The USA Food Hydrocolloids Market is projected to reach a value of USD 2760.8 Million in 2025, growing at a CAGR of 3.3% over the next decade to an estimated value of USD 3819.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 2760.8 Million |

| Projected USA Value in 2035 | USD 3819.8 Million |

| Value-based CAGR from 2025 to 2035 | 3.3% |

The USA food hydrocolloids market demonstrates strong advancement patterns because of hydrocolloids like carrageenan xanthan gum and pectin. Hydrocolloids improve product texture and stability alongside shelf life in bakery products dairy items beverages and plant-based product ranges.

The market drivers for food hydrocolloids increase because customers demand natural ingredients free from GMOs with organic certification. Manufacturers need to use agar-agar and guar gum when they reformulate their products because of this industry movement.

Hydrocolloids play a vital role in developing texturized plant-based food products because the sector commands more than USD 10 billion in value while creating vegan meat dairy-free cheesecake and alternative protein products. Market expansion in functional foods increases the need for hydrocolloids because consumers want low-fat and fiber-rich options that drive the application of hydrocolloids as dietary fibers and fat substitutes.

Market growth could face obstacles because of raw material price fluctuations of seaweed for carrageenan while strict FDA requirements for new hydrocolloids act as growth impediments. A rise in environmental consciousness is encouraging the market to adopt sustainable sourcing and production methods for its products. The market demonstrates positive development trends while offering possibilities to create innovative solutions that follow changing customer needs.

Explore FMI!

Book a free demo

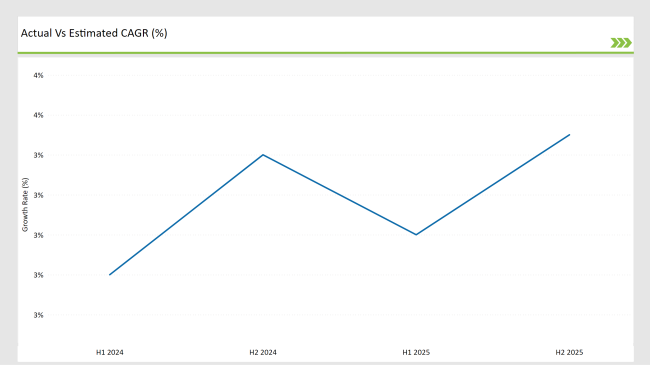

The diagram below compares semi-annual growth trends in the USA Food Hydrocolloids Market for 2024 and 2025. The analysis highlights revenue patterns and market shifts caused by increasing demand for natural ingredients, clean-label formulations, and developments in texturizing solutions for various food applications.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| July 24 | The FDA revoked the use of brominated vegetable oil in food, citing health concerns. |

| October 24 | The FDA published a supplement to the 2022 Food Co., incorporating new food safety recommendations. |

| November 24 | Cargill announced layoffs due to declining profits linked to falling commodity prices. |

| November 24 | Kerry Group reported a 3.4% volume growth in its Taste & Nutrition sector for Q3 2024. |

| December 24 | The FDA updated the definition of "healthy" foods, aligning it with current dietary guidelines. |

Functional and clean-label hydrocolloids are seeing an increasing market demand due to changing customer preferences

A transformation occurs in the USA food hydrocolloids market because customers choose health-focused ingredients that maintain label transparency. The market demand for plant-based and naturally sourced hydrocolloids including pectin agar and xanthan gum has exploded because these ingredients benefit texture and shelf-life stability without using artificial substances.

Consumer choice for minimally processed foods promotes hydrocolloids since these ingredients maintain target product consistency and provide complete ingredient disclosure on product labels. Businesses producing food products use hydrocolloids to create dietary-specific alternative products which boosts their market capture.

Hydrocolloids are used increasingly in dairy-free and alternative protein products for the market

Hydrocolloids are essential for duplicate food texture due to the rapid expansion of plant-based dairy-free products in the USA market. Hydrocolloid-based stabilizers and emulsifiers assist alternative meat manufacturing and dairy-free yogurt and nut-based beverage production through their ability to improve viscosity and mouthfeel properties while stabilizing proteins.

