The United States high tibial osteotomy (HTO) plates for High tibial osteotomy (HTO) plates is forecasted to attain USD 73.1 million by 2025, expanding at 3.2% CAGR to USD 103.2 million by 2035.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size (2025) | USD 73.1 million |

| Projected United States Value (2035) | USD 103.2 million |

| Value-based CAGR (2025 to 2035) | 3.5% |

The United States HTO plates market for knee osteoarthritis in active young patients, which is increasingly common, is driving the demand forward. An escalating focus on deferring joint replacement, especially in athletes and sports enthusiasts, has led to growing popularity for HTO surgeries.

The American orthopedic marketplace is characterized by strong technological momentum in terms of minimally invasive surgical practices and enhanced fixation instruments.

Payment mechanisms and coverage for insurance policies are also among the key factors for the increased use of HTO, given the cost-control motive of healthcare systems that pushes in favor of such procedures which keep the joints in use longer.

Top USA orthopedic centers in states such as California, Texas, and New York are finding a rapidly expanding preference for medial opening wedge plates because they offer versatility along with better outcomes in the post-surgery stage.

Major players in the USA HTO plate market are Johnson & Johnson (DePuy Synthes), Arthrex, and Newclip Technics. DePuy Synthes, a market leader in the USA orthopedic market, uses its wide distribution network and product innovation to retain its competitive advantage.

Arthrex, a leader in sports medicine and orthopedic innovation, has launched advanced plating systems with improved biomechanical stability, addressing high-performance athletes and younger patients.

In contrast, Newclip Technics, a European player, is growing its USA presence through strategic alliances and innovative HTO solutions targeting patient-specific implant designs. As the market keeps changing, these companies are dictating the direction of HTO procedures through innovation, education of surgeons, and customized implant solutions addressing American patient populations.

Explore FMI!

Book a free demo

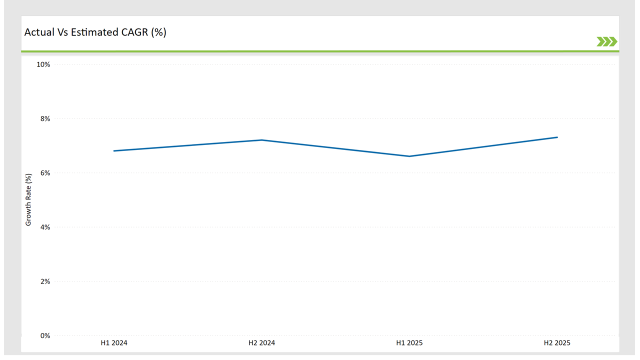

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States high tibial osteotomy (HTO) plates market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

High tibial osteotomy (HTO) plates market of the United States is expected to grow at 3.4% CAGR for the first half of 2023, followed by an upgradation to 4.0% in the same year's second half.

For 2024, the growth is forecasted to go a little down and reach 3.5% in H1 and is expected to rise to 4.1% in H2. This pattern presents a decline of -10.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 8.72 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing high tibial osteotomy (HTO) plates market of the United States, which is primarily affected by regulations, consumer trends, and improvements in high tibial osteotomy (HTO) plates. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Integration of Robotic-Assisted Surgery: DePuy Synthes is holding the lead position in the USA HTO market due to integration of robotic-assisted surgery through the VELYS™ Robotic-Assisted Solution, improving the accuracy of osteotomy procedures. The company is also utilizing its robust hospital network relationships to deliver bundled orthopedic solutions, improving the availability of its implants in high-volume surgery centers. Further, DePuy Synthes is emphasizing patient-specific implants and 3D planning software, meeting the need for customized solutions. With a strong surgeon training system in place, including educational opportunities at USA academic centers, the company facilitates broad acceptance of its state-of-the-art HTO plating systems. |

| 2024 | Extensive Surgeon Training Programs: Arthrex is propelling USA HTO market growth through comprehensive surgeon training programs at its headquarters in Naples, Florida, encouraging hands-on experience with its plating systems. The company is incorporating biologics like Arthrocell® to improve bone healing in osteotomy procedures, differentiating itself from conventional implant companies. Arthrex is also emphasizing minimally invasive surgical approaches, consistent with the USA healthcare trend toward outpatient procedures. The company is also taking advantage of direct-to-surgeon interaction through digital platforms and customized implant solutions, keeping its plating systems a top choice among orthopedic specialists in sports medicine and joint preservation. |

| 2024 | Regional Distribution Agreements: Newclip Technics is aggressively expanding in the USA by forming regional distribution agreements with specialized orthopedic suppliers, ensuring wider accessibility for its HTO plates. The company differentiates itself by offering customizable implant solutions, addressing USA surgeons’ preferences for anatomical alignment and fixation versatility. Additionally, Newclip is investing in FDA clearances for its advanced plating systems, allowing smoother market entry. The firm is also targeting academic partnerships with leading USA orthopedic centers, driving adoption through clinical validation. By focusing on lightweight yet durable implant designs, Newclip aims to compete against established players by offering innovation-driven alternatives. |

Increasing Use of Robotic and Navigation-Guided Procedural Techniques

Major USA sports medicine centers and hospitals are committing to robotic-assisted and navigation-guided orthopedic surgeries to improve the accuracy of HTO.

Tools such as VELYS™ Robotic-Assisted Solution (J&J) and ROSA Knee (Zimmer Biomet) become the norm for high-volume operating centers, better positioning implants, and minimizing complications. The integration of these tools enhances surgeon confidence in performing HTO procedures, which translates into greater use of advanced plate systems for robotic implementation.

