The United States cell culture media bags market is projected to be valued at USD 576.2 million in 2025. Market growth forecast presents an overall 2.3% compound annual growth rate estimated to hit USD 723.3 million by 2035.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size in 2025 | USD 576.2 million |

| Projected United States Value in 2035 | USD 723.3 million |

| Value-based CAGR from 2025 to 2035 | 2.3% |

This particular market of cell culture media bags for the near term will grow significantly in United States, facilitated by solid public health initiatives. United States is the largest contributor in the expansion of the sector by 2025 in North America.

Advancements in the field of regenerative medicine, particularly the fast track observed with stem cell therapies and tissue engineering, constitute the fastest-growth areas in the USA biopharmaceutical markets. The implication of these mainstream therapies makes a requirement for large-scale, efficient, and sterile production processes. In such cases, high-quality cell culture media bags are inevitable. These bags help ensure the reliability of large-scale cell cultivation while ensuring optimal stability and sterility of the media, which is essential for the success of regenerative treatments and their release into the clinic.

Explore FMI!

Book a free demo

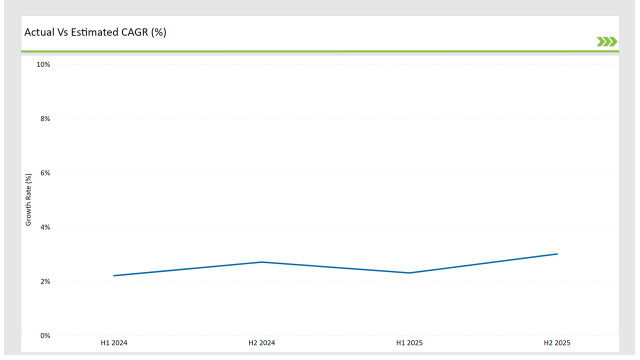

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States cell culture media bags market. This semi-annual analysis reflects changes in the market dynamics, where the pattern of revenue realization and its subsequent outcome can be compared for a clear understanding of growth throughout the year. The half-year period has H1 that extends from January to June, while H2 refers to the time from July up to December.

H1 indicates period from January to June, H2 Indicates period from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The United States market for cell culture media bags is expected to accelerate at 2.2% in the first half of 2023, while in the second half of the same year, the growth is expected to be at 2.7%. In the year 2024, it is expected that the growth rate will dip a little into 2.3% in H1, while in H2, it is expected to shoot up again to 3.0%. This pattern shows an increase of 10 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it is increased by 33 basis points compared to the second half of 2023.

These figures picture a dynamic, fast-changing United States cell culture media bags market, mainly through highly developed biopharmaceutical industry, advancements in regenerative medicine, and strong regulatory support. This semestral breakup is very important to businesses charting their strategies, taking into consideration growth trends and navigating complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Production Capacity Expansion: Sartorius has expanded the capabilities of the production lines in the USA, leveraging the increasing demand for biologics and cell therapies. He aims to make the supply chain more efficient in the supply of cell culture media bags by establishing its manufacturing facilities. Sartorius also invests heavily in automation and digitalization and provides USA biopharmas with solutions integrated, which reduce operational costs as well as time to market. |

| 2024 | R&D: Thermo Fisher uses its USA R&D centers to develop tailored solutions for new technologies like gene therapy and personalized medicine. It's growing through strategic alliances with leading USA universities and research institutions that are fueling innovation. Furthermore, they will continue to increase their product offerings by combining cell culture media bags with other advanced biotech tools to cater to the needs of a diverse USA customer base, ranging from small biotech firms. |

| 2024 | Personalized Therapies: Merck aims to focus on the USA market with its cell culture media bag product aligning with the surging trend of personalized therapies. The company further emphasizes sustainability in its USA-based business. Merck KGaA provides eco-friendly and reuse-friendly cell culture media bags in alignment with the growing regulatory and environmental concerns in the market. Merck KGaA offers eco-friendly and reuse-friendly cell culture media bags corresponding to the increasing regulatory and environmental issues in the market. |

Advancements in Regenerative Medicine

The regenerative medicine and stem cell research in the USA is increasing. Increasing cell therapies and tissue engineering require quality cell culture media bags for effective, sterile, and scalable production to contribute to market growth.

