The UK wireless telecommunication services industry will estimate a market value of USD 1,09,315.4 million in 2025 and poised at a CAGR of 7.1%, reaching USD 2,17,565.3 million by the end of 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 1,09,315.4 million |

| Projected UK Industry Size in 2035 | USD 2,17,565.3 million |

| Value-based CAGR from 2025 to 2035 | 7.1% |

The market is increasing due to the increased demand for high-speed connectivity, urbanization, and advanced wireless technologies. With the 5G networks being rolled out at a fantastic pace across the UK, it is expected that it is helping in the race towards faster and reliable services in various industries including BFSI, healthcare, retail, IT & telecom.

The smart city initiatives help for increasing adoption of IoT solutions in urban regions help to propel the market demand. As the businesses help for digital transformation, wireless solutions play very crucial role for ensuring connectivity and data security. The country strong commitment for fiber and 5G deployment help for strengthen its digital infrastructure, reinforcing telecom market growth.

Explore FMI!

Book a free demo

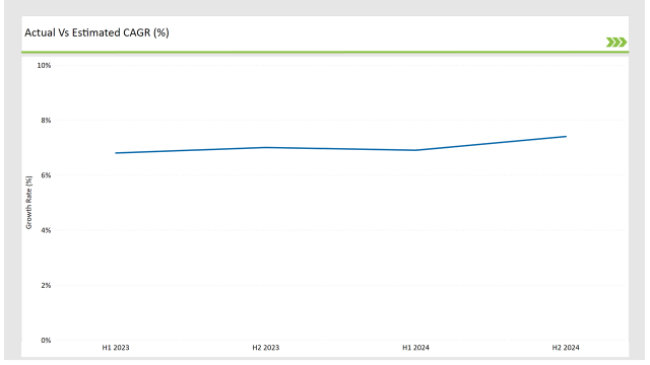

The table below highlights the CAGR trends for the UK market over six-month intervals, providing stakeholders with key growth patterns.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 6.8% |

| H2, 2024 | 7.0% |

| H1, 2025 | 6.9% |

| H2, 2025 | 7.4% |

H1 signifies January to June, while July to December analysis is signified through H2

The accelerating 5G rollouts and focused on expanding the cloud-based telecom services propelling the market growth. Growth trends show the CAGR rising from 6.8% in H1 2024 to 7.4% in H2 2025, highlighting steady industry performance.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Vodafone expands 5G standalone networks across major UK cities. |

| Oct-24 | BT Group partners with Google Cloud to enhance enterprise connectivity solutions. |

| Mar-24 | EE launches ‘NextGen 5G,’ improving speed and reliability for business users. |

| Sep-24 | Three UK collaborates with a regional telecom provider to enhance rural connectivity. |

| Dec-23 | Ofcom introduces new spectrum auction policies to increase competition in 5G deployment. |

To stay competitive, UK telecom providers partner with cloud and IT service providers, offering advanced cloud-managed solutions and AI-powered telecom services. Strategic investments in digital infrastructure ensure that companies lead in innovation.

5G Revolutionizes Connectivity

The UK leads 5G deployment, with Vodafone, BT Group, EE, and Three UK driving adoption. Ultra-low latency and high-speed connectivity of 5G power autonomous vehicles, AR/VR applications, and industrial automation. The businesses use 5G to boost productivity and deliver new digital services that enhance user experience.

The consumers help for seamless streaming, ultra-fast downloads, and strong IoT integration help improve digital lifestyles. The continued investments will also expand the coverage of 5G networks, connecting more than 90% of the UK population by 2030.

Cloud Services Dominate the Market

The shift toward cloud-managed solutions transforms the UK telecom industry. BFSI, healthcare, and government sectors use cloud computing for secure data access, remote collaboration, and real-time decision-making. Financial institutions depend on cloud-based solutions for fraud detection and secure transactions, while healthcare organizations store and access electronic medical records (EMRs) securely.

The telecom-managed services segment is set to grow at a CAGR of 7.9%, surpassing traditional telecom services as companies focus on agility, security, and cost-efficiency.

IoT and Smart Cities Expand Opportunities

UK smart city initiatives incorporate IoT applications, transforming urban infrastructure. IoT-powered solutions optimize traffic management, enhance public safety, and support automated energy management systems. The various industries such as healthcare, manufacturing and transportation benefit from IoT-enabled automation, improving efficiency and operational reliability.

Telecom providers play a very crucial role for deploying strong IoT networks help for ensuring real-time data collection and seamless connectivity for businesses and smart city projects.

Investments in Rural Connectivity Increase

The UK government and private telecom firms are pouring money into the expansion of wireless infrastructure in rural areas. The UK’s Gigabit Broadband Programme is now a massive engine of delivering high-speed broadband to remote communities and boosting tele-medicine, online education and e-commerce.

This builds on rural broadband and mobile networks, which in turn opens up new market access for telcos for underserved regions.

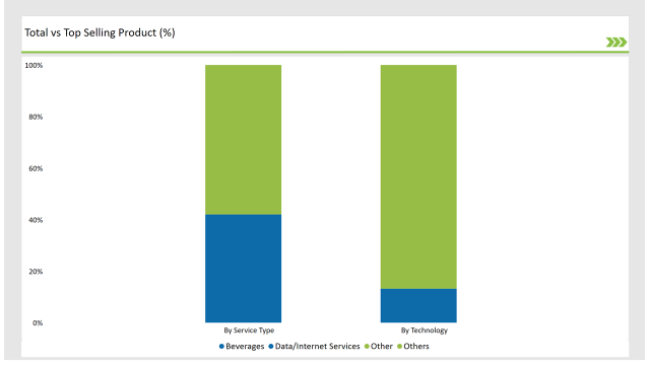

| Service Type | Market Share (2025) |

|---|---|

| Data/Internet Services | 42.0% |

| Fixed Voice Services & Messaging | 21.8% |

| Telecom Managed Services | 19.6% |

| Cloud Services | 16.6% |

The data/internet services segment dominates due to the increasing reliance on high-speed broadband for remote work, online education, and digital streaming. Meanwhile, telecom-managed services and cloud services experience rapid adoption as industries integrate advanced digital solutions for operational efficiency.

| Technology | Market Share (2025) |

|---|---|

| 3G | 13.2% |

| 4G | 51.8% |

| 5G | 35.0% |

While 4G remains dominant and the businesses & consumers are focused on adopting 5G for faster and more reliable connectivity. The phased-out 3G technology accelerates the shift to advanced networking solutions, including edge computing and IoT platforms.

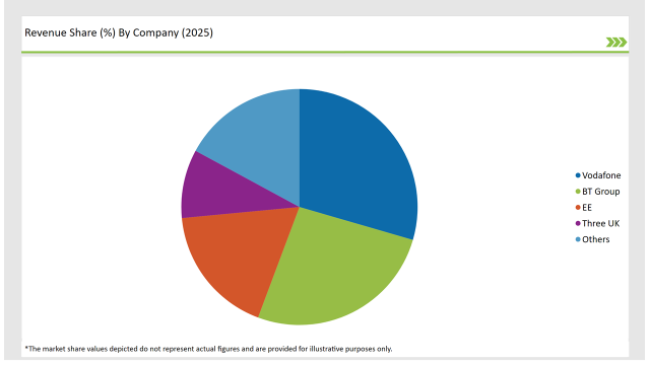

The majors are strongly focused on innovating 5G network expansion and cloud-based telecom services investment. The UK wireless telecom market is very competitive. The leading companies in the UK wireless telecom market are Vodafone, BT Group, EE and Three UK.

| Vendors | Market Share (2025) |

|---|---|

| Vodafone | 29.5% |

| BT Group | 26.2% |

| EE | 17.8% |

| Three UK | 9.4% |

| Others | 17.1% |

The industry will poised at a CAGR of 7.1% from 2025 to 2035.

The market will reach by the end of 20235 is USD 2,17,565.3 million.

The London, Manchester, and Birmingham are dominating due to urbanization and a tech-savvy population.

Vodafone, BT Group, EE, and Three UK dominate the UK wireless telecom industry.

Data/internet services, fixed voice services & messaging, telecom-managed services, and cloud services drive the market. Data services dominate due to growing high-speed internet reliance.

The market comprises 3G, 4G, and 5G technologies. The move from 4G to 5G reflects the need for faster and more efficient connectivity.

BFSI, healthcare, retail & e-commerce, IT & telecom, travel & hospitality and government sectors lead the adoption of wireless solutions.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.