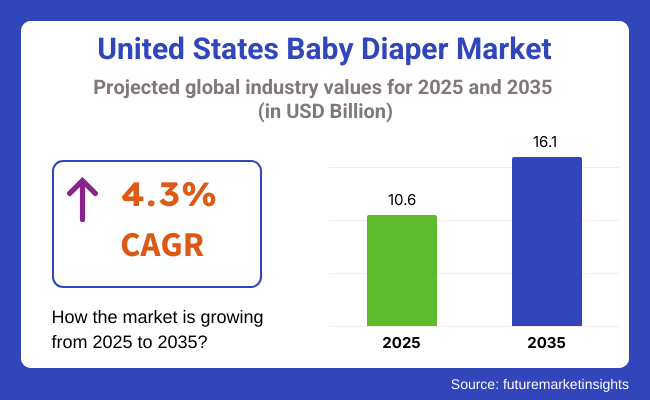

The United States baby diaper market is estimated to reach USD 10.6 billion in 2025 and is expected to record a 4.3% CAGR from 2025 to 2035. The industry is projected to be USD 16.1 billion in 2035. The industry is boosted primarily by surging demand for high-performance, skin-soothing, and green diapering products from a growing health-conscious and eco-sensitive parent base.

New baby diapers have evolved significantly, with technology focused on absorbency, leak protection, and compatibility for sensitive skin. Parents want ultra-thin, hypoallergenic, and fragrance-free products that offer long wear without compromising comfort. Development in moisture-wicking layers, stretch-fit technology, and plant-derived biodegradable materials also supports the growth of the segment, which is more in line with clean-label and green parenting trends.

The brand distinction is more and more centered on sustainability credentials and transparency. Organic and recyclable diapers, like cloth-disposable hybrids, are catching on as landfill contribution dwindles. Simultaneously, intelligent diapers with wetness sensors and mobile connectivity are proving to be in demand among consumers keen to monitor infant health parameters in real-time.

Distribution patterns favor convenience-driven channels, and e-commerce sites occupy a prime position in subscription replenishment-based models and product discovery. Players are blending learning at store and product trials through digital and using influencer posts and parenting networks to induce conversion and interaction. Premiumization of diaper items is fueling new growth across mass and specialty retail channels.

Although birth rates in the USA have fallen, the industry continues to grow due to increasing per-baby spending, particularly among metropolitan and dual-income households. Further, the rising availability of pediatric dermatology-approved diapers and preemie, nighttime protection, and mobility-aiding products is fueling product segmentation and loyalty.

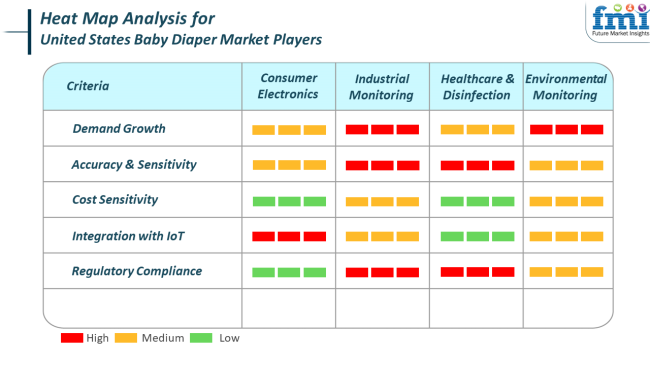

Baby diapering is closely followed by healthcare and environmental monitoring trends, where the performance of the product, safety and sustainability influence purchasing choices.

Parents look more and more for diapers to be gentle to sensitive skin and provide tested protection with a smaller environmental impact. This follows healthcare expectations for accuracy, cleanliness, and low-irritation design.

Demand growth is equally split between urban and suburban industries with most traction in first-time parents and households with income that can support high-end products. Wetness indicators, sizing that is tailored to development stages, and dermatologist-tested ingredients are seen as the standard in the marketplace.

