The USA Canned Tuna market is projected to reach USD 3,073.2 million in 2025, growing at a CAGR of 2.0% over the next decade to an estimated value of USD 3,746.2 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 3,073.2 Million |

| Projected Global Value in 2035 | USD 3,746.2 million |

| Value-based CAGR from 2025 to 2035 | 2.0% |

Canned tuna in the USA market continues to expand because consumers seek both easy-to-use and protein-rich food products. Bought tuna fish earns praise among health seekers due to its omega-3 fatty acid content which makes it appealing to active wellness consumers.

Manufacturers support market growth through two main trends: they implement sustainable fishing practices to source tuna from certified fisheries to meet environmental requirements and consumer market demands.

Consumer understanding of sustainability has led to an eco-friendly evolution in tuna sourcing methods while brands set new standards for follow-able supply chains and environmental sustainability initiatives.

The market benefits from product development that includes flavored canned tuna as well as ready-to-eat options that attract consumer interest. E-commerce development now provides customers with better access to canned tuna products which increases overall market penetration.

The market experiences two main difficulties which stem from volatile raw material prices together with disruptions throughout the supply chain. The industry must embrace sustainable practices because the challenges posed by overfishing, combined with regulatory demands, significantly impact the seafood market.

Although the growth potential of the USA canned tuna market remains robust, it is driven by consumers' desire for both healthy and sustainable meal options that align with their dietary requirements. However, the need for these practices cannot be overstated; they are essential for the future of the industry.

Explore FMI!

Book a free demo

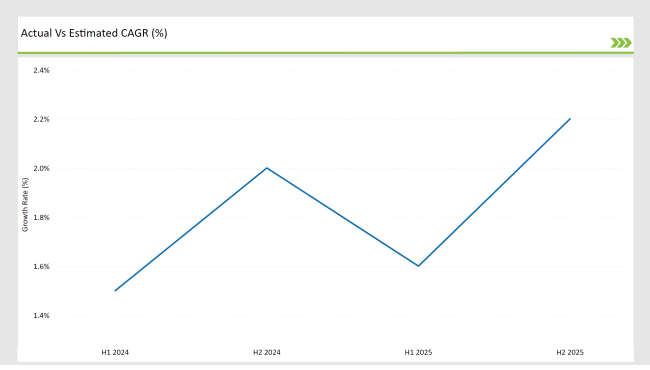

The diagram presents a comparative assessment of the semi-annual growth trends for the USA canned tuna market analyzing changes in market dynamics between the base year and the current year. This update provides insights into shifting consumer preferences, regulatory developments, and evolving retail strategies.

However, it offers stakeholders a clearer picture of market performance, because understanding these factors is crucial for future planning. Although the data is insightful, one must consider external influences that may affect these trends.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| August 2023 | FDA: FDA proposed revisions to canned tuna standards, including weighing methods and optional flavorings. |

| August 2024 | StarKist and Lion Capital: StarKist and Lion Capital settled USA class-action lawsuits related to tuna price-fixing for USD 200 million. |

| August 2024 | Greenpeace USA: Greenpeace USA reported 14 out of 16 major USA grocery retailers failed tuna sustainability and human rights standards. |

| October 2024 | USA Customs and Border Protection announced that the 2024 tuna import quota was not oversubscribed. |

Sustainability-Driven Consumer Preferences Reshaping the Market

USA consumers now drive the canned tuna market toward sustainable practices because they require environmentally friendly fishing methods. The increasing trend of shoppers looking for products certified by the Marine Stewardship Council and brands implementing Dolphin-Safe fishing methods. Three major tuna industry producers StarKist alongside Bumble Bee and Chicken of the Sea are toning up their supply chain transparency by implementing pole-and-line and FAD-free fishing methods.

Greenpeace USA maintains an ongoing ranking process for tuna brands which forces major industry companies to strengthen their environmental promises. Manufacturers now make sustainable tuna products provide recyclable packaging and implement blockchain tracking technology to monitor production activities. Sustainability certifications have emerged as critical selling factors for retail platforms and supermarkets to reshape their product market strategies.

Expansion of Flavored and Ready-to-Eat Tuna Varieties

American consumers across the USA now expand their choice for canned tuna products to multifaceted flavors alongside ready-to-eat choices beyond traditional unflavored offerings. To meet rising demand for convenient protein-rich meals companies produce tuna products spiced with various versions of herbs as well as infused seasonings that conform to modern market preferences.

Gen Z consumers and millennials favor the newly popular tuna options including lemon-pepper and sriracha alongside garlic-herb and buffalo-style tuna products. Leading brands have introduced pouch-packaged tuna products alongside single-serving packs to serve office professionals, fitness consumers, and families with hectic lifestyles.

The new product line supports existing market directions which emphasize both functional snack items and protein content in snacks. The evolution of consumer preferences toward flavored canned tuna sparks new opportunities for profit potential which directs product innovation approaches in the USA canned tuna industry.

