The United States axillary hyperhidrosis treatment market will rise from USD 1,048.1 million in 2025 to USD 1,436.1 million by 2035, growing at a CAGR of 3.2%.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size in 2025 | USD 1,048.1 million |

| Projected United States Value in 2035 | USD 1,436.1 million |

| Value-based CAGR from 2025 to 2035 | 3.2% |

The United States axillary hyperhidrosis market is also constantly growing through the raising awareness regarding this condition and how it is presented as a form of medical ailment with good effective treatment opportunities. The state of excessive sweating or hyperhidrosis specifically under the arms affects the millions of American populations, impacting their critical quality of life. Awareness and publicity from physicians at higher levels, along with changes in the treatment methods of the disorder, such as Botox injections or prescription-strength antiperspirants, add to the growth of the market.

The major companies in this market include Allergan plc. (AbbVie), well-known for Botox-a widespread and highly effective treatment for severe underarm sweating; Journey Medical Corporation (Dermira, Inc.), known for Qbrexza, the first topical treatment that can be easily administered noninvasively; and Riemann A/S (Orkla) with well-known brands like SweatBlock and Certain Dri, fulfilling consumer demand for over-the-counter products with clinical-strength antiperspirants.

The growing acceptance of both clinical and OTC treatments, supported by increasing disposable incomes that are enabling patients to seek specialized care, supports the market. The rise in innovative products and an increase in concern for solutions that are more patient-centric will sustain growth in the years ahead to further solidify the USA as a key market for axillary hyperhidrosis treatments.

Explore FMI!

Book a free demo

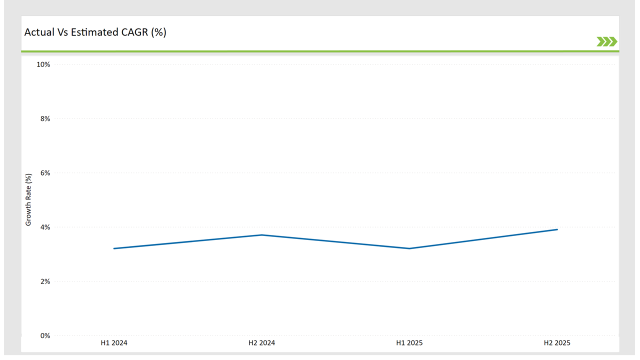

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States axillary hyperhidrosis treatment market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Axillary hyperhidrosis treatment market of the United States is expected to grow at 3.2% CAGR for the first half of 2023, followed by an upgradation to 3.7% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 3.2% in H1 and is expected to rise to 3.9% in H2. This pattern presents a decline of 0.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 23.40 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing axillary hyperhidrosis market of the United States, which is primarily affected by regulations, consumer trends, and improvements in axillary hyperhidrosis treatment. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Portfolio Leveraging: Allergan utilizes the key product Botox to help treat axillary hyperhidrosis. The company develops plans to enhance education in the clinical setting, teams up with dermatologists, and uses R&D spending to increase efficacy of products. The company places high priority on direct-to-consumer promotions to build further awareness, including physicians and patients desiring a longer term, non-surgical treatment of hyperhidrosis. |

| 2024 | Product Innovation: Journey Medical Corporation drives market growth through its innovative topical treatment, Qbrexza, which addresses unmet patient needs for convenience. The company prioritizes digital marketing to enhance product visibility, collaborates with healthcare providers for prescribing support, and explores partnerships to strengthen distribution channels. Ongoing clinical research ensures continuous improvement and product differentiation. |

| 2024 | Portfolio Expansion: Riemann A/S operates its business in a way to ensure that products like antiperspirants under Perspirex, are accessible and effective, over the counter. It adopts targeted marketing programs that emphasize long-lasting effects and dermatological endorsement. Expanding its retail partnerships with pharmacy chains and local branding strategies within the USA support the business's mission of addressing diverse consumer preferences. |

High Prevalence and Diagnosis Rates

Increased awareness among the population and healthcare professionals has improved the diagnosis rate for axillary hyperhidrosis in the United States. There are 5% of the population suffering from the same disease, but enhanced outreach programs of medical societies and pharmaceutical companies have made it less stigmatized. This awareness fosters demand for clinical solutions such as Botox and OTC products.

Insurance Coverage for Clinical Treatments

Insurance coverage for treatments which are FDA approved, such as Botox, is a major motivator in the United States. This makes it more affordable for patients, and more people are likely to seek professional treatments. The changing insurance environment, with collaboration between manufacturers and payers, also motivates patients to switch from OTC products to medical-grade products.

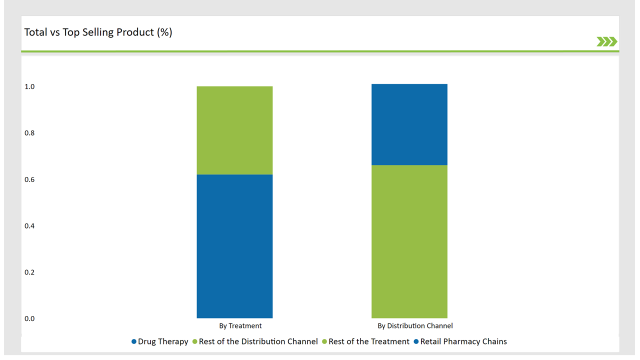

% share of Individual categories by Treatment and Distribution Channel in 2025

Drugged therapy holds a higher usage rate in the USA because of the usage of FDA-approved solutions, such as Botox and Qbrexza, primarily for their proven efficacy and increasing patient trust. Aggressive marketing by the companies along with high awareness among dermatologists ensure these treatments become must-recommend for more patients. Additionally, insurance coverage reduces the cost of out-of-pocket expenditure for these treatments.

The largest portion of retail pharmacy chains dominate in the United States, offering access to the highest number of locations. Chains like CVS and Walgreens actively stock products for hyperhidrosis and employ strategic shelf placement and promotional campaigns. These retail pharmacy chains provide convenience, reputation, and loyalty programs to encourage customers looking for affordable solutions to their excessive sweating.

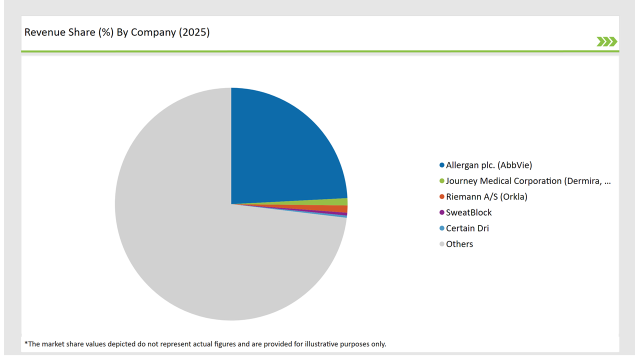

The United States axillary hyperhidrosis treatment market is moderately concentrated with a mix of pharmaceutical giants and niche players that contribute to the competitive landscape. The clinical treatment segment is dominated by key players like Allergan plc. (AbbVie) with Botox, supported by FDA approval and strong physician endorsements.

2025 Market share of United States Axillary Hyperhidrosis Treatment suppliers

Note: above chart is indicative in nature

Journey Medical Corporation (Dermira, Inc.) has managed to carve out a niche with Qbrexza, which is a topical solution for patients seeking non-invasive treatments. In the consumer space, Riemann A/S (Orkla), SweatBlock, and Certain Dri utilize the retail pharmacy chain and e-commerce websites to gain over-the-counter market share.

Innovation will continue to fuel competition with heavy investment in R&D from most firms, helping introduce advanced, patient-friendly solutions. Direct-to-consumer marketing and strategic partnerships with healthcare providers and pharmacies all intensify the dynamics. The best part is that a mix of clinical and OTC products will help companies target a broad consumer base, thus sustaining a steady growth in this evolving market.

By 2025, the United States axillary hyperhidrosis treatment market is expected to grow at a CAGR of 3.2%.

By 2035, the sales value of the United States axillary hyperhidrosis treatment industry is expected to reach United States is USD 1,436.1 million.

Key factors propelling the United States axillary hyperhidrosis treatment market include insurance coverage for clinical treatments as well as increase in disease prevalence and diagnosis rate.

Prominent players in the United States axillary hyperhidrosis treatment manufacturing include Allergan plc. (AbbVie), Journey Medical Corporation (Dermira, Inc.), Riemann A/S (Orkla), SweatBlock, Certain Dri. among others These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

In terms of treatment, the industry is divided into- drug therapy, botulinum toxins, and medicated wipes.

In terms of end user, the industry is segregated into- hospitals, general physician’s clinics, retail pharmacy chains and online sales

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.