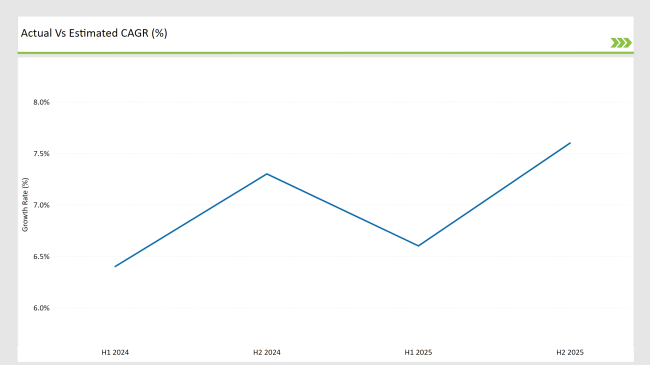

The USA Energy Gel Market is projected to reach USD 209.6 million in 2025, growing at a CAGR of 7.5% over the next decade to an estimated value of USD 432.9 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 209.6 million |

| Projected USA Industry Value (2035) | USD 432.9 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

Market growth occurs because more people take sports nutrition products and more participants join endurance sports and demand portable energy solutions.

Energy gels represent vital athletic equipment for performance athlete’s endurance and fitness people because they offer quick carbohydrate digestion electrolytes and essential nutrients. The market expansion continues to grow because more people who focus on their health want both outdoor experiences and competitive athletic pursuits.

Trained military personnel and recreational hikers together with adventure sporting participants adopt energy gels since these products allow quick absorption of sustained energy during performance activities.

The market demand for unadulterated organic non-GMO sports nutrition products prompts manufacturers to engineer natural ingredients with minimal synthetic additives. Consumer desire for vegan gluten-free and plant-based energy gel products currently drives companies to change their product creation approaches. The demands of diabetic people and those following the ketogenic diet support the new market trend of sugar-free and keto-friendly energy gels.

The market distribution heavily relies on retail and e-commerce operations and e-platforms continue expanding due to the popularity of delivery services and subscription delivery models. The buying patterns of consumers have shifted considerably due to the increasing prominence of mass retailers in addition to their preference for online shopping channels alongside direct B2B sales and sporting goods shops.

The market penetration for chicken and egg methylcellulose-extracted flour faces obstacles from price-conscious customers and shelf-life issues and alternative protein-based energy products including protein bars and drinks. The market addresses consumer issues through innovative sustainable packaging coupled with advanced formulation methods and better product shelf stability improvements.

Explore FMI!

Book a free demo

Growth patterns in the USA Energy Gel Market are robust as consumers prefer both natural energy products and sport nutrition solutions with functional benefits. Customers can now buy products directly through e-commerce platforms as digital marketing transforms market distribution channels alongside electrolyte-infused and caffeine-enhanced premium energy gels.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Clif Bar & Company: Launched CLIF Bloks Organic Energy Chews with 50% less sugar, targeting health-conscious endurance athletes. |

| March 24 | GU Energy Labs: Introduced GU Roctane Ultra with plant-based caffeine (green tea extract) for sustained energy release. |

| April 24 | SIS (Science in Sport): Released Beta Fuel+ Gel with dual-source carbs (maltodextrin + fructose) and added electrolytes for ultra-endurance events. |

| May 24 | Honey Stinger: Partnered with USA Cycling to launch a limited-edition Gold Gel with 25% organic honey for rapid energy absorption. |

| June 24 | PowerBar: Launched PowerGel Hydro with hydrolyzed carbs for faster digestion, catering to triathletes and marathon runners. |

Growing Demand for Clean-Label and Organic Energy Gels

People are more inclined to use natural, organic, and not genetically modified organisms (non-GMO) energy gels, instead of using synthetic preservatives, artificial flavors, and excessive sugar. Companies are putting more effort into the introduction of plant-based, gluten-free, and allergen-free lines as one of the solutions to the requirements of various consumer groups.

The inclination towards a minimal ingredient list is the main reason why consumers want honey-based, coconut-derived, and agave syrup-added energy gels as their choice. This is a green initiative among companies to use eco-friendly packaging and biodegradable pouches that serve as differentiating factors in a highly competitive market.

Expansion of Endurance and Recreational Sports Participation

The increase in popularity and participation in outdoor and endurance sports is an important factor that has led to larger sales of energy gels. The athletes try to get a quick-absorbing energy boost so that they are loyal to the brands that are widely known in the sports nutrition sector.

The emphasis on hydration and balance of electrolytes in energy gels makes the product innovative. Aside from these strategies, companies also collaborate with fitness influencers, organize races, and partner with professional sports teams to promote their brand.

