The USA fermented ingredients market is projected to reach a value of USD 15.649 Billion in 2025, growing at a CAGR of 6.7% over the next decade to an estimated value of USD 30.022 Billion by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 15.649 Billion |

| Projected USA Industry Value (2035) | USD 30.022 Billion |

| Value-based CAGR from 2025 to 2035 | 6.7% |

This steady market expansion is primarily motivated by the increase in demand for fermented ingredients in the food and beverage, pharmaceutical, and industrial sectors. Fermented ingredients offer health benefits, functional properties, and sustainability.

Fermented ingredients are critical elements in flavor improvement, enhancement of gut health, and extension of shelf life in several food products. Growing market growth has been facilitated by rising consumer awareness concerning probiotics, organic acids, and functional fermented foods.

Applications of fermentation in the development of antibiotics, vitamins, and enzymes are also seen in the pharmaceutical industry, hence motivating demand.

The implementation of biotechnology and fermentation techniques drives innovations across spaces where industrial producers use them to create biogas products and biodegradable polymers alongside enzymes.

The restaurant market benefits from rising consumer demand for clean-label ingredients and natural and plant-based products especially in the food and beverage industries because people choose foods without additives and preservatives.

Large market prospects during the forecast period emerge from expanding fermentation-based sustainability solutions such as packaging and biofuels along with plant-derived antibiotic development. We can expect sustained industry growth through increased company investments in fermentative process improvement.

Explore FMI!

Book a free demo

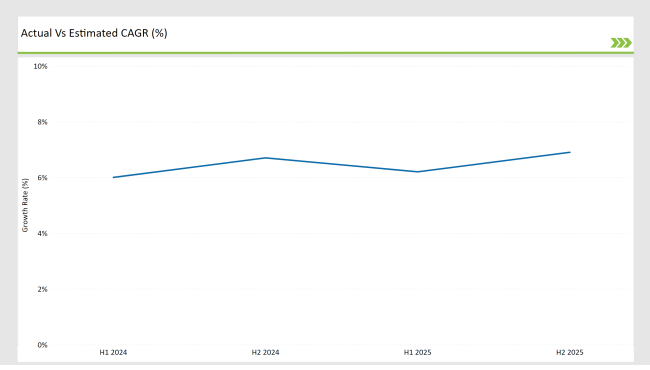

The semiannual market update indicates a constant rate of growth in the fermented ingredients market through the production of functional foods, pharmaceutical formulations, and bioprocessing technologies.

H1 signifies period from January to June, H2 Signifies period from July to December

The market is still experiencing growth due to increasing investments in fermentation technology, consumer preference for fermented functional foods, and industrial enzyme production advancements.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Cargill: Expanded its fermented amino acids production to support the growing demand in the food & beverage and pharmaceutical industries. |

| March 24 | BASF: Launched a new line of bio-fermented vitamins aimed at enhancing nutritional supplement formulations. |

| May 24 | Novozymes: Partnered with a major biotechnology firm to develop fermented industrial enzymes for sustainable bioprocessing. |

| July 24 | Corbion: Introduced an organic acid-based fermentation solution designed to extend the shelf life of dairy and bakery products. |

| September 24 | Chr. Hansen: Unveiled a novel probiotic strain through fermentation, targeted at improving gut health and immunity in dietary supplements. |

Expansion of Fermented Functional Ingredients in the Food & Beverage Industry

The modern market consumption of fermented elements in functional foods and beverage drinks continues to rise because consumers purchase products like yogurts kombucha and plant-based dairy alternatives. The market demand for probiotic-containing wholesome food items expanded the boundaries of what could be potentially achieved.

Food manufacturers are now adding fermented amino acids, vitamins, and organic acids to their products, thus improving their texture, taste, and nutritional benefits. Along with that, the promotion of low-sodium and chemical-free food preservation methods is also the reason behind the adoption of fermentation techniques for the decay resistance of food.

Increasing The Role of Fermentation in Industrial Sustainability

The spread of biotechnologically driven fermentation processes, such as biogas production, biodegradable polymers, and enzyme synthesis, is promoting new market opportunities. Enterprises are taking advantage of fermentation technology to build up the ecological method of chemical production, which is the basis of it.

Fermentation is also getting attention in the field of biodegradable packaging materials, which is why it is a recycling and sustainable aspect of being plastic-free. Within the current air pollution and eco-damage concerns, conservation and the efficiency of technology through fermentation are anticipated to become the centerpiece of innovation in the green industry.

