The USA herbs and spices market is projected to reach a value of USD 26,760.5 Million in 2025, growing at a CAGR of 3.4% over the next decade to an estimated value of USD 37,328.3 Million by 2035.

The market grows steadily because consumers consistently choose products containing natural, organic, and health-focused ingredients. New product developments containing integrated herbs and spices have accelerated the growth of this market through the creation of both plant-based foods and functional beverages.

The expanded market interest for herbs and spices stems from growing consumer education about their health benefits that include anti-inflammatory, antioxidant, and antimicrobial properties that appeal to various population segments.

New product developments targeting areas like organic spices and prepared spice mixes and improved packaging formats have emerged because of expanding customer demands. Market development in the USA is driven by its cultural diversity, which shapes the industry direction.

The rising interest of consumers in ethnic culinary traditions has turned basil, long side cilantro and oregano, long with cumin and paprika, into essential seasonings found in homes across the nation. Market expansion in the food and beverage industry ensures the Herbs and Spices market will maintain its accelerated expansion path.

| Attributes | Description |

|---|---|

| Estimated USA Herbs and Spices Industry Size (2025E) | USD 26,760.5 million |

| Projected USA Herbs and Spices Industry Value (2035F) | USD 37,328.3 million |

| Value-based CAGR (2025 to 2035) | 3.4% |

Explore FMI!

Book a free demo

The table below emphasizes the biannual growth patterns for the USA herbs and spices market, illustrating steady rises in CAGR across successive years. This examination highlights the market’s ability to adjust to consumer preferences, technological innovations, and the increasing appetite for natural components.

H1 signifies period from January to June, H2 Signifies period from July to December

These consistent growth patterns indicate the rising acceptance of high-quality, organic, and sustainably harvested herbs and spices. Improvements in farming methods and progress in processing technologies have additionally bolstered the market’s strength, even during varying economic circumstances.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Launch of Or ganic Spice Blends by McCormick: McCormick introduced a new line of organic spice blends, catering to health-conscious consumers seeking natural flavor enhancements for their meals. |

| April 2024 | E-comme rce Expansion by Spice Jungle: Spice Jungle expanded its e-commerce platform, enhancing accessibility to a wider range of herbs and spices for home cooks and food businesses. |

| May 2024 | New Health-Focused Product Line by Simply Organic: Simply Organic launched a new health-focused product line featuring spices known for their antioxidant properties, appealing to wellness-oriented consumers. |

| July 2024 | Innovative Spice Pac kaging by OXO: OXO unveiled a new packaging design for its spices that improves freshness and usability, targeting modern consumers’ convenience needs. |

| June 2024 | Acquisition of Fr esh Herb Supplier by Fresh Point: Fresh Point acquired a leading supplier of fresh herbs to enhance its offerings in the growing market for fresh culinary ingredients. |

Rising Demand for Organic and Sustainably Sourced Herbs and Spices

People are getting more and more into organic and eco-friendly grown spices as they are getting obsessed with the transparency and the ethical norms that the food industry needs to follow. The number of products that are certified as organic and fair trade has seen massive growth this year, especially among the shoppers who are concerned about the environment and health. The products are the best ones to solve the issues of consumers with pesticides and the effects on the environment, but they are also means to achieve the broader target of sustainable agriculture.

Innovations in Packaging and Product Convenience

The sector is showing progress in new packaging technology initiated to keep products fresh and to make them user-friendly. Re-usable bags, mini-sachets, and eco-friendly materials are now the norm across product categories.

The changes are made with the desire to cater to the needs of modern-day consumers who want things that are easy to use, portable, and that cause less harm to the environment. Spice manufacturers are in addition offering pre-measured blends and seasoning kits for the use of consumers in easy cooking and to trigger their creativity in using more flavors.

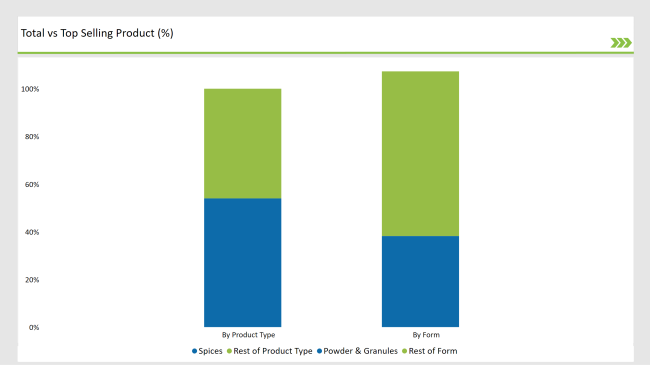

% share of Individual categories by Product Type and Form in 2025

Spices represent the primary segment within the USA Herbs and Spices market that will lead to predicted continuous expansion and reach 53.6% market dominance by 2025. Consumer curiosity about different flavors motivates them to use a broader selection of products thereby increasing their market popularity. The spice market is experiencing increasing popularity of Single-origin ingredients such as turmeric, black pepper and cinnamon because of their multi-purpose potential and documented health advantages.

The consumer trend toward health consciousness triggers growing interest in natural and organic spices at the same time. The American culinary market stands strengthened through its foundation of healthier food choices, which positions herbs and spices markets as fundamental food industry elements. The market demonstrates an ongoing expansion trajectory because current consumer tastes prefer distinctive flavor experiences for their culinary creations.

The USA Herbs and Spices market will have powder and granules as its dominant form segment reaching 38.2% market share by 2025. Food manufacturers together with commercial kitchens select powder and granules because these forms offer convenient storage capabilities and extended shelf durability and work well in multiple recipes.

The market share for whole or fresh herbs along with spices exceeds 24.6% because they provide superior aromatic qualities which remain paramount in top-end restaurants and haute cuisine operations. The combination of packaging options reflects consumer eating habits and operational requirements within the food sector yet successfully drives growth for the herb and spice market.

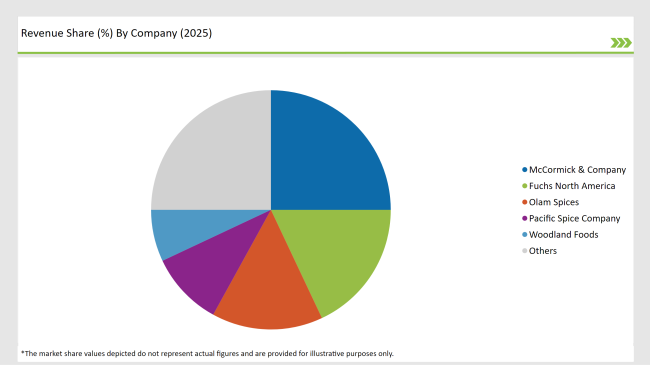

2025 Market share of Herbs and Spices suppliers

Note: above chart is indicative in nature

The Herbs and Spices Market in the USA features a combination of global leaders, regional providers, and specialized manufacturers, all playing a role in its expansion. Leading companies like McCormick & Company, Fuchs North America, and Olam Spices dominate the market because of their wide-ranging product offerings, solid distribution channels, and high consumer confidence. Research and development functions as one of these companies' main budget areas where they produce creative spice mixtures along with organic goods and environmentally conscious sourcing practices.

The local supply infrastructure stands essential because it matches community tastes through unique offerings of fresh herbs together with local spice recipes. High-quality niche producers manufacture premium organic and non-GMO goods which specifically target shoppers concerned about their health. These combined initiatives drive innovation while maintaining product diversity by creating competition in the marketplace.

Foodservice companies now strengthen market concentration by teaming up with spice manufacturers to share their expertise providing standard spice blends for various applications. Spice producers enhance market growth through collaborations that bring their mixes into fast-food channels alongside upscale restaurants thus creating broader product acceptance.

The market is expected to grow at a CAGR of 3.4% from 2025 to 2035.

The USA Herbs and Spices market is projected to reach USD 37,328.3 Million by 2035.

Key drivers include rising consumer demand for natural and organic ingredients, the popularity of ethnic cuisines, and innovations in spice blends and packaging.

Spices dominate by product type, while powder and granules lead by form in 2025.

Top manufacturers include McCormick & Company, Fuchs North America, Olam Spices, Pacific Spice Company, and Woodland Foods.

By Product Types the industry has been categorized into herbs, spices, paprika, and cumin.

By form, the market is segmented into powder and granules, flakes, paste, and whole or fresh.

By end use, the industry is categorized into food, beverage, foodservice, and retail sales.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.