The USA and Canada molded fiber pulp packaging market is developing with great momentum. Increasing demand across food and beverages, health care, and consumer electronics with respect to green, eco-friendly, and recycled packaging is driving the market. The growth drivers for this end market are advancing molded fiber technologies, restrictions on single-use plastics, and increasing consumer awareness concerning environmental sustainability.

Manufacturers are focusing on developing innovative molded fiber solutions, such as water-resistant and customizable designs, to replace traditional plastic packaging. Partnerships with quick-service restaurants (QSRs), electronics companies, and packaging firms are further accelerating the adoption of molded fiber pulp packaging in North America.

Explore FMI!

Book a free demo

Summary

The key players of the molded fiber pulp packaging market in the USA and Canada, by analysis, have been put forth. This would be based on innovation and sustainability that Huhtamaki Oyj offers to customers with molded fiber products but experiences production cost constraints.

Pactiv Evergreen Inc. thrives in the foodservice space but is a small player for scaling in niche markets. UFP Technologies excels in strong, protective packaging but is competitive due to alternative, low-cost packaging options. Opportunities lie in sustainability trends and increasing applications for molded fiber packaging, whereas threats are volatile raw material prices and changing regulations.

Huhtamaki Oyj

Huhtamaki demonstrates strengths in its advanced, recyclable molded fiber products. However, weaknesses include high production costs due to sophisticated manufacturing processes. Opportunities exist in expanding partnerships with QSRs and food packaging companies. Threats arise from raw material price volatility and competition from emerging market players.

Pactiv Evergreen Inc.

Pactiv Evergreen excels in producing molded fiber packaging for the foodservice industry. However, the company faces challenges in penetrating niche and premium segments. Opportunities lie in developing customized packaging solutions for consumer electronics. Threats include intense competition from plastic packaging alternatives.

UFP Technologies

UFP Technologies specializes in protective and durable molded fiber solutions. However, weaknesses include limited market penetration in certain industries. Opportunities exist in innovating with water-resistant molded fiber for e-commerce packaging. Threats stem from regulatory changes and market competition from alternative materials.

| Category | Market Share (%) |

|---|---|

| Top 3 Players (Huhtamaki Oyj, Pactiv Evergreen Inc., UFP Technologies) | 14% |

| Rest of Top 5 Players | 07% |

| Next 5 of Top 10 Players | 08% |

Type of Player & Industry Share (%)

| Type of Player | Market Share (%) |

|---|---|

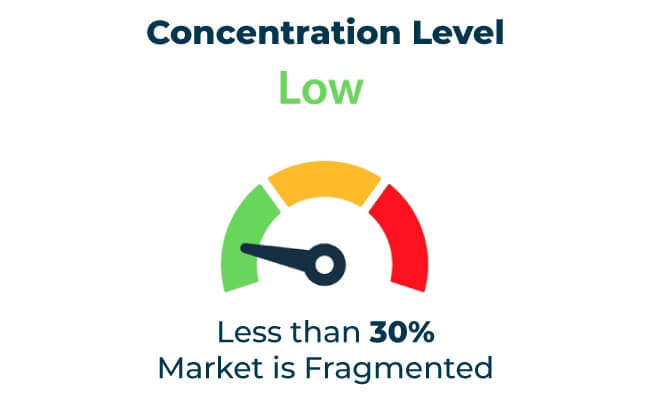

| Top 10 Players | 29% |

| Next 20 Players | 48% |

| Remaining Players | 23% |

Year-on-Year Leaders

Regulating single-use plastics and encouraging sustainable packaging has been a critical step for the USA and Canada. Regulatory policies, such as the Canadian Environmental Protection Act and local state-level bans of plastics in the USA, have spur innovation in molded fiber pulp solutions for packaging.

Emerging markets in Asia-Pacific, Europe, and South America present significant growth potential for manufacturers in the USA and Canada. Demand for sustainable and compliant molded fiber packaging is increasing globally to meet evolving consumer and regulatory expectations.

In-House vs. Contract Manufacturing

The USA and Canada molded fiber pulp packaging market will expand through innovations in sustainable materials, advanced recycling methods, and partnerships with key industry stakeholders. Companies focusing on compliance, eco-friendliness, and cost-effective solutions will dominate this evolving market.

| Tier | Key Companies |

|---|---|

| Tier 1 | Huhtamaki Oyj, Pactiv Evergreen Inc., UFP Technologies |

| Tier 2 | DS Smith, Genpak |

| Tier 3 | Hartmann Group, Pro-Pac Packaging |

The USA and Canadian molded fiber pulp packaging market shall grow steadily backed by stringent rules, growing need for sustainability awareness among consumers, and the rising development of fiber molding technologies. Companies that seek innovation, compliances, and eco-friendliness shall succeed in this swiftly changing market.

Key Definitions

Abbreviations

Research Methodology

This report is based on primary research, secondary data analysis, and market modeling. Insights were validated through industry expert consultations.

Market Definition

The molded fiber pulp packaging market in the USA and Canada includes recyclable, moisture-resistant, and customized packaging solutions for food, healthcare, electronics, and retail sectors.

Rising demand for sustainable and recyclable packaging solutions and stringent regulations.

Markets in this sector are forecast to grow to USD 3.49 billion by 2035, with a compound annual growth rate (CAGR) of 5.2%.

Leading players include Huhtamaki Oyj, Pactiv Evergreen Inc., and UFP Technologies.

Key challenges include high production costs and regulatory complexities.

Opportunities lie in water-resistant coatings, advanced recycling technologies, and partnerships with FMCG brands.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.