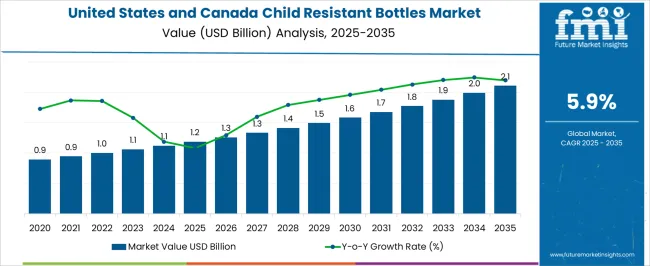

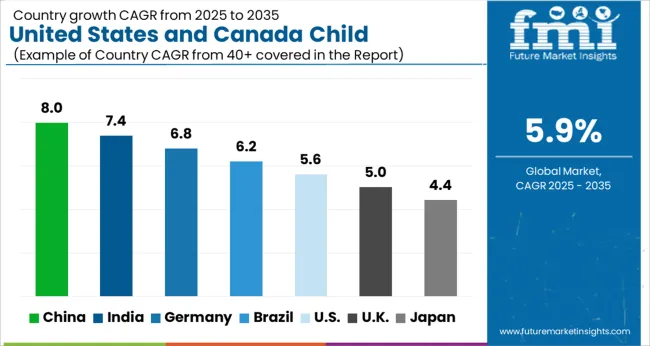

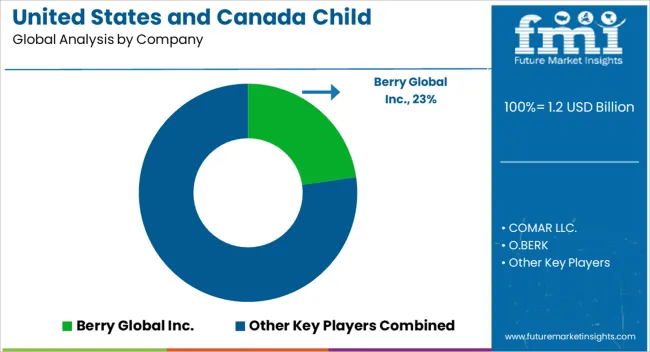

The United States and Canada Child Resistant Bottles Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| United States and Canada Child Resistant Bottles Market Estimated Value in (2025 E) | USD 1.2 billion |

| United States and Canada Child Resistant Bottles Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The United States and Canada child resistant bottles market is experiencing consistent growth driven by rising safety regulations, heightened consumer awareness, and strict packaging compliance standards across pharmaceuticals, nutraceuticals, and household products. Regulatory frameworks emphasize child safety while ensuring product accessibility for adults, which has encouraged widespread adoption of advanced packaging formats.

Manufacturers are investing in innovative designs that balance safety with user convenience, including lightweight structures, recyclable materials, and ergonomic closures. The demand is further reinforced by the expansion of over the counter medication sales, growth in cannabis packaging requirements, and increased use of child resistant solutions in personal care products.

The market outlook remains strong as evolving design innovation and sustainability considerations align with regulatory mandates, reinforcing long term adoption across multiple end use categories.

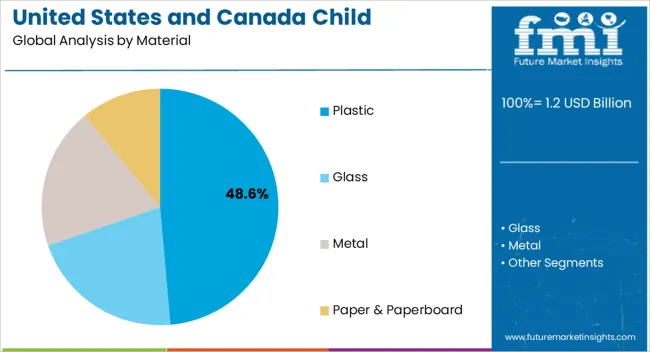

The plastic material segment is projected to account for 48.60% of total revenue by 2025, establishing itself as the leading material category. This growth is being supported by its durability, cost efficiency, and flexibility in molding into diverse shapes and sizes suitable for regulatory compliance.

Plastic has remained the material of choice due to its lightweight characteristics, resistance to breakage, and compatibility with a wide range of closure types. Manufacturers have also benefited from advancements in recyclable and biodegradable plastic options, ensuring sustainability without compromising safety standards.

These factors have consolidated the dominance of plastic in the child resistant bottles market.

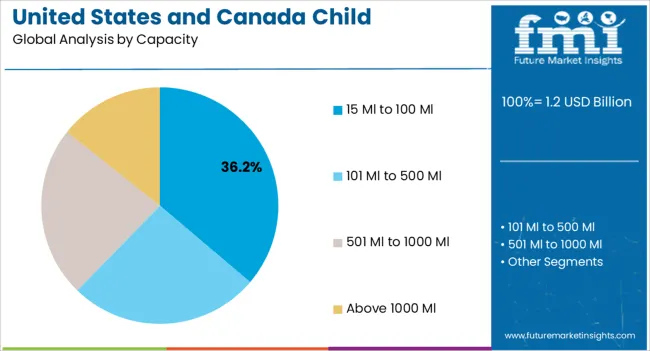

The 15 Ml to 100 Ml capacity segment is expected to represent 36.20% of total market revenue by 2025 within the capacity category, positioning it as the most prominent size range. This preference is driven by its suitability for pharmaceuticals, nutraceuticals, and concentrated liquid formulations where controlled dispensing and child safety are critical.

The segment’s adoption is further reinforced by its compatibility with both prescription and over the counter packaging, as well as growing use in regulated cannabis products.

This balance of convenience, safety, and regulatory alignment has positioned this capacity range as a leading choice among manufacturers and consumers.

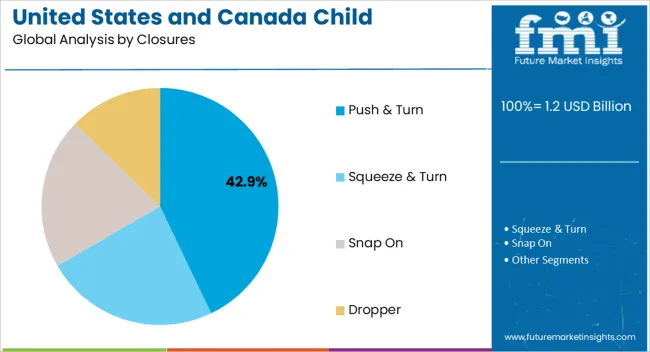

The push and turn closures segment is forecasted to hold 42.90% of total revenue by 2025, making it the dominant closure type. Its prominence is attributed to its proven safety performance, ease of integration with plastic containers, and wide consumer familiarity.

This closure mechanism requires a coordinated action that children find difficult, while adults can open it without excessive effort. Manufacturers continue to favor this design due to its cost effectiveness, regulatory acceptance, and adaptability to multiple bottle formats.

The push and turn mechanism remains a trusted standard in child resistant packaging, reinforcing its leadership in the closures category.

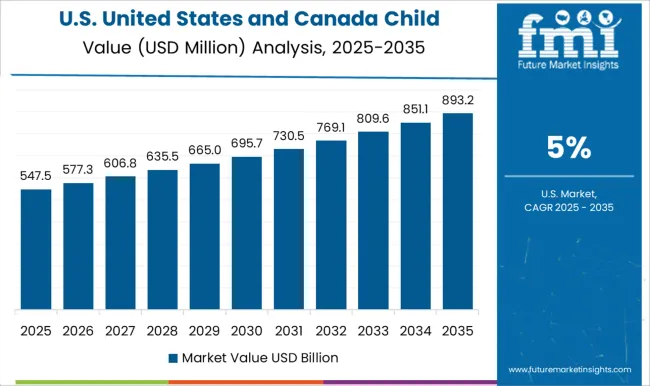

The United States and Canada child resistant bottles market exhibited a CAGR of 4.3% during the historical period. It crossed a market value of USD 1,006.7 million in 2025, as compared to USD 0.9 million in 2020.

The need for child-resistant packaging has become increasingly important due to the growing number of accidental ingestions of harmful substances by children. To address this issue, various regulatory agencies have implemented regulations requiring child-resistant packaging for certain products.

In the United States, the Poison Prevention Packaging Act (PPPA) requires child-resistant packaging for a wide range of hazardous household substances. These include cleaning products, pesticides, and flammable liquids.

The United States Food and Drug Administration (FDA) also requires child-resistant packaging such as bottles for prescription drugs and a few over-the-counter medications. These include pain relievers and sleep aids. These products can be harmful or even fatal if ingested in large quantities, especially by children.

Child-resistant packaging for prescription drugs and certain over-the-counter medications must meet specific requirements set by the FDA. These requirements include testing to ensure that the packaging is difficult for young children to open but easy for adults to use. The packaging must also be designed to remain child-resistant throughout the life of the product.

| Country | United States |

|---|---|

| Market Share (2025) | 83.60% |

| Market Share (2035) | 81.8% |

| BPS Analysis | -180 |

| Country | Canada |

|---|---|

| Market Share (2025) | 16.40% |

| Market Share (2035) | 18.2% |

| BPS Analysis | 180 |

Need for Child-resistant Packaging to Skyrocket in the United States as Sales of Prescription Medications Rise

There have been growing concerns about the safety of children in the United States. It has led to increased regulations around the use of child-resistant packaging for various products. These include medicines, household chemicals, and other hazardous materials.