Cost sensitivity is uneven, yet there is a definite trend toward long-term value versus low cost. Consumers will pay more for trustworthy, environmentally friendly diapers, particularly when underpinned by open branding and positive word-of-mouth from the community.

Meeting FDA safety requirements and eco-label approvals is a major trust driver that impacts brand selection and repeat purchase.

Despite consistent growth, the USA baby diaper industry is also exposed to significant threats likely to affect future performance. Of concern is demographic pressure declining birth rates in the USA that could slowly deplete the addressable industry size unless offset by increases in per-child expenditures or innovation-driven demand in neighboring categories such as toddler training pants and incontinence products.

Environmental criticism also poses a long-term threat. Disposable diapers are often attacked for their landfill contribution as well as petroleum-based composition, stoking increasing consumer and regulatory pressures for greener alternatives. Businesses without biodegradable constituents or substantive ESG commitments can experience reputational damage and limited access to environmentally responsible industry niches.

Finally, super absorbent polymer and natural fiber supply chain volatility can influence price stability and cost of production. Coupled with increasing raw materials costs and greater competition from DTC entrepreneurs and private labels, incumbents need to invest in R&D, supply chain agility, and customer engagement to retain industry share and build brand allegiance in the decade ahead.

The industry increased greatly between 2020 and 2024 due mainly to changes in consumer perceptions, greater sensitivity towards sustainability, and innovation in product lines. Disposable diapers held the industry from 2020 to 2024, and convenience was favored by most customers, especially due to hectic lifestyles.

Cloth diapers were also trending during this time as an environmentally friendly choice based on growing environmental issues. Hypoallergenic and natural ingredient baby diapers grew more popular as parents increasingly looked for safer alternatives to use on the sensitive skin of their babies.

The industry will keep growing during the next decade, to 2025 to 2035. Green diaper usage will grow steadily as people will become increasingly ecologically concerned with the use of conventional disposable diapers. Technologies such as intelligent diapers, humidity sensor and health checking systems will become ever more popular.

In addition, online shopping channels and subscription platforms will grow, providing increased convenience for parents. Advances in technology and product diversification will continue to drive growth, with a focus on sustainability, comfort, and safety.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Robust growth driven by the growing demand for convenience and comfort in baby diapers. | Sustained growth, with a focus on sustainability and green products. |

| Disposable diapers dominated, followed by a rise in cloth diapers and environmentally friendly ones. | Launch of intelligent diapers with advanced features like moisture-sensing and health tracking. |

| Increased demand for disposable diapers owing to convenience and ease of use. | Increased demand for green and environment-friendly diapers as there is increasing environmental awareness. |

| Launch of high-end and hypoallergenic diapers for sensitive skin conditions. | Introduction of intelligent diapers with moisture sensors, and advances in material science. |

| Growing online distribution channels, with wider availability. | Ongoing growth of e-commerce with more subscription options and online purchasing choices. |

| Greater demand for product safety and quality. | More stringent environmental regulations and sustainability norms in the production of diapers. |

Among baby diapers in the United States, training pants/underwear pants and swim diapers are expected to spearhead the industry by 2025. Market shares for training pants/underwear pants and swim diapers currently stand at 15.5% and 16%, respectively.

Growing in popularity with parents who are trying to potty train their children, training pants/underwear pants dominate most by their ease of transitioning from regular diapers to underwear. Major players in this segment, such as Pampers Easy Ups under Procter & Gamble and Huggies Pull-Ups with Kimberly-Clark, are still innovating ways to offer comfort, absorbency, and fit for the growing needs of children. The increased popularity of training pants can also be augmented by the greater level of awareness around potty training methods and how to make it easier for parents.

Swim Diapers are steadily gaining ground, with more families going out to indulge in activities that involve water, such as swimming classes and beach holidays. These diapers are designed specially to contain stromatic waste without absorbing water; hence, they are a must-have product for parents with infants and toddlers.

