Between 2025 and 2035 the United Kingdom river cruise market is expected to rise at a massive rate due to the growing popularity of slow travel, a demand for premium and experiential tourism, as well as the growing aging population that has greater disposable income. More intimate, immersive and culturally enriching than traditional ocean cruising, a river cruise allows passengers to experience historic cities, beautiful countryside and quaint towns down the length of the nation’s storied rivers.

Britain has a thriving river cruise industry of its own, with its best-known rivers (Thames, Severn, Avon and Mersey), not to mention beautiful canals that make for a different kind of sightseeing. The Thames River runs through London, Oxford, and Windsor, an essential destination for local and abroad tourists, providing Perfect views and historical landmarks. Meanwhile, the Avon and Severn rivers offer historical and nature-oriented styles of cruising including visits to medieval towns, Shakespearean heritage sites, and stunning scenery.

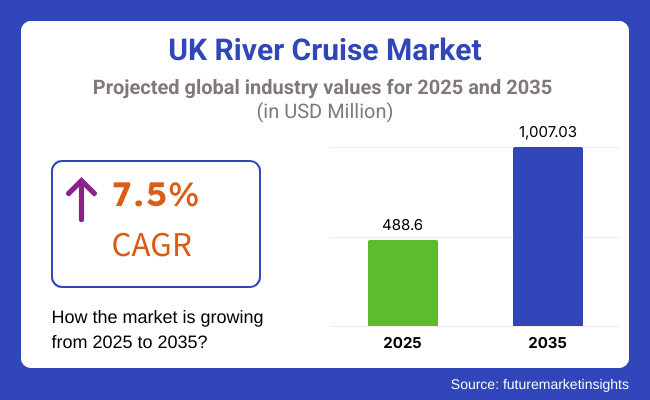

The United Kingdom River Cruise Market accounted for USD 488.6 million in the year 2025 and is expected to reach USD 1007.03 million by the year 2035, at a CAGR of 7.5% during the forecast period.

Emergence of luxury and themed river cruises is propelling the market growth. Cruise operators are increasingly customizing itineraries to appeal to specific interests, including food, history, wildlife and thematic musical programs. Sustainable tourism projects such as these, as well as hybrid and electric-powered riverboats are growing in popularity as eco-conscious traveller’s demand greener methods of travel.

The Northeast, in particular, via river routes along the River Tyne and River Tees is evolving into one of the key areas in the UK river cruise sector. Newcastle upon Tyne, a historic port city, hosts cultural and heritage-driven cruises, while nearby Durham’s scenic river routes lure leisure travelers. This region is expected to grow through increased investment in waterfront tourism and infrastructure.

The UK’s longest river, the River Severn is the West’s key attraction, providing scenic cruises through Shrewsbury, Worcester and Gloucester. It has a rich blend of natural beauty and historical sites, with medieval castles and charming countryside. Increasing popularity of themed river cruises, such as historical tours and wildlife, is aiding in market growth.

The iconic River Thames flows through the East of England, one of the most-bucket listing river cruise destinations in the UK. From luxury sightseeing cruises in London to quiet trips along Oxford’s historic waterways, the Thames monopolizes the market. Tourist footfall, the number of premium cruise operators, and demand for short, picturesque urban cruises are driving growth.

Southern England is served by two primary stretches of river, the River Avon and River Medway, where you can travel a different kind of waterway, with relaxing countryside cruise. The balance is tipping into boutique and eco-friendly river cruises in the likes of Bath and Kent, where historical and cultural tourism is hallowed ground.

With an increased focus on nature-based tourism and heritage experiences, this area, including the river Trent and river Ouse, is gaining traction. York, an ancient city on the River Ouse, has themed cruises with a focus on Viking heritage and medieval history, while the River Trent at Nottingham serves a mix of leisure and adventure tourism.

Challenges

Infrastructure Limitations and Environmental Regulations

Challenges in UK River Cruise Market related to infrastructure such as the need for modernized docking facilities, port congestion and limited cruise routes on particular waterways. This paralleled with stringent environmental rules governing emissions, waste disposal and river ecosystem protection have exerted operational challenges on cruise operators. Meeting sustainability standards demands substantial investment in environmentally friendly ships, alternative fuels, and advanced waste management systems. In addition, seasonal changes in weather and the potential for high water levels to interfere with cruise schedules.

Opportunities

Luxury and Themed River Cruises

In particular, the increasing popularity of high, themed river trips, represent high-potential opportunities for the UK market. It has led to a rise in special on-board experiences, from historical voyages up the Thames to gourmet dining cruises led by Michelin-starred chefs to heritage-focused routes exploring the country’s diverse cultural and heritage attractions. On top of that, the growth of eco-conscious travel is making its way to sustainable cruises, with electric or hybrid-powered vessels in high demand.

UK River Cruise Market Outlook Future: 2020 to 2024 between 2020 and 2024, the UK River Cruise Market experienced a strong recovery from pandemic-related challenges. Domestic tourism was a lifeline for the industry, with bookers fuelling demand for short-haul river-cruising in the Thames, Severn and Mersey. Cruise lines emphasized health and safety protocols, contactless services and small-group experiences. But operational efficiency was impacted by supply chain issues, variable fuel prices, and crew shortages.

Whereas for the years 2025 to 2035, the market would be defined by sustainability, technological advancements and experiential cruising. The use of artificial intelligence in itinerary planning, smart cabins, and digital concierge services will improve customer experience. Additionally, increased luxury river cruise offerings will redefine the sector as will culinary-focused voyages and adventure-based itineraries. Companies focusing on carbon-neutral operations, river conservation, and innovative on-board entertainment will fuel growth in the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Post-pandemic safety protocols and river navigation regulations |

| Cruise Tourism Growth | More domestic river cruising and pandemic recovery |

| Industry Adoption | Interest in small-group, intimate river cruises |

| Sustainability & Energy Efficiency | Early adoption of hybrid power vessels and waste management |

| Market Competition | Traditional cruise operators and regional tour providers |

| Customer Preferences | Interest in short-haul and heritage cruises. |

| Technology Integration | Adoption of digital booking platforms and on-board contactless services |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainability policies, stricter emissions controls and green energy adoption |

| Cruise Tourism Growth | Increase in popularity of international cruise passengers Indeed, themed cruises |

| Industry Adoption | Surge of ultra-luxury river cruises, themed itineraries and green voyages |

| Sustainability & Energy Efficiency | Widespread use of electric propulsion ships; carbon-neutral excursions |

| Market Competition | Growth in boutique cruise lines and luxury travel brands entering the fray |

| Customer Preferences | Increased interest in culinary cruises, action-oriented excursions on rivers |

| Technology Integration | Itinerary planning powered by advanced AI, smart cabins and immersive digital experiences |

The abundance of famous rivers, historic sites and styles of cruises make England the largest and most diverse river cruising market in the UK. England includes great navigable river ways like the River Thames, River Severn, and River Avon attracting a variety of traveller from luxury sightseeing excursions, heritage river journeys, and eco-friendly leisure stays.

London is the center of England’s river cruise industry and has the largest slice of the market with its extensive network of cruises often powered by the Thames. From brief sightseeing excursions highlighting monuments like the Tower of London and Westminster Palace to luxurious dinner cruises with live entertainment, the Thames is one of Europe’s most popular river cruise destinations. The industry of pleasure craft, aided by growing demand, will continue to grow sustainable tourism sector utilizing carbon-neutral, electric-powered vessels.

Outside of London, areas like Oxford, Windsor and Henley-on-Thames have attracted more investment in heritage river cruises that explore England’s literary, academic and royal heritage. The River Avon in Stratford-upon-Avon serves up Shakespeare-themed river cruises, while the River Severn in Worcester is becoming increasingly popular for countryside leisure cruises and wildlife excursions.

| Region | CAGR (2025 to 2035) |

|---|---|

| England | 7.8% |

Scotland is a growing river cruise leader, with its historic waterways, beautiful landscapes and upscale travel experiences. The country’s main rivers - the Clyde, Tay and Spey - are drawing visitors seeking scenic, nature and whisky-themed cruising experiences. Tours of heritage and industrial sites along the River Clyde in Glasgow are in growing demand, giving visitors access to the city’s shipbuilding legacy, maritime museums and avatars of the modern-day waterfront. Nature boulevard environmentally delighted travels along the River Tay and River Tweed have been expanded with wildlife and nature-based cruises. The cruises provide unique chances to see salmon, otters and rare bird species while experiencing Scotland’s peaceful countryside. Whisky-themed tourism along the River Spey is one of Scotland’s most recognisable river-cruising segments, especially in the Speyside whisky region. Several luxury river cruise companies are now operating dumpy-run experiences featuring distillery visits, whisky tastings and cultural storytelling that combine Scotland’s two most famed industries whisky and tourism.

| Region | CAGR (2025 to 2035) |

|---|---|

| Scotland | 7.6% |

Wales is becoming known as a boutique river cruise destination, thanks to its scenic rivers, Celtic heritage and commitment to sustainable tourism. The country boasts the likes of River Wye, River Usk and River Dee, where serene, nature-focused cruise adventures appeal to eco-conscious and adventure-minded travelers. One of the UK’s most scenic waterways, the River Wye has emerged an increasingly popular destination for slow-travel cruising, wildlife tours and countryside getaways. And with the surrounding Wye Valley designated an Area of Outstanding Natural Beauty (AONB), the region is experiencing a wave of eco-friendly river cruises focusing on conservation and sustainability. Cardiff’s River Taff, which runs through the middle of the Welsh capital, is seeing growing interest in urban sightseeing and cultural river cruises. North of those, the River Dee in Llangollen is drawing adventure and heritage tourists with narrowboat cruises along its historic canals and waterways. (The experiences often blend local storytelling and folklore with guided tours in medieval castles and ancient Welsh settlements.

