The USA animal feed ingredients market is projected to reach a value of USD 4,904.0 Million in 2025, growing at a CAGR of 5.5% over the next decade to an estimated value of USD 8,338.7 Million by 2035. The rising demand for high-quality feed, sustainable nutrition solutions, and specialty ingredients is driving market growth.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 4,904.0 Million |

| Projected USA Industry Value in 2035 | USD 8,338.7 Million |

| Value-based CAGR from 2025 to 2035 | 5.5% |

The market for feed ingredients in the USA is experiencing significant and rapid expansion (due to three primary factors): a heightened focus on livestock health, advancements in sustainable aquaculture practices, and improvements in pet feed nutrition. Up to 50% of the feed components currently available in the market originate from plant-based sources, which is largely a response to increasing consumer demand for GMO-free and environmentally friendly feed alternatives.

The additives are particularly valuable because they assist animals in enhancing digestion, gaining weight, and effectively combating diseases. Although the focus on plant-based solutions is strong, the need for a balanced approach remains evident.

Animal feed production has undergone significant changes through advanced precision feeding methods, innovative enzymes, and the investigation of new protein alternatives. These industry-specific innovations combine market demands with sustainable production models that follow consumer preferences.

The market for feed ingredients will experience steady expansion because sustainability and nutrition awareness growth maintain momentum, thus creating new possibilities for stakeholders who develop innovative solutions for evolving agriculture The USA feed ingredients market demonstrates positive growth trends because of its focus on health-oriented and sustainable technologies and innovations.

Explore FMI!

Book a free demo

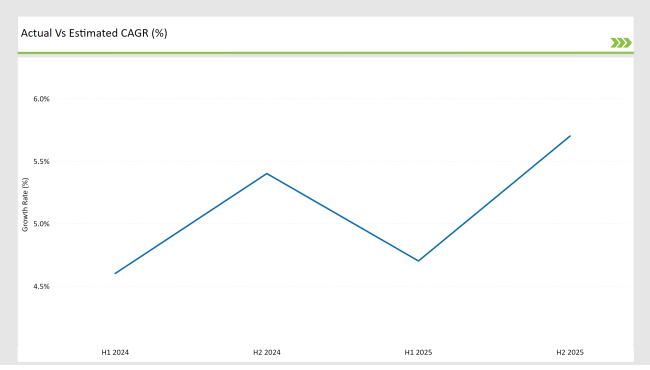

The biannual market update emphasizes the increasing emphasis on sustainable and organic feed components, especially within livestock and aquaculture nutrition. The advancement of specialized feed additives, improved protein sources, and sustainable farming practices is driving ongoing market growth.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Cargill, Inc.: Expanded its sustainable plant-based feed ingredient line to meet growing demand for non-GMO livestock feed. |

| March 2024 | Archer Daniels Midland (ADM): Developed a probiotic-enhanced feed additive to improve gut health in poultry and swine. |

| May 2024 | Nutreco N.V.: Partnered with aquaculture farms to supply high-protein algae-based feed solutions. |

| July 2024 | Purina Animal Nutrition: Introduced a new specialty pet feed formulation for improved digestion and coat health. |

| September 2024 | BASF SE: Launched an advanced amino acid supplement for dairy cows, enhancing milk production and nutrient absorption. |

Diversification of Sustainable and Alternative Protein Sources

The growing emphasis on sustainability and the minimization of environmental impact is the key contributor to the rising need for alternative protein source options in animal feed. Fermented proteins, algae-based feed, and insect meals are the ingredients that are recording popularity as substitutes for traditional soy and fishmeal feeds, respectively.

Environmental protein solution implies a higher nutrient density, a reduced ecological footprint, and a greater digestibility of animals. Feeding conversion efficiency studies lead to the expectancy of quasi-protein accession in the livestock sector - fish farms, and birds.

Development of Functional Feed Additives for Promoting Animal Health

The addition of functional additives such as probiotics, prebiotics, and enzymes into eatables is altering the course of the animal feed field. These materials are the essential support to the gut microbiome's balance, nutrient absorption, and immune system effectiveness, thus it can be possible to leave out the antibiotics in the growth promoters.

Encapsulation technology and nano-nutrient delivery represent more recent advancements in the field. As of the current date, there has been a notable increase in consumer demand for antibiotic-free foods, leading to the growing importance of functional feed additives as essential elements in precision livestock nutrition strategies.