The industry leaders in swim diapers, such as Huggies Little Swimmers and Pampers Splashers, have taken advantage of the niche by offering reliable, quality products. The rising number of very early swimming classes and the promotion of safe water play create a high increase in the industry share of swim diapers.

Some of the other players in the segment, Luv, with different brands such as Huggies, are also extending their reach by developing low-price but good-quality training pants and swim diapers as another way for them to capture price-sensitive parents. Companies like The Honest Company have also built a very good position, taking advantage of the increasing demand for organic products and eco-friendliness by providing such items in both training pants and swim diapers.

The industry in 2025 is expected to remain primarily Pant Style diaper-dependent, accounting for 60% of the industry, whereas Tape Style diapers would continue to claim 40%.

Pant style diapers, otherwise known as pull-ups, have areas of advantage that will be very much in favor of their use; there is great convenience provided to toddlers who become increasingly mobile and are entering the potty-training phase. These diapers could be easily pulled on and off, thus being the right option for parents who want a more independent diapering experience.

Key brands in this class include Pampers Easy Ups and Huggies Pull-Ups. Pampers Easy Ups, for instance, feel soft and cottony with a 360-degree stretchy waistband, providing comfort for active toddlers. Huggies pull-ups with special leak guards and training design help toddlers train harder, thus increasing pant-style diaper use. This style is convenient and flexible for parents, which has now aided in driving this style's sales number one position.

Tape-style diapers account for 40% of the industry share and are used extensively, especially for younger infants and newborns. These diapers provide infants who are not yet mobile with a firm, customizable fit with their adjustable tabs, keeping them leak-proof and comfortable.

Pampers Swaddlers and Huggies Little Snugglers are important brands in the Tape Style segment. Pampers Swaddlers are endowed, for example, with a super-soft liner, while Huggies Little Snugglers come with an added blue wetness indicator in order to maximize experiences for parents. Tape-style diapers are often chosen on the grounds of reliability, with superior leakage protection and comfort during long hours of wear.

As eco-friendly options enter the fray, competition is also increasing among styles in the baby diaper industry. Companies like Honest Company or Seventh Generation offer Tape and pant-style diapers made of organic, hypoallergenic materials, responding to a trend away from chemical-laden products toward sustainable ones.

These environmentally friendly diapers are free of chlorine bleach, fragrances, or synthetic materials, equating to increasing parent demand for eco-aware products for their babies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

USA will expand at a 5.2% CAGR over the study period. The USA industry for baby diapers is witnessing steady expansion driven by factors such as increased birth rates within large cities, increased health concerns among parents, and a newly developing trend of premium, environmentally friendly products.

Parents are making increasing demands about safety, the sensitivity of the skin, and convenience, compelling corporations to innovate around materials, fit, and absorbing efficiency. Demand for disposable nappies remains high due to convenience, but even degradable and reusable nappies are becoming popular with greater environmental concern. Trends are towards value-added features such as wetness indicators, stretch waistbands and breathable constructions.

In addition, online shopping is also increasingly influencing purchasing habits, with parents opting more and more for online subscriptions and bulk purchases for the economy. Startups as well as private labels are rocking the industry with organic compositions and low prices, contributing to a diversified product range.

Government standards and regulations are also influencing product quality and ingredient transparency, further increasing consumer confidence. With ongoing product innovation and shifting parental attitudes, the USA baby diaper industry is expected to expand at a consistent rate until 2035.

The industry is characterized by strong competition between large multinational FMCG companies and a rising number of sustainable and niche diaper brands. The industry leaders, Kimberly-Clark Corporation, Procter & Gamble Company, Cardinal Health Inc., The Honest Company Inc., and Ontex International NV, are well-known for great brand equity, far-reaching retail distribution, and continuous product innovations with respect to absorbency, gentle feel on the skin, and eco-friendliness in formulations.

