The USA hydrolyzed vegetable protein (HVP) market is projected to reach a value of USD 452.5 Million in 2025, growing at a CAGR of 7.1% over the next decade to an estimated value of USD 900.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 452.5 Million |

| Projected Value in 2035 | USD 900.8 Million |

| Value-based CAGR from 2025 to 2035 | 7.1% |

Market growth remains steady because customers choose plant-based protein options corporations use hydrolyzed proteins widely for food production and consumers know about their functional properties.

Hydrolyzed vegetable protein functions as an important flavor enhancer in processed foods because it delivers enhanced umami flavor to soups and sauces and processed snacks. The market keeps growing because plant-based diets have become more popular and people want more protein in their food products. In MySQL agriculture HVP is emerging as an animal feed ingredient that improves both nutrient uptake and dietary breakdown in farm animals.

The increasing adoption of innovative protein extraction methods together with expanded Hydrolyzed Vegetable Protein source variety from soy wheat pea and rice provides the market with new benefits. As clean-label and non-GMO food trends gain popularity manufacturers take development steps toward advanced formulation to serve health-oriented consumers.

The increasing availability of HVP results from improved distribution methods including online e-commerce as well as dedicated specialty food outlets that make HVP accessible to commercial applications and personal consumption.

Explore FMI!

Book a free demo

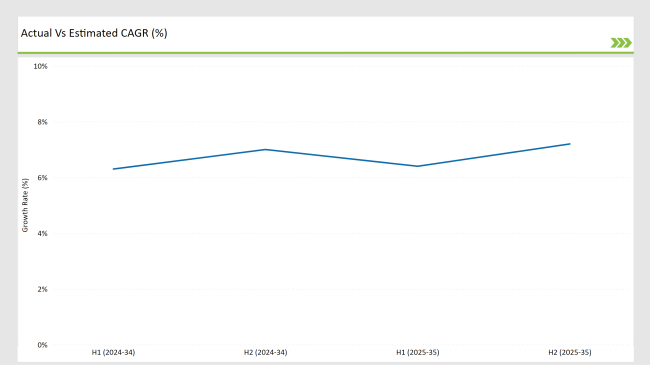

The biannual market assessment demonstrates continuous market growth of hydrolyzed vegetable protein utilization across food production and animal feed sectors.

H1 signifies period from January to June, H2 Signifies period from July to December

Enhanced sustainable protein extraction procedures along with organic HVP variants enhance market expansion. Hydrolyzed Vegetable Protein adoption by food manufacturers continues supporting market expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Cargill: Launched a new line of hydrolyzed vegetable protein products aimed at enhancing flavor profiles in plant-based foods. |

| February 24 | Archer Daniels Midland (ADM): Acquired a specialty ingredient company to expand its portfolio of hydrolyzed vegetable protein solutions for the food industry. |

| March 24 | Kerry Group: Introduced a new hydrolyzed vegetable protein formulation designed for improved solubility in beverages. |

| April 24 | Ingredion: Announced a partnership with a leading food manufacturer to develop innovative hydrolyzed vegetable protein applications in snacks. |

| May 24 | Tate & Lyle: Expanded production capacity for hydrolyzed vegetable protein to meet increasing demand in the North American market. |

Expansion of Hydrolyzed Vegetable Protein Applications in Functional Foods

Food producers increase the use of hydrolyzed vegetable proteins throughout their food products since consumers demand functional food items with fortification additives. HVP functions as a basic ingredient which improvers texture while boosting solubility and digestibility inside protein bars and plant-based dairy alternatives throughout ready-to-eat meals.

HVP attracts health-focused consumers because manufacturers have introduced modern protein hydrolysis processes which create better bioavailable amino acids. Research indicates that Hydrolyzed Vegetable Protein usage in sports nutrition and meal replacement products will increase because these proteins deliver easy absorption together with better muscle recovery properties.

Sustainable Production and Clean-Label Hydrolyzed Proteins

The emerging demand for environmentally friendly protein sourcing pushed industry experts to create eco-friendly hydrolyzed vegetable proteins. Consumers want products with non-GMO organic and minimally processed protein alternatives so manufacturers pursue fermentation extraction methods and plant-based protein combinations.

Having detected growing consumer demand for clean-label products companies redirect resources to develop formulations without artificial additives while minimizing processing requirements for stable functionality attributes. Market innovation will be accelerated by fermented hydrolyzed proteins that provide both improved gut health benefits and enhanced flavor stability. The market will transform through a combination of new trends which create clearer product information and address changing consumer needs.

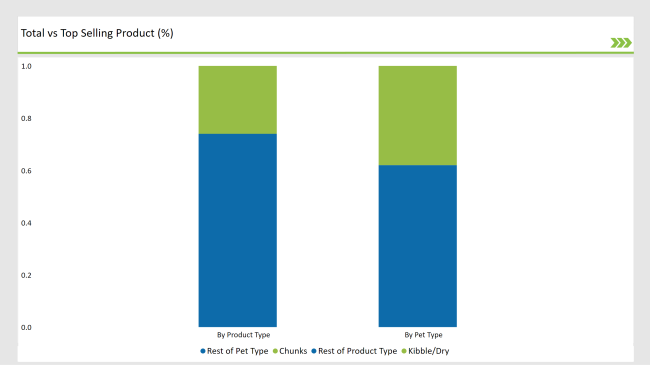

% share of Individual categories by Product Type and Pet Type in 2025

Chunks Dominate the Hydrolyzed Protein Market

Chunks command the highest market share of 38% in 2025 primarily due to its applications in plant-based meat alternatives, ready-to-cook meals, and processed food products. The hydrolyzed chunks contain a considerable amount of fibers and hence come closest to real meat.

Their demand increases more rapidly for products based on plant sources for their application in meat substitute products. Thus, producers have started augmenting their range of hydrolyzed protein products based on chunks to be marketed to increasing customers seeking more plant-based foods.

In addition, chunks are widely applied in food service and commercial uses, where convenience and quick preparation are essential. Further improvements in texturization and flavoring technologies further increase the attractiveness of chunk-based hydrolyzed proteins. Increased focus on sustainable protein sources also helps to raise the demand for plant-based protein chunks as an important ingredient in modern food formulations.

Soy Protein is the market leader

Soy protein continues to be the leading product type, capturing 40% of the market in 2025, due to its high nutritional value, affordability, and versatility in a variety of applications. Hydrolyzed protein based on soy is a rich source of plant-based protein, making it an excellent addition to a wide variety of processed foods, functional beverages, meat substitutes, and nutritional supplements.

Although the protein fortification aspect has become increasingly innovative, soy protein still enjoys a large market share due to its established supply chains and steady performance in food processing, in addition to catering to the growing demand of high-protein, plant-based food products from consumers.

Note: above chart is indicative in nature

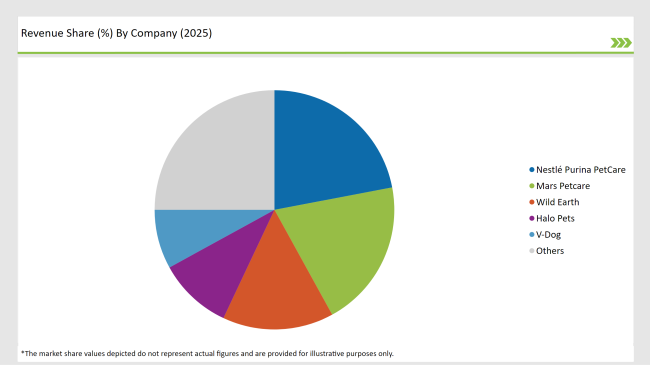

The USA hydrolyzed vegetable protein market shows high level of competition thanks to major contributors Cargill and Archer Daniels Midland (ADM) together with Kerry Group and Ingredion and Tate & Lyle which drive market expansion. Advanced extraction methods along with robust distribution networks help these firms establish their market dominance.

Industrial interest in hydrolyzed proteins with sustainable production and non-GMO characteristics has increased significantly because consumers want organic and clean-label options. Research and development investments increase because manufacturers prioritize better protein extraction methods which keep both nutritional value and functional properties high.

Industrial sales channels enabled by e-commerce businesses and specialized health food outlets provide emerging operators with opportunities to compete with established brands. Through strategic alliances between ingredient suppliers and food manufacturers hydrolyzed vegetable proteins have become more widely accessible in multiple food and beverage formats.

The market is expected to grow at a CAGR of 7.1% from 2025 to 2035.

The USA Hydrolyzed Vegetable Protein market is projected to reach USD 900.8 Million by 2035.

Chunks hold 38% of the market share, widely used in plant-based meat alternatives and processed foods.

Key players include Cargill, Archer Daniels Midland (ADM), Kerry Group, Ingredion, and Tate & Lyle.

By form, the market includes chunks, slices, flakes, and granules.

By product type, the market is segmented into soy protein, wheat protein, pea protein, rice protein, chia protein, flax protein, and corn protein.

By end-use, the industry is divided into household, commercial, food industry, and animal feed applications.

By distribution channel, the market includes direct and indirect sales.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.