The USA Frozen Ready Meals Market is projected to reach USD 13,450.48 million in 2025, growing at a CAGR of 5% over the next decade to an estimated value of USD 22,220.20 million by 2035.

| Attributes | Description |

|---|---|

| Estimated USA Frozen Ready Meals Industry Size (2025E) | USD 13,450.48 million |

| Projected USA Frozen Ready Meals Industry Value (2035F) | USD 22,220.20 million |

| Value-based CAGR (2025 to 2035) | 5% |

The market for frozen ready meals in the USA is growing very fast because customers look for convenience in meal choices as well as healthy options. People with a busy lifestyle choose frozen meals, which are convenient and extend the shelf life of food. The market continues to benefit from escalating health-minded demographics because multiple brands deliver protein-rich food with minimal calories combined with organic ingredients.

Product developments that include plant-based dishes and gourmet frozen meals successfully draw customers who value health and environmental consciousness to the market. Technology improvements in freezer methods have achieved better-frozen meal quality alongside improved flavor tastes.

E-commerce growth drives this market transformation by increasing the customer preference for purchasing items online for their convenience. The frozen meal sector has driven retailers to add more products to their inventory while developing delivery options for their customers.

The frozen readymade meals market faces obstacles deriving from supply chain breakdowns and erratic pricing for ingredients. The growing interest in sustainability has forced manufacturers to implement green approaches for packaging materials and sustainable sourcing methods. The USA frozen ready meals market shows strong potential for future growth because customers want convenient healthy options that are environmentally friendly in their mealtime choices.

Explore FMI!

Book a free demo

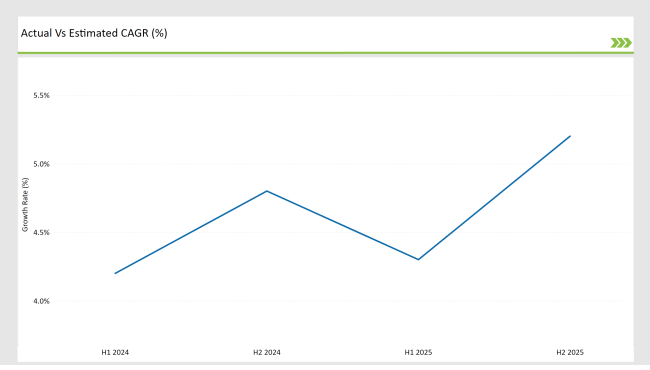

The below diagram delivers a thorough comparison of the USA frozen ready meals market CAGR modifications from the 2023 base year to the 2024 current year. The quarterly analysis shows important marketplace changes by displaying revenue patterns to aid stakeholders in better understanding yearly market growth patterns. The first half of the year, H1 covers from January to June, and the second half, H2 covers from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Nestlé S.A.: Nestlé announced a significant investment of ₹60-65 billion (USD 723-783 million) to expand its manufacturing capacity in India by 2025. |

| May 2024 | Tyson Foods, Inc: Tyson Foods completed the acquisition of a plant-based protein company, enhancing its portfolio in the alternative protein segment. |

| July 2024 | Conagra Brands, Inc.: Conagra expanded its Birds Eye brand with new, culinary-inspired frozen products targeting younger, affluent consumers. |

| July 2024 | Kraft Heinz Company: Kraft Heinz appointed Todd Kaplan as Chief Marketing Officer for North America, signaling a strategic focus on marketing leadership. |

| September 2024 | Tyson Foods, Inc: Tyson Foods completed the acquisition of a plant-based protein company, enhancing its portfolio in the alternative protein segment. |

Surge in Demand for High-Protein & Keto-Friendly Frozen Ready Meals

The growing health-conscious consumer base alongside rising numbers of fitness-oriented people has influenced significant demand for high-protein along with keto-friendly frozen ready meals in the USA market.

Food brands now produce frozen meals with low-carbohydrates and high-protein content made using grass-fed animal meat in combination with plant proteins alongside high-fiber ingredients. The public awareness about metabolic health and weight management leads people to choose frozen meals that fit their specific dietary needs.

Direct-to-Consumer models enable customized meal plans that match individual nutrition needs because of their growing presence. The premium product market expansion has led retailers to increase freezer shelf space which drives intense competition among suppliers for developing better ingredients and portion controls while working on sustainable packaging solutions for evolving customer tastes.

Expansion of Ethnic and Global Cuisine Frozen Meal Offerings

The USA frozen ready meals market shows rapid growth because consumers seek international ready meals based on Asian, Latin American and Mediterranean cuisines.

The market demands restaurant-quality authentic international cuisine delivered through convenient packaging which matches the taste and purity standards of restaurant dining. The product innovation surge includes Korean BBQ bowls together with Indian curry-based meals and Mexican tamales as well as Mediterranean grain bowls which were developed due to elevated consumer demand.

Manufacturers of food products are working to find authentic ingredients and proper cooking methods that deliver genuine flavor experiences to consumers. The plant-based ethnic frozen meal market continues its upward trend by introducing dairy-free sauces alongside alternative proteins and gluten-free grains which serve customers who follow multiple health approaches and eat different foods.

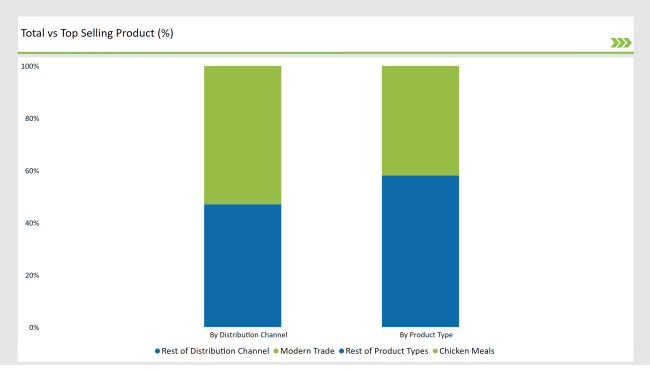

% share of Individual categories by Product Type and Distribution Channel in 2025

Chicken Meals Leading with 42% Market Share

Chicken-based frozen meals constitute the leading ready meal category in the United States where they seize 42% of total market sales due to their lean protein content economic viability and culinary functionality. Chicken-based frozen meals attract consumers belonging to diverse groups because they satisfy athletic personnel who want protein-rich healthy meals as well as household families needing speedy convenient meals.

Customers can find a full range of chicken meals within the category that features grilled chicken bowls chicken Alfredo pasta and chicken stir-fry as well as keto-friendly frozen chicken options.

Clean-label frozen meal consumption drives consumers towards buying organic antibiotic-free chicken products that use minimal processing methods. Manufacturers pursue innovations based on global flavor trends through items like teriyaki chicken, tikka masala, and chipotle-seasoned choices to expand their frozen meal's presence in the market.

Modern Trade Channels Holding 53% Market Share

Supermarkets and hypermarkets through modern trade hold the biggest position in USA frozen ready meal sales with a 53% market share. Major retail companies including Walmart Kroger and Target control this space because they provide extensive product assortments alongside competitive prices and their private brand options and the modern trade channels sell the most frozen ready meals. Consumers select modern trade channels because they provide physical product displays along with promotional deals and as well as handy meal bundles.

The combination of strategically placed freezer sections at major retail chains with upgraded in-store tasting programs and specific promotion strategies drives expansion. Modern trade has become more powerful by implementing click-and-collect and in-store pickup services which enable customers to buy their frozen ready meals through online channels before picking them up at the store for freshness and convenience.

Note: above chart is indicative in nature

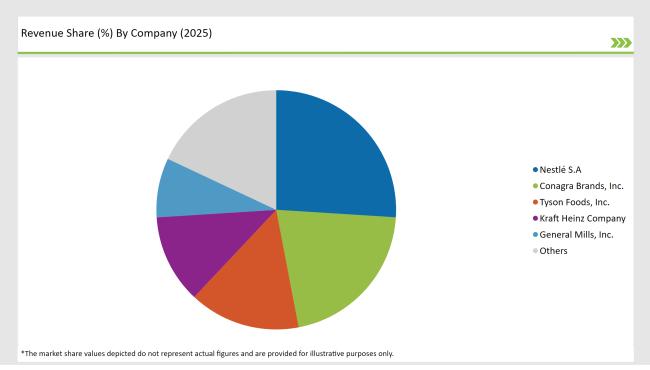

The USA frozen ready meals industry reveals moderate concentration through the coexistence of companies from different market tiers including Tier 1 and Tier 2 and Tier 3 entities. Frozen ready meals in the USA market are controlled by Tier 1 leading companies Nestlé (Stouffer’s, Lean Cuisine) Conagra (Healthy Choice, Banquet) General Mills Kraft Heinz, and Tyson Foods because of their extensive distribution networks strong brand recognition and various product lines.

Tier 2 food manufacturing firms such as McCain Foods, Pinnacle Foods, and Amy’s Kitchen concentrate on delivering organic alongside gluten-free premium frozen meals to health-oriented customers.

Small start-up companies and labels operate in Tier 3 to serve ethnic food lovers with plant-based food choices as well as serving gourmets with their special meals. The businesses in this sector enhance market competition through budget-friendly options and customization of distribution methods which results in continuous growth for the frozen ready meals market.

The market is projected to reach USD 22,220.20 million

The market is expected to grow at 5.0% CAGR.

Chicken-based frozen meals are anticipated to grow the fastest, attributed to their high protein content, affordability, and versatility in meal preparation.

Rising demand for convenience foods, healthier frozen meal alternatives, expanding retail presence, and innovations in plant-based and ethnic cuisine offerings are driving market expansion.

Leading players include Nestlé (Stouffer’s, Lean Cuisine), Conagra (Healthy Choice, Banquet), Tyson Foods, Kraft Heinz, General Mills, McCain Foods, and Amy’s Kitchen.

The market is segmented into Vegetarian Meals, Chicken Meals, Beef Meals, and Others, driven by changing dietary preferences, protein consumption trends, and demand for convenient meal solutions.

The market is categorized into Food Chain Services, Modern Trade, Departmental Stores, Online Stores, and Other Distribution Channels, with modern retail formats leading due to extensive product variety and accessibility.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.