Kimberly-Clark, with its Huggies brand, is a market leader and is improving technologies to reduce leakage and increase comfort while continuously expanding the biodegradable range. The Pampers division of Procter & Gamble continues to dominate through intense marketing, tics with hospitals, and subscription models to keep the brand in the minds of consumers from birth. Cardinal Health, better known in the healthcare segment, nonetheless is quite strong in private-label diaper manufacturing for major USA retailers and institutional care providers.

The Honest Company Inc. defines a premium natural niche offering plant-based diapers with designer prints, catering to eco- and health-conscious parents. Ontex International NV is a key player in the value segment supplying branded and private-label diapers, focusing on affordability without compromising on quality.

Smaller but fast-growing players like Bambo Nature USA, Seventh Generation, and Charlie Banana have been rewriting the industry narrative around sustainability as well as reusability. Cloth and hybrid diaper brands such as GroVia, Geffen Baby, and ECOABLE are gaining ground among eco-conscious families through direct-to-consumer channels and parenting communities.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Kimberly-Clark Corporation | 28-33% |

| Procter & Gamble Company | 25-30% |

| Cardinal Health Inc. | 8-11% |

| The Honest Company Inc. | 6-9% |

| Ontex International N.V. | 5-8% |

| Other Key Players | 13-18% |

| Company Name | Offerings & Activities |

|---|---|

| Kimberly-Clark Corporation | Market leader with Huggies , investing in biodegradable as well as sensitive-skin lines. |

| Procter & Gamble Company | Offers Pampers and Luvs , focusing on hypoallergenic features and hospital partnerships. |

| Cardinal Health Inc. | Supplies private-label and institutional-use diapers , expanding via wholesale distribution. |

| The Honest Company Inc. | Premium eco-friendly brand with plant-based materials and designer prints. |

| Ontex International N.V. | Provides value-segment diapers through retail chains active in private-label production. |

Key Company Insights

Kimberly-Clark Corporation (28-33%)

Remains the industry leader with strong brand recall as well as premium innovations in overnight and biodegradable diaper segments.

Procter & Gamble Company (25-30%)

Dominates through Pampers with expansive retail, hospital, and e-commerce presence; continuously enhances product comfort and fit.

Cardinal Health Inc. (8-11%)

It focuses on private label and institutional segments, as well as significant suppliers for healthcare and elder care channels.

The Honest Company Inc. (6-9%)

Rapidly scaling premium brand appealing to environmentally-conscious parents; focuses on ingredient transparency.

Ontex International N.V. (5-8%)

Key supplier in value and mid-tier markets; uses global manufacturing network to deliver affordable quality options.

By product type, the industry is segmented into training pants/underwear pants, swim diapers, preemie diapers, and cloth diapers (including flat cloth diapers, pre-fold cloth diapers, pocket diapers, fitted cloth diapers, hybrid cloth diapers, and all-in-one diapers).

By functionality, the industry is divided into disposable diapers and reusable diapers.

By style, the industry is classified into tape style and pant style.

By age, the industry is segmented by age groups, including 0 to 5 months, 5 to 8 months, 9 to 24 months, and above 24 months.

By sales channel, the industry is analyzed across various sales channels, including modern trade, departmental stores, convenience stores, specialty stores, online retailers, drug stores, and other sales channels.

The industry is slated to reach USD 10.6 billion in 2025.

The industry is predicted to reach a size of USD 16.1 billion by 2035.

Key companies include Kimberly-Clark Corporation, Procter & Gamble Company, Cardinal Health Inc., Ontex International N.V., Bambo Nature USA (Abena Group), Aleva Naturals (D&G Laboratories Inc.), Babyganics (S.C. Johnson & Son Inc.), The Honest Company Inc., Bumkins, Charlie Banana USA LLC, Earth's Best (The Hain Celestial Group Inc.), ECOABLE, Seventh Generation Inc., Flip Diapers (Cotton Babies Inc.), GeffenBaby.com, GroVia, and Medline Industries.

China, slated to grow at a significant CAGR during the forecast period, is poised for fastest growth.

