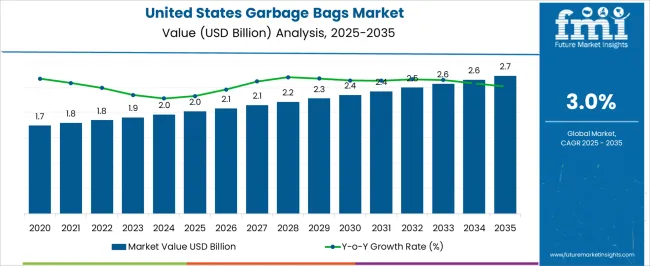

The United States Garbage Bags Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| United States Garbage Bags Market Estimated Value in (2025 E) | USD 2.0 billion |

| United States Garbage Bags Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The United States Garbage Bags market is experiencing steady growth, driven by increasing urbanization, rising household waste generation, and expanding commercial and industrial activities. Demand is being supported by the growing need for hygienic and efficient waste management solutions across residential, commercial, and public sectors. Advancements in polymer technology, particularly in polyethylene-based products, are enhancing durability, flexibility, and tear resistance, making garbage bags more reliable and convenient for consumers.

Rising environmental awareness and regulations encouraging proper waste collection and disposal are further supporting market expansion. The growing adoption of non-scented, biodegradable, and high-capacity bags is reflecting evolving consumer preferences and sustainability initiatives.

Manufacturers are increasingly focusing on product innovation, including enhanced strength, odor control, and eco-friendly options, to meet the diverse needs of households and businesses As waste management practices continue to modernize, the market is expected to witness sustained growth, with opportunities emerging from both urban and suburban areas seeking efficient, reliable, and environmentally responsible garbage bag solutions.

The polyethylene material segment is projected to hold 35.8% of the United States Garbage Bags market revenue in 2025, establishing it as the leading material type. Growth in this segment is driven by the material’s superior strength, flexibility, and cost-effectiveness compared with alternative polymers. Polyethylene garbage bags are highly durable, resistant to tearing and puncturing, and suitable for a wide range of household and commercial waste types.

The material also allows for lightweight designs without compromising performance, which improves ease of use and reduces shipping costs. Compatibility with various manufacturing technologies and ability to incorporate features such as odor control and UV resistance further enhance adoption. Rising awareness of hygienic waste management practices in households and businesses is supporting strong demand.

The combination of durability, versatility, and affordability is reinforcing the dominance of polyethylene bags As consumers increasingly seek reliable and convenient waste disposal solutions, the polyethylene segment is expected to maintain its leading market position, driven by consistent product performance and innovation.

The non-scented product segment is expected to account for 55.4% of the market revenue in 2025, making it the largest product category. Growth in this segment is being driven by consumer preference for odor-neutral waste disposal options that do not interfere with indoor air quality. Non-scented garbage bags are widely used in households, offices, and healthcare facilities, where odor-free disposal is critical.

The ability to manage waste hygienically without masking smells with chemicals or fragrances makes them preferable for sensitive environments. These products also offer compatibility with high-capacity bins and standard disposal systems, increasing convenience for users. As awareness regarding chemical sensitivities and indoor air quality rises, the adoption of non-scented garbage bags is being reinforced.

Manufacturers are focusing on maintaining durability, flexibility, and leak resistance while ensuring that bags remain free of artificial scents With sustained demand from both domestic and commercial users, the non-scented product segment is expected to continue leading the market, supported by consumer preference for safe, odor-free, and practical waste management solutions.

The 30 to 90 litres capacity segment is projected to hold 37.8% of the market revenue in 2025, making it the leading capacity category. This segment is favored due to its suitability for a wide range of household, office, and commercial waste bins, offering an optimal balance between volume and manageability. Bags within this capacity range provide sufficient storage for typical waste collection cycles while remaining easy to handle and transport.

The segment’s growth is being supported by the increasing adoption of medium-sized bins in apartments, offices, and commercial establishments, which require reliable, leak-resistant garbage bags. Polyethylene material is commonly used in this capacity range to ensure durability and puncture resistance.

