The UK software distribution market is anticipated to grow exponentially in the next decade, owing to the growing acceptance for cloud-based solutions, digital transformation across various sectors, and the increasing prevalence of subscription-based software models. At an estimated market value of USD 22,115.2 million in 2025, the market is expected to be on a rise at a CAGR of 12.8% till USD 73,743.7 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated UK Market Size in 2025 | USD 22,115.2 million |

| Projected UK Market Size in 2035 | USD 73,743.7 million |

| Value-based CAGR from 2025 to 2035 | 12.8% |

Explore FMI!

Book a free demo

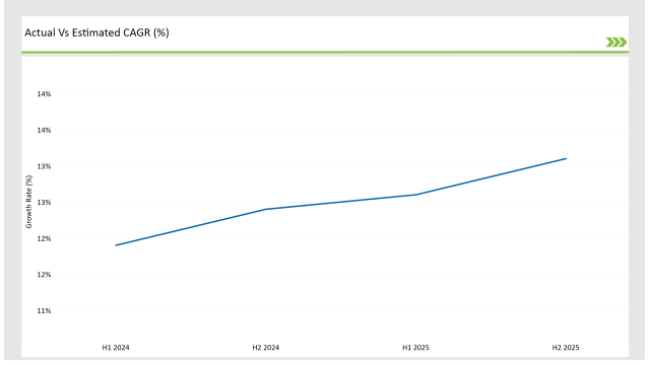

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 11.9% (2024 to 2034) |

| H2 2024 | 12.4% (2024 to 2034) |

| H1 2025 | 12.6% (2025 to 2035) |

| H2 2025 | 13.1% (2025 to 2035) |

The CAGR for the software distribution industry over semi-annual periods is subject to fluctuations, as the market is influenced by various factors. H1 2024 (11.9%) to H2 2024 (12.4%) - a 50 BPS increase in revenue growth expectation for the industry. Nonetheless an upswing of 20 BPS at H1 2025 (12.6%) indicates a marginal market growth. 2Q 2023 (up 8.2%) continued to see growth, followed by a 2x increase with a 50 BPS rise across the board: H2 2025 +13.1%, indicating renewed demand and market confidence. The overall trend in the industry is northward, punctuated by calibrations in response to the drivers.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Softcat expands cloud software distribution services to meet growing demand in the UK. |

| Oct-24 | Bytes Technology Group acquires a regional software reseller to strengthen its UK market presence. |

| Mar-24 | Computacenter partners with Microsoft to enhance software distribution capabilities. |

| Sep-24 | SCC UK launches an AI-driven software distribution platform for improved efficiency and automation. |

| Dec-23 | The UK government announces new digital transformation policies, boosting demand for software distribution. |

Growth of Cloud-Based Software Distribution Models

Cloud based software distribution whereby businesses use information on demand remotely located from the business but still stored on a server of the service provider (often on a subscription basis which provides the service and automatic updates), is growing in use amongst UK businesses. As most employees work remotely, demand for SaaS (Software-as-a-Service) solution has surged - especially within SMEs and large organisations transitioning to hybrid working environments.

With data security and GDPR compliance as major concerns for UK-based firms, it's also driving investment in localized cloud distribution networks. Most software vendors - including Microsoft, AWS and Google Cloud work with local distributors to address unique compliance requirements. The transition to multi-cloud strategies enables companies to steer clear of vendor lock-in, increasing the demand for flexible licensing models and pay-as-you-go software services.

Rising Demand for Cybersecurity and Compliance Software

GDPR regulations as well as an increase in cyber threats have encouraged UK organizations to invest in solid security software solutions. Endpoint security, zero-trust architectures, and AI-driven threat detection tools are in demand, according to software distributors. The data means industries like finance, healthcare, and retail are particularly interested in compliance-driven software that ensures data protection and secure cloud migration.

UK cybersecurity companies including Darktrace and Sophos leverage AI and machine learning for real-time threat mitigation, guiding distribution partnerships. To compliance-based software distribution across enterprises, the government’s National Cyber Security Strategy encourages organizations to adopt certified cybersecurity software which results in a steady growth.

Shift Towards Value-Added Reseller (VAR) Ecosystem

The UK software distribution model is transitioning from licensing led hardware software melding to value added resellers (VARs) focused on bespoke software solutions and managed services. Distributors are targeting customized implementations, integration assistance, and consulting post-sale, especially for ERP, CRM, and business intelligence software.

