The anti-osteoporosis fracture healing industry will be valued at a market value of USD 4,847.5 million by 2025, expanding at 2.9% annually, and is set to hit USD 6,451.7 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 4,847.5 million |

| Projected Value 2035 | USD 6,451.7 million |

| Value-based CAGR from 2025 to 2035 | 2.9% |

An aging population combined with the well-developed healthcare infrastructure of the USA, especially an increasing prevalence of osteoporosis, drives this market of fracture healing due to anti-osteoporosis medication. In this regard, major sources of osteoporotic fracture economic burden placed on the USA health care system exceeds USD 57 billion annually.

This was primarily because CMS focused on the management of osteoporosis, mainly because the majority of hip, spine, and wrist fractures take place in postmenopausal women and elderly men. FRAX is the most common tool by the USA physicians to determine fracture risk and thereby help guide their treatment decisions. This is further augmented by Medicare's value-based care and bundled payment models, which make aggressive treatment of osteoporosis more demanding, thus increasing the need for pharmaceuticals and medical interventions.

They are on a drive to innovate in drugs more precision medicine and digital health-to grow their osteoporosis portfolios. Pfizer is taking the lead on real-world data analytics. It applies patient registries to optimize the pathway of treatment. Investments in the long-acting bisphosphonates and combination therapies can ensure higher adherence and effectiveness for the patients. In keeping with these objectives, osteoporosis treatments innovations in the USA market still focus on growing issues of early intervention and novel drug therapies.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

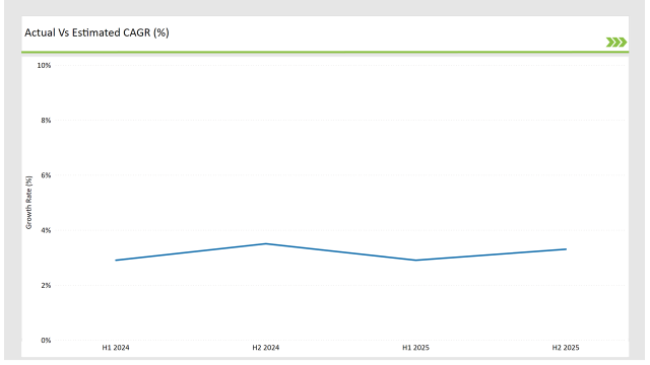

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States acetaminophen market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

United States market is expected to grow in the Anti-Osteoporosis Fracture Healing sector at a CAGR of 2.9% in H1 of 2023, and by second half, it should be greater than 3.5%. This is expected to decline a bit at 2.9% in H1 of 2024. The same, however, should be up by H2 to 3.3%. This pattern presents decline of 0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 16 basis points compared with the second half of 2023.

These figures represent a dynamic and fast-changing United States acetaminophen market, largely influenced by regulations, consumer trends, and improvements in acetaminophen. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Pfizer has been working with real-world evidence and predictive analytics in its effort to aid in betterment of the way osteoporosis is being treated in the United States. It is investing in personalized treatment pathways through the implementation of genomic screening and AI-based risk assessment tools to find those who are high-risk patients. |

| 2024 | Merck focuses on extended-release bisphosphonates and novel combination therapies to improve patient compliance and decrease dosing frequency. |

Medicare & Private Insurance Reimbursement Expansion

The USA osteoporosis market enjoys wide Medicare and private insurance coverage, which has significantly increased the number of patients who can access anti-osteoporosis medications and fracture-prevention programs. Medicare Part D covers bisphosphonates, biologics, and other osteoporosis drugs, making them affordable for seniors, an important target population.

In addition, private insurers are developing value-based osteoporosis management programs, reimbursing treatments based on fracture prevention success rates. This reimbursement structure encourages physicians to prescribe more and adopt new drug formulations.

Rise of Digital Health & AI in Fracture Risk Prediction

The USA is among the leaders regarding AI-driven solutions in healthcare for fracture risk predictability and is integrating these prediction tools and the digital health platforms into routine practice. Wearables, EHRs, AI-based bone assessments, and assessments are allowing better early detection and personalized treatment protocols for osteoporosis.

Reappraisals of efficacy and adherence towards drugs are performed by companies including Pfizer and GSK through a real-world approach to data analysis, thus preventing fractures and saving patients.

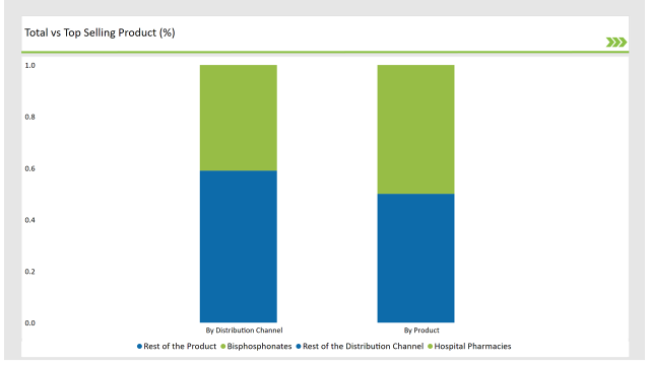

% share of Individual categories by Drug Type and by Distribution Channel in 2025

The USA market will be dominated by bisphosphonates on account of their long-term efficacy, cost-effectiveness, and Medicare coverage. Bisphosphonates are the first-line treatment choice among physicians, especially the oral formulations alendronate, given the extensive research history and its extensive availability.

Long-acting intravenous formulations like zoledronic acid are also becoming popular because of once-a-year injections that minimize issues due to noncompliance of the patients. Merck's longer-form formulation investment is also fortifying the segment's lead position.

In the USA, hospital pharmacies are critical in osteoporosis treatment, mainly because Medicare and private insurance regulations mandate physician oversight for certain osteoporosis treatments. Injectable biologics such as denosumab and teriparatide are administered in hospitals, thereby ensuring proper dosing and monitoring. Moreover, hospital-led fracture prevention programs streamline osteoporosis treatment pathways, making hospital pharmacies the primary access point for advanced osteoporosis medications

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

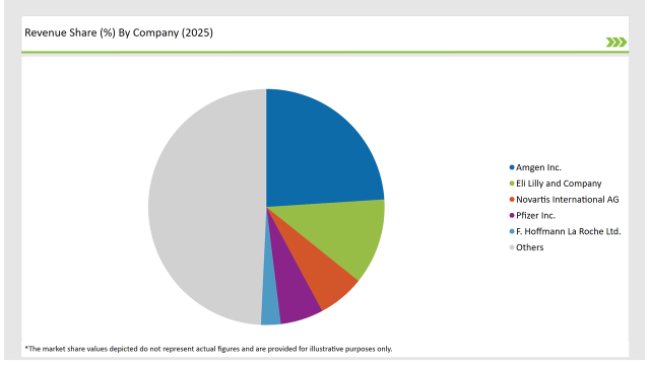

The USA anti-osteoporosis market is highly consolidated with large pharmaceutical giants. By leading end pipelines, alliances with robust insurance, and integration of digital health, Pfizer, Merck, and GSK are at the forefront. However, next-generation osteoporosis therapy biotech companies are emerging as strong contenders, introducing targeted biologics and AI-driven treatment solutions.

Continued FDA approval acceleration for biologic therapies and innovative drug formulations maintain the USA as a competitive, innovation-driven osteoporosis market. Future growth in the market will depend on precision medicine, digital health, and patient-centered treatment strategies.

2025 Market share of United States Anti-Osteoporosis Fracture Healing suppliers

Note: above chart is indicative in nature

In terms of drug type, the industry is divided into Bisphosphonates (Osteoporosis and Others), Calcitonin (Osteoporosis and Others), Estrogen or Hormone Replacement Therapy (Osteoporosis and Others), Anabolics (Osteoporosis and Others), others (Osteoporosis and Others)

In terms of route of administration, the industry is segregated into oral and injectable.

In terms of distribution channel, the industry is divided into hospital pharmacies, drug stores, retail pharmacies and E-commerce and Others.

By 2025, the United States Anti-Osteoporosis Fracture Healing market is expected to grow at a CAGR of 2.9%.

By 2035, the sales value of the United States acetaminophen industry is expected to reach United States is USD 6,451.7 million.

The key drivers fueling the growth of the United States acetaminophen market include government-supported bone health programs and high demand for bioengineered and resorbable implants.

Prominent players in the United States acetaminophen manufacturing include Pfizer Inc., Sanofi, Janssen Pharmaceuticals (Johnson & Johnson), Bayer AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd, Cardinal Health Inc., Novartis AG, Abbott, Sun Pharmaceutical Industries Ltd, Procter & Gamble Company, Amneal Pharmaceuticals among Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Explore Therapy Area Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.