United States market, in generic injectable are significantly expanding. With rate of 6.1%, the market will reach to USD 69.2 million in 2035 from USD 38.2 million in 2025.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size (2025) | USD 38.2 million |

| Projected United States Value (2035) | USD 69.2 million |

| Growth Rate from (2025 to 2035) | 6.1% |

The growth in USA if a result from rising demand for cost-effective biologics, a growth in chronic ailments, and favoring biosimilar regulatory frameworks. Moreover, this is facilitated further by technical enhancements for complicated injectables and the pre-filled syringe industry. Growing use of mAbs- and peptide-based injectables continues to reshape their key application domains: oncology, diabetes, and infectious diseases.

Besides, hospital pharmacies are dominating due to the role of specialized and high-potency injectable medications being performed at hospitals. This is further helped by the rising number of treatments at hospitals and an increased preference for parenteral mode of drug delivery.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States generic injectable market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The generic injectable sector for the United States market is expected to rise at 6.4% growth rate in the first half of 2024, which will increase to 6.8% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 6.1% in H1 but is expected to rise to 6.7% in H2.

This pattern shows a decline of 30.0 basis points from the first half of 2023 to the first half of 2025, in the second half of 2024, it is lower by 11.3 basis points compared to the second half of 2024.

The nature of the United States generic injectable market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Collaboration: Samsung Biologics Co Ltd, engages in collaborative efforts in order to expand its regional footprint. It allows the company to expand its supply chain operations in developed as well as developing countries. |

| 2024 | Expansion: Aurobindo Pharma Limited, focuses on expanding capacity in several key markets and various product areas of the medical devices segment. |

| 2024 | Expansion: Sun Pharmaceutical Industries Ltd., has vast generic drug portfolio range. It focuses on developing new generic molecule entities in order to expand its current portfolio across different therapeutic areas. |

Growing preference for IV administration in critical care.

This makes IV administration still the dominant route of delivery due to its fast onset of action and higher bioavailability. Thus, IV injectables are increasingly used in treatments for severe infections, cardiovascular diseases, and blood disorders within ICUs and emergency care units of hospitals.

Developmental Advances in Pre-filled Syringes and Long-acting Injectables

The USA market is shifting toward prefilled syringes and long-acting formulations, improving patient compliance and reducing medication errors. Biologics administered through injections for diabetes, cardiovascular diseases, and CNS disorders significantly benefit from such innovations.

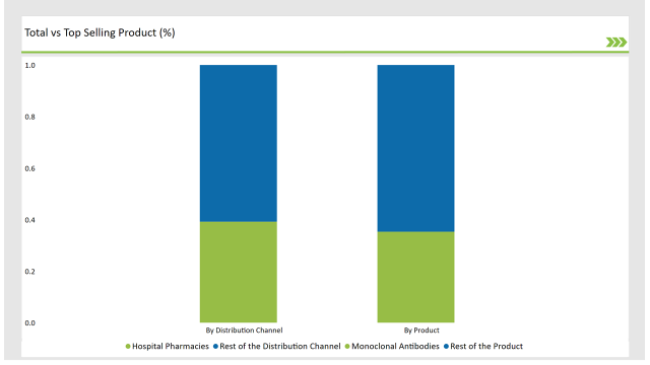

% share of Individual categories by Product Type and Distribution Channel in 2025

Monoclonal antibodies records significant surge in generic injectable market

Monoclonal antibodies are the leading products in the generic injectable segment due to their wide range of applications various chronic diseases. The increase preference for biosimilars in the globe as these are cost effective for patient and healthcare providers.

The largest share will, therefore, comprise network distribution dominated by leading roles played by hospital pharmacies regarding expertise in critical care, oncology, and surgical intervention for complex injectables. Retail and online growth will also scale up because many more treatments of chronic diseases require injections at home.

Note: above chart is indicative in nature

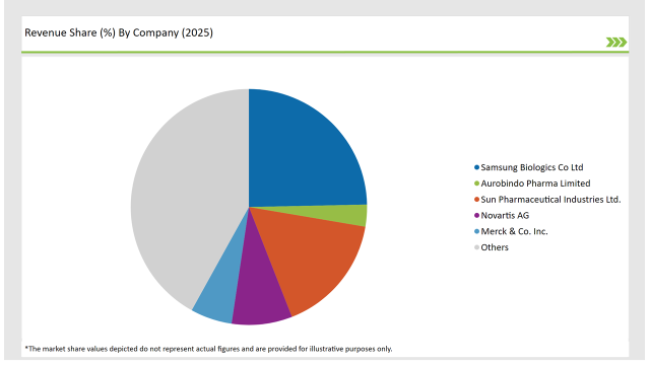

The generic injectables market in the USA is highly competitive and faces strong market consolidation, with a proper blend of established players and emerging companies. It is dominated by Tier 1 companies, focusing on high-performance injectables, regulatory compliance, and continuous innovation.

With strong biosimilar, complex generics, and parenteral drug formulation investments, these companies have been promising to ensure a steady supply of cost-effective alternatives to branded injectables.

While Tier 2 companies, in turn, find a winning formula by offering cost-effective and affordable solutions to the hospitals, specialty clinics, and retail pharmacies. They focus on high-demand generic injectables like insulin, monoclonal antibodies, and peptide hormones, whereby investments are made in efficient production technologies that boost their market presence.

The share of New Entrants and Mid-Sized Players is competitive pricing, increasing capacity, and strengthening of their distribution networks. These companies will seek market share in niche therapeutic areas and in the hospital-based injectables segment.

The market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Monoclonal antibodies are the leading products in the market.

Key players include Samsung Biologics Co Ltd, Aurobindo Pharma Limited , Sun Pharmaceutical, ndustries Ltd., Novartis AG, Merck & Co. Inc., Cipla Ltd, Pfizer Inc., Fresenius Kabi, Sanofi S.A, AstraZeneca Plc, Teva Pharmaceuticals., Mylan N.A, Baxter International, Dr. Reddy’s Laboratories Ltd.

The industry includes various product type such as monoclonal antibodies, immunoglobulin, cytokines, insulin, peptide hormones, blood factors, peptide antibiotics, vaccines, small molecule antibiotics, chemotherapy agents, and others.

The industry includes various molecule type such as small molecule, large molecule.

The industry includes various indications such as oncology, infectious diseases, diabetes, blood disorders, hormonal disorders, musculoskeletal disorders, CNS diseases, pain management, cardiovascular diseases

Available in route of administration like intravenous (IV), intramuscular (IM) and subcutaneous (SC)

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.