Growing Demand from Younger, Active Patient Segments

Unlike other countries, the USA sees rising HTO adoption among athletes and active individuals aged 40-55, driven by a strong sports medicine culture and emphasis on joint preservation over total knee replacement.

Organizations like the American Academy of Orthopedic Surgeons (AAOS) and sports leagues promote early intervention, boosting demand for high-durability HTO plates suitable for long-term activity.

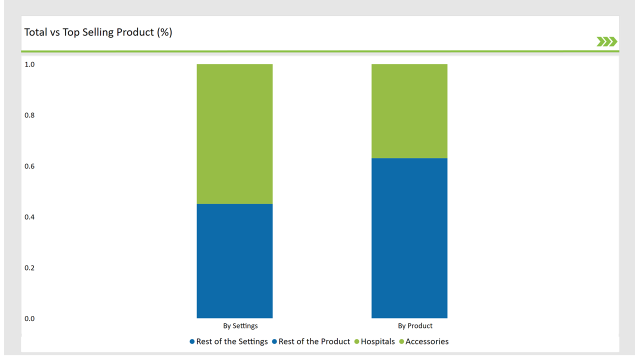

% share of Individual categories by Product Type and Material in 2025

Medial Opening Wedge Plates records significant surge in United States High Tibial Osteotomy (HTO) Plates, By Product

Medial Opening Wedge Plates are the market leaders in the USA because of their better biomechanical stability, simplicity of use, and quicker recovery compared to lateral closing wedge methods.

These plates provide gradual and accurate angular correction and are best suited for robotic and navigation-assisted procedures, which are gaining popularity in the USA Minimally invasive methods are also preferred in outpatient facilities, where medial opening wedge plates facilitate bone grafting for better healing.

Additionally, their lower rate of complications-less risk of peroneal nerve damage-makes them the surgeon's first choice for treating younger, active patients who prefer joint preservation rather than knee replacement.

Titanium plates dominate the USA market for their biocompatibility, resistance to corrosion, and lightness, minimizing patient discomfort and risks of implant failure.

Compared to stainless steel, titanium possesses a better strength-to-weight ratio and is associated with more osseo integration, an essential factor in young patients who have high physical demands. Moreover, the MRI compatibility of titanium caters to the reliance of the USA healthcare system on sophisticated imaging for post-operative evaluation.

Major manufacturers like Arthrex and DePuy Synthes have grown more inclined to move towards titanium-based HTO plates, expanding market uptake among high-volume orthopedic clinics and sports medicine facilities.

Note: above chart is indicative in nature

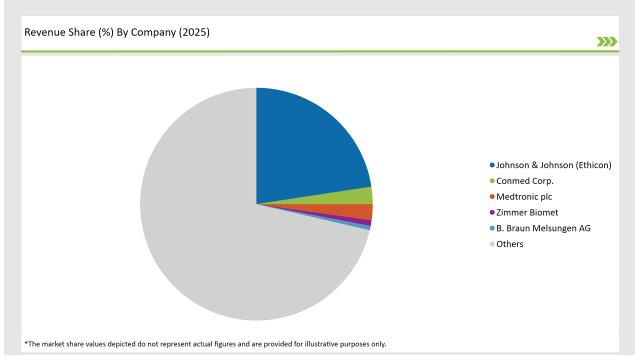

The USA high tibial osteotomy (HTO) plates market is moderately consolidated, with a few major players holding a large share of the revenue. Industry leaders maintain competitive differentiation through proprietary titanium and bioresorbable materials, as well as patient-specific instrumentation. Companies with strong surgeon training programs and efficient distribution networks have an advantage, as adoption of procedures is highly dependent on orthopedic specialist preference.

Tier-I companies, such as DePuy Synthes, Zimmer Biomet, and Arthrex, dominate the market due to their rich product lines, regulatory savvy, and established track records in reimbursement. Mid-sized, niche players, such as Acumed and Paragon 28, pursue anatomically oriented plating systems and advanced fixation methods to exploit niche market opportunities.

Competitive positioning is defined by strategic acquisitions and licensing agreements as firms look for new osteotomy planning software and 3D-printed implant technologies. Value-based healthcare models are also pouring in, creating pricing pressure that forces manufacturers to focus on clinical efficacy and long-term cost-effectiveness.

Regulated compliance remains an important barrier to entry for new entrants; FDA approval time lines for Class II medical devices create market entry challenges. In the expanding out-patient orthopedic space, companies able to optimize instrumentation for minimally invasive techniques should gain market share.

By 2025, the United States high tibial osteotomy (HTO) plates market is expected to grow at a CAGR of 3.5%.

By 2035, the sales value of the United States high tibial osteotomy (HTO) plates industry is expected to reach is USD 103.2 million.

Key factors propelling the United States high tibial osteotomy (HTO) plates market include increasing use of robotic and navigation-guided procedural techniques and growing demand from younger, active patient segments.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

In terms of product, the industry is divided into- Medial Opening Wedge Plates, Lateral Closing Wedge Plates, Biplanar Osteotomy Plates, Locking Compression Plates (LCPs), Contoured Plates and Spacer Plates.

In terms of material, the industry is segregated into- medial opening wedge plates, lateral closing wedge plates, biplanar osteotomy plates, locking compression plates (LCPs), contoured plates and spacer plates.

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications.

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers.

The Intraoperative Radiation Therapy Systems Market Is Segmented by Disease Indication and End User from 2025 To 2035

The Cirrhosis Management Market is segmented by Corticosteroids, Analgesics and Dialysis from 2025 to 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.