As a result, manufacturers are increasingly turning to child-resistant packaging solutions to meet these regulations and ensure the safety of their customers. Rising accidental poisoning incidents involving children have further highlighted the need for child-resistant packaging.

According to the American Association of Poison Control Centers, over 2 million poisoning exposures occur each year in the United States. Most of these incidents involve children under the age of six.

As regulations around child-resistant packaging become more stringent, manufacturers are increasingly turning to this type of packaging solution. They aim to meet these requirements and ensure the safety of their customers. It is especially true in industries such as pharmaceuticals and healthcare where child-resistant packaging is mandatory for prescription medications.

Rising Cases of Accidental Ingestions in Canada to Spur Demand for Child-Resistant Containers

According to the Government of Canada, the pharmaceutical sector is one of the most advanced industries in Canada. It is made up of businesses that produce over-the-counter medications, generic medications, and newly developed pharmaceuticals.

Total sales of medicinal goods and over-the-counter medicines in the country are USD 29.9 billion. It increased by 35.3%, making it the 9th largest market in the world.

The pharmaceutical sector in Canada is increasingly focusing on patient safety and compliance with government regulations. Health Canada has specific requirements for child-resistant packaging for certain products, including prescription drugs and over-the-counter medications.

Manufacturers must meet these requirements to comply with government regulations and ensure that their products are safe for use. Child-resistant bottles are a popular choice for complying with these regulations, as they are highly effective in preventing accidental ingestions by young children.

Rising Demand for Durable Solutions to Propel Sales of Plastic Child Resistant Blister Packaging

The plastic segment by the material is estimated to generate around 61.6% of the United States and Canadas child-resistant bottle market share by 2035. Plastic child-resistant bottles are set to be one of the most popular types of child-resistant packaging.

The segment is expected to reach a valuation of USD 2.1 billion by 2035. Child-resistant packaging needs to be able to withstand a certain amount of force and pressure without breaking or opening. Plastic is strong and resilient, making it an ideal material for creating packaging that is both child-resistant and durable.

Child Resistant Closures in Squeeze and Turn Format to Gain Traction with Rising Need for Customization

Growth of squeeze and turn closures is likely to surge at a moderate CAGR of 6.4% during the forecast period. Squeeze & turn closures are compliant with regulations set by the Consumer Product Safety Commission (CPSC) and the Poison Prevention Packaging Act (PPPA).

These regulations require that certain products such as prescription drugs and household chemicals must be packaged in child-resistant containers to prevent accidental ingestion by children. Squeeze & turn closures meet these requirements, making them an ideal choice for manufacturers who want to ensure that their products are safe for consumers.

Squeeze & turn closures' popularity is escalating as they can be used on a wide range of container types, including plastic and glass bottles & jars. They are also available in various sizes, making them suitable for use with different container volumes.

Squeeze & turn closures can be customized to meet specific branding requirements. They can be printed with logos or other branding elements. It makes them an excellent choice for companies looking to differentiate their products in the market.

Leading companies in the market for child resistant bottles across the United States and Canada are concentrating on developing innovative child resistant packaging solutions. They are set to experience high demand for child safe packaging solutions from diverse industries such as pharmaceutical and chemical.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.2 billion |

| Projected Market Valuation (2035) | USD 2.1 billion |

| Value-based CAGR (2025 to 2035) | 5.9% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) |

| Segments Covered | Material, Capacity, Closure, Country |

| Key Countries Covered | United States, Canada |

| Key Companies Profiled | Berry Global Inc.; COMAR LLC.; O.BERK; Origin Pharma Packaging; SGD Pharma; KISICO GmbH; BERICAP; Weener; NEUTROPLAST; FH Packaging; United States Plastics Corp; Berlin Packaging; SKS Bottles & Packaging, Inc; C.L Smith; Hach |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global united states and Canada child resistant bottles market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the united states and Canada child resistant bottles market is projected to reach USD 2.1 billion by 2035.

The united states and Canada child resistant bottles market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in united states and Canada child resistant bottles market are plastic, _polyethylene (pe), _polyethylene terephthalate (pet), _polypropylene (pp), _others (pvc), glass, metal and paper & paperboard.

In terms of capacity, 15 ml to 100 ml segment to command 36.2% share in the united states and Canada child resistant bottles market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA