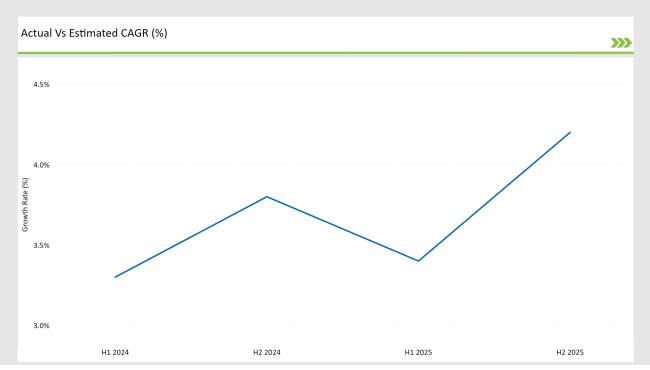

The USA Dehydrated Onions Market is projected to reach USD 361.5 million in 2025, growing at a CAGR of 4.1% over the next decade to an estimated value of USD 519.6 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 361.5 million |

| Projected USA Value in 2035 | USD 519.6 million |

| Value-based CAGR from 2025 to 2035 | 4.1% |

This rise is due to the availability of long-shelf-lives and easy-to-handle items in food production and the growing usage of dehydrated onions in ready-to-eat meals, seasonings, and snacks.

Inexpensive and quick, dehydrated onions do not have the disadvantages of fresh onions like rot, and season dependency. The need for more dehydrated onions by the food service industry, B2B manufacturers, and retail consumers is mainly the reason for the market expansion, as they are added to soups, sauces, dressings, and processed foods more frequently.

The increase in natural food ingredients that are salt-free and without preservatives is driving consumer demand further. Innovations in dehydration technology are the ones that have air drying, vacuum drying, and freeze drying, which cause the extended flavor, nutritional profile, and shelf-life stability of dehydrated onions.

Regardless of the market's positive forecast, there are still challenges that are facing, including the price fluctuations of raw onions, supply chain disruptions, and strict food safety regulations that the market's situation encounters.

But, the companies that are the front-runners in this sector are tackling these problems by optimizing their supply chains, making investments in new processing facilities, and adopting practices that are sustainable in agriculture.

Explore FMI!

Book a free demo

The market for dehydrated onions in the USA is witnessing consistent growth, fueled by increased demand from quick-service restaurants (QSRs), packaged food producers, and direct-to-consumer sales. Advancements in freeze-drying and vacuum-drying methods are likely to enhance quality and production efficiency, thereby boosting market growth.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Sensient Natural Ingredients: Expanded its dehydrated vegetable production facility, increasing output for foodservice applications. |

| March 2024 | Olam Food Ingredients USA: Introduced a new air-dried onion granule range designed for seasoning blends. |

| May 2024 | Gills Onions: Partnered with a major meal kit company to supply organic dehydrated onions. |

| July 2024 | Spice World Inc.: Launched freeze-dried onion powders, catering to the premium food segment. |

| September 2024 | Archer Daniels Midland (ADM): Developed an enhanced vacuum-dried onion formulation for bulk B2B food manufacturing. |

Increasing Use of Dehydrated Onions in Packaged and Processed Foods

The expansion of dehydrated onions (in packets) and processed goods is directly connected to the escalating demand for convenience foods and ingredients with prolonged shelf lives. Factories that produce packaged meals especially those that focus on soups, chips and, sauces are increasingly integrating dehydrated onions into their products to enhance flavor consistency, minimize moisture and, extend shelf life.

However, this trend reflects a broader shift in consumer preferences. Although the focus is on convenience, the quality of ingredients remains paramount, because it ultimately determines the overall culinary experience. The consumer trend of preferring to eat ready-to-cook meals also corresponds with the inlet of the dehydrated onion powder and granule products. Dehydrated onions are seen as an efficient way of flavoring the food and also are easily added to the respective dishes, thus they are a frequently used ingredient in food processors. The meal kit sector and packaged food sector are the main factors that bring about this particular growth.

Advancements in Dehydration Technologies for Enhanced Quality

Technological Progress in Dehydration Methods for Superior Quality The production firms are looking at cutting-edge dehydration technologies like freeze and vacuum drying as a way to preserve the nutritional value, taste, and smell of the product.

These methods of operating the machinery are responsible for the increased content of the precious oils, therefore, the dried onions produced are more similar to the original product due to the absence of synthetic substances used in the drying process.

The low-temperature drying methods was taken in to advantages on the textural properties and rehydration efficiency of dehydrated onions for its use on organic and premium food products. Its also been initiated to promote sustainable energy-efficient dehydration technologies by which carbon footprint of dehydration plants system is reduced.

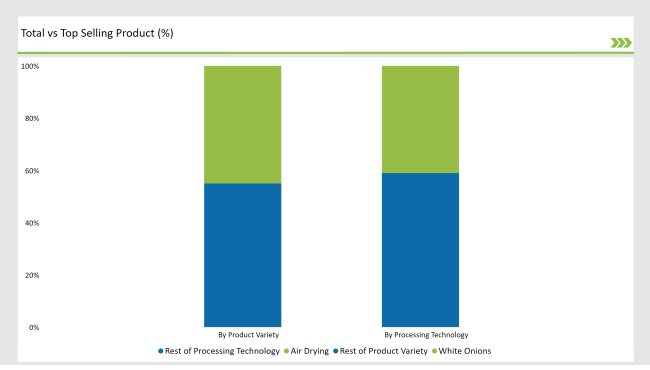

% share of Individual categories by Product Variety and Processing Technology in 2025

The predominant product variety in the USA dehydrated onion market is white onions, which account for an impressive 45% of the total market. Their sweet and mild flavor, along with the ability to use them in several types of foodstuffs, have made them the most sought-after choice.

One can often find white onions in dehydrated forms, for instance, such as powders, granules, and chopped pieces. This is one reason why they are widely used in the snack and seasoning industries. The fact that they are also utility enhancers in soups, sauces, and ready-to-eat meals is a bonus as they do not add extra calories.

The market is oriented toward consumer health issues; thus, convenient and tasty foods attract white dehydrated onion consumers. Therefore, it is implied that the additional consumer preferences for study-on-the-innovation in product formulations and broad use in culinary applications will last unwavering for a while into the foreseeable future.

Dehydrated onion air drying is the pivotal processing technology dominating the market in the United States and it takes up a 41% market share. This packing method is famous for its cheap price and the fact that it can maintain as much of the natural onion taste as possible which leads to a long shelf life.

Air drying is operated by pumping air, thus making it suitable for mass production and the food service of bulk possessions. The procedure has the desired effect because water-soluble substances, vitamins, and other nutrients that are quenched due to the dehydration of onions are kept intact. Consequently, these are found to be sought-after items by both food manufacturers and consumers.

As the sales of dehydrated onions expand, air drying is most likely to be a major processing method, enabling companies to respond to the market demands effectively while also ensuring high-quality fruits.

Note: above chart is indicative in nature

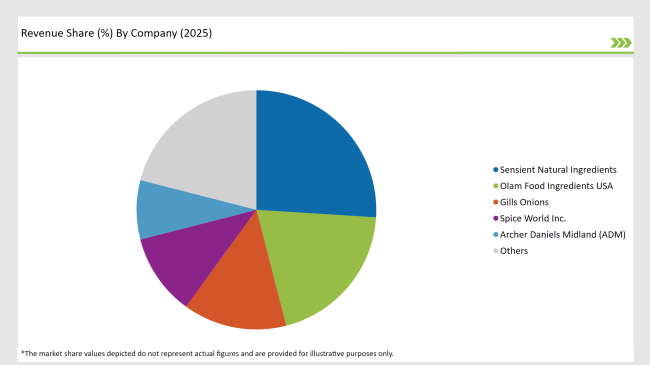

The marketplace of dehydrated onions in the USA can be viewed more as a competitive but still the real one with the help of three main categories of companies market reach, product innovation, and processing capacity.

The companies in the tier 1 class include the likes of Sensient Natural Ingredients, Olam Food Ingredients USA, and Archer Daniels Midland (ADM) which have a great impact on the market through numerous large-scale plants and excellent supplier networks. They have indeed proved their strength since they can meet the growing need for dehydrated onion products in many different industries.

A company like Gills Onions, Sensory Effects, and Bolthouse Farms a residents of Tier 2. The main goal of this company is to focus on the production of high-quality dehydrated onion brands and to provide customized processing that meets the needs and requirements of the clients.

A distinct Tier is seen in the cases of Spice World Inc., Ingredion Incorporated, and Wismettac Asian Foods which operate in a niche market segment offering organic and specialty dried onion products. The tier is all about the unique combinations of ingredients that are in demand among health-conscious consumers.

As the trend in the food sector goes toward faster meal preparation and higher amounts of processed food, the companies in these tiers will however be forced to compete for both creativity and business in the dehydrated onions business.

The market is projected to reach USD 519.6 million.

The market is expected to grow at 4.1% CAGR.

White onions dominate with a 45% market share.

Rising demand for convenience foods, advancements in dehydration technology, and increased application in packaged foods.

Sensient Natural Ingredients, Olam Food Ingredients USA, Gills Onions, Spice World Inc., and ADM.

The USA Dehydrated Onions Market is segmented by product variety into white onions, red onions, pink onions, and hybrid onions.

By product form, the market is categorized into chopped, minced, granules, powder, flakes, and others.

Segmentation by processing technology includes air drying, vacuum drying, freeze drying, and others.

The end-use segmentation consists of B2B (direct), food service, and retail (B2C).

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

UK Sports Nutrition Market Report – Growth, Demand & Innovations 2025-2035

USA Sports Nutrition Market Trends – Demand, Size & Forecast 2025-2035

Australia Sports Nutrition Market Outlook – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.