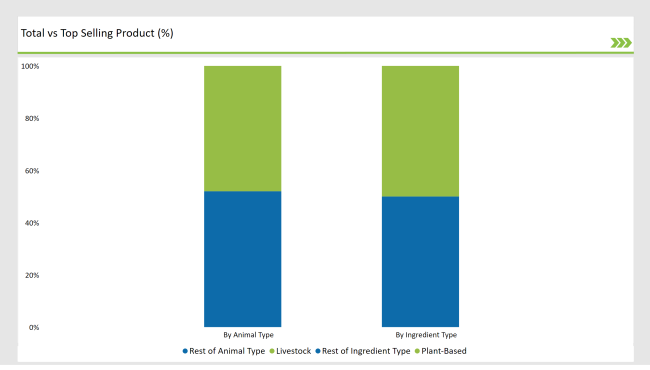

% share of Individual Categories Ingredient Type and Animal Type in 2025

Plant-Derived Ingredients Control the Market

Plant-derived ingredients are the major force in the animal feed business. They have the leading position of 50% in the market due to the increasing interest of consumers in the production of sustainable, non-GMO, and allergen-free feed sources.

The continuous growth in the use of alternative proteins including pea proteins and fermented plant proteins together with soybean meal establishes them as vital elements for animal and pet nutrition. Rising consumer demand for organic and antibiotic-free animal feed has substantially increased the market for vegetable-based animal feed substitutes.

Farmers resist completely embracing dietary changes caused by consumer preferences due to traditional farming approaches although these new preferences are vital. The opposition to these alternatives has presented itself as an obstacle to advancement yet more people now recognize the benefits of such alternatives.

Livestock Feed Is the Segment with the Highest Market Share

Livestock feed is the dominant part of the market with 48%, which shows the constant growth of dairy, poultry, and cattle farming industries that it is a reflection of. The new and improved formulations of high-quality feed that come enriched with the right balance of amino acids, omega fatty acids, and probiotic blends are profoundly affecting animal growth rates and disease resistance positively.

By following the newest scientific findings in livestock feeding such as precision feeding and having the right animal nutrition, this segment will be, in my opinion, the main driving force for the further increase in market demand.

Note: above chart is indicative in nature

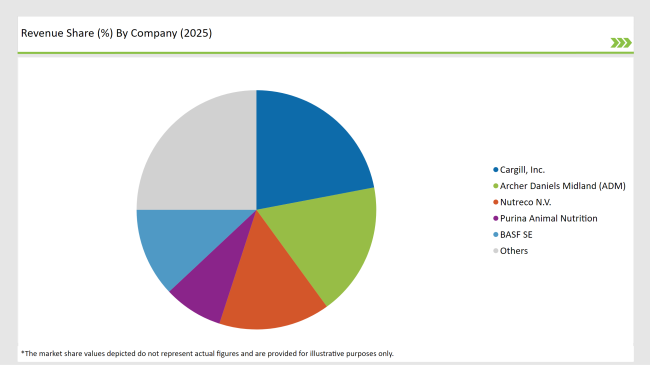

Main competitors in the USA animal feed ingredients market direct their efforts toward sustainable products precision nutritional advances and high-performance solutions for animal feed. Five leading industry companies consist of Cargill, ADM, Nutreco, Purina Animal Nutrition, and BASF SE who lead through innovations in feed formulations strategic partnerships, and ongoing research and development initiatives.

The modern demand for sustainable feed components with alternative protein sources has led manufacturers to explore fermentation-based animal feeds together with insect proteins and enzyme-modified solutions. The rise of livestock efficiency requirements and decreased feed waste has pushed companies to develop AI-control feeding approaches combined with nutritional optimization systems.

The demand for aquaculture feed and improved pet nutrition formulations drives ingredient preference shifts which makes functional feed additives the main growth factor in this sector.

The market is expected to grow at a CAGR of 5.5% from 2025 to 2035.

The USA animal feed ingredients market is projected to reach USD 8,338.7 Million by 2035.

Key drivers include rising demand for high-quality feed, innovations in specialty ingredients, and the shift toward sustainable feed solutions.

Plant-based ingredients lead by ingredient type, while livestock feed dominates the animal type segment in 2025.

Top manufacturers include Cargill, ADM, Nutreco, Purina Animal Nutrition, and BASF SE.

By ingredient type, the market includes plant-based ingredients, animal-based ingredients, additives, and specialty ingredients.

By animal type, the industry is segmented into livestock, aquaculture, pets, equine, and others.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.