Training pants/underwear pants and swim diapers are being widely used.

Table 01: United States Market Value (US$ million) Analysis By Country, 2018 to 2033

Table 02: United States Market Volume (Units) Analysis By Country, 2018 to 2033

Table 03: United States Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 04: United States Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 05: United States Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 06: United States Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 07: United States Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 08: United States Market Volume (Units) Analysis By Style, 2018 to 2033

Table 09: United States Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 10: United States Market Volume (Units) Analysis By Style, 2018 to 2033

Table 11: United States Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 12: United States Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Table 13: West Region Market Value (US$ million) Analysis By Country, 2018 to 2033

Table 14: West Region Market Volume (Units) Analysis By Country, 2018 to 2033

Table 15: West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 16: West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 17: West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 18: West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 19: West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 20: West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Table 21: West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 22: West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Table 23: West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 24: West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Table 25: South East Region Market Value (US$ million) Analysis By Country, 2018 to 2033

Table 26: South East Region Market Volume (Units) Analysis By Country, 2018 to 2033

Table 27: South East Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 28: South East Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 29: South East Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 30: South East Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 31: South East Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 32: South East Region Market Volume (Units) Analysis By Style, 2018 to 2033

Table 33: South East Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 34: South East Region Market Volume (Units) Analysis By Age, 2018 to 2033

Table 35: South East Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 36: South East Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Table 37: South West Region Market Value (US$ million) Analysis By Country, 2018 to 2033

Table 38: South West Region Market Volume (Units) Analysis By Country, 2018 to 2033

Table 39: South West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 40: South West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 41: South West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 42: South West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 43: South West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 44: South West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Table 45: South West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 46: South West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Table 47: South West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 48: South West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Table 49: Mid-West Region Market Value (US$ million) Analysis By Country, 2018 to 2033

Table50: Mid-West Region Market Volume (Units) Analysis By Country, 2018 to 2033

Table 51: Mid-West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 52: Mid-West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 53: Mid-West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 54: Mid-West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 55: Mid-West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 56: Mid-West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Table 57: Mid-West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 58: Mid-West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Table 59: Mid-West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 60: Mid-West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Table 61: North East Market Value (US$ million) Analysis By Country, 2018 to 2033

Table 62: North East Market Volume (Units) Analysis By Country, 2018 to 2033

Table 63: North East Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 64: North East Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 65: North East Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Table 66: North East Market Volume (Units) Analysis By Functionality, 2018 to 2033

Table 67: North East Market Value (US$ million) Analysis By Style, 2018 to 2033

Table 68: North East Market Volume (Units) Analysis By Style, 2018 to 2033

Table 69: North East Market Value (US$ million) Analysis By Age, 2018 to 2033

Table 70: North East Market Volume (Units) Analysis By Age, 2018 to 2033

Table 71: North East Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 72: North East Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 01: United States Market Value (US$ million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: United States Market Value (US$ million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: United States Market Value (US$ million) Analysis, 2018 to 2022

Figure 04: United States Market Value (US$ million) Forecast, 2023 to 2033

Figure 05: United States Market Absolute $ Opportunity Value (US$ million), 2023 to 2033

Figure 06: United States Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 07: United States Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: United States Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: United States Market Attractiveness By Product Type, 2023 to 2033

Figure 10: United States Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 11: United States Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 12: United States Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 13: United States Market Attractiveness By Functionality, 2023 to 2033

Figure 14: United States Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 15: United States Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 16: United States Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 17: United States Market Attractiveness By Style, 2023 to 2033

Figure 18: United States Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 19: United States Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 20: United States Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 21: United States Market Attractiveness By Age, 2023 to 2033

Figure 22: United States Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 23: United States Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 24: United States Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 25: United States Market Attractiveness By Sales Channel, 2023 to 2033

Figure 26: United States Market Value (US$ million) Analysis By Region, 2018 to 2033

Figure 27: United States Market Volume (Units) Analysis By Region, 2018 to 2033

Figure 28: United States Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 29: United States Market Attractiveness By Region, 2023 to 2033

