The UK sports drink market is projected to reach USD 2,154.0 million by 2025, with continued expansion pushing its value to approximately USD 3,524.0 million by 2035. This growth represents a compound annual growth rate (CAGR) of 5.0% over the forecast period, driven by rising consumer interest in fitness and hydration, increased demand for low-calorie options, and the expansion of online retail channels.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 2,154.0 million |

| Projected UK Value (2035) | USD 3,524.0 million |

| Value-based CAGR (2025 to 2035) | 5.0% |

The UK sports drink market is transforming in response to consumers’ growing demand for clean hydration and health-oriented beverages. Although traditional sports drinks still command a significant share at 65.8%, beverages with low calories and natural or organic ingredients are more popular now as people become more conscious of sugar and artificial ingredient content in products.

Key competitors like Lucozade Ribena Suntory, Red Bull UK, and Coca-Cola European Partners are expanding their product portfolios to include new offerings for athletes, recreational users, and health-focused audiences. The emergence of D2C, e-commerce, and specialty sports nutrition suppliers is also reshaping the distribution landscape.

While PET bottles remain the most widely used packages, the increased focus on sustainability is driving demand for alternative forms of packaging such as cans and tetra packs.

Even with the rise in sustainable purchasing, the competitive environment among global and niche brands remains fierce with strives towards engrossing innovations in flavor, electrolyte-rich formulas, and natural supplementation to gain a greater portion of the marketplace.

Explore FMI!

Book a free demo

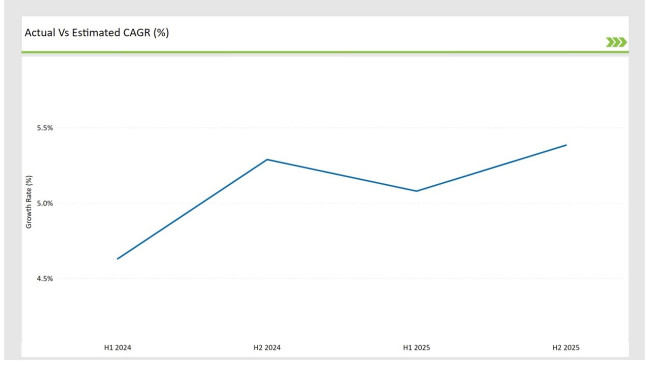

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Sports Drink market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.6% |

| H2 Growth Rate (%) | 5.3% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.1% |

| H2 Growth Rate (%) | 5.4% |

For the UK market, the Sports Drink sector is projected to grow at a CAGR of 4.6% during the first half of 2024, with an increase to 5.3% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 5.1% in H1 and reach 5.4% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Lucozade launched a new range of plant-based electrolyte drinks with sustainable packaging. The products feature natural sweeteners and British-sourced botanical extracts. |

| Sept-2024 | Science in Sport acquired performance beverage startup FuelTech UK for £25M. The acquisition includes innovative formulation technology for rapid nutrient delivery. |

| July-2024 | Grenade UK introduced a new line of ketone-enriched sports drinks for endurance athletes. The products demonstrate improved endurance performance in clinical studies. |

| May-2024 | PhD Nutrition launched an innovative range of protein-enhanced sports drinks with natural colors. The beverages contain a novel protein blend that prevents precipitation during storage. |

| Feb-2024 | Monster Energy opened a new production facility in Manchester for sugar-free sports beverages. The facility specializes in producing drinks with novel natural sweetener blends. |

Rising Demand for Low-Calorie and Natural Sports Drinks

The latest shifts in consumer behavior show that UK citizens now prefer low-calorie and organic sports drinks which mirrors the movement towards healthy hydration. Low-calorie formulations currently hold 26.3% of market share, expanding with casual athletes, regular gym goers, and health-conscious individuals.

The focus on clean label, sugar free, and natural ingredients is fostering innovation. Marketers are now investing in plant-based sports drinks formulated with coconut water and other extracts. Brands like Lucozade Ribena Suntory and Britvic are expanding their product offerings in response to this demand.

Expansion of Online Retail and Direct-to-Consumer Sales

Online retail, which currently possesses 18.7% of the market share, is emerging as a powerful distribution channel for sports beverages in the UK. There is a noticeable increase in the buying of sports drinks through subscription models, ecommerce, and direct sales.

This change is motivated by convenience and winning offers available online. Red Bull UK and Monster Beverage UK, as well as many others, are using social media and influencer marketing to increase online sales, as are traditional sports nutrition suppliers moving into ecommerce.