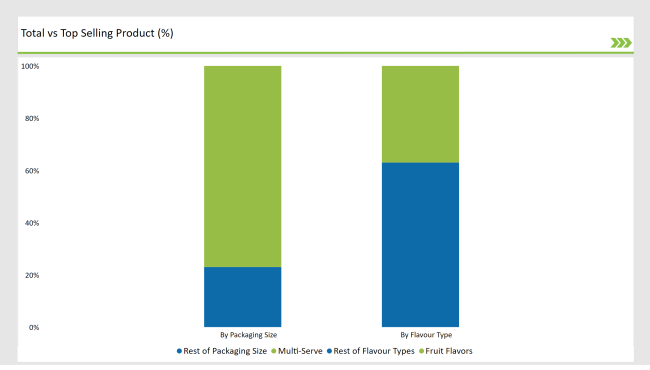

% share of Individual categories by Flavour and Packaging Size in 2025

Fruit flavor dominates the USA energy gel market since endurance athletes prefer these flavors and natural carbohydrates which together comprise 37% of the market share. Multiple energy reactions depend greatly on citrus berry and tropical blends since these flavors quickly deliver energy for long physical activities.

The market expansion of energy gels includes brands that add electrolytes to their assortment of fruit-flavored products which addresses consumer diversity and promotes hydration.

Fruit-flavored energy gels stand out as popular athletic products because they satisfy health-minded performance goals and taste needs during exercise. Market success depends on the extensive selection of flavors because it enables a wider customer range and competitive market position.

Multi-serve packaging dominates the USA energy gel market since it represents 77% of total sales while offering both cost-effective measures and sustainability benefits to consumers. The consumer preference now centers on big pouches which enable users to make exact portion decisions throughout extended athletic events including marathons and triathlons.

Artists who engage in prolonged athletic activities benefit from this packaging design since multiple servings fit within one package while simultaneously minimizing product waste.

Customers are choosing multi-serve versions because they seek practicality and value in their nutritional products. Sustainable packaging research by brands will continue driving market expansion through the multi-serve format which will attract athletes and fitness fans together.

Note: above chart is indicative in nature

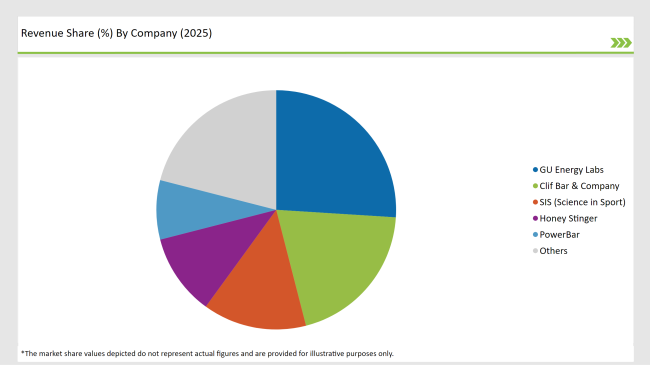

Several organizations compete in the USA Energy Gel Market and companies split into three distinct levels based on their market share combined with product selection and distribution channels.

GU Energy Labs Clif Bar & Company Gatorade together with Tier 1 competitors leads the energy gel market through their extensive retail operations and well-known brands and upscale product lines.

These market-leading firms use their broad distribution systems together with strategic marketing tactics to retain substantial control of the market. SIS (Science in Sport) together with Honey Stinger and PowerBar constitute the second tier of endurance sports nutrition manufacturers.

The companies network with elite sports figures through their specialized high-performance product development to serve committed fitness fans. The market segment of Tier 3 companies consists of businesses such as Huma Gel, Tailwind Nutrition, EnduroPack, and Nutrend which cater to specialized consumer markets through their use of organic components green packaging, and minimal ingredient labeling.

Health-conscious consumers guide each company sector to innovate and compete through separate segments that attempt to fulfill modern diet requirements. The energy gel market shows continuous expansion potential because the demand for these products continues to grow among athletes and fitness-minded people.

The market is projected to reach USD 432.9 million.

The market is expected to grow at 7.5% CAGR.

Fruit flavors dominate with a 37% market share.

Rising participation in endurance sports, clean-label product demand, and e-commerce expansion.

GU Energy Labs, Clif Bar & Company, SIS, Honey Stinger, and PowerBar.

fruit flavors, lemonade/limeade flavors, chocolate flavor, coffee/espresso flavor, and others.

the market is divided into single-serve and multi-serve energy gels.

The sales channel segmentation includes direct B2B (sports nutrition distributors, gyms, and specialty stores) and indirect B2C (e-commerce platforms, mass retail, and grocery stores).

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.