parents based on issues relating to artificial additives, allergens, and digestive issues.

Organic baby formula is showing robust growth through the clean-label trend and a desire for non-GMO, hormone-free content. Hypoallergenic and specialty formula address babies suffering from lactose intolerance, reflux, and other health conditions that drive purchasing choices based on the pediatrician.

The toddler formula segment is expanding as companies promote nutritional supplementation post-infancy. Price sensitivity, however, is a key factor, particularly among middle-income households. Regulation compliance is stringent, with the FDA closely monitoring ingredients and nutritional content. In general, the industry will expand as companies focus on innovation, premiumization, and targeting particular infant health conditions while navigating regulatory challenges.

The industry grew steadily between 2020 and 2024, aided by enhanced understanding of infant nutrition and rising demand for organic and specialty formulas. Demand for convenience and the rise in dual-income households fueled infant formula product demand. Major players invested in product development, launching formulas enriched with probiotics, human milk oligosaccharides (HMOs), and vital nutrients for infant growth and immunity.

FDA regulatory updates in nutritional content and ingredient safety affected industry forces. Supply chain disruptions and product recalls were challenges, but these affected consumer confidence and stock availability. The need for plant-based and hypoallergenic formulas also increased as parents opted for alternatives against lactose intolerance and milk allergy.

The industry will undergo profound changes between the years 2025 and 2035. Innovation in biotechnology will make possible the creation of formula products resembling human breast milk closely, utilizing bioactive proteins and richer nutrient profiles. Artificially intelligent production and quality control will increase the productivity of production while reducing the risk of contamination.

Organic ingredients and sustainable packaging will be demanded since consumers will focus more on environmental and health issues. Increased research in children's gut health and immunity will result in new customized infant nutrition products on the industry. Increased industry penetration via e-commerce and direct-to-consumer (DTC) will allow brands to penetrate more parents and bring subscription options for guaranteed supplies.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for organic and special formulas (probiotics, HMOs). | Bioengineered formulas that are modeled after human breast milk with improved nutrients. |

| Regulatory reforms by FDA in ingredient safety and formulation. | Manufacturing and quality control with AI for enhanced efficiency. |

| Availability-driven supply chain shortages and product recalls. | Green packaging and organic ingredients will be industry norms. |

| Development of hypoallergenic and plant-based versions of allergy formulae at a faster pace. | Customized infant nutrition as per scientific evidence in gut health and immunity. |

| Offline and online platform-based formulation of sales. | Subscription plans and DTC will increase industry penetration. |

The expansion of the industry is chiefly attributable to the increased interest in quality, nutritious products. Nevertheless, strict adherence to the FDA's guidelines and the need to follow the evolving safety protocols prove to be the main headaches of the companies. So, they must carry out stringent quality checks, get the necessary approvals, and observe rigorous labeling and formulation guidelines in addition to all that if they want to get the consumer trust and regulatory approval.

Consumers increasingly prefer organic, non-GMO, and plant-based infant formulas; thus, the industry experiences a sharp increase in demand for new product formulations. However, prevalent misunderstanding regarding the alternative of ingredients and distrust of synthetic nutrients can affect consumers' decisions in the opposite direction. Companies need to emphasize transparent marketing, scientific facts, and consumer education as the means to promote product acceptance.

Intense rivalry between multinational firms, private labels, and new companies results in price pressure and differentiation. To induce their industry shares, organizations have to advertise their best features, such as the inclusion of immune-enhancing elements, digestive benefits, and infant-specific sophisticated profiles of nutrition.

Inflation and household income variations are the key factors that influence consumers' buying habits. For companies to achieve long-term growth, they need to consider executing the company in a cost-efficient way, growing their retail and e-commerce distribution channels, and, in the end, eating well and drinking cheap - all while keeping affordability and quality intact.

Based on structure, the industry is divided into starting milk formula and follow-on milk formula. starting milk formula is further segmented into standard, comfort, and hypoallergenic formulas and the follow-on milk formula 1st and 2nd follow formula. By category, starting milk formula segment holds the biggest industry share, with an estimated industry share of around 60% in 2025.

Suitable for babies 0-6 months old, this Formula offers crucial nutrients that mimic breast milk composition with the addition of DHA, ARA, and prebiotics. The rise in working mothers and a proliferation of breastfeeding problems have increased the demand for infant formula as a substitute.

The industry has major brands like Similac (Abbott), Enfamil (Reckitt Benckiser), and Gerber (Nestlé) with specialized formulations for lactose-free and organic products. The FDA has also introduced strict quality standards at various levels of production to enhance further consumer safety and nutritional adequacy, which helps to boost consumer confidence.

Follow-on milk formula is expected to be the leading segment with approximately 40% volume share during the enhanced consumption phase between 2023 and 2025 as the baby moves from 6 to 12 months of age when solid food consumption increases.

This Formula provides more iron, calcium, and essential vitamins to support healthy growth and development. Parents looking for nutritionally enhanced formulas tend to choose follow-on versions to add to their little one's diet. Major players like Danone (Aptamil) and Earth's Best are capitalizing on the trend toward clean-label infant nutrition by offering organic and non-GMO formulas.

The distribution channel segment of the industry is categorized into specialty outlets and supermarkets, all of which support the industry by making a wide variety of products available to consumers at the right time, making it easy for them to decide whether or not to purchase a product.