Figure 30: West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 31: West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 32: West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 33: West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 34: West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 35: West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 36: West Region Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 37: West Region Market Attractiveness By Functionality, 2023 to 2033

Figure 38: West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 39: West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 40: West Region Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 41: West Region Market Attractiveness By Style, 2023 to 2033

Figure 42: West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 43: West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 44: West Region Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 45: West Region Market Attractiveness By Age, 2023 to 2033

Figure 46: West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 47: West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 48: West Region Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 49: West Region Market Attractiveness By Sales Channel, 2023 to 2033

Figure 50: South East Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 51: South East Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 52: South East Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 53: South East Region Market Attractiveness By Product Type, 2023 to 2033

Figure 54: South East Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 55: South East Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 56: South East Region Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 57: South East Region Market Attractiveness By Functionality, 2023 to 2033

Figure 58: South East Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 59: South East Region Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 60: South East Region Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 61: South East Region Market Attractiveness By Style, 2023 to 2033

Figure 62: South East Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 63: South East Region Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 64: South East Region Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 65: South East Region Market Attractiveness By Age, 2023 to 2033

Figure 66: South East Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 67: South East Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 68: South East Region Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 69: South East Region Market Attractiveness By Sales Channel, 2023 to 2033

Figure 70: South West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 71: South West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 72: South West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: South West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 74: South West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 75: South West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 76: South West Region Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 77: South West Region Market Attractiveness By Functionality, 2023 to 2033

Figure 78: South West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 79: South West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 80: South West Region Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 81: South West Region Market Attractiveness By Style, 2023 to 2033

Figure 82: South West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 83: South West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 84: South West Region Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 85: South West Region Market Attractiveness By Age, 2023 to 2033

Figure 86: South West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 87: South West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 88: South West Region Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 89: South West Region Market Attractiveness By Sales Channel, 2023 to 2033

Figure 90: Mid-West Region Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 91: Mid-West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 92: Mid-West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 93: Mid-West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 94: Mid-West Region Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 95: Mid-West Region Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 96: Mid-West Region Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 97: Mid-West Region Market Attractiveness By Functionality, 2023 to 2033

Figure 98: Mid-West Region Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 99: Mid-West Region Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 100: Mid-West Region Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 101: Mid-West Region Market Attractiveness By Style, 2023 to 2033

Figure 102: Mid-West Region Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 103: Mid-West Region Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 104: Mid-West Region Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 105: Mid-West Region Market Attractiveness By Age, 2023 to 2033

Figure 106: Mid-West Region Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 107: Mid-West Region Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 108: Mid-West Region Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 109: Mid-West Region Market Attractiveness By Sales Channel, 2023 to 2033

Figure 110: North East Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 111: North East Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 112: North East Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 113: North East Market Attractiveness By Product Type, 2023 to 2033

Figure 114: North East Market Value (US$ million) Analysis By Functionality, 2018 to 2033

Figure 115: North East Market Volume (Units) Analysis By Functionality, 2018 to 2033

Figure 116: North East Market Y-o-Y Growth (%) Projections, By Functionality, 2023 to 2033

Figure 117: North East Market Attractiveness By Functionality, 2023 to 2033

Figure 118: North East Market Value (US$ million) Analysis By Style, 2018 to 2033

Figure 119: North East Market Volume (Units) Analysis By Style, 2018 to 2033

Figure 120: North East Market Y-o-Y Growth (%) Projections, By Style, 2023 to 2033

Figure 121: North East Market Attractiveness By Style, 2023 to 2033

Figure 122: North East Market Value (US$ million) Analysis By Age, 2018 to 2033

Figure 123: North East Market Volume (Units) Analysis By Age, 2018 to 2033

Figure 124: North East Market Y-o-Y Growth (%) Projections, By Age, 2023 to 2033

Figure 125: North East Market Attractiveness By Age, 2023 to 2033

Figure 126: North East Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 127: North East Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 128: North East Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 129: North East Market Attractiveness By Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA