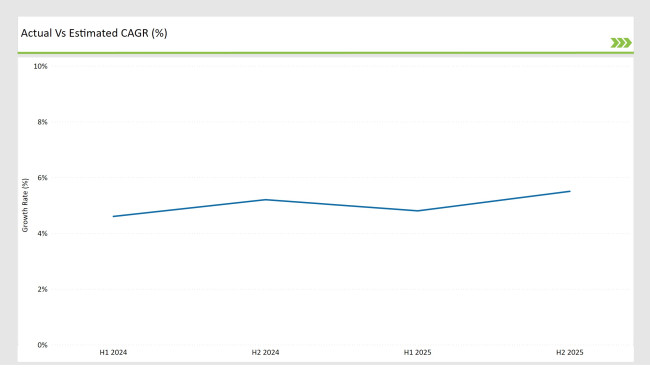

The USA frozen food market is projected to reach a value of USD 132.496 Billion in 2025, growing at a CAGR of 5.3% over the next decade to an estimated value of USD 223.041 Billion by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 132.496 Billion |

| Projected USA Value in 2035 | USD 223.041 Billion |

| Value-based CAGR from 2025 to 2035 | 5.3% |

The market's consistent growth is propelled by escalating demand for convenience foods, and an increasing role of e-commerce in grocery retailing. Though this expansion does not come easy; on one hand, there is demand, and on the other, there is competition. So, it's business adapt or perish.

The increasing consumer liking for fast and easily prepared meals has sparked the need for frozen ready meals, frozen seafood, and frozen snacks & bakery products. The emergence of health-oriented customers has also increased the number of frozen fruits & vegetables, which are the ones that keep nutrients and freshness for a longer time.

The advancements of the individual quick freezing (IQF) and blasting freezing methods have resulted in the remarkable improvement of the product quality, thus, the frozen food can offer the texture, the flavor, and the nutritional value comparable to the fresh alternatives. Besides, the growth of the online grocery platforms has been an extra factor that has contributed to the frozen food market outreach to the broader consumer base.

The food service industry (HoReCa), the own-brands frozen food, and the premium frozen food enlarged categories are predicted to be among the major frozen food sector's growth drivers. With shoppers still inclined towards aspects such as convenience, affordability, and safety in food, frozen food will be commonplace in households and the food business as well.

Explore FMI!

Book a free demo

The semiannual market update finds that frozen food sales are continually gaining in e-commerce platforms, as well as in foodservice applications.

H1 signifies period from January to June, H2 Signifies period from July to December

The market still continues to enjoy benefits from frozen packaging innovations, green freezing solutions, and optimized supply chain logistics in ensuring a continuous supply of good-quality frozen food products.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Nestlé USA : Launched a new range of plant-based frozen ready meals , targeting health-conscious consumers. |

| March 2024 | Conagra Brands : Expanded its frozen snacks portfolio by introducing low-carb and protein-rich frozen meal options . |

| May 2024 | Tyson Foods : Invested in advanced freezing technology to improve the quality of its frozen meat products. |

| July 2024 | General Mills : Partnered with leading grocery delivery services to enhance the distribution of its frozen food brands. |

| September 2024 | Kraft Heinz : Developed an eco-friendly frozen packaging solution , reducing plastic waste in frozen food storage. |

Rising Adoption of Frozen Food in Plant-Based Meat Alternatives

The rise in health-conscious eating, together with the interest of these people in a plant-based diet, has proven to be the outer of frozen meals that have a plant base and hence are healthy. Nutritionally, protein-centric meals have become the hottest among vegan and protein-rich foods that are not fresh.

Food manufacturers are, however, devising new solutions to address the heightened demand for meal replacements. This includes offerings such as low-carb, high-protein, and organic ingredients that are not typically derived from these substitutes, although some might argue otherwise.

Also, the brand is about fortified frozen food products like calcium-enriched frozen snacks, fiber-rich frozen vegetables, and probiotic-enhanced frozen dairy alternatives, which are often the main point of focus. As health and sustainability take the lead in consumption trends, it is expected that this will continue.

Advancements in Freezing Technologies for Better Product Quality

Freezing Technology Improvements for Better Product Quality Innovations in individual quick freezing (IQF), cryogenic freezing, and belt freezing have completely transformed the frozen food sector with advancements such as improved texture, moisture retention, and shelf life of the foods. IQF is engineered in such a way that rapidly freezes individual pieces of food instead of sticking together, which means that the food retains better flavor and texture.

Moreover, companies have begun utilizing energy-saving and sustainable processes of freezing, which not only address the carbon footprint problem but also maintain high product quality. Such trends strengthen the faith of consumers in frozen foods and continue the positive trend of the industry, which is keeping up with the quality of fresh-tasting and high-quality frozen products.