Additionally, non-scented options in this range meet the hygiene and odor management needs of end users As waste management practices become more structured and demand for convenient, versatile bags rises, the 30 to 90 litres capacity segment is expected to maintain its market leadership, supported by its balance of practicality, performance, and widespread applicability across multiple end-use environments.

The United States garbage bags market had a CAGR of 0.9% during the historic period. It had a market value of USD 2 billion in 2025, up from USD 1.7 billion in 2020. During the forecast period 2025 to 2035, sales are likely to soar at 3.2% CAGR.

The garbage bags market in the United States is forecast to grow steadily throughout the forecast period. This is primarily due to as rising demand for easily disposable and eco-friendly garbage bags.

Growing awareness among the people regarding cleanliness and hygiene is another key reason of their popularity. One of the significant factors behind growth is rapid globalization and innovations related to sustainable products.

Increasing demand for waste disposable trash bags to maintain a hygienic and clean environment in commercial and residential places is expected to drive demand. Innovations in this market have led manufacturers to develop and offer biodegradable and compostable bags. This factor has also helped the garbage bags market to soar during the projection period.

Biodegradable garbage bags are made of materials that can break down naturally, reducing the amount of waste in landfills. It has created traction among consumers and is moving towards adopting sustainable solutions.

Garbage bags make waste disposing easy as they can be used as liners in trash cans or bins. This helps to collect both dry and wet waste separately and becomes convenient to identify and carry the waste. These are the prominent factors driving the garbage bags market in the United States.

Smart waste management systems, including smart bins and sensors, are gaining popularity among consumers in the country. These systems can optimize waste collection and disposal processes. It might influence the demand for specific types of garbage bags suitable for automated waste handling.

Governments and environmental organizations worldwide are implementing regulations and bans on single-use plastics. Such initiatives aim to reduce plastic pollution and promote sustainable alternatives. These regulations may impact the choice and availability of garbage bags in the market.

Increasing Demand for Biodegradable and Compostable Bags:

With growing environmental concerns, there is a rising preference for garbage bags made from biodegradable or compostable materials. Consumers prefer them since they are designed to break down naturally, reducing the impact on the environment compared to traditional plastic bags.

Rising Popularity of Odor Control and Antimicrobial Features:

Garbage bags with odor control and antimicrobial properties are gaining traction in the market. They are highly popular because they are designed to minimize unpleasant odors and inhibit the growth of bacteria, which leads to promoting hygiene and cleanliness.

Innovation in Design and Functionality:

Manufacturers are investing in research and development to introduce innovative designs and functional features in garbage bags. This includes features such as drawstrings, handles, tear-resistant materials, and leak-proof technology to enhance convenience and durability.

Growth of Online Sales and E-Commerce Platforms:

The convenience of online shopping has extended to the purchase of household items, including garbage bags. E-commerce platforms provide a wide range of options, making it easy for consumers to access different sizes, materials, and features of garbage bags.

There has been increased awareness among the public for the necessity of cleanliness and sanitization. This has been significantly driving the garbage bags market during the forecast period.

In United States, the office of justice programs promoted the public awareness and education projects to highlight the need for crime prevention in communities.

Researchers also have now recognized the need for improving public awareness to create effective waste management’s systems in the United States.

The international energy agency highlighted the importance of campaigns for awareness and behavior change in citizens to help them follow the cleanliness rules.

The Organization for Economic Co-operation and Development (OECD) recognizes the impact of education on civic and social engagement in the United States. It includes promoting cleanliness and sanitation.

Pleasingly, public awareness campaigns in the United States promote the importance of cleanliness and sanitation. It will in turn is driving the demand for garbage bags in the country.

Customization of garbage bags has become necessary for the manufacturers to meet the specific demands from the consumers. There are several brands in the United States offering customized garbage bags such as scented bags, drawstring bags, and heavy duty bags.

For instance, Simplehuman, a United States company, is offering custom fit garbage bags for the trash cans which ensure a perfect fit and reduce the risks of spillage and leakage.

New York has also implemented the customized garbage bag programs for the residents of the city, which provide clear bags for recycling and blue bags for the trash free of cost.

