The UK Shrimp market is expected to reach USD 3,197.7 million in 2025 and is projected to reaching a total value of USD 7,710.2 million by 2035. This represents a compound annual growth rate (CAGR) of 9.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,197.7 million |

| Industry Value (2035F) | USD 7,710.2 million |

| CAGR (2025 to 2035) | 9.2% |

The shrimp market in the UK is currently a hot segment of the seafood industry thanks to increased consumer requests for premium quality and versatile seafood.

Shrimps are a sought-after food for many UK nationals due to the amazing nutritional values they offer such as a high amount of protein, omega-3 fatty acids, and various essential vitamins and minerals. The sector includes many kinds and states of the product covering a wide selection of traditional and modern foods.

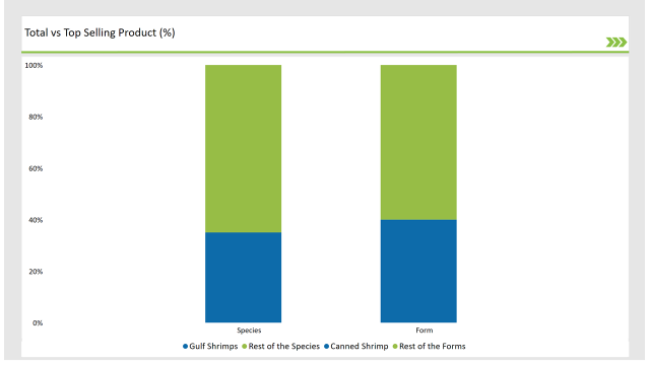

The primary species in the UK shrimp market is Gulf shrimps, which command a 35% market share. Shrimps are esteemed for their hard flesh, unique taste, and large size, which explains why they are preferred as household items and in the food sector.

Mostly imported, Gulf shrimps indicate the UK’s reliance on the overseas market to satisfy the local needs. Conversely, canned shrimp occupies 40% of the overall market on account of its practical benefits of easy Use, long storage, and cheap price. It is often added to meals like salads and ready-to-eat options in line with the growing Consumer preferences and healthy eating.

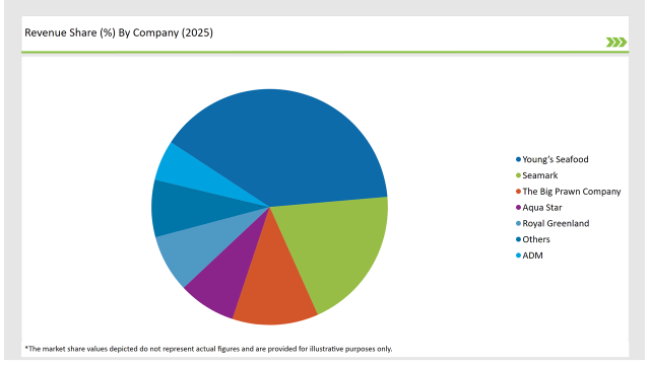

The leading firms in the UK shrimp industry are Young's Seafood, Seamark, and The Big Prawn Company, which are committed to sourcing only shrimp that is sustainable and to offer a variety of different products. The progress of this market is also propelled by the increasing consumption of seafood-based diets, which has been popularized by the health and wellness trends.

Besides, the UK foodservice sector works a big deal to reenergize shrimp consumption. Restaurants and catering services are more and more introducing shrimp in their menus, from sophisticated recipes to fast food settings.

UK shrimp business is consistently anticipated to develop and offer a diverse choice of products to meet the changing customer requests owed to the cutting-edge processing and packaging technology.

Explore FMI!

Book a free demo

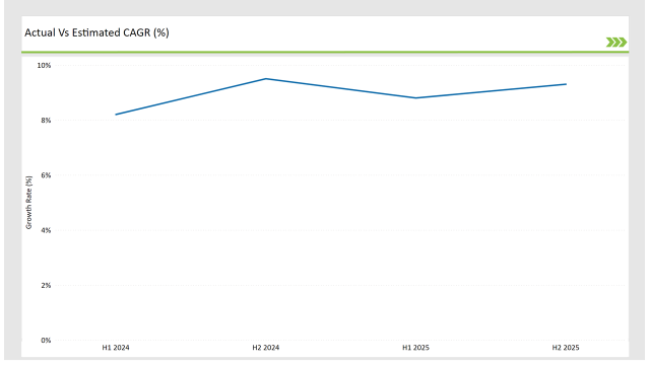

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Shrimp market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Young’s Seafood launched a new range of sustainably sourced Gulf shrimp products targeting premium retail markets. These products are specifically aimed at health-conscious consumers seeking high-quality seafood with clear traceability. |

| May 2024 | Seamark expanded its processing facility in Manchester to increase production capacity for canned shrimp products. The new facility uses state-of-the-art equipment to enhance efficiency and meet the growing demand for convenience-based seafood options. |

| August 2024 | The Big Prawn Company introduced an organic shrimp line certified by the Marine Stewardship Council (MSC). This product launch addresses the rising demand for eco-friendly seafood and strengthens the company’s premium product portfolio. |

| October 2024 | A study by Seafish UK highlighted a 12% year-over-year increase in shrimp consumption in the UK, driven by health-conscious consumers. The report also revealed a growing preference for Gulf shrimp in high-end dining establishments. |

| December 2024 | Young’s Seafood partnered with leading UK supermarkets to launch ready-to-eat shrimp salads in recyclable packaging. This initiative aims to attract eco-conscious consumers and boost sales in the convenience food category. |

High-End Restaurants That Pair Shrimp with Unique Ingredients

A notable trend prevailing in the UK shrimp market is the offering of premium shrimp pairings in gourmet dishes. Gulf shrimps are now mostly prepared in the forte cuisine fusion style, where they are blended with local ingredients and exotic spices. The chefs in the luxury restaurants showcase this combination by preparing dishes exclusively for them, consequently, making shrimp-based meals more attractive.

The surge of shrimp cooking is the main factor

The ready-to-eat shrimp meals market is going up in the UK as customers appreciate the convenience while still getting proper quality. These meals usually come with pre-seasoned shrimp matched with sides like rice or vegetables. Some companies such as Seamark are launching meal kits designed especially for busy people, which in turn expands their customer base.

Launch of Functional Shrimp Products

One more trend in the market is the introduction of functional shrimp products that are enriched with the elements such as omega-3 and collagen, both of which are added to the market.

These products are designed to satisfy health-conscious consumers who prefer to eat things that are not only convenient but also good for you. The leading brands are taking advantage of this trend to create added-value shrimp products that are higher in price.

% share of Individual categories by Species and form in 2025

UK Island shrimps are the most widely consumed types in the UK, making up the distribution of 35% of the species. Gulf shrimps rank high on the List of favorite food products among customers and the food sector because of their terrific quality and texture.

High-quality Gulf shrimps are the perfect addition to a variety of exclusive dishes, such as seafood platters, pasta, and stir-fries. Companies that are ahead in their field commonly prioritize Gulf shrimps in their propositions, with the main aspect being the recycling of the materials and the sustainable brands position.

Canned shrimp is the winning shrimp choice in the overall UK shrimp market as it claims a total of 40% of the market. Its widespread use is generally enabled by the benefits of being economical, easy to use, and a long shelf life.

Canned shrimp is more available in the ready-to-eat segment, including soups, and salads which are preferred due to the need for easy-to-prepare meal options. Seamark is one of the companies that have actively expanded their canned shrimp product line, ensuring a good quality and stable supply all through the retail space.

Note: above chart is indicative in nature

The UK shrimp market is moderately fragmented with both domestic and international players involved in order to meet the consumers' demands. The marine protein market is flooded with players with Tier 1 companies like Young’s Seafood, Seamark, and Big Prawn Company dominating it since they have wide strong distribution networks, good innovations, and they focus on sustainability. Tier 2 and Tier 3 companies are addressing niches by offering organic and special types of shrimp products.

Leading manufacturers are investing in new technologies that will improve processing, they are broadening their product lines, and they are putting an emphasis on products that are premium and convenient. Together with the corporations and retailers that are engaged in the collaborations, they have even solidified their market base.

For example, through their signed contracts with major UK supermarkets, the reach of Young's Seafood to premium shrimp products has improved and the sea market's focus on canned products has been realized by Seamark as it asserts that they meet the demand of ready-to-eat meals that are fast and cheap.

As customers’ choices are likely to change, so the UK shrimp market is going to develop new innovative programs and increase the volume of goods, thus it is going to strengthen its position as a significant part of the seafood market.

Within the UK Shrimp market is expected to grow at a CAGR of 9.2%.

By 2035, the sales value of the UK Shrimp industry is expected to reach USD 7,710.2 million.

Gulf Shrimps, Farmed White Leg Shrimps, Banded Coral Shrimps, Royal Red Shrimp, Giant Tiger Shrimps, Blue Shrimps, and Ocean Shrimps.

Canned, Breaded, Peeled, Cooked & Peeled, Shell-On, and Frozen.

Organic and Conventional

Food, Pharmaceutical, Cosmetics, Industrial, and Biotechnology.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.