The UK Sourdough market is poised to reach a value of USD 6.5 million in 2025, and further expand at a CAGR of 5.2% to reach USD 10.8 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.5 million |

| Industry Value (2035F) | USD 10.8 million |

| CAGR (2025 to 2035) | 5.2% |

The UK sourdough market maintains a steady increase, territory that is ruled by consumers growing interest in natural, artisanal, and health-oriented baked goods. Well-known for its unique and sour flavor, sourdough has become a leading product in the organic and premium bakery segment.

The concept of fermentation relates to food products that are living, such as sourdough, eating which the consumers bring live bacteria into their guts. The sourdough category is one of the fermented products that consumers appreciate more.

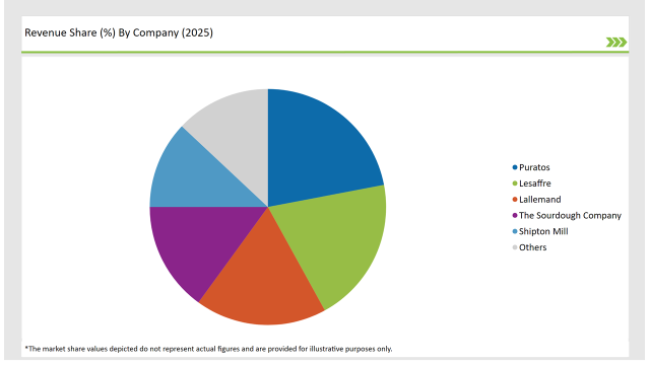

The key players of the trade, namely Puratos, Lesaffre, Lallemand, The Sourdough Company, and Shipton Mill, are the ones who set the pace of innovation by coming up with totally new or improved formulations and expanding organic product lines. The ongoing trend of home-baking, preference for clean-label products, and concern on gut health is another factor contributing to the rising demands.

The regulatory environmental which is under the supervision of the UK Food Standards Agency (FSA) and the British Retail Consortium (BRC) is responsible for the quality and authenticity of the sourdough products. In addition to the classic sourdough option, there is the option of organic gluten-free, and different flour-based sourdough that is slowly but surely entering the market.

Despite the issues like higher production costs, long-lasting fermentation processes, as well as the competition of bread from the market, the sector is growing because of strong customer satisfaction, bakery technologies, and the decision of customers to choose superior bread.

Explore FMI!

Book a free demo

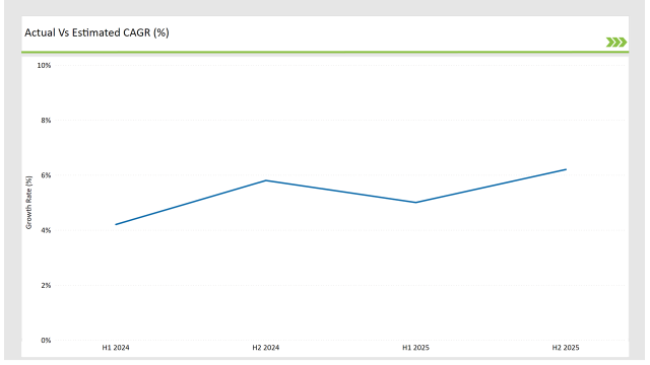

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Sourdough market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Puratos introduced a new range of organic sourdough starters tailored for large-scale bakeries. The company aims to improve consistency in artisanal bread production. |

| Oct 2024 | Lesaffre expanded its UK-based fermentation facility to enhance the production of natural sourdough starters. The expansion aligns with the growing consumer demand for clean-label bread products. |

| Sep 2024 | The Sourdough Company launched a line of gluten-free sourdough products, catering to the increasing demand for allergen-free alternatives. The product is formulated using a mix of rice and buckwheat flour. |

| Aug 2024 | Lallemand partnered with UK supermarkets to introduce pre-packaged, long-fermented sourdough loaves in the premium bread segment. This initiative is designed to appeal to health-conscious consumers. |

| Jul 2024 | Shipton Mill developed a sourdough flour blend with enhanced fermentation properties, enabling small bakeries to maintain product consistency. The blend is targeted at organic and specialty bakeries. |

Trend of Long-Fermented, Artisan Breads

The consumers become more and more conscious and they turn to choose the authentic long-fermented bread that is easy to digest, has a richer flavor, and lowers the GI index. The base of this fermentation process is using gluten and phytic acid for the breakdown of sourdough, thus, it is more digestive-friendly.