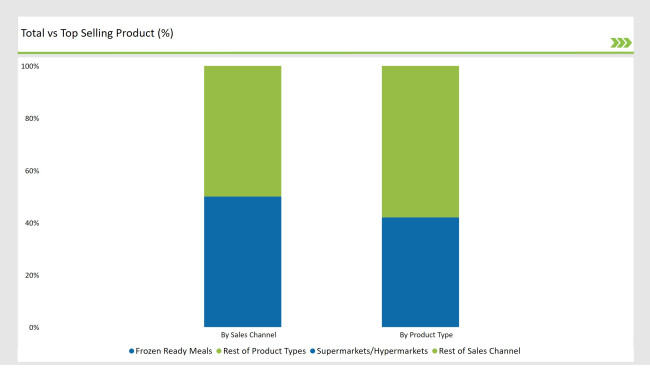

% share of Individual categories by Product Type and Sales Channel in 2025

Frozen prepared meals take up the biggest market share, at 42%, primarily because of the growing popularity of fast, convenient meal solutions among busy consumers. These meals come in a variety of formats, ranging from plant-based, high-protein, and low-calorie options. The market expansion persists through portion-control-friendly single-sized packages and meal preparation services.

People seek nutritious ready-made dining options that serve balanced nutrition while being convenient and saving time for their busy lifestyles. The frozen meals market is expanding through manufacturer launches of premium organic and gluten-free options. Plant-based frozen entrees together with ethnic cuisine products are experiencing increasing demand.

Freezing technology advancements resulted in better frozen ready meals that now offer superior taste, texture, and longer storage time which attracts today's household consumers. The market segment will expand further since consumer demand for nutritious quick meals will keep rising.

The frozen food market is expected to grow quicker than ever before; supermarkets and hypermarkets, in particular, are going to be the major sales channel, and they will hold 50% of the total market by 2025. These traditional retail places are still the main shopping locations for customers who experience in-store shopping and marketing the best way.

They can do that by seeing different frozen products and promotions. However, the landscape may shift over time, although the current trend favors these traditional outlets. Online grocery platforms have recently been slowly transforming consumer purchasing patterns to digital platforms. There has therefore been a recent drastic change in shopping habits because busy consumers will require easy and convenient meals. Cold chain logistics also prove efficiency as there is an increased number of products and much freshness.

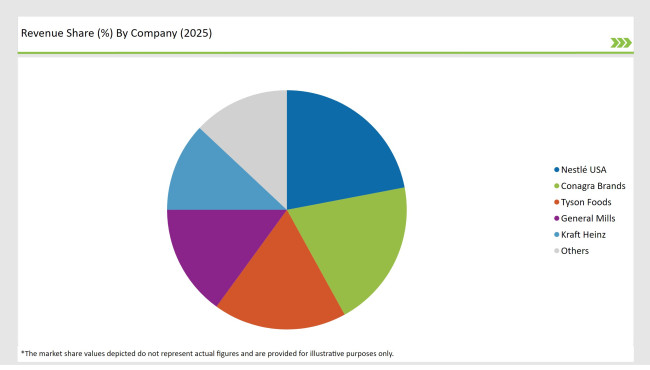

The competition in the USA frozen food market is quite intense as the top players are targeting the innovation of the products, the implementation of state-of-the-art freezing tech, and new distribution partnerships as their main priorities.

Nestlé USA, Conagra Brands, Tyson Foods, General Mills, and Kraft Heinz are some of the leading and powerful brands in the market, thanks to the tremendous number of products they have and also through the collaborations they did with different private labels. They are also following the market trend of adding frozen meals and snacks that are free of artificial ingredients by including organic, vegan, and other premium products in the mix.

2025 Market share of USA Frozen Food Market suppliers

Note: above chart is indicative in nature

The shift towards digital grocery platforms and the direct-to-consumer model is a viable strategy for companies to increase their penetration in the market.

The use of automated freezing technology and the enhancement of cold chain logistics through these technologies have led to the production and distribution of frozen food being more efficient. The greater number of supermarkets, hypermarkets, and e-commerce grocery platforms driving the increased availability of frozen food products, which is a cheap but modern consumer choice, is a fact that still holds.

The market is expected to grow at a CAGR of 5.3% from 2025 to 2035.

The USA Frozen Food market is projected to reach USD 223.041 Billion by 2035.

Technologies like IQF, cryogenic freezing, and belt freezing enhance texture, moisture retention, and shelf life.

Frozen ready meals hold the largest share at 42%, driven by demand for quick and easy meal solutions.

Top manufacturers include Nestlé USA, Conagra Brands, Tyson Foods, General Mills, and Kraft Heinz.

By product type, the market includes frozen ready meals, frozen seafood & meat products, frozen snacks & bakery products, frozen fruits & vegetables, and others

By sales channel, the industry is segmented into supermarkets/hypermarkets, convenience stores, online retail, foodservice/HoReCa, and others.

By freezing technique, the market includes individual quick freezing (IQF), belt freezing, blast freezing, plate freezing, and cryogenic freezing.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.