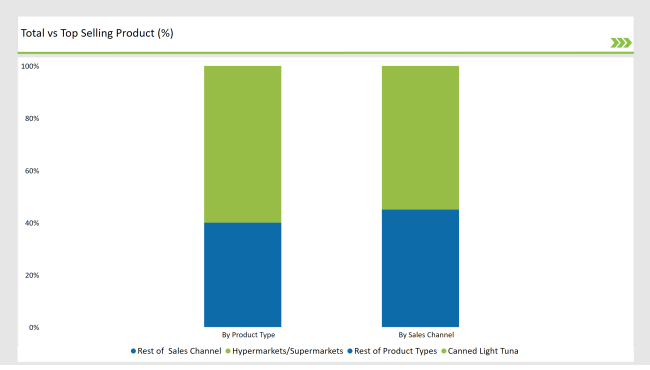

% share of Individual categories by Product Type and Sales Channel in 2025

Product Type: Dominance of Canned Light Tuna

Canned Light Tuna will maintain 60% control over total USA canned tuna market sales by 2025. The product has gained widespread popularity because it provides affordable prices with subtle taste and easy accessibility across the market.

The main supply comes from skipjack and yellowfin tuna which makes the product suitable for health-conscious consumers because it contains lower mercury content. The versatility of canned light tuna makes it ideal for meal preparation and it appears in both household and food service operations and salads and sandwiches.

The market demand for chunk light tuna continues to grow because consumers recognize the good price value and retailers' growing preference for private-label products. The leading tuna companies dedicate resources to sustainable fishing practices which builds market reliability through gaining consumer confidence.

Sales Channel: Hypermarkets/Supermarkets Leading with 55% Share

The 2025 USA canned tuna market will experience 55% of its total sales through Hypermarkets and Supermarkets. Walmart together with Kroger Costco and Target operate as major retail locations that provide affordable bulk items alongside extensive brand options to customers.

The stores maintain durable tuna manufacturer supply chains that support their inventory stability and promotional activity. Supermarkets dominate the flavored and premium canned tuna market due to effectively satisfying the consumer desire for ready-to-eat food.

The retail operations of Great Value and Kirkland Signature bring consumers affordable choices to select products. Shoppers still choose in-store shopping for their quick shopping needs as well as to check product quality alongside competitors.

Note: above chart is indicative in nature

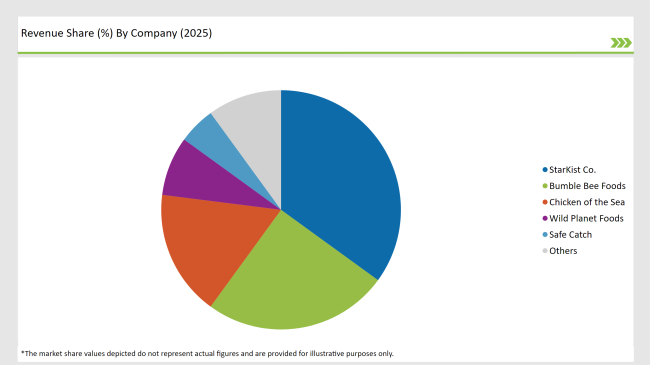

As this is the industry of canned tuna in the United States, modest market power applies because several large fish canning enterprises retain significant authority. Entry barriers exist because of high operating expenses strict laws regarding sustainability conditions and strong customer brand preferences for the product itself.

The industry leadership belongs to StarKist coupled with Bumble Bee and Chicken of the Sea. Major retailer and food service provider connections allow these companies to distribute their products broadly together with affordable pricing structures. Their management of fishing operations on a worldwide scale together with sustainable sourcing investments gives them an advantage over smaller brands in the market.

Mid-range retailers are increasingly relying on their exclusive store-branded tuna products which stem from major supermarket chains. These brands give shoppers quality seafood options at accessible prices which attracts buyers focused on cost savings.

Premium brands that specialize in sustainably sourced mercury-safe tuna products represent the bottom segment of the market. Businesses dedicated to responsible fishing techniques together with organic methods pull in more customers who care about sustainability and their health.

The market is projected to grow at a CAGR of 2.0% from 2025 to 2035.

The market is expected to reach USD 3,746.2 million by 2035.

The flavored canned tuna segment is anticipated to witness the fastest growth, as demand for convenient, ready-to-eat, and premium tuna varieties rises among health-conscious and younger consumers.

Key growth drivers include rising demand for protein-rich foods, increasing preference for sustainable seafood, expansion of flavored and ready-to-eat options, and growth in online retail sales.

The market is led by StarKist, Bumble Bee Foods, and Chicken of the Sea, with private-label brands and premium seafood companies gaining traction in niche segments.

The market is segmented into canned white tuna, canned light tuna, and canned specialty tuna, with light tuna being the most preferred due to affordability and taste.

Canned tuna is available in chunk, solid, flakes, and other forms, with chunk tuna dominating due to its versatility in salads, sandwiches, and meal preparations.

The market consists of unflavored and flavored variants, with unflavored being the primary choice, while flavored options like lemon-pepper, sriracha, and garlic-herb are gaining popularity.

The market is distributed through B2B/HoReCa and B2C segments, with hypermarkets, supermarkets, convenience stores, online retail, and other retail outlets serving as key purchasing channels.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.