In 2025, specialty channels represent a 45% share of the infant formula industry; this is bolstered by parents' need for expert recommendations and premium formulations. Others, such as baby specialty stores, pharmacies, and health-focused retailers, find parents looking for personal guidance on choosing a formula.

Specialty outlets often carry organic, hypoallergenic, and medical-grade formulas, for example, Neocate (Nutricia) and Similac Alimentum (Abbott), designed for infants with allergies or digestive sensitivities. Moreover, e-commerce platforms such as Amazon, Buy Buy Baby, and the online stores of The Honest Company have experienced an increase in direct-to-consumer sales, with subscription-style purchasing and home delivery options providing additional access to specialized infant nutrition products.

Supermarkets represent the majority of the retail channel and are projected to account for around 55% of the industry share by 2025 on the basis of convenience and cost-effectiveness. Big retailers like Walmart, Target, and Kroger sell a number of common infant formula brands, including Similac, Enfamil, and Gerber, often at discounted and bundled prices.

The selection of private-label formulas, such as Parent's Choice (Walmart) and Up & Up (Target), is enticing to the price-sensitive consumer. Also, there are government assistance programs, such as WIC (Women, Infants and Children) that help get formula purchases in supermarkets which promotes more sales.

The industry is indeed highly competitive as the demand for premium, organic, and specialized formulations for infant nutritional needs continues to grow with each passing day. Due to increasing regulatory scrutiny and supply chain irregularities, the dynamics of competition and product innovations have been disrupted.

The leaders in this industry include Abbott Laboratories (Similac), Reckitt (Enfamil), Nestlé (Gerber), Perrigo, and Bobbie, all of which offer a variety of standard, organic, hypoallergenic, and specialty infant formulas. Meanwhile, consumer interest in European-style formulas, goat milk, and plant-based formulas is providing a springboard for startups and niche brands to take off. These choices are fully compliant with consumer demand for clean-label and digestive-friendly products.

Industry evolution has already been impacted by FDA regulations and mounting incentives to manufacture domestically. The sector is undergoing a shift in investments towards local manufacturing, alternative protein sources, and nutrition research supported by credible clinical studies with the aim of bolstering the safety and availability of such products.

Competitive tactics also embrace direct-to-consumer (DTC) sales, partnerships with pediatricians, and diversifying the supply chain to guard against future disruptions. Another major focus area for brands is sustainability, with eco-friendly packaging and responsibly sourced ingredients to match the new parental shifts.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories (Similac) | 30-35% |

| Reckitt Benckiser (Enfamil) | 25-30% |

| Nestlé (Gerber, Nido) | 10-14% |

| Perrigo Nutritionals | 8-12% |

| Bobbie | 5-8% |

| Other Players (Combined) | 10-20% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Abbott Laboratories (Similac) | Leading cow's milk-based, hypoallergenic, and organic infant formula brand, with a concentration on immune-boosting nutrients and digestive wellness. |

| Reckitt Benckiser (Enfamil) | Specialized in brain-development formulas containing DHA and MFGM, growing in non-GMO, organic, as well as sensitive-stomach formulations. |

| Nestlé (Gerber, Nido) | Concentrated in organic and transition-toddler formulas, using probiotics and plant-based alternatives. |

| Perrigo Nutritionals | Primary private-label formula supplier, providing economical, FDA-approved alternatives for large retailers. |

| Bobbie | Organic, European-style infant formula, picking up steam for its clean-label, grass-fed dairy as well as non-GMO ingredients. |

Key Company Insights

Abbott Laboratories (30-35%)

Industry leader through rebuilding consumer confidence with augmented production capacity and new safety measures.

Reckitt Benckiser (25-30%)

Owns hospital-recommended formulas, investing in premium infant nutrition and hypoallergenic versions.

Nestlé (10-14%)

Building out its organic and plant-based business, Gerber's formula range is being built as consumers demand clean-label products.

Perrigo Nutritionals (8-12%)

Top store-brand vendor, providing cheap substitutes for upscale brands, profiting from frugal consumers.

Bobbie (5-8%)

Direct-to-consumer upstart, taking advantage of USA consumers' appetite for European-style organic formulas.

Other Key Players

The industry is expected to generate USD 6.56 billion in revenue by 2025.

The industry is projected to reach USD 9.08 billion by 2035, growing at a CAGR of 3.3%.

Key players include Abbott Laboratories (Similac), Reckitt Benckiser (Enfamil), Nestlé (Gerber, Nido), Perrigo Nutritionals, Bobbie, Kendamil, Bubs Australia, Else Nutrition, Earth’s Best (Hain Celestial), and ByHeart.

Rising awareness of infant nutrition, increasing demand for organic and non-GMO formulas, and the growing number of working mothers opting for formula feeding are key growth drivers.

Cow’s milk-based infant formula dominates due to its close resemblance to human breast milk, followed by specialty formulas catering to lactose intolerance and hypoallergenic needs.

By product type, the industry is classified as starting milk formula, follow-on milk formula, and special milk formula.

By distribution channel, the industry is classified as specialty outlets, supermarkets, online stores, pharmacy stores, and others.

By state, the industry is segmented as California, Texas, Florida, New York, Illinois, Ohio, North Carolina, Michigan, Colorado, Wisconsin, and Washington.

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.