% share of Individual categories by Form and Product Type in 2025

Dry fermentation ingredients have secured 75% dominance over the market primarily from their extended shelf life combined with convenient storage capabilities and high substance concentration levels.

The food processing industry and pharmaceuticals sector as well as animal feed utilize these ingredients to improve stability levels and achieve better consistency and greater operational efficiency. Manufacturers select dry forms because these ingredients enable better transportation systems formulation incorporation capabilities and improved handling characteristics.

Manufacturers use dry fermented ingredients to develop nutritious dairy, bakery, and protein-based foods with enhanced flavor retention and longer shelf life. Dry fermented proteins serve the animal feed industry and pharmaceutical businesses through precise dosage controls and product longevity capabilities of dry forms.

Industrial and nutritional applications will maintain their dependency on dry fermented ingredients because clean-label product demands and the use of natural preservatives push this segment toward continued expansion.

The fermented ingredients market will have amino acids claiming 60% of its total projected value in 2025. Amino acids serve essential health benefits and functional properties that support food fortification and pharmaceutical as well as sports nutrition production.

Protein supplements and high-protein foods together with dietary supplements use fermented amino acids to upgrade protein content and enhance recovery functions and metabolic well-being. Amino acids serve vital pharmaceutical purposes because they supply intravenous nutritional support and contribute to drug development and treatment of metabolic disorders.

Food manufacturers employ amino acids as flavor intensifiers and dietary fortifiers throughout functional foods as well as fermented alcoholic beverages and plant-derived protein items.

Organic plant-based amino acids have become increasingly popular due to market demand thus initiating the development of bio based fermentation-derived compounds that fully align with clean-label and non-GMO consumption preferences. Amino acids show exponential growth through industrial expansions between various sectors which drives steady innovation in this field.

Note: above chart is indicative in nature

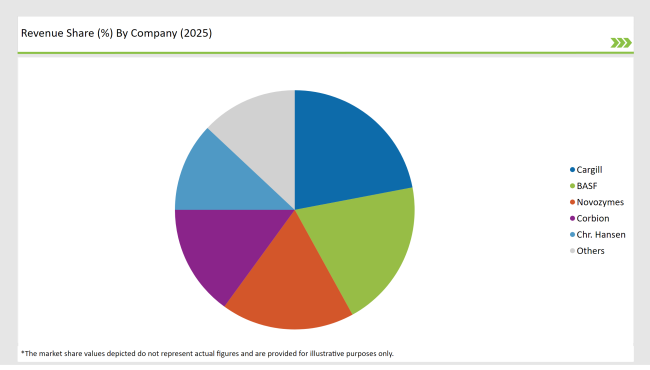

The USA fermented ingredients market operates in a competitive field where major companies prioritize technologies that build sustainability and expand product applications. Major companies such as Cargill unite with BASF, Novozymes, and Corbion, and Chr. Hansen creates industry leadership by investing in research operations, building worldwide market operations, and providing premium products.

The desire of consumers to use natural functional ingredients with clear labels has motivated businesses to improve their fermentation production methods. The industry's growth path received stronger support when microbial fermentation technologies began to be used for food preservation together with enzyme production and biofuel generation.

The food & beverage industry continues to maintain its position as the biggest application area since fermented substances dominate dairy products, alongside bakery items, beverages, and products made from alternative proteins.

Fermentation-derived antibiotics, together with bioactive compounds, more often appear in pharmaceutical drug formulations as pharmaceutical companies increase their pharmaceutical product formulations.

Investors significantly increase their commitment to both bioplastics production and bioenergy sectors because fermentation serves as a vital platform for sustainable industrial progress.

The market is expected to grow at a CAGR of 6.7% from 2025 to 2035.

The USA Fermented Ingredients market is projected to reach USD 30.022 Billion by 2035.

The market is expanding due to rising demand for functional foods, pharmaceuticals, and industrial fermentation applications.

Fermentation is gaining traction in biodegradable plastics, biofuels, and sustainable food preservation.

Top manufacturers include Cargill, BASF, Novozymes, Corbion, and Chr. Hansen.

The market includes dry and liquid fermented ingredients.

The market is segmented into amino acids, organic acids, biogas, polymers, vitamins, antibiotics, and industrial enzymes.

The market covers food & beverages, pharmaceuticals, paper, feed, and other industrial applications

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.