United States market, in cold laser therapy are significantly expanding. With rate of 3.8%, the market will reach to 66.6 million in 2035 from 45.7 million in 2025.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size (2025) | USD 45.7 million |

| Projected United States Value (2035) | USD 66.6 million |

| Value-based CAGR (2025 to 2035) | 3.8% |

Cold laser therapy’s abilities are acknowledged in sectors like healthcare, sports medicine, and physiotherapy, thus, being a multifunctional and preferred option. Its popularity has been due to the growing populations of chronic pain, musculoskeletal disorders, and sports injury patients in the USA-the primary cold laser therapy populations.

While health care professionals increasingly are looking toward cold laser therapy, it has become an attractive option that provides treatment efficacy without the risks of surgery or medications. Technologies developed, including portable devices and combination therapy units, add more features to clinicians' and patients' usability.

The greater preference of patients in the USA for non-invasive treatments largely boosts demand for portable laser therapy equipment. As such, this trend is driving adoption in clinic and into the home.

Awareness of the beneficial effects of cold laser therapy improved among the patients and the healthcare workers which in turn resulted in a rise in the use of it in the treatment of pain and in the sports medicine domain.

The market expansion is also being driven by innovations in laser technology such as cold laser devices, including portable systems, wearables, multi-wavelength lasers, etc. that make therapy less expensive and more effective.

Explore FMI!

Book a free demo

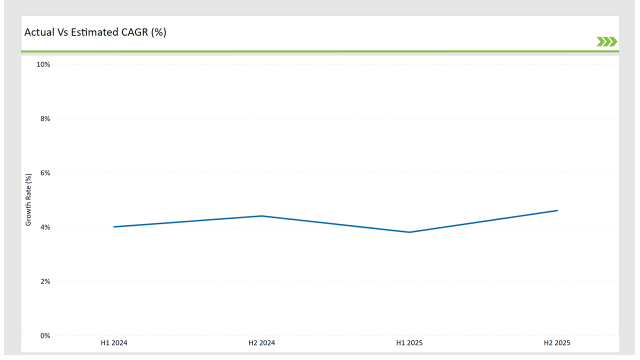

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States cold laser therapy market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cold laser therapy sector for the United States market is expected to rise at 4.0% growth rate in the first half of 2024, which will increase to 4.4% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 3.8% in H1 but is expected to rise to 4.6% in H2.

This pattern shows a decline of 20.0 basis points from the first half of 2023 to the first half of 2025, while in the second half of 2024, it is higher by 13.7 basis points compared to the second half of 2024.

The nature of the United States cold laser therapy market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Apira Science Inc. focuses on expanding its presence in the global market by increasing its research and development activities. It also focuses on gaining patents and approvals from various organizations for its research. |

| 2024 | Collaboration: B-Cure Laser Australia (Good Energies Ltd.) focuses on collaborating or partnering with different companies or media partners.. |

| 2024 | Expansion: Erchonia Corporation focuses on expanding its presence in the global market. |

Increased Usage in Sports Medicine and Rehabilitation

These days, sportsmen and physically active people use cold laser therapy to recover from injuries faster and become stronger. The fact that it encourages faster healing, lessens inflammation, and improves blood flow gives it a robust place in the sporting arena.

Introduction of Portable and Wearable Devices

The tech sector has successfully advanced the cold laser unit to practical sizes, such that handheld units for in-house home use become possible for its users. Such devices flood the market, making it conceivable and accessible for consistent and effective therapy.

Patient-Centered Care Gaining Significance

Patient-centered care is a clear priority for USA healthcare providers, and treatment with cold laser therapy is a good fit for this model. The therapy can be adapted to the particular conditions of patients thus ensuring improved outcomes and more patient satisfaction.

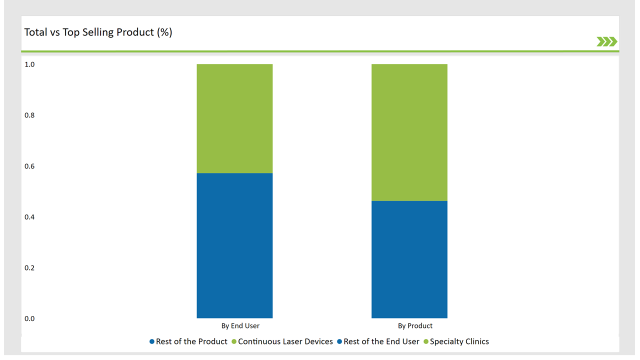

% share of Individual categories by Product Type and End User in 2025

Continuous laser devices records significant surge in cold laser therapy market

Continuous laser devices dominate the USA cold laser therapy market due to their effectiveness in offering high precision, rapid treatment times, efficacy in pain management, and tissue healing. These devices provide a continuous laser output and thus guarantee optimal therapeutic outcome for both acute and chronic conditions.

The large end-user segment of the USA cold laser therapy market is specialty clinics, which play a crucial role in providing targeted pain management and rehabilitation services. Specialty clinics prefer continuous laser devices due to their superior ability to treat sports injuries, arthritis, neuropathy, and post-surgical recovery.

Additionally, the increasing preference for non-pharmaceutical pain relief amid concerns over opioid dependency has boosted demand for cold laser therapy in specialized clinical settings.

Note: above chart is indicative in nature

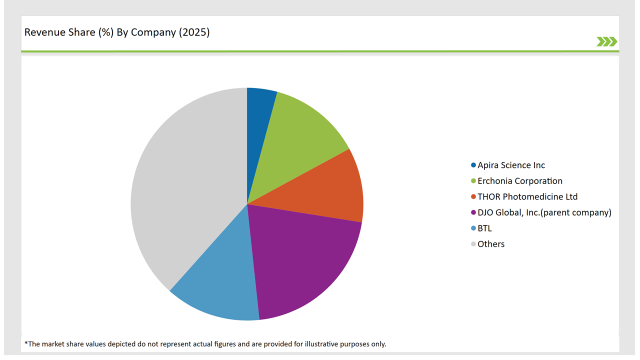

Some key players operating in the USA cold laser therapy market are Erchonia Corporation, DJO Global, Inc., BTL, THOR Photomedicine Ltd, and BioLight Technologies LLC. These key players hold a major market share of the USA cold laser therapy market owing to continuous technological advancements and expansion of their therapeutic use.

These Tier 1 companies are significantly investing in R&D to develop very efficient LLLT devices for both medical and home-use applications. The strict regulations by the USA FDA and the growing demand for evidence-based treatment solutions have driven these companies to strive for clinically validated, high-precision, FDA-cleared products, ensuring their products meet strict medical device standards in the country.

Meanwhile, Tier 2 companies like Irradia, Omega Laser Systems, and Multi Radiance Medical are finding their niche by offering cost-effective yet high-performance solutions, thus making cold laser therapy more accessible across mid-sized clinics to home care settings.

The market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

Continuous laser devices are the leading products in the market.

Key players include Apira Science Inc, BioLight Technologies LLC, B-Cure laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, and Photomedex.

The industry includes various product type such as Continuous Laser Devices Pulse Laser Devices and Combination Laser Devices

The industry includes various materials such as single wavelength cold laser therapy devices, multiple wavelength cold laser therapy devices.

The industry includes various indications such as pain management, arthritis wound healing, nerve regeneration, dermatology, musculoskeletal and others

Available in end user like hospitals, specialty clinics, ambulatory surgical centers, and homecare settings.

Hyperammonemia Treatment Market Trends – Growth & Therapeutic Advances 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Hutchinson-Gilford Progeria Syndrome Market Growth – Innovations & Therapies 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.