The rising popularity of beverages made from oat almond and pea ingredients creates an increased market demand for hydrocolloid solutions designed to stop ingredient separation while creating better suspension effects. The growth of the plant-based food industry encourages hydrocolloid manufacturers to create specialized blends for this market segment which will support sustained business growth.

% share of Individual categories by Product Type and End-Use Application in 2025

Starch's Dominance in USA Food Hydrocolloids Market and Innovations

Starch holds the largest position in the USA food hydrocolloids market with a 30% market share. The wide incorporation of starch in food systems occurs because it functions as a remarkable gelling agent along with superior thickening properties.

The starch procurement starts from basic materials including corn, potatoes, and tapioca as raw materials and it appears in sauce, gravy, and baked food products. The formulation of starch serves both the rising clean-label consumer demand and the growing preference for natural ingredients. The market shows a firm position because Starch innovations improve starch functionality during food processing stages.

Bakery Applications of Hydrocolloids: Enhancing Texture and Stability

The bakery sector in the USA utilizes food hydrocolloids as essential components which represent 37% of their market. Food hydrocolloids add functional properties to baked products through an improvement of texture while retaining moisture and providing extended shelf life. The manufacturing industry depends on xanthan gum and starch stabilizers to achieve correct bread and pastry structures with targeted cross-sections in production.

Consumer interest in gluten-free food along with clean label preferences drives increased demand for modified bakery products on the market. The growing influence of health-conscious preferences drives bakery companies to create new innovative versions and product options for their consumers.

Note: above chart is indicative in nature

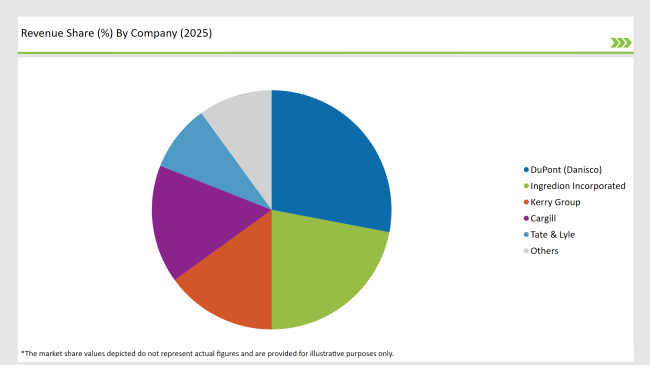

The USA market for food hydrocolloids is concentrated moderately because leading Tier 1 firms maintain their powerful position through their vast manufacturing capabilities and research investments alongside their major distribution operations. The major manufacturers in this market continue to build their natural hydrocolloid product lines and deploy acquisition strategies to improve their market reach.

Tier 2 companies deliver hydrocolloids for specialized food applications because they maintain regional operations that target plant-based dairy and functional beverages and gluten-free bakery markets. To keep pace with consumer preferences these manufacturers innovate through research and development of specialized hydrocolloids which include modified starches combined with plant-based gelling agents.

Small companies along with start-ups in the Tier 3 segment focus on selling organic non-GMO and sustainable hydrocolloids to their customers. Food manufacturers enable these companies to succeed by providing them with direct partnerships that produce customized hydrocolloid blends along with specific solutions.

The USA hydrocolloids market experiences heightened competitive pressure because of rising consumer demand for clean-label and functional ingredients that pushes both novel developments and strategic business decisions at every market segment.

The market is expected to grow at a CAGR of 3.3% from 2025 to 2035.

The USA Food Hydrocolloids market is projected to reach USD 3819.8 Million by 2035.

Starch and xanthan gum are projected to witness the fastest growth, owing to their widespread use in gluten-free, plant-based, and functional food formulations.

Rising demand for natural stabilizers, clean-label ingredients, plant-based formulations, and functional food applications are major factors boosting market growth.

Key companies in the USA Food Hydrocolloids Market include DuPont, Cargill, Ingredion, Kerry Group, and Ashland Global Holdings.

By form, the market includes dry and liquid fermented ingredients.

By product type, the market is segmented into amino acids, organic acids, biogas, polymers, vitamins, antibiotics, and industrial enzymes.

By application, the market covers food & beverages, pharmaceuticals, paper, feed, and other industrial applications

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Non-Alcoholic Malt Beverages Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.