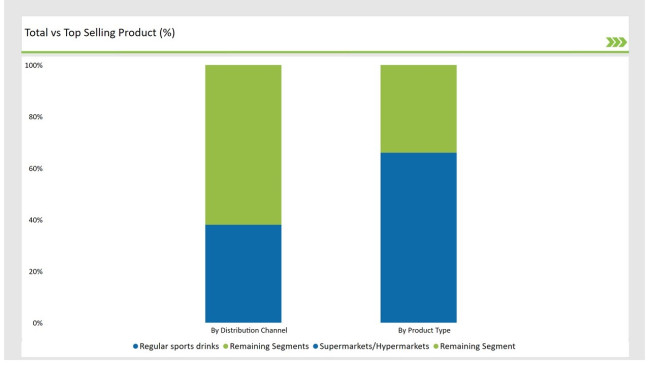

| By Product Type | Market Share |

|---|---|

| Regular Sports Drinks | 65.8% |

| Remaining Segments | 34.2% |

Traditional sports beverages continue to be the largest segment due to their popularity and ready accessibility. However, concerns around sugar and artificial additives are increasing the market share for low-sugar and all-natural sports beverages.

Companies have begun developing plant based hydration products and electrolyte infused formulas to meet the shifting demands. The market is expecting low-sugar and no sugar versions to further erode the market share of traditional sports drinks in the future.

| By Distribution Channel | Market Share |

|---|---|

| Supermarkets/Hypermarkets | 38.2% |

| Remaining Segments | 61.8% |

Sales for Supermarkets and hypermarkets continue leading due to their availability and selling strategies. Other channels such as e-commerce are rapidly growing due to subscriptions and direct sales. Convenience outlets still maintain high volume sales, however, specialist sports shops and petrol kiosks are growing at a slower rate as a result of shifting consumer spending to online channels. With the rise of e-commerce, companies are responding by launching products that are only available online and investing more in selling directly to consumers.

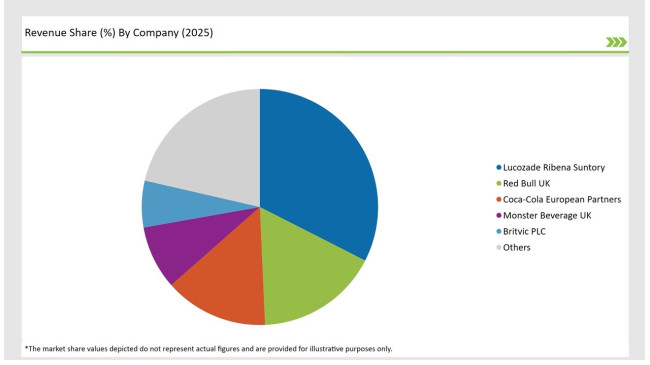

Suntory Holdings Limited subsidiary currently leads the market of the United Kingdom for sports drink, followed by Red Bull UK, and Coca Cola’s European Partners. Red Bull and Coca-Cola Import their main ingredients from Europe and Asia whereas Suntory Has health centered and functional drinks patented to their brand.

Although Grenade UK and Science in Sport strive to expand into the sports nutrition realm, they are considerably less renowned than regional brands. The competition also attracts young people by integrating sales to other niches like health-centered and functional drinks and selling through marketplaces.

| Company Name | Market Share |

|---|---|

| Lucozade Ribena Suntory | 32.5% |

| Red Bull UK | 16.8% |

| Coca-Cola European Partners | 14.2% |

| Monster Beverage UK | 8.7% |

| Britvic PLC | 6.4% |

| Other Players | 21.4% |

The UK sports drink market is highly fragmented with some major brands such as Gatorade. While regional brands like Grenade UK and Science in Sport have been relatively growing, there is a clear rating spread among other competitors Britain and Monster beverage.

Britvic and Monster Beverage look up to young adults to increase sales by making limited edition drinks and introducing outrageous flavors. Britvic’s strategy is feasible due to high demand for low sugar, fully functional, and hydrating drinks effortlessly available through eCommerce and convenience stores. These business plans have led Gatorade to increase online direct sales.

By 2025, the UK sports drink market is projected to expand at a CAGR of 5.0%, fueled by rising demand for fitness and hydration beverages.

By 2035, the UK sports drink market is estimated to reach a valuation of USD 3,524.0 million, nearly 1.6 times its 2025 size.

The growing fitness culture, increasing preference for functional hydration drinks, rising e-commerce sales, and consumer demand for low-calorie formulations are key factors propelling the UK sports drink market.

Within the UK, London and the South East lead in sports drink consumption, driven by higher participation in fitness activities, gym memberships, and a strong retail presence of major brands.

The top manufacturers in the UK sports drink industry include Lucozade Ribena Suntory, Red Bull UK, Coca-Cola European Partners, Monster Beverage UK, Britvic PLC, PepsiCo UK, Carabao, Grenade UK, Science in Sport, and AM Nutrition.

Regular Sports Drinks, Low-Calorie Sports Drinks, Natural/Organic Sports Drinks

Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Sports Stores, Gas Stations

PET Bottles, Cans, Tetra Pack, Others

Fruit Flavors, Berry, Citrus, Tropical, Others

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.