| Region | CAGR (2025 to 2035) |

|---|---|

| Wales | 7.4% |

With its historic rivers, burgeoning tourism industry and growing investment in waterfront regeneration, Northern Ireland is an emerging river cruise hotspot. Northern Ireland’s burgeoning river tourism economy is centered on the River Lagan, River Foyle and River Bann. Belfast’s River Lagan is at the forefront, with an increasing number of sightseeing, historical and luxury cruises. The revitalization of the Titanic Quarter waterfront has led to a boom in demand for maritime-themed river tours, which offer visitors the chance to discover more about Belfast’s shipbuilding legacy, as well as its waterfront attractions and spectacular cityscapes. Derry’s River Foyle is emerging as a premier destination for eco-tourism and cultural river cruises, including wildlife-watching, history tours and leisure experiences. The government’s emphasis on sustainable tourism growth has resulted in more investment on carbon-neutral and solar-powered cruise boats, part and parcel with a worldwide movement toward environmentally responsible travel.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northern Ireland | 7.5% |

Strong demand from domestic and foreign tourists is a positive for the UK river cruise market. A growing demand for slow travel, heritage experiences, and luxury cruising has promoted the country as a focal point in river-based tourism. Strengthened market growth has also been due to the rise of personalized itineraries, themed cruises and enhanced on-board experiences.

Domestic Tourism Dominates as UK Travelers Seek Scenic and Relaxing River Journeys

Most of the UK river cruise market is made up of domestic tourists, with a focus on short-haul, immersive experiences along key waterways such as the Thames, Severn and the Norfolk Broads. These cruises offer an easy means to explore the country’s cultural and natural heritage while skipping the headaches of international travel.

The popularity of themed river cruises, on everything from historical and wildlife to seasonal itineraries has helped sustain increased domestic demand. Tourists have been choosing more cruises that showcase local attractions, such as Shakespeare themed voyages in Stratford-upon-Avon or whisky-tasting excursions in Scotland. An increasing number of British holidaymakers are looking for stress-free travel experiences, fuelling demand for short-break cruises which usually last a couple of days, but can also take the form of weekend getaways.

Domestic cruise travel is attractive on one hand for local travelers, yet on the other hand, still faces challenges such as demand volatility throughout the seasons and competition from the land-based tourism sector. Yet the growth in this segment is fuelling continued growth due to the growth of year-round cruise operations and increased marketing efforts.

International Tourism Surges as the UK’s River Cruises Attract Global Visitors

River through the UK are a favourite of international tourists who want to learn about the country’s rich history while admiring its beautiful landscapes and enjoying it truly unique hospitality. North Americans, Europeans and Asians are pursuing cultural immersive experiences that blend sightseeing with slow travel along historic waterways.

Luxury river cruises seeking the deep pockets of overseas visitors have taken off, with premium products including fine dining, private guided excursions and boutique accommodation.

Although visa complexities and currency fluctuations have impacted international arrivals, close to real-time investments in river cruise infrastructure, enhanced marketing efforts, and strategic partnerships with the world's leading travel agencies ensure steady growth throughout the market. The accessibility to international tourists is also increased via digital booking platforms and AI-driven personalized travel recommendations.

Family Cruises Expand as Multi-Generational Travel Gains Traction

Family river cruises have become increasingly popular as travelers look for immersive, educational and stress-free vacations. Aligned to families, cruises come with interactive activities on-board, guided shore excursions and family entertainment, making them a popular alternative to traditional vacations.

Parents and grandparents are increasingly choosing river cruises with younger family members to expose them to history, nature and cultural experiences in a fun way. Popular itineraries include cruises on the Thames, with stops at castles, historical sites and wildlife reserves.

Some families enjoy the all-inclusive nature of river cruises, but issues like limited on-board amenities designed for kids and pricing worries exist. But operators are continually expanding family-oriented options - from dedicated kid-free programs to multi-generational travel packages - which will allow strong growth in this segment.

Couples Segment Flourishes as Romantic River Cruises Gain Momentum

Family river cruises have become increasingly popular as travelers look for immersive, educational and stress-free vacations. Aligned to families, cruises come with interactive activities on-board, guided shore excursions and family entertainment, making them a popular alternative to traditional vacations.

Parents and grandparents are increasingly choosing river cruises with younger family members to expose them to history, nature and cultural experiences in a fun way. Popular itineraries include cruises on the Thames, with stops at castles, historical sites and wildlife reserves.