This wave is particularly visible among health-conscious people, type 2 diabetes patients, and consumers with light gluten allergies. As a result, bakeries and producers are focusing on the long-fermentation method and natural leavened products to satisfy this request.

The Rise of Organic and Clean-Label Sourdough

Despite the corona pandemic, the organic bakery sector is gaining momentum and making great strides, with 35% of the market now composed of sourdough made of organic flour. Consumers dress for success in the kitchen, so they favor minimally processed, additive-free products that fit their clean-label preferences.

The biggest names in the industry are launching organic sourdough mixes, starters, and pre-baked loaves to target this new group of customers. In fact, the UK shopkeepers are also hopping on the bandwagon by boosting their organic bakery sections, which is pointed out as the cause of the need for bread free of additives and preservatives.

Harnessing Technology in Sourdough Fermentation and Processing

To increase product consistency, cut down on fermentation time, and ramp up production, they are creating and deploying controlled fermentation systems and starter cultures. Companies like Lesaffre and Puratos are also bringing on board freeze-dried and liquid sourdough that both improve production and protect flavor integrity for commercial bakeries. Moreover, technological progression in fermentation biotechnology has pushed forward the development of targeted sourdough blends.

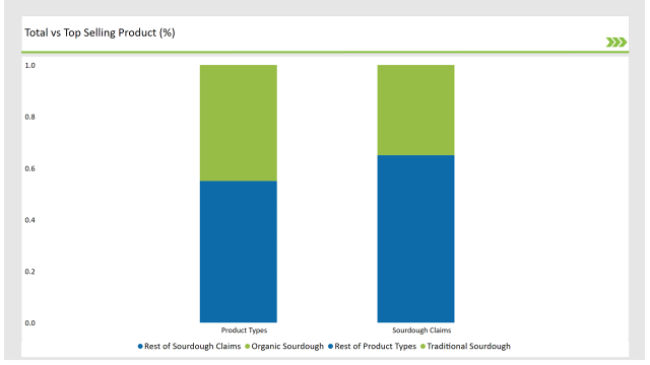

% share of Individual categories by Product Type and Claim in 2025

Sourdough bread accounts for 45% of the UK market, it is a consumer favorite for its true taste, chewy consistency, and its natural fermentation production. The pursuit for long-fermented and naturally fermented bread is on the rise, particularly in artisan bakeries and premium retail categories.

Many people regard traditional sourdough as a better and tastier choice compared to bread made with commercial yeast. As the bakeries' skills are confined to master handcrafting techniques and to high-hydration dough mixing, more and more consumers are being drawn to traditional sourdough.

The share of organic sourdough in the UK sourdough market is 35%, which is driven by the clean-label movement and the growth of the organic food sector. The consumers are now more educated about food origins non-GMO and non-pesticide plant food, therefore many of them go for organic sourdough.

Bakeries and manufacturers are broadening their product range to include organic varieties with wholegrains, stone-milling, and additives, while of The availability of sources, which are certified as organic, for both flour blends and starter sales, has positively influenced this segment too.

Note: above chart is indicative in nature

The UK sourdough market is a bit competitive, with both artisanal bakeries and commercial manufacturers alongside specialty flour producers. Prominent players like Puratos, Lesaffre, Lallemand, The Sourdough Company, and Shipton Mill are sinking money into fermentation innovation, organic formulations, and frozen sourdough solutions.

As the choice of the consumers for original sourdough keeps on increasing, manufacturers are reshuffling their plans and going to the direction of regional grain, heritage flour blends, and fermentation standardization. What is more, there is a soaring trend of frozen and par-baked sourdough loaves being developed in the retail and foodservice sectors.

Within the Forecast Period, the UK Sourdough market is expected to grow at a CAGR of 5.2%.

By 2035, the sales value of the UK Sourdough industry is expected to reach USD 10.8 million.

Key factors propelling the UK Sourdough market include Increasing demand for artisanal, organic, and long-fermented bread, alongside the growing awareness of gut health benefits.

Prominent players in the UK Sourdough manufacturing include Puratos, Lesaffre, Lallemand, The Sourdough Company, and Shipton Mill. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Traditional Sourdough, Flavored Sourdough, Specialty Sourdough, Convenience Sourdough

Organic, Non-GMO, Gluten-Free, High Fiber, Others

Retail Packaging, Bulk Packaging, Frozen Packaging, Others.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.