Supportive Regulatory Environment

The USA policy environment thus provides much encouragement to innovation and growth in biotechnology. Organisations such as the FDA and NIH provide policies and funding which promote biopharmaceutical research and manufacturing, further increasing the demand for high level bioprocessing solutions, including cell culture media bags.

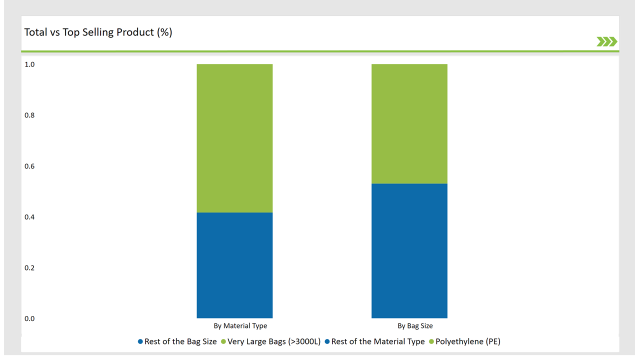

% share of Individual categories by Bag Size and Material Type in 2025

Very large bags (>3000L) records significant surge in United States cell culture media bags market

Very Large Bags (>3000L) account for major sales due to the increasing demands of large-scale biopharmaceutical manufacturing, especially in the area of cell-based therapies, vaccines, and biologics. Very large bags enjoy fast growth a bigger volume have become necessary in the production of biologics and other treatments, companies need large capacity media bags with the capability to hold huge quantitates of cell culture media with the sterility level and prevention of contamination.

The Polyethylene (PE) segment is likely to witness considerable growth in the market, on account of material's cost-effectiveness, durability, and excellent barrier properties. PE is widely applied in the manufacturing of media bags as it can resist moisture and oxygen better and more other kinds of contaminants while keeping the sterility of the cell culture media intact.

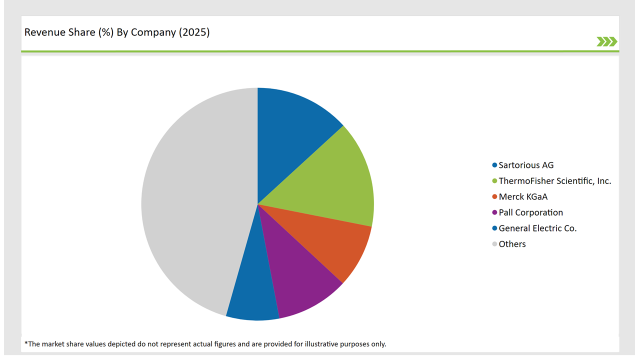

The USA cell culture media bags market is moderately concentrated, with key players dominating the landscape. Leading companies such as Thermo Fisher Scientific, Sartorius AG, and Merck KGaA capture considerable market shares because of their advanced product offerings, strong distribution networks, and continuous innovation in bioprocessing technologies.

2025 Market share of United States Cell Culture Media Bags suppliers

Note: above chart is indicative in nature

These players continue to invest heavy in R&D to come out with quality scalable products that are at the same time environment friendly. Moreover, this reinforces their competitive positioning. Regional as well as smaller participants also exist to offer specialized products directed at niche application. Strategic alliance, merger and acquisition of companies aim towards market expansion by offering a robust product line; and in this backdrop, biopharmaceutical production demand continues its upward movement.

By 2025, the United States cell culture media bags market is expected to grow at a CAGR of 2.3%.

By 2035, the sales value of the United States cell culture media bags industry is expected to reach United States is 723.3 million.

Key factors propelling the United States cell culture media bags market include robust biopharmaceutical industry, advancements in regenerative medicine and strong regulatory support, ensuring widespread adoption of high-quality cell culture media bags.

Prominent players in the United States cell culture media bags manufacturing include Sartorious AG, Thermo Fisher Scientific, Inc., Merck KGaA, Pall Corporation, General Electric Co., Saint-Gobain Performance Plastics, Charter Medical, Avantor Fluid Handling LLC, Lonza and Entegris Inc. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry classifies bag sizes into very small bags (< 150 ml), small bags (151 - 500 ml), medium bags (501 ml - 1000L), large bags (1001L - 3000L), and very large bags (>3000L).

Regarding material types, the sector is categorized into polyethylene (PE), ethylene vinyl alcohol (EVOH), fluorinated ethylene propylene (FEP), polyolefin, and additional options.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.