Some families enjoy the all-inclusive nature of river cruises, but issues like limited on-board amenities designed for kids and pricing worries exist. But operators are continually expanding family-oriented options - from dedicated kid-free programs to multi-generational travel packages - which will allow strong growth in this segment.

The UK river cruise sector is continuing to expand with travelers showing continued interest in dream-journeys, luxury ships, and themed excursions. Cruise operators and travel companies were using innovative ideas such as AI-driven itinerary personalization, interactive on-board entertainment, and digital booking services in real-time to facilitate passenger journeys. The UK river cruise market is comprised of river cruise operators, hospitality brands (hotels, resorts, and fine dining experiences) and travel agencies which further supports the growth of river-based tourism. New trends include sustainable cruise tourism, memory and heritage-themed voyages and fully immersive local cultural experiences along leading UK Rivers like the Thames, Severn and Trent.

Market Share Analysis by Key Players & Cruise Operators

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Viking River Cruises UK | 20-25% |

| Riviera Travel River Cruises | 15-20% |

| Saga River Cruises | 12-16% |

| Scenic River Cruises | 8-12% |

| Emerald Cruises | 5-9% |

| Others | 30-40% |

Key Company Cruise Offerings

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Viking River Cruises UK | Luxury river cruises featuring historical tours, fine dining, and all-inclusive packages along the Thames and Severn. |

| Riviera Travel River Cruises | Themed cruises such as heritage voyages, garden and literary tours, and cultural excursions across the UK’s inland waterways. |

| Saga River Cruises | Premium river cruises for the 50+ market, offering wellness packages, classical music cruises, and scenic countryside tours. |

| Scenic River Cruises | Boutique river cruises with butler service, gourmet dining, and sustainable travel experiences along the UK’s most scenic river routes. |

Viking River Cruises UK (20-25%)

The No. 1 UK river cruise operator, Viking's river voyages on its fleet of longships offer all-inclusive dining, cultural onshore excursions and deluxe facilities - all targeting the wealthy traveller.

Riviera Travel River Cruises (15-20%)

Riviera Travel is a UK river cruise heavy hitter, focusing on expertly guided river itineraries, history themes and great service at an at-peace price point.

Saga River Cruises (12-16%)

Saga River Cruises caters to the over-50s travel market, offering refined and relaxed river sailing with on-board curated activities, wellness programs and heritage-centric port calls.

Scenic River Cruises (8-12%)

Scenic River Cruises specializes in luxury small-ship cruising that immerses you in your travels with 5-star accommodations, customized shore excursions and personal on-board service.

Emerald Cruises (5-9%)

Emerald Cruises provides modern river cruises featuring a combination of adventure, comfort and sustainability, including ships with new designs and active shore excursions.

Other Key Players (30-40% Combined)

Several other players contribute to the UK’s burgeoning river cruise sector - from cruise lines and tour agencies to digital travel platforms, many of which are focusing on bespoke itineraries, AI-powered booking solutions and immersive local experiences. These include:

The overall market size for UK river cruise market was USD 488.6 million in 2025.

The UK river cruise market is expected to reach USD 1007.3 million in 2035.

The demand for river cruises in the United Kingdom will rise due to increasing consumer interest in leisurely and scenic travel experiences, driven by the growing popularity of domestic tourism, rising spending on premium cruise packages, and the expansion of luxury and themed river cruise offerings. Additionally, the shift toward sustainable travel, the integration of advanced onboard amenities, and the rising demand from senior and family travelers seeking relaxed yet immersive journeys will further propel market growth during the forecast period.

The top 5 regions which drives the development of UK river cruise market are England, Scotland, Wales, and Northern Ireland.

Domestic tourism and family cruise to command significant share over the assessment period.

Table 01: Capital Investment in Tourism (US$ million)

Table 02: Total Tourist Arrivals (million), 2023

Table 03: Total Spending (US$ million) and Forecast (2018 to 2033)

Table 04: Number of Tourists (million) and Forecast (2018 to 2033)

Table 05: Spending Per Traveler (US$ million) and Forecast (2018 to 2033)

Figure 01: Total Spending (US$ million) and Forecast (2023 to 2033)

Figure 02: Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03: Number of Tourists (million) and Forecast (2023 to 2033)

Figure 04: Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05: Spending per Traveler (US$ million) and Forecast (2023 to 2033)

Figure 06: Spending per Traveler Y-o-Y Growth Projections (2018 to 2033)

Figure 07: Current Market Analysis (% of demand), By Age, 2023

Figure 08: Current Market Analysis (% of demand), By Duration of Trip, 2023

Figure 09: Current Market Analysis (% of demand), By Demographic, 2023

Figure 10: Current Market Analysis (% of demand), By Nationality, 2023

Figure 11: Current Market Analysis (% of demand), By Group Type, 2023

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA