The UK Sports Nutrition market is currently valued at around USD 1,084.8 million, and is anticipated to progress at a CAGR of 8.7% to reach USD 2,498.3 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,084.8 million |

| Industry Value (2035F) | USD 2,498.3 million |

| CAGR (2025 to 2035) | 8.7% |

The UK sports nutrition market is enjoying a tremendous expansion, principally attributed to the rising knowledge of fitness, muscle recovery, and performance support. The robust increase in the use of sports nutrition items by both professional athletes and ordinary gym-goers is a key factor of market development.

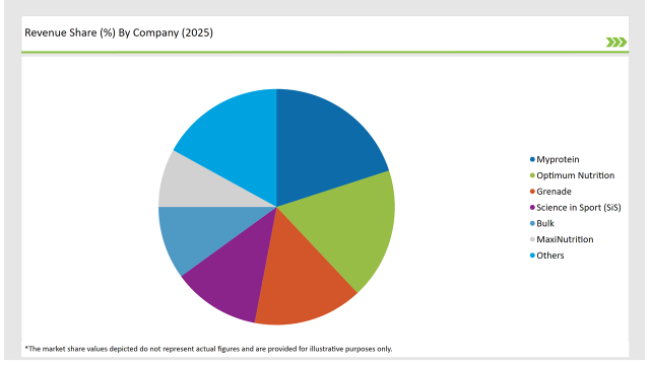

The upward movement of foods high in nutrients and dietary supplements is another reason fueling the demand for these types of products. Myprotein, Optimum Nutrition, Grenade, Science in Sport (SiS), Bulk, and MaxiNutrition are the major players on the UK sports nutrition market. These firms are putting in place product innovations, using clean-label and sustainable packaging to meet the new needs of consumers.

One of the driving forces for this market to expand is the rise of sports nutrition as part of the personalized fitness plans. People are interested in having their nutrition aligned with their training routines and health goals. The firms react to this by implementing AI-driven recommendations and digital health platforms.

The utmost priority for the market is the observance of regulations and quality assurance, alongside mounting pressure for transparency about ingredients and health claims. The increased trend in environmentally friendly materials and packaging, as brands focus on decreasing their carbon footprint and sourcing materials ethically also adds another layer of reshaping the competition.

Though the UK sports nutrition market faces challenges owing to factors like oversaturation and dynamic consumer preferences, it is still on the path of growth by integrating fitness with dietary supplementation and demand for easy-to-use nutritional formulations.

Sports nutrition products are now easier to get due to the increased e-commerce channels and direct-to-consumer strategies, which has seen them penetrate a wider market.

Explore FMI!

Book a free demo

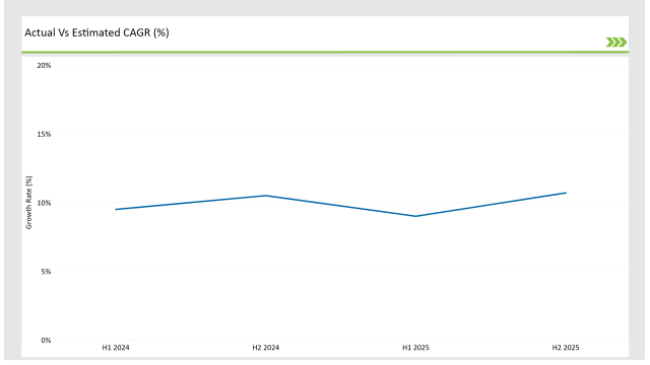

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Sports Nutrition market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Myprotein launched a new range of high-protein energy bars with natural Sports Nutritions. |

| Oct 2024 | Optimum Nutrition expanded its pre-workout supplement line with clinically tested ingredients. |

| Sep 2024 | Grenade introduced a vegan-friendly protein bar to cater to plant-based consumers. |

| Aug 2024 | Science in Sport (SiS) announced a partnership with professional athletes to promote pre-workout supplements. |

| Jul 2024 | Bulk revamped its e-commerce platform, offering personalized sports nutrition recommendations. |

A Link between Sports Nutrition and Digital Fitness Solutions

With the widespread adoption of fitness tracking equipment and mobile applications, sports nutrition brand is collaborating with digital solutions to facilitate customers' personalized nutrition plans.

AI-driven recommendations that are based on fitness goals, activity levels, and biometrics are aiding consumers in selecting the right supplements for optimal performance. This tendency to achieve the aim of collaboration among sports nutrition companies and digital health platforms is another factor.

The Increase in Clean-Label and Sustainable Sports Nutrition

Clients are gradually becoming more aware of the element of ingredient transparency and the sustainability factor in sports nutrition commodities. Therefore, firms are reacting by taking off artificial additives, Sports Nutritions, and synthetic compounds and planting them with natural and organic alternatives.

What is more, companies are not just focusing on the production of sustainable wrappers but also, they are exploring the use of recyclable containers in the meantime as the environment is secured.

The Attention Given to Pure Product Research and Improvement

Establishing the efficacy of sports nutrition supplements through scientific proof is now a new strategy to set a brand apart. Enterprises being a potential financial immediately start to advance their agenda further through the promotion of clinical trials as a tool to legitimize their performance claims, to make formulation more precise and to create consumer trust.

The trend of emphasizing scientifically proven ingredients such as BCAAs, creatinine, and adaptogens is also growing, with the brands utilizing research-promoted marketing for building credibility and trust with the consumers.

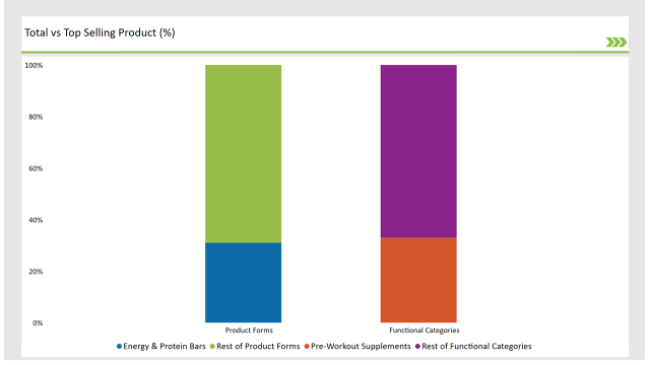

% share of Individual categories by Product form and function in 2025

Energy and protein bars account for 31% of the UK sports nutrition market. The bars serve as a convenient state of consuming proteins, carbohydrates, and vitamins. There is an increasing demand for protein bars that are high in protein and low in carbs, which is particularly true for the audience base interested in keto and high-protein diets.

The company is concentrating on the product flavor and texture, as well as the use of functional ingredients like fiber, probiotics, and superfoods to stand out from the competition. The listing of gluten-free, dairy-free, and plant-based protein bars is another strategy that has recourse to a wider potential market.

Pre-workout supplements are the mainstay of the market, accounting for 33% of the overall market due to their features that can promote stamina, muscle pumps, and mental focus. Key components are creatinine, nitric oxide boosters, and amino acids.

The buyers are now progressively asking for clean, transparent labeling along with the inclusion of clinically tested ingredients. The desire for stimulant-free pre-workout options is on the rise again, with the targeted audience being those who abstain from caffeine. This segment will stay as the major industry growth driver because of the continued interest in high-intensity workouts and endurance training.

Note: above chart is indicative in nature

Product differentiation, digital marketing, and environmentally sustainable practices have made the UK sports nutrition market moderately competitive. The primary companies, namely Myprotein, Optimum Nutrition, Grenade, Science in Sport (SiS), Bulk, and MaxiNutrition, are putting their resources into clean-label formulations, green packaging, and extending their online presence to involve consumers on a high level.

The rise in the number of products that are plant-based and allergen-free in the sports nutrition sector has led to increased research and development with companies looking at protein sources like pea and rice. Collaborations with active fitness personalities and pro athletes are still a leading marketing approach, not only enhancing consumer trust but, also, brand awareness.

The internet is a major channel for market growth, and we are seeing an expansion of subscription models. Personalized sports nutrition tools, going by AI-driven dietary suggestions, are expected to be the hallmark of the new era. As the customer's tastes keep changing, the firms endeavor to present competitive, comfortable, and high-performance projects in Category sports nutrition.

Within the Forecast Period, the UK Sports Nutrition market is expected to grow at a CAGR of 8.7%.

By 2035, the sales value of the UK Sports Nutrition industry is expected to reach USD 2,498.3 million.

Key factors propelling the UK Sports Nutrition market include the Growing health and fitness consciousness among consumers, leading to increased participation in sports and exercise activities. Advancements in sports nutrition product formulations and the development of specialized supplements to support athletic performance, recovery, and overall well-being.

Prominent players in the UK Sports Nutrition manufacturing include namely Myprotein, Optimum Nutrition, Grenade, Science in Sport (SiS), Bulk, and MaxiNutrition. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Plant Based, Animal Based

Ready-to-drink, Energy & Protein Bar, Powder, Tablets/Capsules

Energizing Products, Rehydration, Pre-Workout, Recovery and Weight Management.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.