Top UK distributor Tech Data and experts West coast have joined forces with software makers to market everything from cloud and cybersecurity singles to hybrids of hardware and services. The trend is especially robust in regulated industries such as finance and healthcare, where companies need tailored compliance solutions. And VARs facilitate rapid deployment of software as well as local technical support and are now further embedded in the software supply chain.

Growing Adoption of AI-Powered Business Applications

The adoption of UK-based business software; however, is on the up, especially in predictive analytics, automation and customer experience management. Demand for AI-enabled custom application development is also surging among other software distributors such as supply chain optimization, HR automation, and CRM platforms.

Businesses demand analytic tools augmented by artificial intelligence to facilitate data-driven decision making and operational optimization. Enterprise-Software: UK-based AI start-ups, including Faculty AI and Peak AI, are embedding AI into enterprise software, impacting software distribution manner.

Booming Market for E-commerce and Retail Software

Rising in e-commerce, changing consumer behavior, and Omnichannel retailing in the UK is driving demand for retail & e-commerce software. Retailers in the UK invest in their POS system, inventory management software, and AI-powered customer analytics platforms. In the UK, software distributors are leveraging agency partnerships with e-commerce platforms including Shopify, Magento and BigCommerce, providing tailored solutions for local businesses.

The growing influence of Buy Now, Pay Later (BNPL) services and upcoming mobile commerce trends have driven the need for payment gateway integration software. UK businesses need software that adheres to UK tax regulations, UK logistics network, compliance standards, etc.

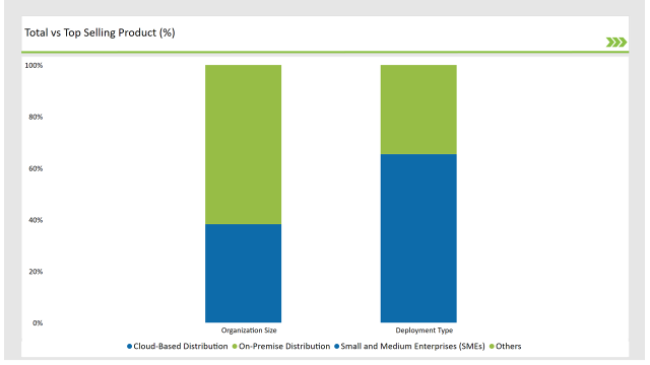

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based Distribution | 65.4% |

| On-Premise Distribution | 34.6% |

| Organization Size | Market Share (2025) |

|---|---|

| Small and Medium Enterprises (SMEs) | 38.2% |

| Others | 61.8% |

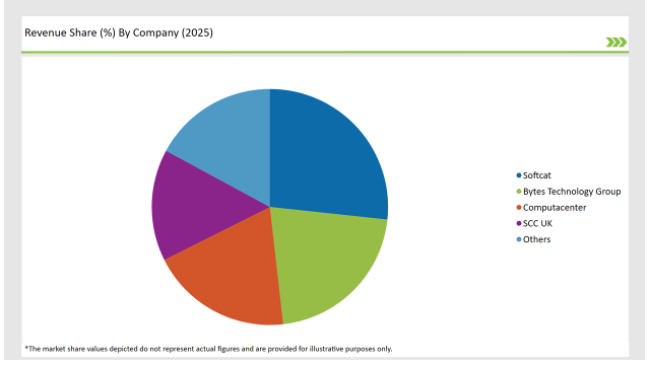

The UK software distribution market is highly competitive, with several key players driving innovation and growth.

| Vendors | Market Share (2025) |

|---|---|

| Softcat | 26.7% |

| Bytes Technology Group | 21.5% |

| Computacenter | 19.4% |

| SCC UK | 15.3% |

| Others | 12.8% |

The market will grow at a CAGR of 12.8% from 2025 to 2035.

The industry will reach USD 73,743.7 million by 2035.

Key drivers include digital transformation, cloud adoption, and increasing software subscription models.

London and South East UK lead in software distribution adoption due to high business concentration and advanced IT infrastructure.

The major players include Softcat, Bytes Technology Group, Computacenter, and SCC UK, among others.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.