The USA Freeze-Dried Food market is projected to reach USD 1,355.5 million in 2025, growing at a CAGR of 8.0% over the next decade to an estimated value of USD 2,931.5 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,355.5 Million |

| Projected USA Value in 2035 | USD 2,931.5 Million |

| Value-based CAGR from 2025 to 2035 | 8.0% |

The market of freeze-dried food in the USA is experiencing consistent growth as a result of more and more consumers opting for convenience-oriented, long shelf life, and non/low-fat calorie nutrient options. The market is partly concentrated but the key players making huge investments in capacity expansions, R&D, and brand strategies to ensure their presence is known.

Many companies are increasing their production capacity to meet the order increase not just because of the trending freeze-dried fruits, vegetables, and milk but especially because of faster expansion on demand for freeze-dried ready-to-eat meals. Some of the other players are adding more manufacturing capacities and introducing more advanced freeze-drying equipment to raise efficiency and cut down production costs.

Consumer trends like choosing clean-label products and naturally occurring ingredients over additives have made it very important for producer to restate their products by not using chemical preservatives and food additives.

Enterprises are bringing organic and non-GMO freeze-dried food options in line with the health-minded people’s group. Makers are now also benefiting from improvements in package design through such things as nitrogen-flushed and vacuum-sealed pouches that not only prolong shelf life but maintain nutritional integrity, thus attracting more consumers.

To acquire a bigger market share, the producers are focusing on online selling and direct-to-consumer channels more and more. Also, subscription-based models, along with meal kits that contain freeze-dried ingredients, are becoming popular, thus bringing consumers closer to companies. Furthermore, the firms also resort to premiumization strategies by offering luxury foods and rare types of freeze-dried products for high-end customers.

The outdoor recreation industry, which encompasses camping, hiking, and emergency preparedness parts, is still the main growth driver, as the manufacturers are selling their products through adventure tourism. Due to the increasing demand, the competition is becoming fierce, which compels the companies to stand out by introducing innovative tastes, engaging in sustainability programs, and extending market channels in retail and online platforms.

Explore FMI!

Book a free demo

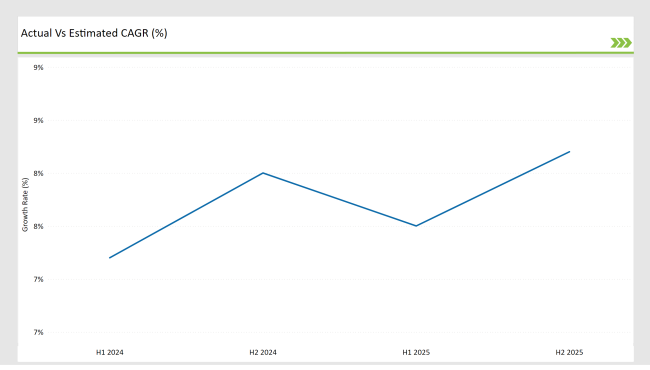

The chart displayed below demonstrates a comparative scrutiny of the variation in the compound annual growth rate (CAGR) over the six months for the basic year (2024) and the current one for the USA frozen-dried food market (2025).

This half-yearly assessment brings out major market changes and revenue realization differentials, and it gives readers helpful inputs on the progressive shift in consumer tastes and production functions. The first half of the year, H1, is from January to June, and the second half, H2, extends from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | The FDA implemented new traceability recordkeeping requirements, improving food safety for freeze-dried manufacturers. |

| May2024 | Companies are investing in advanced freeze-drying technologies to enhance product quality and shelf life. |

| July 2024 | Freeze-dried food companies are adopting biodegradable and recyclable packaging solutions to meet eco-friendly demands. |

| October 2024 | Skittles launched "Skittles Pod," entering the freeze-dried candy market with innovative snack options. |

| December 2024 | The availability of freeze-dried meal kits increased, offering convenient, long-lasting meal options for consumers. |

Expansion of Freeze-Dried Food in Meal Kit and Ready-to-Eat Segments

As the USA freeze-drying food market is changing it is moving more towards meal kits and ready-to-eat products. It is the case that more and more people are choosing freeze-dried food components as their first choice of product due to their convenience, their taste longevity, and the nutritional content that they can retain as compared to other food product categories.

Many companies are increasing the amount of freeze-dried meats, vegetables, and meal options in their subscription meal delivery services thinking this will bring a significant market share into North American supermarket stores to adhere to the target consumer segment of busy professionals and health-conscious consumers.

Military and Emergency Preparedness Demand Driving Innovation

The main driving force behind the innovation process which is generating freeze-dried food is the increased demand for emergency food supplies, disaster preparation, and also for the rations that are included in soldier rations.

New preservation techniques that make the largest possible temperature fluctuation possible in each batch are being explored in the USA by the government to maximize the shelf life as well as the nutritional and physical stability of freeze-dried food during stressful circumstances. The increased number of natural disasters and the rising consumer knowledge about emergency preparedness have been the main factors behind the huge demand for foods that can be long-term stored freeze-dried.

Furthermore, the military's requisition of lightweight, high-calorie, and nutrition-rich freeze-dried meals is key in propelling the producers to produce better quality packaging and to optimize rehydration properties. The development of this sector is being reflected through the partnerships formed between food-tech companies and defense departments, thus, leading the way to the innovation in freeze-dried foods.