United States based manufacturers offer diverse garbage bags according the needs of the specific industries. It includes healthcare, food service, and others to meet their unique waste management requirements.

Polyethylene Garbage Bags to Generate Massive Share as They Are Weatherproof and Resistant

Polyethylene garbage bags are mostly preferred by consumers as it is lightweight, cost-effective, durable, and tear-resistant. These bags are weatherproof and resistant to chemicals.

Polyethylene garbage bags are easy to open, pack, and close resulting in shorter time. These factors are likely to stimulate demand for garbage bags in the United States.

Clear bags are mostly preferred by waste management companies as they allow one to see the inside contents making it quicker in sorting for final disposal.

Among the material, polyethylene is anticipated to dictate the garbage bags market with nearly a market share of 63.4% share by 2035. Revenue is set to reach at a worth of USD 2.7 billion by 2035 end.

Rising Awareness About Maintaining Cleanliness And Hygiene Will Drive Demand

Commercial places such as offices, businesses, and industries are creating a lot of waste which has been increasing the demand for garbage bags in the United States. There is also increasing awareness about maintaining cleanliness and hygienic working environments. It is likely to fuel demand for garbage bags in the United States.

The United States is a hub of with commercial places which has led to the increased demand for garbage bags. The strict regulations in the United States to maintain waste management systems are increasing the sales of garbage bags.

Commercial segment is the prominent end-use segment with a market share of more than 61.4% in 2025. The market is likely to create an incremental opportunity worth USD 1.4 billion by 2035.

Demand for Scented Garbage Bags to Surge in the United States for Ordor Control

Based on products, scented garbage bags accounted to be at the forefront in the garbage bags market in the United States. It is set to witness 4.5% CAGR over the forecast period 2025 and 2035.

This is due to the rising demand for masking unpleasant odors that cam emanate from trash. The scents infused in these bags help to neutralize and minimize the smell, making them useful. These can be used for kitchen waste, diapers, pet waste, and other malodorous thrash.

Scented garbage bags offer a convenient solution by eliminating the need for additional air fresheners and deodorizers. Scent released from the bags can help in marinating a fresh and pleasant environment. This is especially useful in areas where trash are kept in close proximity to living spaces.

Key players in the market are focusing on differentiating their products from competitors by offering unique features. This includes using eco-friendly material, incorporating odor control mechanism, providing extra strength and durability.

Recent development:

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Product, Capacity, Type, Sales Channel, End Use, Sub-Region |

| Key Sub-regions Covered | Northeast; Southwest; West; Southeast; Midwest |

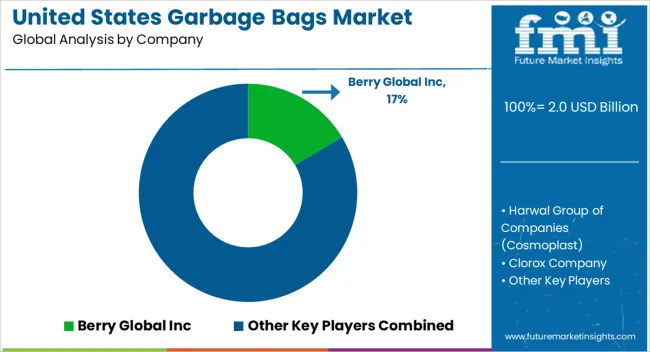

| Key Companies Profiled | Berry Global Inc; Harwal Group of Companies (Cosmoplast); Clorox Company; Simpac Impex P Ltd; Reynolds Consumer Group; Novolex; American Plastic Co.; International Plastics Inc.; Poly-America LP; Four Star Plastics; Inteplast Group Corporation |

| Customization & Pricing | Available upon Request |

The global United States garbage bags market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the United States garbage bags market is projected to reach USD 2.7 billion by 2035.

The United States garbage bags market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in United States garbage bags market are polyethylene, _low-density polyethylene (ldpe), _linear low-density polyethylene (lldpe), _high-density polyethylene (hdpe), polypropylene (pp), bioplastics and others.

In terms of product, non-scented segment to command 55.4% share in the United States garbage bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA