The USA Human Milk Oligosaccharides (HMO) market is projected to reach USD 29.7 Million in 2025, growing at a CAGR of 6.5% over the next decade to an estimated value of USD 56.0 Million by 2035.

| Attributes | Description |

|---|---|

| Estimated USA Human Milk Oligosaccharides Industry Size (2025E) | USD 29.7 million |

| Projected USA Human Milk Oligosaccharides Industry Value (2035F) | USD 56.0 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

The USA Human Milk Oligosaccharides (HMO) market shows increased growth because parents understand better infant nutritional needs coupled with the recognized benefits of HMOs in building gut health together with immune system improvement.

Parents who want to deliver the best possible nutrition for their infants now widely choose HMOs for infant formula because of their functional properties. The market's expansion is supported by increasing consumer interest in supplements for adult gut health and immunity support together with cognitive benefits.

Synthetic biology and biotechnological advancements have elevated HMO production scales and dropped costs thus making the products more marketable. The HMO research field explores adult nutrition uses as scientists expand their work on prebiotic-purpose and symbiotic-formulated products and investigate how personal nutrition requires microbiome health analysis.

Market participants are using strategic tie-ups and developing new HMO formulations as they target expanding markets among different consumer groups. The HMO market stands to grow strongly because consumers today focus on health benefits included in their product choices.

The increasing market demand for HMOs demonstrates a wider movement toward nutritious food products which support total health wellness thus making them essential for infant formula and adult dietary supplement sectors.

Explore FMI!

Book a free demo

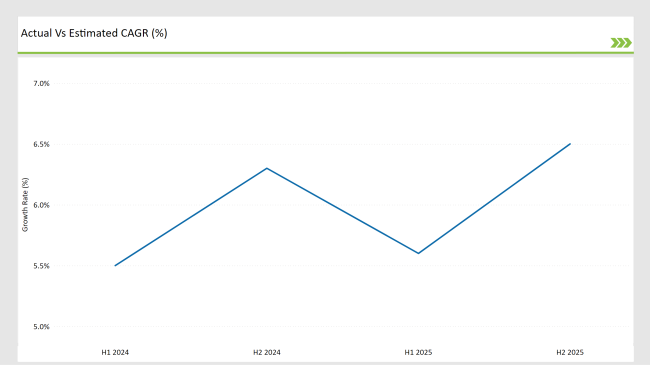

The Data shows that semi-annual growth in the USA Human Milk Oligosaccharides (HMO) market remains significant because of its rising CAGR. The market continues its upward trajectory because parents now focus on promoting both digestive health and nutritional requirements of their little ones.

Successful market diversification requires both innovative product formulations in addition to strategic partnering strategies. Ready-to-use packaging innovations provide consumer convenience and make products available to diverse market segments.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Abbott Laboratories: Expanded its infant formula portfolio with an advanced HMO blend targeting gut and immune health for newborns. |

| March 2024 | Nestlé Health Science: Launched an HMO-based dietary supplement focusing on gut microbiome enhancement for adults. |

| May 2024 | DSM-Firmenich: Introduced a new cost-effective fermentation process for HMO production, improving accessibility. |

| August 2024 | DuPont: Announced an exclusive research partnership to develop personalized HMO formulations for premature infants. |

| December 2024 | Kyowa Hakko Bio Co. Ltd.: Unveiled a new synbiotic formula combining HMOs with probiotics for enhanced immune support. |

Expansion of Human Milk Oligosaccharide (HMO) market in Adult Nutrition

American Human Milk Oligosaccharide (HMO) market dynamics experience rapid evolution because manufacturers extend their applications into adult nutritional products. Studies have established HMOs' importance for microbiome health so manufacturers expanded their reach from infant formula to create dietary supplements specifically designed for adults. Research has demonstrated that HMOs affect immune function brain health and gastrointestinal system well-being thus causing a market rise in dietary supplements containing these beneficial compounds.

Large manufacturing companies now release symbiotic products that merge HMOs with probiotics so consumers get better gut microbiome stability. Functional foods alongside personalized nutrition products have become increasingly popular among consumers thus matching this industrial trend.

Advances in Fermentation Technology for Cost-Effective Production

New fermentation technology developments have transformed the manufacturing methods of HMO products. The extraction methods used for HMOs from human milk prove uneconomical for industrial purposes so the industry now focuses on enzymatic synthesis along with microbial fermentation processes. The new manufacturing processes achieve economic efficiency improvements without damaging the complex composition of HMOs.

These biotechnological advancements receive substantial funding from DSM-Firmenich and DuPont resulting in market readiness across different market segments for HMO ingredients. The HMO marketplace demonstrates strong potential for continued expansion because consumer understanding of health advantages keeps increasing as part of general health and wellness trends.

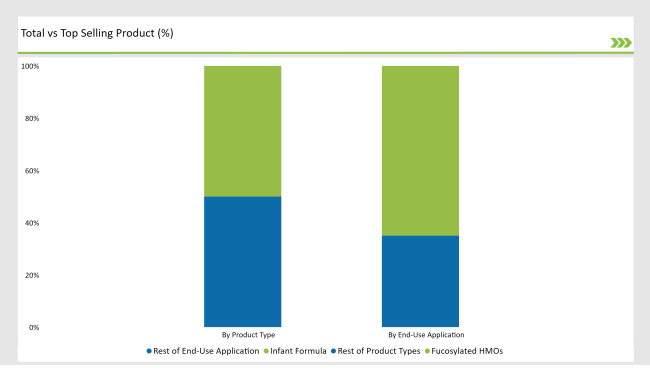

% share of Individual categories by Product Type and End-Use in 2025

Product type: Fucosylated HMOs are the most significant representatives

Fucosylated HMOs are going to be the leading ones in the USA HMOs (Human Milk Oligosaccharides) market with a share of 50% projected by 2025. These are the factors that are being increasingly valued and stringently demanded in the industry for their definite immune benefits and gut microbiota disadvantages. These substances are remarkable for the fact that they act as they breast-feeding almost exactly. Their widespread use in infant formula formulas is revealing their vast importance in the field of infant nutrition.

Top manufacturers pay more heed to HMO portfolios which are enriched with fucosylated mixes to high purity as the economic support for the increased consumer demand for wellness products by helping them to stay healthy. Since people have become more conscious of the health advantages that come with fucosylated HMOs, companies now channel funds to research and development projects to craft and grow their products and maintain competition in this fast-paced market.

By End Use: Infant Formula Leads the Market

Infant formula is still the biggest and most used application area of HMOs, which is going to cover 65% of the market share in 2025. Utilizing the synthetically produced HMOs in infant nutrition, became a tangible competitive edge for the premium brands as customers tend to be more and more interested in goods that replicate human milk more closely.

This trend has forced the producers to innovate and think outside of the box by adding more and more of the HMO in their formulas, which they, in turn, think will be the focus point of infant health plus nutrition.

The increasing demand for breast milk-like formulations is a sign of the growing emphasis on delivering the best nutrition to infants. Parallel to the clamour for better quality infant formula, producers put extra effort into upgrading the product with innovation and ensuring that it meets babies' needs while being in line with parents' expectations.

Note: above chart is indicative in nature

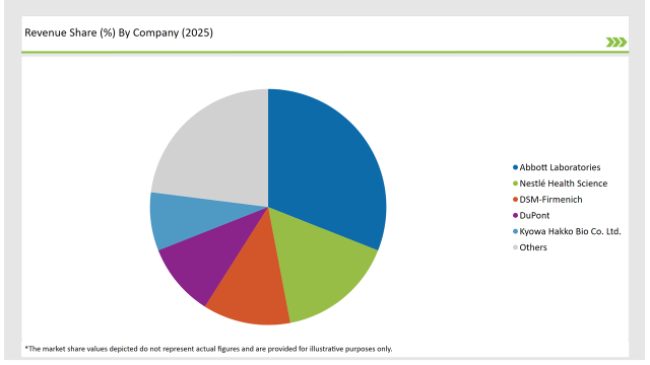

The USA Human Milk Oligosaccharides (HMO) market concentration lies at a moderate level among established biotechnology corporations and localized producers as well as emerging startup companies. The market is controlled by leading companies Abbott Laboratories together with Nestlé Health Science and DuPont thanks to their patented production technologies and their strategic deals with infant formula brands. Their enterprise position enables HMO production by utilizing their cutting-edge research facilities and extensive supply chain reach to handle HMO market growth needs.

Two India-based drug manufacturers Dextra Laboratories and Carbosynth develop HMO ingredients for particular formulation requirements. Their fermentation-based manufacturing together with processing efficiency enables the company to dominate specialized market segments that serve individual consumer requirements.

The market expansion drives start-ups and academic institutions to launch HMO supply because consumers want personalized nutrition and microbiome-specific advancements. Symmetric biology advancements allow new market participants to achieve enhanced HMO production effectiveness which enables the widespread availability of dietary supplements and functional foods.

The evolving market creates opportunities for stakeholders to work together which boosts R&D activities in this field. HMO benefits recognition growth combined with consumer interest in health-oriented products that support gut health and general well-being will expand the market.

The market is projected to grow at a CAGR of 6.5% from 2025 to 2035.

The market is expected to reach USD 56.0 Million by 2035.

Rising demand for infant nutrition, advancements in fermentation technology, and increasing applications in gut health and immunity support.

Infant formula holds the largest market share (65%), followed by dietary supplements.

Leading companies include Abbott Laboratories, Nestlé Health Science, DSM-Firmenich, DuPont, and Kyowa Hakko Bio Co. Ltd.

By product type, the USA human milk oligosaccharides market is segmented into Fucosylated HMOs, Silylated HMOs, and Non-fucosylated Neutral HMOs.

By end use, the market includes Infant Formula and Dietary Supplements.

By distribution channel, the market encompasses Online Retail, Supermarkets/Hypermarkets, and Pharmacies/Drug Stores.

By production technology, the market is categorized into Microbial Fermentation, Enzymatic Synthesis, and Chemical Synthesis.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.