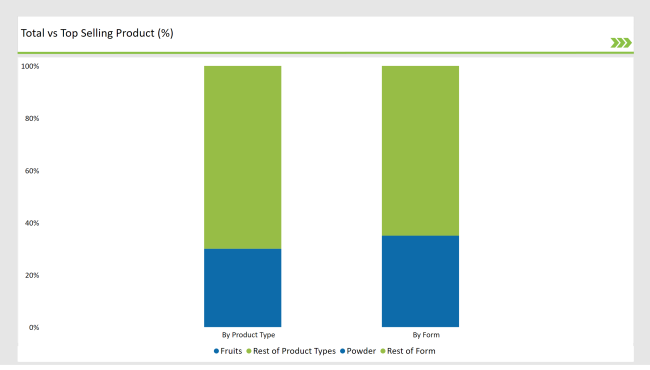

% share of Individual categories by Product type and Form in 2025

Fruits Are the Most Prominent Freeze-Dried Product Sector with Various Applications

Freeze-dried fruits are the best-selling item in the freeze-dried food market, and this product straddles the USA consumer market and holds a 30% market share of overall sales. More and more people are choosing freeze-dried fruits because they keep them for a long time, are easy to eat, and are free of preservatives. The rise of the segment in the snack and smoothie markets is significant due to the trends of seeking convenience and preferring sugar-free alternatives by health-conscious consumers.

The other major driver of the application of freeze-dried fruits is the increasing popularity of clean-label ingredients in cereals, yogurt toppings, and pastries. The segment is also experiencing the boom in the single-ingredient snack trend where people are choosing snacks made out of fruit that are minimally processed and contain no additives.

Powdered freeze-dried food is a fast-growing product in functional and specialty nutrition.

Dried, freeze-dried, and powdered food is becoming increasingly popular in the functional nutrition and specialty food sectors (where it is 35% of the market in terms of form). Freeze-dried powders, fruit, vegetables, and dairy are increasingly used for protein powders, meal replacement, and infant nutrition due to better bioavailability and a natural profile.

In addition, demand is increasing in the bakery and confectionery sectors, where powdered freeze-dried foods are applied as natural colorants and flavor enhancers. Plant-based and organic ingredient preferences have also triggered the development of new freeze-dried powders, which find their way into vegan formulations, sports nutrition, and dietary supplements.

Note: above chart is indicative in nature

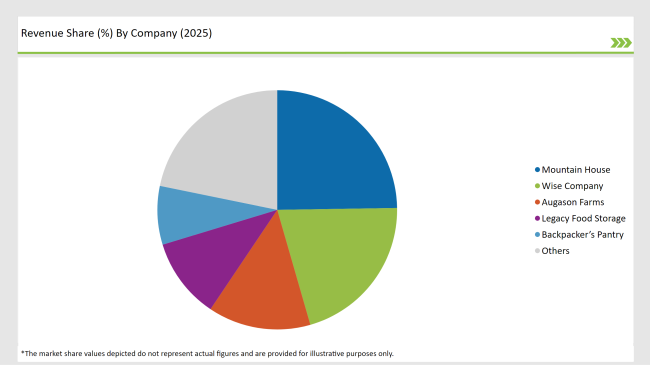

The United States freeze-dried food market is competitively dominated by three types of establishments Tier 1, Tier 2, and Tier 3 companies that operate throughout a wide range of different product segments. The market is predominantly dominated by Tier 1 companies throughout all of their endeavors who have large-scale production sites, extensive freeze-drying properties, and a substantial roster of warehoused locations across both all food service outlets and all retail outlets across a wide range of business-to-business e-commerce channels including business-to-consumer sales. To improve their market position, these companies are making huge strides in increasing their output, innovating with high-end products, and completing their sustainability projects.

Tier 2 players are selling freeze-dried food products with organic and clean-label compositions mainly targeting health-conscious consumers and specialty food markets. A significant number of mid-sized manufacturers are also developing their respective product portfolios by adding functional and plant-based freeze-fried ingredients that are in demand in sports nutrition and meal replacement segments.

Tier 3 companies are the majority of the companies that are remote and special brands concentrating on the local area and selling directly to consumers. They are offering emergency preparedness kits, outdoor/camping food, and other accessories. Such companies take advantage of online marketplaces and innovative marketing strategies rather than competing head-on against larger businesses.

The market is projected to grow at a CAGR of 8.0% from 2025 to 2035.

The market is expected to reach USD 2,931.5 Million by 2035.

The snacks segment is anticipated to grow the fastest due to increasing consumer demand for convenient, healthy, and portable snack options in various settings.

Growth is driven by rising consumer interest in convenience, outdoor activities, advancements in freeze-drying technology, and a heightened focus on food safety and traceability.

Key players include Nestlé, Kraft Heinz, Mountain House, Harmony House Foods, and OvaEasy, known for their extensive product ranges and strong market presence.

The market is segmented into fruits, vegetables, meals, snacks, and other products.

Segmentation includes powder, granules, whole pieces, and other forms.

The market is divided into food and beverages, outdoor and camping, emergency preparedness, retail, pet food, and other applications.

Segments include organic freeze-dried food and conventional freeze-dried food.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.