The UK starch derivatives market is expected to achieve a market size of USD 1,743.0 million by 2025, with its valuation projected to expand further, reaching approximately USD 2,690.5 million by 2035. This growth reflects a compound annual growth rate (CAGR) of 4.4% over the forecast period, supported by increasing demand in the food & beverage sector, the expansion of starch-based sweeteners, and innovations in functional starch applications across industries.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 1,743.0 million |

| Projected UK Value (2035) | USD 2,690.5 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

With food and beverages dominating the industry at 41.3% market share, the UK starch derivatives industry is transforming quickly. There is a growing need for starch and sweetener modifications among the processed food and beverage industries because they are used to thicken, stabilize, and bind.

Cargill and Roquette, with origins in the United Kingdom, along with Tate & Lyle PLC, are at the forefront of innovation today. As competition increases with regional players and niche brands hungry for market share with specialty products like biodegradable packaging stems, these big players too are investing in specialty food applications.

Sustainable and eco-friendly practices are becoming increasingly important as industries strive to meet environmental regulations. The effort has not gone down in vain - With strong strides towards clean, plant-based and non-GMO products, these big corporations are seamlessly shifting focus towards sustainable manufacturing.

Explore FMI!

Book a free demo

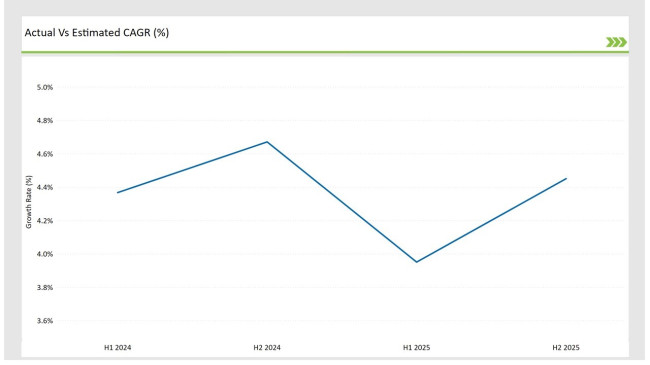

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Starch Derivatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.4% |

| H2 Growth Rate (%) | 4.7% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 3.9% |

| H2 Growth Rate (%) | 4.5% |

For the UK market, the Starch Derivatives sector is projected to grow at a CAGR of 4.4% during the first half of 2024, with an increase to 4.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 3.9% in H1 and reach 4.5% in H2.

| Date | Details |

|---|---|

| Nov-2024 | Tate & Lyle expanded their modified food starch facility in Yorkshire with £50M investment. The expansion focuses on producing clean-label starches for plant-based meat alternatives. |

| Sept-2024 | Cargill acquired British starch innovator StarchTech Solutions for £35M. The acquisition includes proprietary technology for producing functional native starches. |

| July-2024 | Roquette UK launched a new range of pea-based modified starches for food applications. The products offer improved texture and stability in frozen foods and bakery applications. |

| Apr-2024 | Ingredion opened a new research center in Cambridge focusing on novel starch modifications. The facility specializes in developing clean-label starch solutions for various food applications. |

| Feb-2024 | ADM launched a new line of sustainable potato-based modified starches in the UK market. The products are sourced from British farmers and processed using energy-efficient technology. |

Surging Demand for Modified Starch in Processed Foods

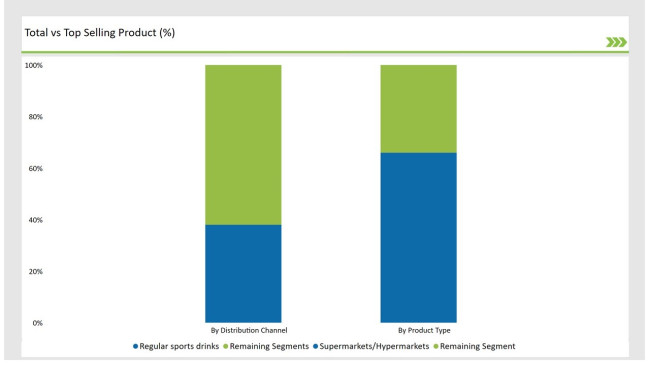

Modified starches have seen wide spread application in food processing, resulting in them holding a market share of 45.2%. As clean-label, gluten free starch based products are on the rise, manufacturers are being forced to step up.

Big food companies are utilizing modified starches at an unprecedented rate for enhanced texture, stability, and durability in a variety of products, dairy and ready to eat meals. In the UK, Tate and Roquette have also begun focusing on non-gmo, plant-based modified starches to appeal to more conscious consumers. As a result, these companies are reaping the benefits with little competition.

Corn-Based Starch Dominates Amid Rising Demand for Sustainable Alternatives

Starch potatoes command 65.4% of the market share, remaining the single most used source in the UK starch derivatives market. Because of concerns centered around supply chain instability and sustainability, manufacturers are now considering potato- and wheat-derived starch substitutes.

There is a growing need for plant-based and non-GMO starch sources, which is encouraging firms such as Cargill UK Ltd and Ingredion UK Limited. Sustainability will cassava based starch alternatives have started to gain attention, especially for starch based biodegradable packaging materials.

| By Product Type | Market Share |

|---|---|

| Modified Starch | 45.2% |

| Remaining Segments | 54.8% |

Modified starch continues to dominate due to high versatility in food, paper, and pharmaceutical industries. Targeting the processed and convenience food segments increases demand for all starch types, particularly modified starch.

On the other hand, native starch, which commands a 16.8% share, has a slower adoption rate due to a lack of definable functionalities and multifarious industrial requirements. Focus on high performance and stability yields modified starch growth, while native starch is restricted to organic, minimally processed food.

| By Source Type | Market Share |

|---|---|

| Corn | 65.4% |

| Remaining Segments | 34.6% |

Due to its wide availability and affordability, corn starch maintains a healthy market share, and is the leader in potato starch market which, as of now, accounts for 18.2%.

Cassava starch remains a niche segment at 4.1% but is growing in specialty applications, such as biodegradable packaging and gluten-free food products which marks the use of sustainable and non-GMO starch products. Meanwhile, with the increasing volatility in wheat prices, wheat based starch has been growing, but at a much slower rate.

Large MNCs tend to dominate the UK starch derivatives market due to owning large shares of the market, which stems from their extensive processing facilities, vertical integration, R&D expenditure, and stable supply chains. A significant portion of the industry is controlled by Tate & Lyle PLC, Cargill UK Ltd, and Roquette UK Limited because of their established industry partnerships and global distribution.

However, local players like Avebe UK Ltd or KMC (UK) Limited have focus on specialized starch applications, which include pharmaceutical grade starches, starches for Biodegradable Packaging, and clean label food products. Pricing and supply affairs are managed by the leading firms in the industry. Thus, the market remains very controlled.

| Company Name | Market Share |

|---|---|

| Tate & Lyle PLC | 21.3% |

| Cargill UK Ltd | 17.8% |

| Roquette UK Limited | 14.2% |

| Tereos UK | 10.5% |

| ADM UK Trading Ltd | 8.9% |

| Other Players | 27.3% |

Leading starch derivitive manufacturers in the UK are developing clean-label and functional starch products to address the increased market demand for food supplements, pharmaceuticals, paper, and other products. Tate & Lyle and Cargill UK Ltd own corn and wheat starch sourcing facilities in Europe and North America, along with large scale production in England and Scotland.

Roquette UK and ADM UK Trading Ltd take advantage of regional distribution les to provided high performance starches for specialized industrial uses, including biodegradable packaging. The investment in enzymatic starch modification and alternative plant proteins for ecofriendly requires is shifting leading players towards sustainability.

By 2025, the UK starch derivatives market is forecasted to expand at a CAGR of 4.4%, driven by increasing adoption in food, pharmaceuticals, and biodegradable packaging applications.

By 2035, the UK starch derivatives market is projected to reach a total valuation of USD 2,690.5 million, growing from USD 1,743.0 million in 2025.

Key growth factors include rising demand for functional starches in clean-label food production, increasing applications in industrial adhesives, and the expansion of biodegradable packaging solutions. The shift towards plant-based and non-GMO starch sources is also influencing market growth.

Within the UK, the Midlands and Southeast England dominate starch derivative consumption, given their high concentration of food processing, paper manufacturing, and pharmaceutical companies that rely on starch-based solutions.

Prominent starch derivative manufacturers in the UK include Tate & Lyle PLC, Cargill UK Ltd, Roquette UK Limited, Tereos UK, ADM UK Trading Ltd, Avebe UK Ltd, KMC (UK) Limited, Emsland UK Ltd, Ingredion UK Limited, and AGRANA UK Trading Ltd.

Modified Starch, Sweeteners, Native Starch, Cationic Starch

Corn, Potato, Wheat, Cassava

Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, Textiles

Dry, Liquid

Thickening, Stabilizing, Binding, Emulsifying

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.